Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Addressing the Minimum Wage Conundrum: A Proposal

Addressing the Minimum Wage Conundrum: A Proposal

a katz / Shutterstock.com

The minimum wage has been a prominent issue of late, with the Left arguing for significant increases thereof and the Right pointing to the likely catastrophic consequences of such an increase. Even absent a potential increase, economic difficulties still arguably exist at the low-income margin.

Below, in faux-interview format, is an overview of a potential alternative mechanism for implementing the “minimum wage” concept that, to my knowledge, has not been proposed before that I’ve dubbed “The Alternative Minimum Wage.” If it has, I am confident that the Ricochetti will promptly correct my ignorance.

What are we to do about the minimum wage?

Simply put: Despite its political durability, the minimum wage is economically destructive, pricing a significant fraction of those struggling to climb up to prosperity out of the labor market.

Why is minimum wage politically durable? Many perceive the minimum wage as necessary so that “everyone can earn a living;” that is, it should never be the case that a person be required to work, yet not earn enough through that work to feed himself and his family/dependents. This is well and good for those holding jobs in a market governed by a minimum wage, but does little to help those afflicted by the marginal unemployment induced by a price floor on labor. A person’s labor value is what it is. No amount of wishing will make them able to perform work that affords more value; only gains in experience and education can do that. But those out of work lack access to one of the key things offering some promise of such gains, and economic damage follows.

So, again: What are we to do about the minimum wage?

First, on the question of political durability: when it comes down to it, the “everyone needs to eat” motivation for the minimum wage is entirely valid. Demand for the basics of survival in society — food, housing, clothing, transportation, etc. — is inelastic at the lower margin. Even someone whose labor has a market value only of $3/hour still needs to feed himself, even if the return from his labors is insufficient to procure basic survival needs. This seems to me one of the things that gets liberals most upset when conservatives argue against raising the minimum wage, or against the minimum wage generally. The economic difficulty is quite real and — given prevailing sentiments about government provision of a “social safety net” — it’s not unreasonable to demand the matter be considered.

As I see it, the problem is that the current form of the minimum wage commits a category error in attempting a market-intervention solution that directly constrains employers and employees in terms of what wage rates are or are not permitted. I posit that, in fact, the proper approach to addressing this problem is in fact through non-marketmeans.

Once upon a time, private institutions such as churches or charities, might have served such a role, but today the public acceptance of a government-mediated safety nets has significantly diminished the role of such organizations. Thus, while I (and I assume many others) would prefer a non-governmental solution, I believe that only a government-mediated approach is likely to gain sufficient traction to actually be implemented in the present political environment.

Ok, ok, smart guy, get to it. What’s your solution?

I call my proposed solution to this problem the “Alternative Minimum Wage” or AMW (The allusion to the Alternative Minimum Tax is intentional, though I hope the AMW would have fewer negative consequences and be more positively regarded.) There are three key premises, already mentioned above, which are important to keep in mind in the following discussion:

- The concept of the minimum wage is politically durable and will be a part of the economic body politic for the foreseeable future.

- The minimum wage as currently instituted has intrinsic, toxic economic consequences at the low-income margin.

- The government on all levels is already heavily engaged with financial transfers to the citizenry in employment-related matters, will likely be thusly engaged for the foreseeable future, and enjoys general public support of such engagement. Accordingly, the proper question for the present is not “Should these transfers be taking place?” but instead “What is the least negative form that these transfers could take?”

The overall objectives of the AMW are to:

- Eliminate the artificial floor on the market rate for labor;

- By transferring the burden of providing a ‘living wage’ to a government mechanism;

- That doesn’t dramatically further entangle the labor market with government intervention;

- While providing incentives for a) Employees to work, to gain skills and to improve their market labor value and b) Employers to abide by the rules (mainly, to not defraud the system).

So how does it work?

At a high-level, there are two steps:

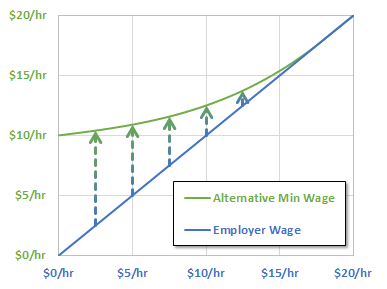

First, employers hire employees at whatever wage rate they wish and pay them for their hours worked. Second, employees take their pay stubs showing hourly pay and non-zero wage rate to the Alternative Minimum Wage Office for further compensation up to the AMW, as illustrated to the right.

First, employers hire employees at whatever wage rate they wish and pay them for their hours worked. Second, employees take their pay stubs showing hourly pay and non-zero wage rate to the Alternative Minimum Wage Office for further compensation up to the AMW, as illustrated to the right.

The AMW Office would take the pay stub and map the “Employer-Paid Wage” (EPW) rate to a defined “Government Supplemental Wage” (GSW), likely through the use of a lookup table similar to the 1040 tax table, which they would then calculate based upon the hours worked and pay to the employee. The employee’s net pay is then the AMW.

The figure above illustrates how this would work: the straight blue line is the EPW, the dashed arrows represent the GSW at a few different EPW rates, and the green curve is the resulting AMW. As the EPW increases, the GSW decreases, eventually trending to zero. However, the GSW is structured so that the AMW is always a strictly increasing function with respect to the EPW, which provides important features as described below. (For details of the particular functional form of the AMW in this figure, see the Appendix at the end of the Google Doc linked below.

So, how does “living wage” get defined?

Federalism! I would advocate for a law at the federal level that allows each state to choose between retaining the minimum wage status quo or implementing the Alternative Minimum Wage (again, the AMW). Each state electing to implement the AMW would then be free either to define a state-wide Government Supplemental Wage (again, the GSW) schedule, or to devolve definition of the schedule to the county or municipal level if it so elects. The “living wage” is thus defined on a state or local level, which should permit, for example, New York to define a substantially higher “living wage” than Kansas.

At least one constraint would have to be placed on the AMW curve, though. As best I can figure, in order to satisfy Objective 4a (incentivizing employees to work and gain skills) the AMW would have to be a strictly increasing function, such that the marginal income on the AMW curve is always positive. This is a key aspect, as it would provide a consistent, direct financial incentive for one to improve the marketability of his labor and, consequently, increase his pay.

If we implement this, why should people bother to work instead of just staying on unemployment? What about things like SNAP?

These programs would also have to be modified, probably to include significant cutbacks in unemployment benefits and other transfer payment programs. For unemployment, I envision a significant reduction in the duration of the eligibility period — something like 6 to 12 weeks — to incentivize people to work for the government assistance. Other transfer payments would have to be eliminated or restructured to ensure positive marginal income at every point as the EPW increases.

Ok, so people are working, fine. But what’s to stop employers from paying 10 cents per hour and making the whole thing completely unaffordable?

This is one of the additional benefits of requiring a strictly increasing AMW function: the uniformly positive marginal income on the AMW curve means each employee has a consistent incentive to maximize the EPW for their hours worked. Therefore, they would be incentivized to change employers if that would provide them a higher EPW and — per standard microeconomics principles — the EPW labor price for each given job type would adjust to a supply/demand equilibrium. The AMW then “fills in the gap” for any workers whose equilibrium price of labor is below what the relevant jurisdiction considers a “living wage.”

Who would be eligible for this?

Everyone with a valid Social Security or Tax Identification Number.

Yes, everyone! Anyone who earns an hourly wage in the reimbursement range can go to the AMW office to get the GSW for their hours worked. If Bill Gates decides to work half-time at a McDonald’s for $4/hr, he is eligible to claim the GSW on those wages if he wishes. Attempting to carve out eligibility exceptions based upon net worth, other income, personal situation, or other factors would only complicate and confound implementation.

What about overtime? Is there a 40-hour-per-week limit?

Nope! Any hour of work is eligible for GSW compensation up to the AMW. One constraint that must be imposed, though, is that overtime pay would have to be reported with a multiplier on the wage rate, and not on the hours worked. For example, ten hours at time-and-a-half on a $4/hr EPW would be reimbursed as ten hours at $6/hr, not fifteen hours at $4/hr. This would be readily enough policed, as the records of GSW disbursements would include the total hours compensated for each taxpayer, allowing ready detection of instances where the hours reimbursed exceed forty in a given week.

What are the tax implications?

These would have to be hammered out, but I envision GSW and EPW would be taxed identically at all levels, federal, state and local. That way, as long as tax regimes are rationally constructed from the perspective of avoiding negative marginal net income, definition of an AMW curve that also avoids negative marginal gross income is more straightforward.

One of the big questions is of jurisdiction: if someone living on the eastern edge of California commutes to a job in Nevada, who pays the GSW and to whom does the employee pay tax on the GSW? While all sorts of games could be played to try to engineer the incentives, I think the most straightforward scheme is for the GSW to be paid by the jurisdiction of the employer, and for the tax on the GSW to be paid to the jurisdiction of the employer. I’m definitely not an expert in this area, though.

How would you pay for this?

In theory, the money would be freed up by a combination of reduced utilization and tightened eligibility criteria of other programs such as unemployment and SNAP. I haven’t attempted to run any of the numbers, so this theory could easily be flawed. As a first, rough approximation: if I understand correctly, a common unemployment compensation rate is 75% of the pay received at one’s last job. So, as long as the average equilibrium EPW is at least about 25% of the current minimum wage, the overall GSW outlay should be no more than the current unemployment benefits expenditures.

What about fraud? Couldn’t someone just …

Yep, of course there’s a fraud risk. Satisfying Objective 4b (having employers play by the rules) without obliterating Objective 3 (keeping government entanglement to a minimum) is probably the biggest challenge for any system like this. One wants to keep the system streamlined, while also putting in place appreciable disincentives to the low-hanging fruit modes of fraud.

Frankly, I don’t have any magic-bullet ideas, but here are two suggestions:

- Add a cost to the preparation/submission of the pay stub to the AMW Office, either by setting a price for the paper forms or for an electronic submission ($5/form, perhaps). The amount would need to be small enough relative to the the average expected EPW paycheck not to discourage employers from hiring at low equilibrium wage rates, but high enough that bulk submission of forms would be disincentivized.

- Require registration with the AMW Office on the part of any employee wishing to receive a GSW, using systems approximately similar to those for unemployment benefits, SNAP, etc. Alternatively, perhaps a model more similar to driver’s licenses would be appropriate. Regardless, the idea would be to require a periodic, infrequent, affirmative action of appreciable inconvenience on the part of the employee in order to be eligible to receive AMW benefits.

Ultimately, as long as there’s no reason to expect dramatically more fraud under an AMW regime than in the present arrangement, I don’t really care about a neatly fraud-proofed system. No matter the system, some people will find the cracks; the task is simply to make the effort of exploiting them sufficiently difficult so that the brightly-lit path of proper participation is the rational choice. I’d advocate for each state/locality to implement AMW an experiment with its own fraud-management approach, with more successful ideas spreading as their efficacy is demonstrated.

Any last words?

The core idea of the Alternative Minimum Wage is changing the paradigm from government paying people not to work, to instead paying people to work. Regardless of the direct fiscal effects of the GSW payments themselves, a sea change in the incentive structure that (hopefully) results in more people in the workforce should bear significant, positive societal returns.

What do you all think? Is this a decent idea, or am I blind to some glaring flaws, loopholes, or political poison? I’ll keep track of revisions to my thinking based on comments in a Google Doc.

Published in Culture, Domestic Policy, Economics

One problem with minimum wage laws is that they don’t take into account non-wage benefits (except when a union wants it to). A $12/hr government job with full healthcare, paid time off, and a pension is worth a whole lot more than $15 an hour as a busboy at a mom and pop establishment.

Brian,

Your proposal would go a lot further with conservatives if you pitched it as an alternative welfare system instead of an alternative minimum wage.

This is a good argument.

Good grief. I repeat:

Eric, you won’t find a soul here who does not agree that theoretically the very best solution is to let the unfettered marketplace as described by Adam Smith resolve every issue.

That has never happened, though, since the Articles of Confederation, so the point is utterly useless. We have to live in the world as it is, not as we wish it to be. Show me how Reagan made things happen as you describe. He did not– nor did he waste his time trying- either in California or Washington.

=================

And the prescient response is “You can give up, I choose not to.”

There are many ways to improve the market compatibility of programs- including minimum wage, many things that we may be able to eliminate if the voters trust us. For example, improving the EITC as a substitute for the minimum wage. But most here who speak loudest against the minimum wage also hate the EITC. And that understanding makes lower middle class voters refuse to listen to reform proposals because they simply do not trust the Right.

Our true believers comprise 25%- at most- of the electorate. We need to find ways to address concerns without sounding like Ebenezer, but maximizing freedom and market systems. Perfect? No. But perfect would only be possible if we controlled 65% of the votes.

It’s fascinating to me how slavishly bookish we’ve become. Free markets are a great idea. An important idea. But the reality is that all markets are structured in some way. We use money. That’s a structuring element.

We shouldn’t be trying to match our lives to our ideas but we should be using our ideas to better our lives. That we don’t to that, I think, is why we lose.

“Free markets” at root means the Hayekian concept of utilizing the price information to allocate resources. That is not “bookish”, it is the only reality that matters.

I bet you read that in a book.