Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Athens on the Potomac

Athens on the Potomac

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Instead of pointing fingers at the innumerates running Athens, they should consider our own situation. Jason Russell of the Washington Examiner shows how America’s debt projections look suspiciously like Greece’s recent history.

With all the chaos unravelling in Greece, Congress would be wise to do what it takes to avoid reaching Greek debt levels. But it’s not a matter of sticking to the status quo and avoiding bad decisions that would put the budget on a Greek-like path, because the budget is on that path already.

A quarter-century ago, Greek debt levels were roughly 75 percent of Greece’s economy — about equal to what the U.S. has now. As of 2014, Greek debt levels are about 177 percent of national GDP. Now, the country is considering defaulting on its loans and uncertainty is gripping the economy.

In 25 years, U.S. debt levels are projected to reach 156 percent of the economy, which Greece had in 2012. That projection comes from the Congressional Budget Office’s alternative scenario, which is more realistic than its standard fiscal projection about which spending programs Congress will extend into the future.

If Congress leaves the federal budget on autopilot, debt levels will soar. Instead, spending must be reined in to avoid a Greek-style meltdown.

While we’re right to be concerned about 2040, the U.S. is in deep trouble now. Yet if you mention the debt to most Americans, they’re either confused or indifferent. “But Obama lowered the deficit.” “Just print more money.“ “It’s Reagan’s fault!”

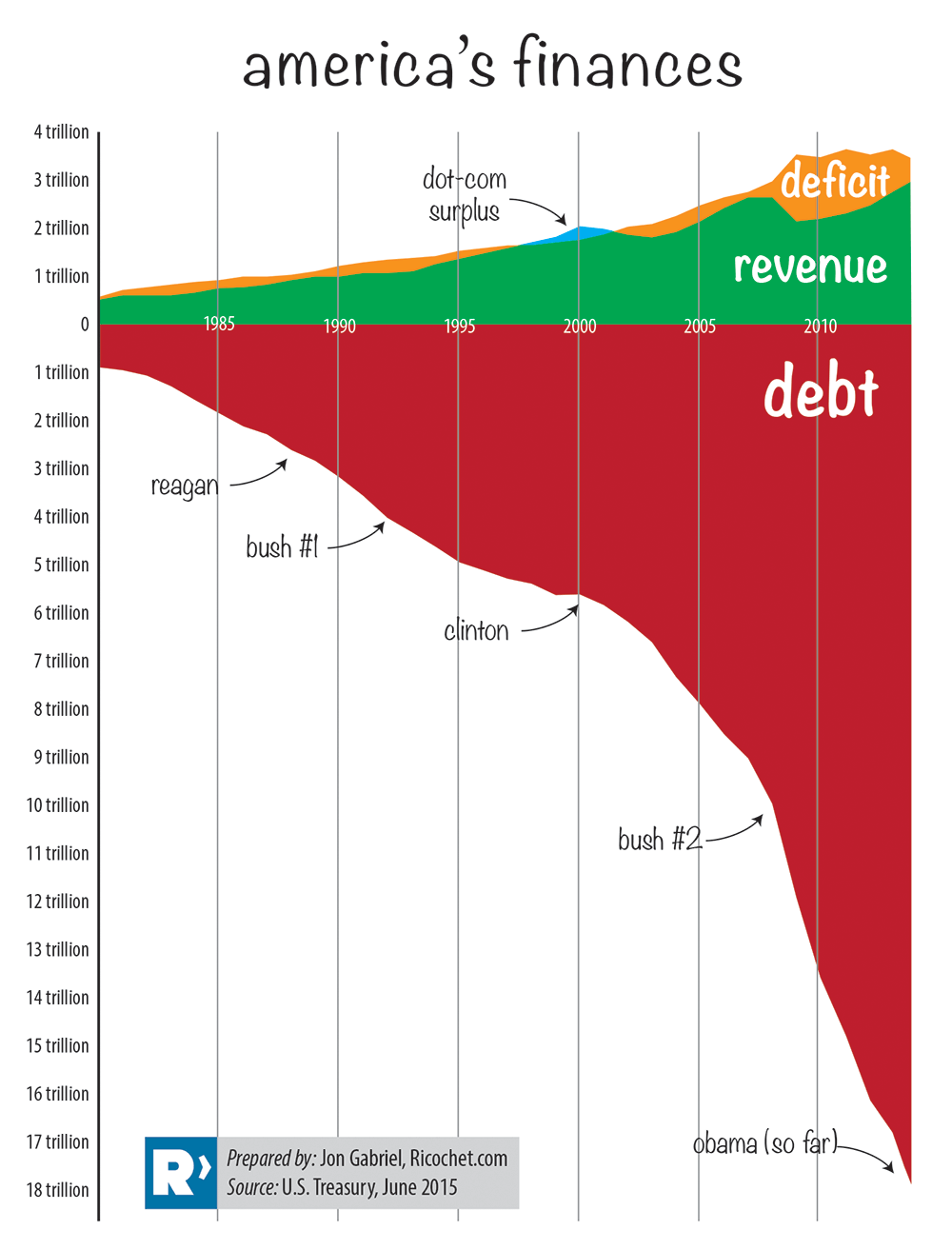

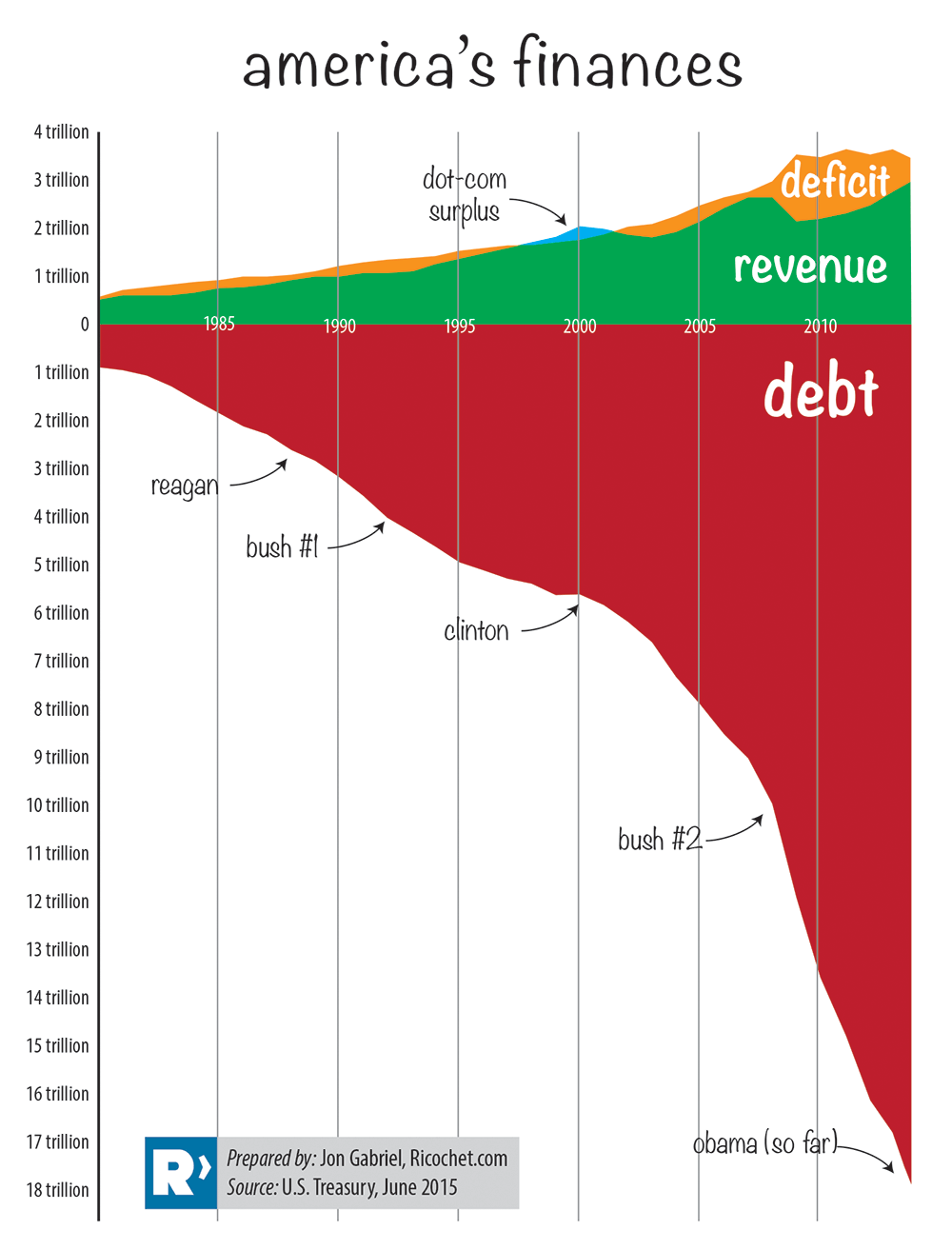

Since most graphs look like this, I created my own user-friendly debt chart focused on three big numbers: Deficit, revenue and debt. (My first version was published a couple of years ago. This one is updated with the most recent figures).

It’s an imperfect analogy, but imagine the green is your salary, the yellow is the amount you’re spending over your salary, and the red is your MasterCard statement.

The chart is brutally bipartisan. Debt increased under Republican presidents and Democrat presidents. It increased under Democrat congresses and Republican congresses. In war and in peace, in boom times and in busts, after tax hikes and tax cuts, the Potomac flowed ever deeper with red ink.

Our leaders like to talk about sustainability. Forget sustainable — how is this sane?

Yet when a conservative hesitates before increasing spending, he’s portrayed as a madman. When a Republican offers a thoughtful plan to reduce the debt over decades, he’s pushing grannies into the Grand Canyon and pantsing park rangers on the way out. While the press occasionally griped about spending under Bush, they implore Obama to spend even more.

When I posted the earlier version of this chart, the online reaction was intense. A few on the right thought I was too tough on the GOP while those on the left claimed it didn’t matter or it’s all a big lie. Others told me that I should have weighted for this variable or added lines for that trend. They are free to create their own charts to better fit their narrative and I’m sure they will. But the numbers shown above can’t be spun by either side.

All of the figures come from the U.S. Treasury and math doesn’t care about fairness or good intentions. Spending vastly more than you have, decade after decade, is foolish when done by a Republican or a Democrat. Two plus two doesn’t equal 33.2317 after you factor in a secret “Social Justice” multiplier.

If our current president accumulates debt at the rate of his first six-plus years, the national debt will be nearly $20 trillion by the time leaves office. That is almost double what it was when he was first inaugurated.

Like many Americans, I haven’t had the privilege of visiting Greece. Unfortunately, Greece will be visiting us unless we change things and fast.

Published in Economics

That’s fine, but can there be filters for those of us who are annoyed by all of these podcast posts that clutter up and obscure the good stuff in the main feed?

The problem with your theory is that it only takes into account the interest rate now. The reality is that, when debt becomes due, the government will be in no position to repay the debt, and will refinance it instead. In all probability, at a considerably higher rate than when it was first accrued.

There will be no option to pay it off with revenue when debt becomes more costly, because we can’t even pay for normal operating expenses in economically good years without extraordinary costs of wars and natural disasters and economic troubles. The debt will become due with no option except to refinance it with debt that is more expensive, because it will not be possible to attain revenue to cover it at. This is when the debt will be unsustainable, but it is avoidable by controlling spending now.

The problem with America is that it is spending too much. It is foolish to finance an unhealthy practice, no matter how cheap it is to do so.

The market only cares about where money is safe now. Wise leadership considers that the position the country will be in.

Apologies in advance for nit-picking to a ridiculous degree and for being an overall killjoy.

While it’s very pretty and fear-inspiring – and I agree with the message it’s trying to convey – your chart is somewhat misrepresentative. The units of the green and red lines are $/year, but that of the red line is simply dollars. Not only that, but any given point on the red line is equal to the sum of the deficit for every year prior, which means that each subsequent point includes what was already integrated. That strikes me as taking credit twice.

-E

But that is how debt actually works. It continues to accrue until you pay back both the interest and the principal. The only time the total debt is reduced is when there is a surplus that is actually used to repay debt (i.e it’s never happened).

In my lifetime, debt has never actually been reduced by any substantial amount. It has only continued to accrue, and been refinanced when it became due. The government’s been making interest only payments for over three decades.

Billy, your argumentation skills have improved considerably since I’ve been away. Attaboy!

Interest rates…now…don’t reflect now, however. That’s the point of interest rates. They’re about expectations of repayment out to 5 or 10 or 30 years or whatever the life of the bond is.

How much does the US government pay today in interest payment? How much did it pay in 1990?

Did you know the US government pays less in interest payment as a % of GDP today, than it has done since WW2?

Yeah. It really isn’t a problem.

Better load up on dirt cheap debt now then. Although, your assumption is still unfounded by any evidence, and all evidence points to the opposite.

Spending and debt are two separate issues.

The question is about debt vs taxes. I agree that we spend too much, but that’s not something that changes if you use taxes instead of debt.

Given whatever level of spending, the indicators show that it’s still better to finance it through debt.

Not even a little bit so.

“Wise” is to use the cheapest form of financing, not the most expensive.

Now now. Godel might have some words of encouragement for you.

And yet strangely interest rates have only gone down. I.e., people are willing to give the US government money at even lower rates than before (in fact, at negative rates).

So what does this all tell you?

It OUGHT to tell you something.

No, but TARP was a Bush-initiated program. And I strongly believe that the government spent FAR too much under Bush (as well as under Clinton, Bush I, and Reagan for that matter).

I agree that the president has a limited impact on spending, revenue, and even economic growth. Sound policies will have an effect over time, and Reagan wouldn’t have increased the debt so much without the “help” of Tip O’Neill, et al.

Lastly, I strongly agree that this chart is a very simplified expression of the issues, and intentionally so. As I note in the piece, when confronted with a chart like this…

…99% of the public’s eyes glaze over and they switch to cat videos on YouTube. My Fisher-Price version is not terribly useful to the economically savvy, but hopefully serves as a wake-up call to my fellow average Joes. There are endless charts indexing the numbers to inflation, showing them in reference to GDP, etc.; I enthusiastically recommend readers turn to those for a better understanding of the issues. However, my intention was simplicity above all.

Interest rates are at an all time low right now. That is unlikely to be the case in the future. I very much doubt that the US government will default when a 10yr bond issued today comes due. I don’t expect the US government to have revenue to repay it, however. It will refinance at a higher interest rate. It will do this with every bond that comes due, because it cannot raise revenue to cover normal expenses, let alone repay debt. It will borrow to pay the interest, as well.

Increasing debt now, with the knowledge that it will not be paid off before it must be refinanced at higher interest rates is foolish. It’s like loading up a credit card because it has an introductory 2% rate, knowing you won’t pay back a cent before the rate reverts to a normal level.

Just because borrowing is cheap does not mean it is wise.

As I mentioned to James of England, my goal was to make the graph as simple as humanly possible. With such simplicity, I’m not going to impress trained economists, but my goal is to quickly and clearly show the dramatic increase in debt and the comparative inconsequentiality of Obama’s deficit reduction.

I agree that numbers below the zero line are cumulative while above the line are annual, but I think that point is made very clear to anyone looking at the chart. The revenue and deficit are intended to be a year-to-year reference for the growing debt, which is why I placed both above the line in positive territory.

Interest rates right now reflect expectations about the future, however.

Better load up right now then.

All expectations current interest rates already take into account. And they seem to disagree with you.

That’s just not the case. Again, numbers:

You pay the debt you incur now at the rate you get now. The rate for the debt you incur now, doesn’t change in the future. You seem to be forgetting that. Second, the “normal rate” was also extremely low.

The only thing that matters here is…cost of taxes vs. cost of debt. That’s it.

This isn’t the first time you’ve said, regarding multifaceted and complex things, that only one metric matters. This is almost never true.

It’s almost always true, depending on the question. If you want to make a “theory of government spending”, then yes it can’t be that simple. Then again, you also can’t make such a theory of everything.

If the question is “debt vs tax”, i.e. the deficit…then yes.

That doesn’t mean that these terms don’t imply very complex processes. They do. But that’s why we have to use a proxy that adequately captures this complex behind the scene process.

But it also can only answer a specific question. The problem is that people confound lots of things with it. Like spending. Spending isn’t deficit. They are separate questions.

I am starting a new workout regimen to keep a civil tongue in my head. Fitness requires practice, and this should be a pretty good workout.

Is this what you’re saying?

Taxes are cheaper than debt, and so should be the preferred method of financing government activities.

Cost of debt is lower than for Greece, so we would, at a minimum, need a conversion factor to compare numbers and their consequences between here and there.

Some things should be financed due to their nature.

—

If this all pops clear in later comments, disregard. Still on the first page.

Titus.

GDP includes USG spending as one of its components. The percentage of the total budget outlays for interest payments on debt have risen to levels that are (gasp!) approaching what they were since WW2.

I guess that really isn’t a problem. I mean, by that logic, as long as we cover the cost of debt, we can all yawn and go back to bed.

What happens when interest rates go up? What happens when we have to start paying out our promised but under-funded liabilities in Medicare, Medicaid, and Social Security – and we’re too busy making interest payments to cover that cost of debt to cut checks to citizens?

You’ll see Greece, that’s what. You’ll see banks only cashing checks on certain days. And eventually, you’ll see a rapid spiral downward. That’s the real cost of debt and unfunded liabilities. Interest payments on the debt do not exist in a vacuum, and there are ripple effects in other markets (crowding out) that constrain economic growth – which reduces tax revenue growth to service the sainted debt.

Wall Street’s out of it’s mind?

Lending to serial bankrupts is a long tradition in finance. It means you think you’re going to get your bonus and retire before the cows come home.

It does not mean the serial bankrupt is a wise investment.

In for a penny, in for a pound. Maybe the EU should do a Krugmanesque experiment and tell Greece, oh what the hell, we will not only roll over the debt but extend new loans to double the “stimulus” of Greek government spending. Per Krugman, shouldn’t there be a resounding boom? If not, we round up the Keynesians and…

AIG: I get that if we assume constant spending, cheap debt versus economically harmful taxes makes sense. But what establishes a limit? If I expect to be on a roll, borrowing from my bookie seems like an investment (per Krugman) but if my personal “stimulus” plan fails and I have to ask Vinnie to front even the vig, then limits will quickly materialize. When the amount we pay to finance the debt is itself also borrowed and China stops buying T-bills or the Lakers and Cowboys both fail to cover the spread, isn’t there a new cost structure that was not factored into the earlier more optimistic cost calculus?

I want to thank you AIG. On previous topics you have taught me that arguing with a fool will only bring frustration and lots of CoC redactions. So keep up the good work!

(and remember, even Paul Rahe came to the conclusion that you are a troll)

We’re living in a world where the contradictory member arguments above are reasonable and not inconsistent with each other. Spending is the problem which can be financed by cheap debt rather than distorting taxes.The Fed has been monetizing the debt through favored banks that get to buy Treasury’s then sell to the fed for a little spread where it is held with indifference to interest rate risk. Now the monetization has increased the monetary base by 500% but the resulting 5000% increase in money hasn’t occurred because demand for credit has been weak. Demand is weak because the economies in the west are stagnant especially among debt dependent smaller business. Why? Well the government is increasing it’s burdens and creating greater risks and uncertainty. Stagnation serves the interests of the government, the Fed, the big banks and some stockholders. This thing could all start to come unraveled if those dirty Republicans actually do things to create growth, such as removing the regulatory burdens and reforming taxes, which will increase demand for credit, balloon the money supply, require Central Bank restraint , interest rates will increase, folks will panic, our external debt will become very expensive which will restrain government spending and scare the media into a frenzy. Sounds good to me as long as new leadership understands what they have to do. Hint, it won’t be Keynesian.

Correct. Until it matures. Then unless you pay it back, and we certainly are not paying back out debt, you roll it over at the prevailing interest rates at that time. With our current ZIRP environment, there is only one way to go. So where this may be “affordable” now, in these days of artificially low interest rates, it will not be going forward. Imagine the deficits if interests rate reverted to norm, something closer to 4%.

Have to say, if I was Treasury Secretary, I would be looking for a way to float 100 year notes.

Actually, AIG, you missed my point. Let me rephrase:

Once you allow debt, elected leaders will use debt instead of taxes in order to spend money because they see it as cheaper, both in ways you point out, and in terms of political pain in the right now. There is no way to limit how they will use the debt, and will be free to spend however they want to spend.

The only ultimate limit is to allow them no debt at all. Otherwise they will abuse the system (as will the voters).

It is a philosophical point as opposed to a policy one.

In my own life, I have 0% interest debt on my car. Therefore, it is to my advantage to use the debt for my car. I get that point.

Edited by adding word interest to be more clear.

AIG, you seem to be under the impression that the interest rate of a debt instrument today is an accurate prediction of what it will be for a similar instrument at the time of the instrument’s maturity. Or am I mischaracterizing your view?

A particular interest rate tells you nothing about future interest rates. On the other hand, the shape of the yield curve gives an indication – but far from an accurate prediction – of the direction of interest rates in the future. However, it tells you little about the level of future interest rates.

Is it your assertion that the yield curve is flat, or inverted?

There’s nothing wrong with showing “flow” numbers – such as revenues or EBITDA – along with “balance” numbers – such as debt or cash-on-hand – as long as they are clearly labeled. In fact, in my line of work, we look at financial ratios such as Debt/EBITDA every day. It shows how many years’ worth of EBITDA the company’s debt represents.

Such a ratio could be graphically represented in a chart like Jon’s. Rather than mixing apples and oranges, it shows an important relationship between two metrics.

If Jon’s chart used constant dollars, I would have no quibble with it at all.

Show me the numbers.

You couldn’t be more wrong. Look above.

You borrow less.

So this is the “everyone is an idiot except for me” argument? Ok.

When did the US go bankrupt again?

Well, thank goodness someone at least acknowledges the point! Pfeww…

The interest rate.

I’d argue there is much more of a limit that debt imposes, than taxes. Look at European countries. You can get some really high tax rates…but you really can’t get much borrowing at high interest rates.

Taxes only depend on political limits. Debt depends on actual market limits.

So all the people saying “but what happens when the interest rates go up?” That’s the point!! That’s the market saying…nope.

That’s a hard limit. Politicians can always tax you more. But they can’t always borrow more.

But that’s not where the US is. It’s in the opposite place. It’s the market saying “regardless of anything else, you’re the best investment out there”

I work on Wall Street, as a matter of fact. ;)

Let’s see:

FDR defaulted in 1933. Nixon defaulted again in 1971. That bill in your pocket that says “Federal Reserve Note” but is no longer redeemable for anything except another IOU is a handy reminder.

Like I said, serial bankrupt, yet people keep lending to us.

Perhaps you can familiarize yourself with some financial history along with the economics lesson you’re in dire need of?

So AIG, you approve of inflating/devaluing the government out of its printing problem?

The idea that the yield on our bonds is a true measure of the value of our national debt is nonsense. The largest owner of our debt is the Federal Government itself, not any independent buyer. The Social Security Administration is required by law to invest in treasuries regardless of the true value of that debt. The Fed loans money virtually for free; if you allowed me access to free money from the Fed, I’d buy Treasuries at a few percent interest as well. As soon as the domestic holders of that debt get the idea the Fed is going to significantly raise rates, they will dump those holdings as fast as they can. Just another reason among many that the Fed, and us, are screwed. And, when all else fails, the Fed simply buys Treasuries directly to support the “market ” for them.

If there were real genuine interest in our debt out there, the Fed would not have to keep interest rates at zero or keep trillions of government debt on its books.

Which brings up the question, AIG: If there is so much demand for U.S. debt out there, why does the Fed keep so much of it on its books?

Well, that’s right. That’s the point I’m making.

Well, this is where you lost me.

Doesn’t look like stagnation to me

As I said, if you think we’re not paying back our debt, go buy a US government bond and see if you get any money.

The rate right now is what matters. If you borrow at a very low rate (effectively negative interest rate), paying it back is a much easier thing.