Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Athens on the Potomac

Athens on the Potomac

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Financial experts in New York, London, and Brussels have tut-tutted Greece’s economic travails as Athens considers its future with the European Union. Why did they borrow so much money? How can they ever pay it back? Do they think that much debt is sustainable?

Instead of pointing fingers at the innumerates running Athens, they should consider our own situation. Jason Russell of the Washington Examiner shows how America’s debt projections look suspiciously like Greece’s recent history.

With all the chaos unravelling in Greece, Congress would be wise to do what it takes to avoid reaching Greek debt levels. But it’s not a matter of sticking to the status quo and avoiding bad decisions that would put the budget on a Greek-like path, because the budget is on that path already.

A quarter-century ago, Greek debt levels were roughly 75 percent of Greece’s economy — about equal to what the U.S. has now. As of 2014, Greek debt levels are about 177 percent of national GDP. Now, the country is considering defaulting on its loans and uncertainty is gripping the economy.

In 25 years, U.S. debt levels are projected to reach 156 percent of the economy, which Greece had in 2012. That projection comes from the Congressional Budget Office’s alternative scenario, which is more realistic than its standard fiscal projection about which spending programs Congress will extend into the future.

If Congress leaves the federal budget on autopilot, debt levels will soar. Instead, spending must be reined in to avoid a Greek-style meltdown.

While we’re right to be concerned about 2040, the U.S. is in deep trouble now. Yet if you mention the debt to most Americans, they’re either confused or indifferent. “But Obama lowered the deficit.” “Just print more money.“ “It’s Reagan’s fault!”

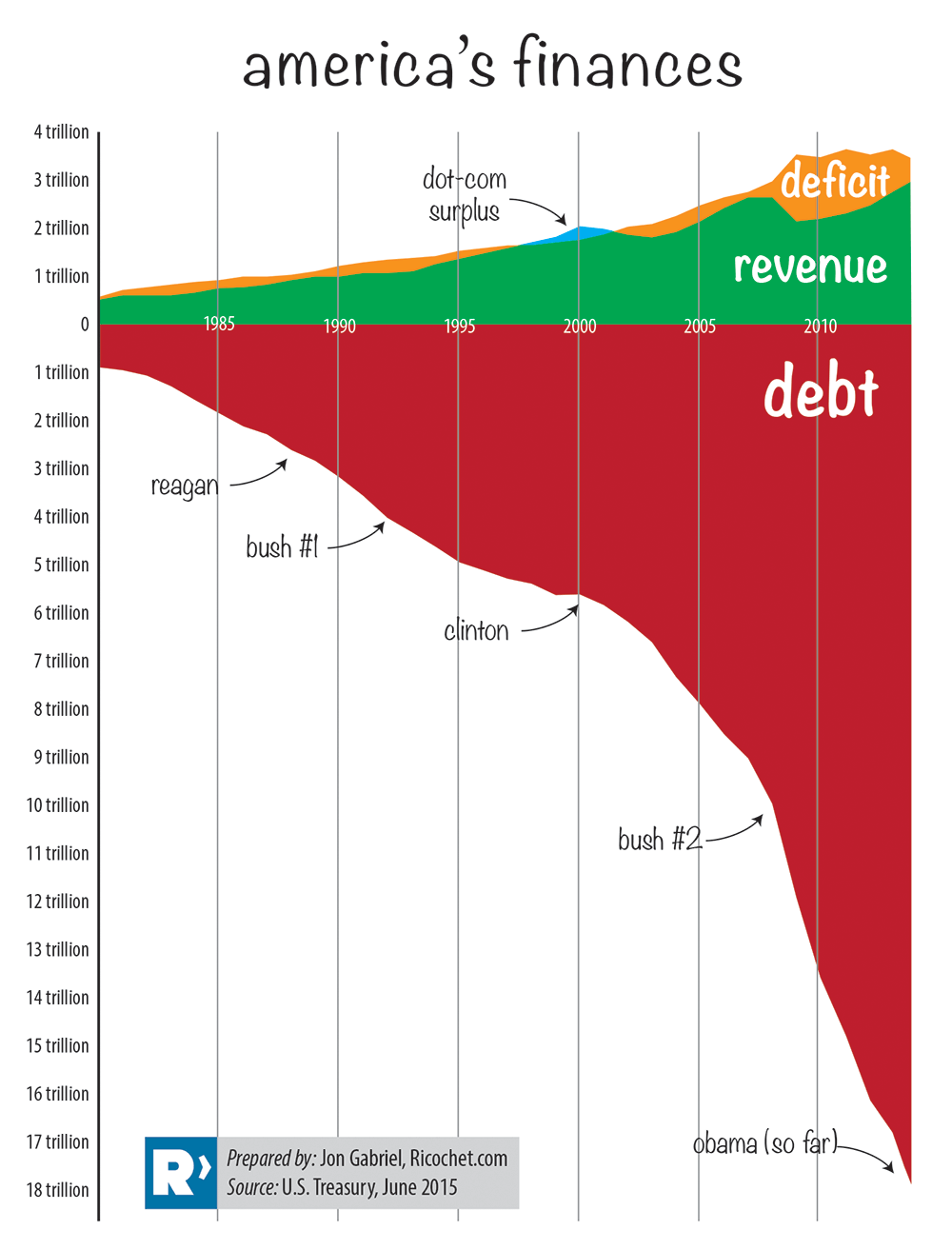

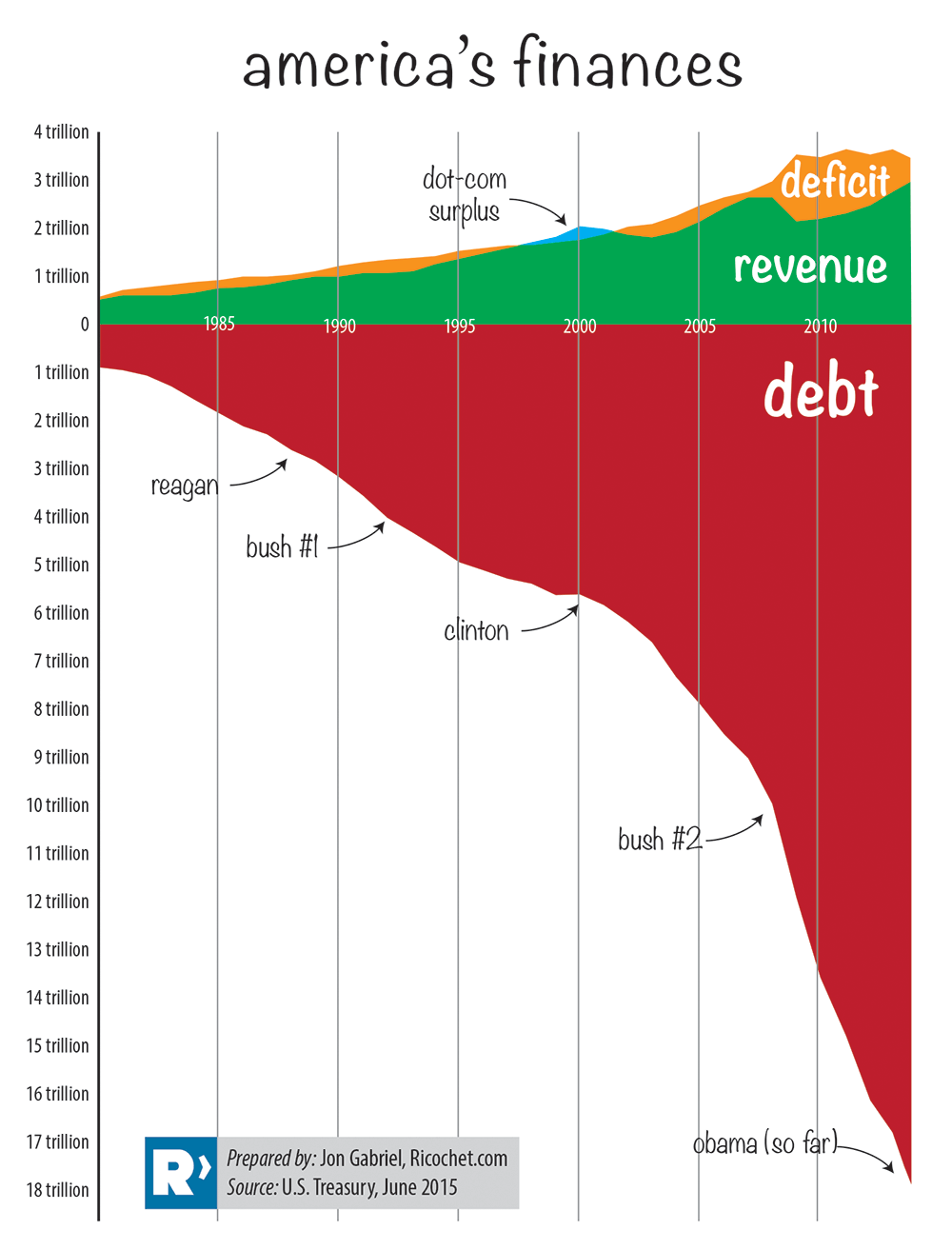

Since most graphs look like this, I created my own user-friendly debt chart focused on three big numbers: Deficit, revenue and debt. (My first version was published a couple of years ago. This one is updated with the most recent figures).

It’s an imperfect analogy, but imagine the green is your salary, the yellow is the amount you’re spending over your salary, and the red is your MasterCard statement.

The chart is brutally bipartisan. Debt increased under Republican presidents and Democrat presidents. It increased under Democrat congresses and Republican congresses. In war and in peace, in boom times and in busts, after tax hikes and tax cuts, the Potomac flowed ever deeper with red ink.

Our leaders like to talk about sustainability. Forget sustainable — how is this sane?

Yet when a conservative hesitates before increasing spending, he’s portrayed as a madman. When a Republican offers a thoughtful plan to reduce the debt over decades, he’s pushing grannies into the Grand Canyon and pantsing park rangers on the way out. While the press occasionally griped about spending under Bush, they implore Obama to spend even more.

When I posted the earlier version of this chart, the online reaction was intense. A few on the right thought I was too tough on the GOP while those on the left claimed it didn’t matter or it’s all a big lie. Others told me that I should have weighted for this variable or added lines for that trend. They are free to create their own charts to better fit their narrative and I’m sure they will. But the numbers shown above can’t be spun by either side.

All of the figures come from the U.S. Treasury and math doesn’t care about fairness or good intentions. Spending vastly more than you have, decade after decade, is foolish when done by a Republican or a Democrat. Two plus two doesn’t equal 33.2317 after you factor in a secret “Social Justice” multiplier.

If our current president accumulates debt at the rate of his first six-plus years, the national debt will be nearly $20 trillion by the time leaves office. That is almost double what it was when he was first inaugurated.

Like many Americans, I haven’t had the privilege of visiting Greece. Unfortunately, Greece will be visiting us unless we change things and fast.

Published in Economics

How do you limit what they spend taxes on right now? You don’t.

As for your previous point, the only control on taxes is political. The control on debt is the actual market. Which one do you trust more?

The only real limit is for people to stop demanding more spending from government.

Which “conservatives” haven’t ever…ever…done. Because the moment any program is about to be cut, there will be some “conservative” constituency that will come up and scream “no cuts for us!” Look at the cuts on military benefits as an example.

That’s right.

If we’re debating spending, that’s a separate issue.

If we’re debating…deficits…then it’s a question of the cost of debt vs taxes

It’s not about predictions. It’s about the current expectations.

And what it does in the future isn’t all that important for two reasons:

1) Even if it does, and it will, increase, it won’t increase all that much, since US government debt still remains the safest investment out there. Interest rates on different maturities say that.

2) Regardless of what rates do in the future, you borrow more now at the lowest interest rate, because you’ll have much smaller payments to pay in the future. Saying that things are likely to be more expensive in the future is precisely why you buy it now that it’s cheap.

Oh boy!

Thanks. How is gold doing anyway? Did it reach $5,000 yet?

Well, it’s a good thing no one said that then.

Monetary policy.

Monetary policy is tied to fiscal policy.

See, one DOES actually need a PhD in economics to figure this stuff out (or more specifically a PhD focusing on monetary or fiscal maters) . People who say otherwise, are fooling themselves. So, read what the economists are saying…Yo don’t have to agree with them. They don’t between themselves often. But at least its good to know what the disagreements are over, what the issues are, and what this system actually looks like.

Or don’t. Whatever.

Doh!!

John. I’m very disappointed in you. No really, I mean it.

Because your argument fails the most basic understanding of…RISK.

Interest rates, and hence return on the bond, reflect RISK.

I can equally say that you can compare government bonds with the S&P 500 and you’ll do FAR worst compared with that, than compared to basket of “gold and land” (which is a really poor investment, but anyway).

But that is a pointless comparison. People buy government bonds because of their LOW RISK. Not returns. That’s actually the whole point :)

Debt is good for the person issuing the debt precisely because it is so cheap! Meaning, it has such low interest that you have to pay back.

You’re just flipping the argument around and saying “well from the perspective of the guy buying the debt, it’s really low return”

Yeah!

But why are they buying it then? Cause its the lowest risk investment out there. RISK!

AIG, you are assuming the people buying US debt are smart enough to correctly price the risk of US debt. I have no confidence that the bond market is always right.

It requires no assumption that anyone is smart enough for anything. It simply requires the assumption that it reflects what people are willing to accept from the US government in exchange for their money.

Which is self evident by the fact that they are. If they weren’t willing to accept it, you wouldn’t be able to sell it.

Your argument would be an excellent argument for a Leftist to say why markets don’t work and why government needs to price everything.

AIG,

Your style of argument makes you no friends.

Everybody realizes your main point that the government should take on debt when the cost is cheap. What you won’t concede is that if the government takes on debt, eventually the taxpayers have to pay it back.

We are arguing that Congress has no intention of ever paying it back, and that the political realities are that both the taxpaying public and the bondholder are being naive in thinking that Congress will ever raise taxes to pay back the debt.

The reality is that government debt gives Congress to the political ability to raise spending beyond what it otherwise would be because they can offer the taxpayer $1.4 of spending for every $1 of taxes. Most people are not long term thinkers, and Wall Street are the shortest thinkers of them all.

AIG, you’ve outdone yourself in #66. nevermind the caps, the bold, the exclamation points: risk is priced in. it is a component of the expected value, which is reflected in the returns by the law of large numbers.

Well Duh! Of course they are willing to buy US debt at that price – they are buying it. What I am saying is that the people buying US debt right now are like the people buying a McMansion in 2006. The people that bought McMansions in 2006 didn’t take on half a million in debt because they thought it was going to be a poor investment. Just because people make investment decisions doesn’t mean they made a good investment decision.

anonymous:

No. It’s not.

I’m saying its the worst possible investment if you want returns. It’s the best possible investment if you want safety.

Which is precisely why it’s very cheap for the US government to finance itself this way.

As a debt issuer, I don’t want it to pay off.

What does “wild fluctuations” tell you?

Your “bet” is precisely why it’s cheap to finance through debt right now, and expensive to finance through taxes.

All you’re telling me is that you’d prefer to walk into a bank and tell them “why are you so stupid to give me a loan at 0% interest? Do you guys not want profit?”

Would you rather pay back a higher interest rate, or a low interest rate?

Do taxes not have costs?

You can argue that all you want, but that’s not a realistic description of the situation.

Wow. Great. You’ve just made an excellent argument for Elizabeth Warren.

Yes it is! That’s my point :)

Thanks for agreeing with me. That’s why the return is so low.

The people buying the debt aren’t the issue here. Why do we care about them? We want them to get “screwed”.

I.e., you want your bank to give you 0% interest loans.

The argument is rather: you can pay for the $1 in spending today out of the $1 you could have invested in something else, and earned you a 5 or 7% return per year, and thus have much greater economic growth in the future.

Or would you rather pay for that $1 now with $1 borrowed at (effectively) free interest rate, and instead invest the $1 you have now in economic growth?

Which scenario is better?

So it’s not simply an argument for why cheap debt is “good”. It’s also why taxes are expensive. Paying taxes now vs the future has a cost.

I agree with you. I’m counting on those limits. More so on the market limits to the issuance of debt.

Sure. What the government spends it on, is a political issue.

Every where you quoted me, you did not include the most important line:

I am making a philosophical point, not a policy one.

Why was that?

If you are going to try to refute my point, why ignore the most important part of it.

Your point is that you spend the cheapest money. My point is, making money more expensive means you have less to spend. If the only way to spend money is politically painful, less will be spent.

As you choose bash conservatives for not wanting cuts, in my post, without knowing my thoughts, I will share them.

I would be for an across the board 10% reduction in spending.

There, a conservative that wants real cuts. Or, do you claim that I lie?

AIG:

“And what it does in the future isn’t all that important for two reasons:

“1) Even if it does, and it will, increase, it won’t increase all that much, since US government debt still remains the safest investment out there. Interest rates on different maturities say that.

“2) Regardless of what rates do in the future, you borrow more now at the lowest interest rate, because you’ll have much smaller payments to pay in the future. Saying that things are likely to be more expensive in the future is precisely why you buy it now that it’s cheap.”

Me:

1) The country that had a T-Bond rate of about 14.6% in the early ’80s? Was that a different US of A? And the rate was half that amount five years earlier. I’ll bet there were folks in 1977 who thought rates couldn’t go up all that much.

2) Here’s an analogy: You buy a house, perhaps a little more house than you can afford. You finance it with a mortgage that has an interest rate of 2.5% for 10 years, after which it readjusts at prevailing interest rates. Your income is fairly stagnant. What if you made the purchase based on your friend’s insistence that you should “borrow more now at the low interest rate, because you’ll have much smaller payments to pay in the future [sic]. If you think rates will be more expensive in the future – that’s precisely why you should take on more debt now that it’s cheap.” Would that advice make any sense at all?

Likewise every single Tea Party enthusiast who rejoiced at “a return to 2008 spending levels”, and who balked at *less* cuts than that. We have never seen a budget proposal that even balanced at the end, much less instantly.

So you have no answer other than the arrogant assertion that you are so much smarter than me that I can’t possibly understand why the Fed is monetizing debt.

In my experience, that sort of arrogance is a bluff always deployed by the pretentious when they have no answer, rather than by the truly brilliant who are distinguished by the ability to convey sophisticated ideas in a straightforward manner. Someone who really knows never finds it necessary to hide behind charges of ignorance in his interlocutors.

Your faith in the wisdom of the markets is heart-warming, if naive.

Markets are composed of irrational people. To think that combining irrational people will make a rational market is to think that tying two rocks together will allow them to float.

The advantage that free markets have over Warren’s socialism is not that they make better decisions, but that the bad decisions fail. Participants in a free market are not, per se, more rational than socialists, but they can go out of business. Evolution will take care of the rest.

Your argument seems to rest on a notion that the market will enforce some useful discipline on the amount of debt this country can take on. That is belied by experience, whether it’s America, Argentina, Greece, Puerto Rico, or many others, the irrational group of people known as the market will happily buy from you the debt with which to bankrupt yourself.

And then another group will line up to do it to the next guy…

You may be right in theory that this is a good time to finance with debt, but history tells us that it’s a bad time, because the low interest rates will encourage over-utilization of debt, and politicians will not plan for the bad times that are inevitable—because it’s not in their interest, and will leave us with an overhang of unsustainable debt.

LOL.

You don’t understand what risk is. Risk is not your perception of what your neighbor’s perception of what the value of a thing is.

That’s known as the greater fool theory—the theory that there’s always a greater fool than you to take the asset off your hands.

anonymous’s got the understanding of risk absolutely right. I would suggest you don’t take the other side of his bet, as it’s been running for 100 years already, and he’s way ahead.

No doubt the coin-debasing crown-ed heads of Europe, the Emperors of the Romans, and the Pharaohs alike all had PhDs in finance when they monetized debt as well. As opposed to the obvious offloading of pain — in the short term.

BTW, thank you Ricochet!

The spectacle of AIG lecturing anonymous on how he doesn’t understand risk and reward will keep me smiling for the rest of the morning.

John, you should feel very fortunate. It must not be often you get trawled like that.

Thank you for this comment, also.

You should read up on the folks who ran Long-Term Capital. They were your kind of guys…

Last I heard they were accepting investors in a new venture…

I’ll be chuckling for the rest of the day over that statement of yours…

Because you’re not making a philosophical point. You’re making a policy one.

Obviously, yes.

Except that there’s no “readjusting” rates. The rate you borrow at, is the rate that you have to pay back.

I already gave you my answer: monetary policy.

It’s got nothing to do with the “wisdom” of the market. It’s got everything to do with who processes information in a more efficient way.

So…that’s that then.

Those are all excellent examples of the opposite. What are the interest rates for those countries? What do you think…interest rate…means?

Jiminy Cricket!!

Have you ever gone to a bank to borrow money?

Good thing no one made that argument then ;)

Again, I’ll repeat the question I asked above…have you EVER gone to a bank to borrow money?

Seems to me, you haven’t.

Indeed. How people can’t understand that the reason something gives very low returns is precisely because of its risk discount…is truly educational.

Or how one would argue that you want to pay your creditors more, instead of less.

This is like walking into a bank and demand that they increase your interest rates by 5%, because “don’t they want to make more profit?”

Thank you Ricochet, indeed.