Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Athens on the Potomac

Athens on the Potomac

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Instead of pointing fingers at the innumerates running Athens, they should consider our own situation. Jason Russell of the Washington Examiner shows how America’s debt projections look suspiciously like Greece’s recent history.

With all the chaos unravelling in Greece, Congress would be wise to do what it takes to avoid reaching Greek debt levels. But it’s not a matter of sticking to the status quo and avoiding bad decisions that would put the budget on a Greek-like path, because the budget is on that path already.

A quarter-century ago, Greek debt levels were roughly 75 percent of Greece’s economy — about equal to what the U.S. has now. As of 2014, Greek debt levels are about 177 percent of national GDP. Now, the country is considering defaulting on its loans and uncertainty is gripping the economy.

In 25 years, U.S. debt levels are projected to reach 156 percent of the economy, which Greece had in 2012. That projection comes from the Congressional Budget Office’s alternative scenario, which is more realistic than its standard fiscal projection about which spending programs Congress will extend into the future.

If Congress leaves the federal budget on autopilot, debt levels will soar. Instead, spending must be reined in to avoid a Greek-style meltdown.

While we’re right to be concerned about 2040, the U.S. is in deep trouble now. Yet if you mention the debt to most Americans, they’re either confused or indifferent. “But Obama lowered the deficit.” “Just print more money.“ “It’s Reagan’s fault!”

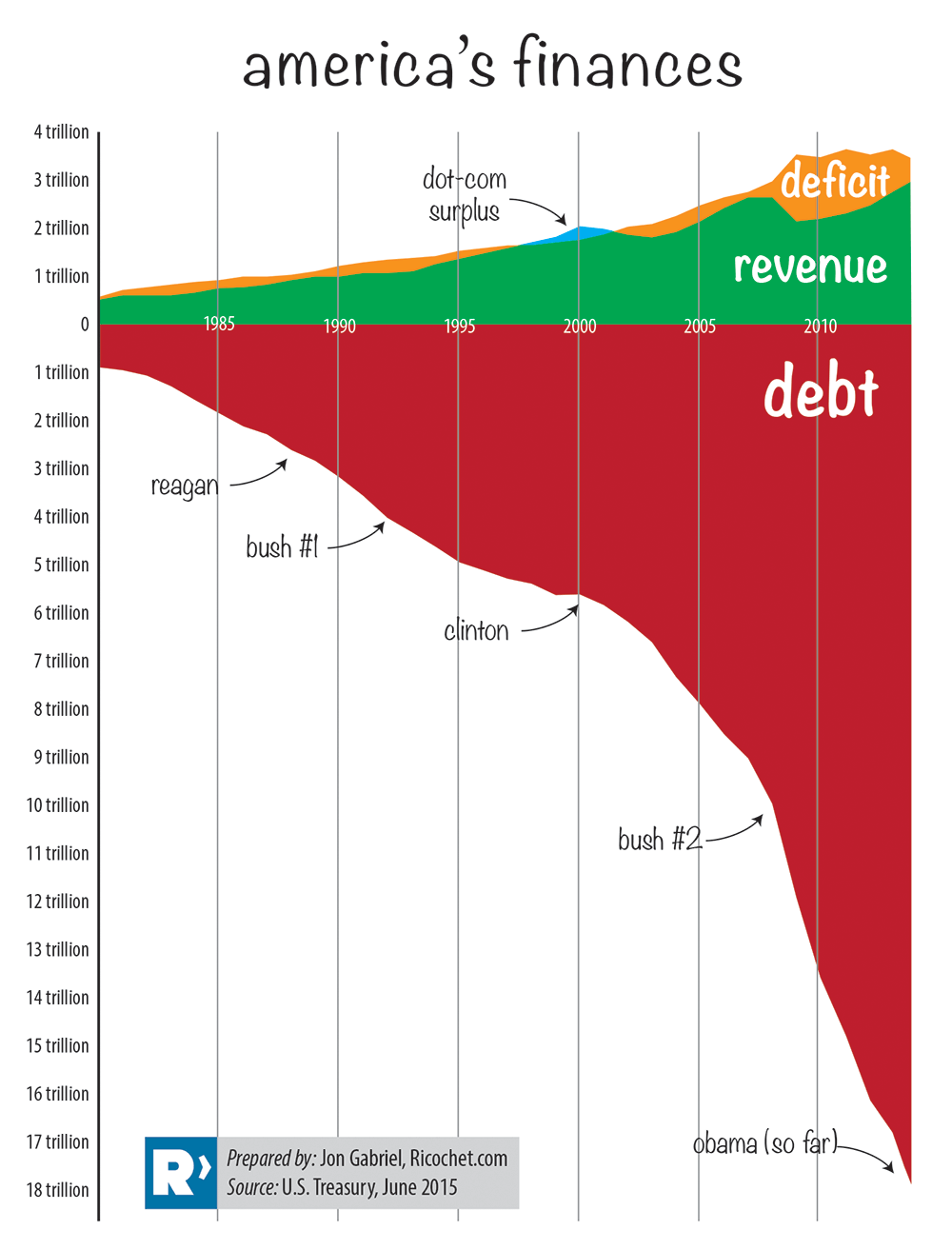

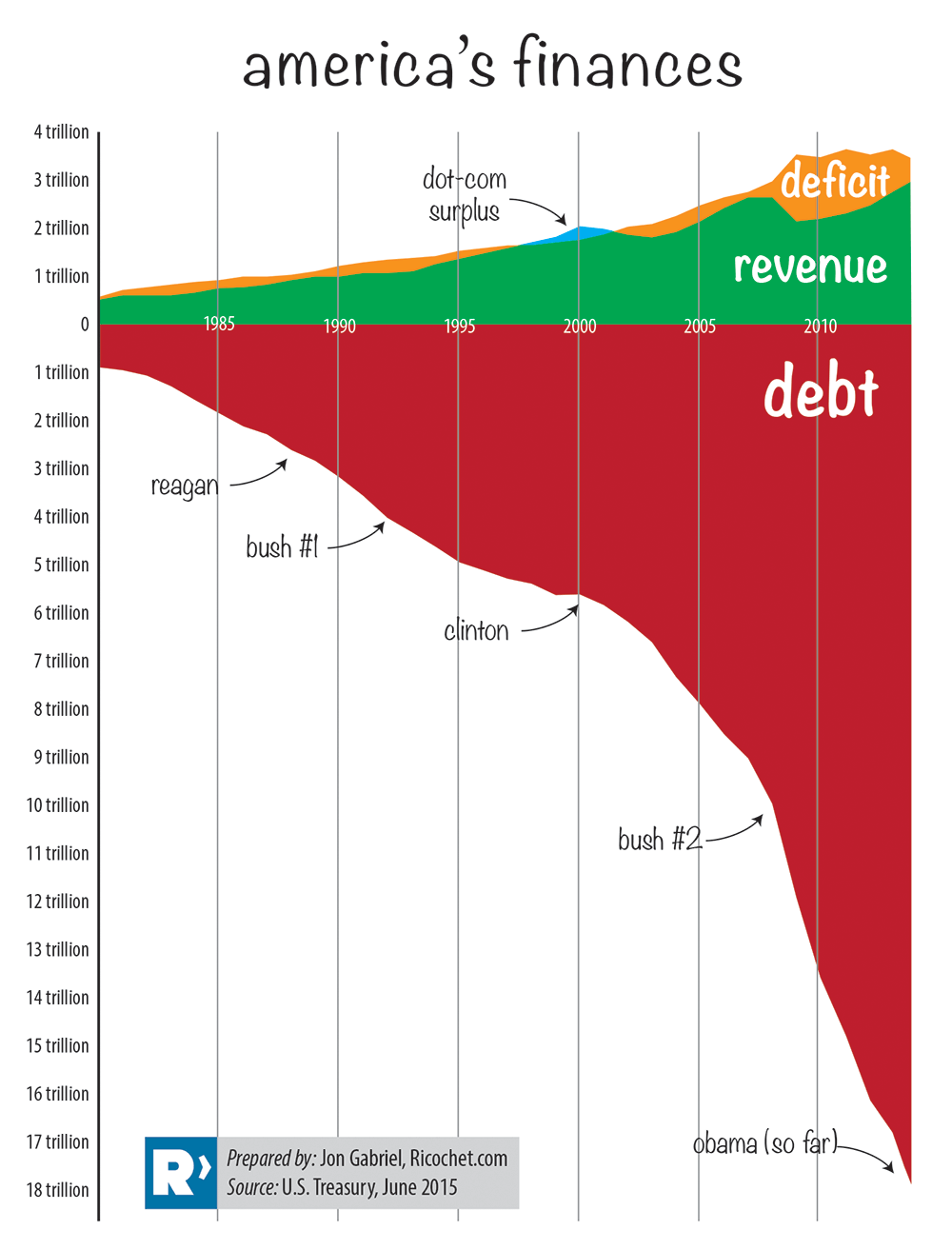

Since most graphs look like this, I created my own user-friendly debt chart focused on three big numbers: Deficit, revenue and debt. (My first version was published a couple of years ago. This one is updated with the most recent figures).

It’s an imperfect analogy, but imagine the green is your salary, the yellow is the amount you’re spending over your salary, and the red is your MasterCard statement.

The chart is brutally bipartisan. Debt increased under Republican presidents and Democrat presidents. It increased under Democrat congresses and Republican congresses. In war and in peace, in boom times and in busts, after tax hikes and tax cuts, the Potomac flowed ever deeper with red ink.

Our leaders like to talk about sustainability. Forget sustainable — how is this sane?

Yet when a conservative hesitates before increasing spending, he’s portrayed as a madman. When a Republican offers a thoughtful plan to reduce the debt over decades, he’s pushing grannies into the Grand Canyon and pantsing park rangers on the way out. While the press occasionally griped about spending under Bush, they implore Obama to spend even more.

When I posted the earlier version of this chart, the online reaction was intense. A few on the right thought I was too tough on the GOP while those on the left claimed it didn’t matter or it’s all a big lie. Others told me that I should have weighted for this variable or added lines for that trend. They are free to create their own charts to better fit their narrative and I’m sure they will. But the numbers shown above can’t be spun by either side.

All of the figures come from the U.S. Treasury and math doesn’t care about fairness or good intentions. Spending vastly more than you have, decade after decade, is foolish when done by a Republican or a Democrat. Two plus two doesn’t equal 33.2317 after you factor in a secret “Social Justice” multiplier.

If our current president accumulates debt at the rate of his first six-plus years, the national debt will be nearly $20 trillion by the time leaves office. That is almost double what it was when he was first inaugurated.

Like many Americans, I haven’t had the privilege of visiting Greece. Unfortunately, Greece will be visiting us unless we change things and fast.

Published in Economics

Considering all the things we have been told were “for the children,” what we have really (and immorally) given them is this unplayable debt. What we have given them is nothing less than slavery – both administrative/governmental and economic.

Looks like it all might go t.u. soon.

Tsipras up?

Thanks for putting this chart together. It’s a reminder that the majority of both parties in elected office are big spenders or so concerned about retaining office that they refuse to act appropriately. Sadly, I don’t see a way out of this…but I’m not all that clever when it comes to finance or politics.

Nothing will happen to address this until A. interest rates jump bigtime, B. inflation jumps bigtime, C. both. Once that happens, many of the same experts who act like those of us who point out this problem now are nuts will be saying we should have acted sooner to prevent a crises…just like people who said we needed to be realistic and learn to live with the Soviets in the 80s now say the demise of the Soviet Union was obvious/inevitable. Everyone will be an expert in hindsight.

Nice chart, Jon. Make sure to get an extra case of canned food at the Costco as we get ready for a wild ride :)

In one sense the Greeks are fortunate. Not being able to print Euros, they either have to find someone to loan them more money, or face the reality of their debt obligations. Holding the world’s reserve currency, and being able to print as much of it as we like, we can deny reality a lot longer than the Greeks – making it all the more painful when reality finally catches up.

Jon, serious question: can we please get a podcast with Jim Rickards?

1) Not again with the “imagine if this was your salary” analogy. Government finances don’t work like household finances.

2) The level of debt isn’t why Greece is in trouble.

3) The level of debt, if anything, should be increasing more due to this reason:

4) Revenues, deficit and debt are totally meaningless numbers. Spending is all that matters. Revenues, deficit and debt simply tell you how you’re financing your spending.

Ultimately, there’s no particular reason to say that “revenue” (i.e. taxes) are a preferable means of financing than debt.

In fact, given its historical low costs, debt is a much more attractive form of financing than “revenue”.

Not only are we not Greece, we’re the exact opposite of Greece. Look at the bond yields :) They mean something.

I will bring that up with the podcasting powers that be. Thank you for the suggestion.

Not again with the “world’s reserve currency” apologetics. No mention of how much of our debt is in foreign hands, no mention of treasury sell-offs and gold bullion buying by foreign central banks or sovereign wealth funds, no mention of the BRICS reserve currency pool (hint: it’s not in $US).

At the risk of having our new moderators pay me a visit: it’s long past time to wake up and smell what you’re shoveling.

Hello All; Happy Tuesday!

Great article, what always strikes me is the people in the US and our press can understand the problems with Greece. But, they do not see the same problems with the US Economy. In some ways the US it is much worse off, and our current President is far more liberal than other Socialist Governments.

I guess the great equalizer will always be an empty wallet!

Saw a funny old picture of people in Germany burning their money in winter, as it was cheaper than coal? Well Obama has just wiped out coal, I guess we can burn all the horse sh&*T that comes out of Washington DC? Though it is far more dirty than coal?

Chainsaw

Mathematics is a micro-aggression.

Steyn has argued that it’s a mistake to assume the US can get away with the same percentage of GDP in debt as small economies like Greece. As the world’s economic juggernaut, our debts have a greater impact due to the sheer amount.

None of this has anything to do with what I was saying.

It’s called cost of debt. Read about it, instead of reading Zero Hedge.

Mark Steyn would do well to read an econ book. Read Milton Friedman while he’s at it, if he’s got a preference.

The amount of debt is quite an irrelevant number, if you’re not taking into account the cost of debt.

It’s a topsy-turvy world we live in, where conservatives are saying that you shouldn’t use things that are cheap to use, but instead should use things that are expensive to use.

Jon, I appreciate the graph. Kevin Williamson wrote a book about this topic called “The End Is Near And It’s Going To Be Awesome.” In sum, as I recall, the thesis of the book is that our financial situation is irredeemable, but the inevitable collapse brings with it hope for a new beginning. I commend the book to my peers here at Ricochet.

Throughout my adult life, I’ve been told — at least during Democratic administrations — that I’m too simple to understand the brilliance of spending more than you take in and eternally increasing debt (which is now higher than the GDP).

Guilty as charged. I don’t believe that credit is infinite and nor do I think that what goes up will never, ever come down. The people who promised me that history had ended and real estate would always go up now assure me that financing America’s future is the smart play. Fresh from a multi-billion-dollar bailout, technocrats who can’t build a website or change the oil in their cars have invented a perpetual prosperity machine using byzantine fiscal instruments which transcend simple arithmetic.

Like free jazz and Obamacare, the common man is too dumb to understand it without first getting a doctorate. Just trust the experts; they’ve got it all figured out and have only my best interests at heart. Maybe -$18.3 trillion is just a good start and we should triple our debt in the next administration. But it all reminds me of the years leading up to 2008. My co-workers showed me impressive charts and graphs that proved I should trade in my dinky house for a McMansion in the exurbs with a 50-year balloon mortgage.

Come to think of it, that was the smart play for them. I’m still paying off my dinky house while my tax dollars are paying off theirs. Nevertheless, I believe 99% of people and countries throughout human history would have been better off living within their means. If this makes me dumb, so be it. Not like any of our bought-off politicians will listen to me anyway.

Recommended, if for no other reason that to see the devolution of conservative economics from Milton Friedman level down to…well down to what we have today.

Indeed he is.

Which isn’t what anyone says. So, I guess your point above was true.

This is about the cost of debt.

Taxes cost something. Debt costs something. If you’re going to finance spending through one means or another, you pick the cheapest form first.

Look at the cost of debt. What does it tell you?

There is such a thing as an optimal level of debt, and it is never zero. What it is, is different for each country. Hence, comparisons with Greece or anything else fail on face value due to the simple fact that…the cost of debt for the US is the lowest in the world.

You don’t need a doctorate to understand interest rates, Jon.

There might be an optimal debt that is not zero. However, there is no limiting principle to that. If you say no debt at all, that is an easy line to draw.

Trying to argue over how much non-zero debt is OK just leads to where we are now.

Huh. I could have sworn there was some difference between revenue and debt. Can’t quite seem to put my finger on what it is… but I’m just some poor benighted ZeroHedge reader who obviously hasn’t read the works of the masters.

Read this: take your arrogant, pompous [redacted] and [redacted].

[Saved the Editors the trouble of doing their thing.]

Sure there is a limiting factor to it. That’s what the interest rate is.

That’s why I’m saying this is about the interest rate (i.e cost of debt). All else is not even secondary.

If you say zero debt period, then you’re in essence saying “do things in the most expensive way possible”.

That’s an easy problem to fix Godel. Don’t fret.

Actually, there are 3 simple rules. (variations on the same theme)

Sure. That’s what the cost of debt reflects.

Fortunately, in America, we have an unlimited supply of “the rich” upon which can heap tax increases to fix everything. Right? They’re everywhere.

Alternative solution: All political donations over $500 have a 10% tax. That will raise revenue and get money out of politics.

Jon, are you attributing the Stimulus to Bush? If you remove that, does that help you to feel better about the differences between the parties?

One of the reasons why this stuff is less “math” when one gets into it is that the changes under a President aren’t always caused by that President (even putting aside exogenous and non-political influences on the economy). Thus the chief political input to the “dot-com surplus” was the 1990 OBRA, which had a ten year budget window. Clinton got a big cut in 1993 (although his impact was smaller than Bush’s), but the Newt/ Clinton arrangement chiefly cut spending by doing nothing and letting Bush’s budget work.

Also, I think you’re using nominal dollars there, which makes the chart look scarier, but seems somewhat hard to justify.

What happened to the Peace Dividend?