Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Start Paying Attention to Social Security, Whatever Your Age

Start Paying Attention to Social Security, Whatever Your Age

After the late Sen. Robert Dole (R-KS) passed away earlier this month, I visited YouTube to watch his Senate farewell address. He resigned from the Senate as Majority Leader and as the Senior Senator from Kansas on June 11, 1996. I had a front-row seat for his speech as Secretary of the Senate.

During that speech, Dole considered helping extend the solvency of Social Security, which teetered on the edge of bankruptcy in 1983, as his single most significant legislative achievement, among many. It was a bipartisan agreement that included reforms insisted by Republicans (phasing in the age to receive full retirement benefits, including mine) and tax hikes demanded by Democrats. It was signed into law by President Ronald Reagan, flanked by a happy bipartisan delegation from Congress, along with Treasury Secretary Don Regan.

There was even a side deal between congressional Democrats and Republicans not to attack each other in the upcoming elections over the rescue package, or provide support for those who do. Partisan attacks in prior years had prevented needed reforms. It led President Reagan to create a bipartisan commission that provided the basis for the legislation. It was a delicate dance that worked.

During Dole’s farewell address, he expressed satisfaction that Social Security would remain solvent until about 2029. He was prescient. That’s about the time that Social Security’s “old age” (OASDI, or Old Age, Survivors, and Disability Insurance) trust fund runs out of money again, forcing an estimated and immediate 20-25 percent reduction in benefits if Congress doesn’t act. The trust fund for Medicare, an insurance program for people over 65, may go bankrupt even sooner, forcing benefit cuts for that program as well, mainly in the form of reduced doctor and hospital reimbursements, which are already low. Imagine how that will work out for new retirees looking for a doctor.

For those of a certain age — raising my hand — we’re paying careful attention. An estimated 54.7 million Americans today are over age 65. A man retiring in 2020 (hand raised) can expect to live to age 84; women, age 87. The fastest-growing demographic in the US today? Those over 100 years of age. That means an estimated 6 million centenarians will have received Social Security checks for about 35 years by the year 2050 — almost as long as their entire working careers. On average, Americans will collect far more in Social Security benefits than they paid in over a 40-year career.

And who is paying into this “trust fund,” or in reality, a transfer program? Most anyone working. And the program is already spending more than it’s bringing in since 2018. Only about 2.5 workers are paying into the system for every beneficiary. It was nearly 4:1 about 50 years ago.

Enter Charles Blahous, a friend and former Social Security trustee who has been warning for years of the impending need for reforms. He and two colleagues recently penned a helpful and informative post on a recent proposal that would make the Social Security funding problem even worse.

Despite repeated warnings from Social Security’s trustees that the program is facing a growing financial shortfall, lawmakers seem to have reached a bipartisan consensus to kick the can down the road. If they continue procrastinating until Social Security’s trust funds near depletion in the 2030s, it will be impossible to save the program without abruptly cutting benefits for retirees or significantly reducing the lifetime incomes of young workers. Americans who rely on Social Security cannot afford to wait much longer for lawmakers to enact corrections.

Unfortunately, a new proposal that was the subject of a congressional hearing earlier this month, Social Security 2100: A Sacred Trust, moves in the wrong direction. It would worsen intergenerational inequities by providing substantial benefit increases for those becoming benefit-eligible in 2022-2026, while passing the costs to everyone else, especially young workers already getting the short end of the stick under current law. There is no justification for such discriminatory treatment. In fact, those who would receive the proposed windfall already benefit from superior treatment under current Social Security law, relative to those who would pay for it.

The Sacred Trust proposal would regressively increase benefits for upper-income individuals. It increases the rate at which benefits accrue, inflates cost-of-living adjustments, cuts taxes on benefits and allows double-dipping between Social Security and state-provided pensions. A previous budget score of similar provisions concluded they would disproportionately benefit high-income earners.

In theory, the proposal would fund these benefit increases by taxing earnings above $400,000. But the math only appears to work because new benefits are limited to people who claim benefits within a narrow five-year window, while tax increases would be permanent and paid by future workers. Taken at face value, this is an absurd policy; there is no rationale for raising benefits for those retiring in 2026 by more than 10 percent, but not for anyone retiring in 2027 or later.

Some have proposed changes to help make Social Security either more solvent or more available to younger workers. The result? Political punishment. Just ask George W. Bush. The consequence? There is a growing generational standoff between fed-up, often struggling younger workers and their parents (and grandparents. And great grandparents), and no incentive to address the impending crisis, other than to kick it down the road to a future Congress and President.

I was a young Capitol Hill staffer in 1983 for a freshman GOP congressman. I wrote extensively about the reforms that year for newsletters distributed to his northern Indiana constituents. What I learned made an enormous impression on me.

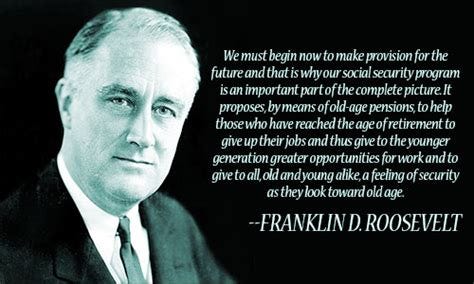

I learned that Social Security’s retirement age in 1935, when Franklin Roosevelt signed the program into law, was 65 — one year longer than average life expectancy then. I learned that Social Security was designed to supplement retirement income, not be the sole source as it is for 40 percent of seniors today. I knew that Social Security benefits have grown over the years to include Medicare, disability, and death benefits. And I learned Social Security’s wages had been indexed not to inflation but a higher wage index.

And the impetus for Social Security in the first place? To remove older people from the workforce to make way for young people. These days, given vacancies, there are plenty of opportunities, even incentives, for seniors to keep working if they desire.

The day of reckoning is coming again. Many young people, including my millennial-age sons, don’t believe Social Security will be around when they retire (I had my doubts at their age, too). Something, or some things, will have to give. Except for government work, pensions are a thing of the past (and many government pension funds have issues, too). Phasing in higher retirement ages, as was done in 1983, to age 70 or even higher, given more extended life expectancy that some suggest may eventually reach 125 years. Changing the index by which benefits are increased will slow the increases in payouts.

And my least favorite idea: Lift the wage cap on how much you can pay into Social Security’s retirement fund, currently at $142,800, although focused on those making over $400,000. Do we want to convert Social Security from a transfer program into a welfare program? It’s challenging enough being an entitlement program. Frankly, done right, the first two solutions now might do the trick.

That’s the prescription to preserve the program for future generations. And that doesn’t even include Medicare. I have a solution there that no one seems to like. Still, I would convert Medicare benefits into an annual voucher, adjusted annually for inflation, that allows me to shop around for benefits that serve me best. You know, insurance companies would compete for my dollars. Novel concept! But frankly, there’s no political will for that common-sense solution. Most Democrats prefer “Medicare for all.” Yeah, that’s the ticket. Say goodbye to American leadership in health innovation, and say hello to health care rationing.

Blahous and his colleagues, modern-day Paul Reveres, have been riding through our villages to warn of Social Security’s impending crisis for years. And the longer Congress waits, the more significant the political and policy hurdles become. And under the Senate’s “Byrd Rule,” named after the late Senate Democratic Leader Robert C. Byrd, the Senate cannot change Social Security under budget and reconciliation rules that can evade a filibuster. A bipartisan solution is essential.

There isn’t a Bob Dole around anymore for the next fix.

Published in General

The easier fixes are all behind us now :(

The income limit for medicare has already been eliminated on LT Cap Gains. I just sold a property that I had held for decades. My business was run out of that building. On top of all the other Cap Gains taxes, I had to pay 3.8% extra for Medicare (it has a special name for disguise). That was hefty enough, but now, because of the income that sale produced last year, my 2022 Medicare bill has doubled, before any deductibles. The only thing I can say is before this event I always felt that Medicare was never funded by enough of my taxes, while Social Security came pretty close (if allowed to invest the money privately all my life). Now I can say fairly confidently that Medicare is no longer a government handout for me. I’ve paid my fair share.

I was a young budget analyst that year, working for Social Security and in the middle of implementing all those changes that “saved” the program, at least for a little while.

It’s good to see an informative column that avoids the usual “OMG Congress raided the trust funds!!” blather and focuses on the real reason for the problem — too many retirees being supported by too few tax-paying workers.

This is both racist and sexist. Since white women expect live 10 years longer than black men, it is no different than modern day slavery. The only fair thing to do would be to base retirement on individual life expectancy. Go get a blood test at 60 and a computer will calculate your retirement age.

Abolish the entire thing. If you’re too stupid to plan for your retirement, that’s not my fault.

Boomers calling for bipartisan solutions won’t be around for the consequences. Who cares about future generations, as long as you get your government check?

A “harsh” truth, but true none the less.

Maybe it’s a version of making a deal with the devil, but the fact remains that much of what people appreciate these days in terms of the economy and employment and technology development etc, depends on consumption. It’s pretty obvious to me that much of what we enjoy in terms of conveniences and so much more, simply wouldn’t exist if people were putting away a significant fraction of their income towards retirement instead.

The rejoinder usually then comes, “but with all that money to invest, businesses will have all kinds of funding to produce new technology and stuff!” Okay, but who will they sell it to, if people aren’t buying because they’re putting the money away instead? If anything that seems to lead even more toward a class of oligarchs living in luxury while most people are focused on saving enough for a perhaps-meager retirement. What a life!

It’s not like saving is guaranteed either, of course. Especially if the money is invested in businesses or stock or whatever, that fail. Lots of people before Social Security saved and invested a lot of money that wound up disappearing for one reason or another, and they were left with nothing for retirement. And the rapidity with which businesses and even whole technology sectors can rise and fall these days, make such ideas less attractive, not more.

Maybe a program like Social Security isn’t the ideal answer, but the alternative of basically “every man for himself!” isn’t a panacea either. In the words of Thomas Sowell, “There are no solutions. There are only trade-offs.” So far I haven’t heard anyone propose anything that works out better overall than something like Social Security. Maybe one part of the “solution” is for people to understand that one of the prime things people need to do is to make more people, something which many people have been shirking lately.

Promises that can’t be kept won’t be.

Allow me to introduce you to Thomas Sargent, economist. In 2007 he gave a short speech to the graduating class of Berkeley. It included this gem.

Learn from the Social Security system of Singapore.

Here is the entire speech. Pretty decent.

Tell me please, how does one go about significantly reducing the lifetime incomes of young workers as a method of saving Social Security?

BTW – I am betting on the “abruptly cutting benefits” solution being the one adopted. It is already the solution that SSA is mentioning the most.

Which is another reason why people should be more focused on home-ownership than many are today. It’s a lot easier to get by with a reduced income if you’re not paying rent from it.

The implication is that workers would be taxed higher and that would reduce take-home income.

I am sure any agency that wants more money talks about the doom of not getting more money.

Can I get back all the money they put in plus what would have been reasonable interest?

The Federal government is fundamentally incapable of doing anything without corruption or misdirection. The thousands of folks who run it don’t have a clue about the 50 states and thousands of cities and towns. It’s beyond them. We have to have national defense and foreign policy nationally because there is no alternative. Everything else has alternatives, but we keep believing that Federal employees can know and care about the 320 million other folks in the most divers complex system that has ever existed. They don’t because they can’t. That is the first reality we must come to grips with, then States and others can sort out what is actually needed, what would be nice and what actually might work. All Federal programs begin with direction and leadership that try to do what they’re suppose to, but they leave, lose focus, come to grips with reality and change focus because they find it’s impossible.

Dr. Thomas Saving (that’s his name, you can’t make this kind of thing up) is an economist (conservative) who was a Social Security/Medicare trustee in the early 2000’s. He had an extensive and detailed proposal to gradually arrange the privatization of Social Security and Medicare. It involved allowing younger workers to opt for putting social security withholdings into private accounts (Vanguard type stock market indices funds) so that they would retain ownership. Everyone under a specified age could begin doing this. Based on historical market changes, over a working lifetime, one would be in far better shape financially on retirement by doing this, as opposed to being forced to put money in the (nonexistent) trust fund (Lockbox, anyone?). Medicare is partially privatized using Medicare Advantage programs that are widely used and popular (and heavily advertised–see “Humana” every fall).

However “popular” Social Security is, it is a coerced intergenerational Ponzi scheme. Why should the government be allowed to force you to “save” a certain amount (which the government has already long since spent), tell you when you can access it, charge you taxes on it when you receive benefits, and dictate what you can receive from it? The government has arrogated to itself (with self-injuring voter acquiescence) a program that is a disaster. Perhaps most significantly, the program misleads people to fail to save themselves, apparently believing that they can live on Social Security when they retire.

The idea that people have to be incentivized to NOT save is sheer nonsense. A country that incentivizes spending, though that may stimulate economic activity for a while, will eventually wind up impoverished. That our federal government works on massive debt, and encourages citizen to do the same, is not a recipe for long term prosperity, but the opposite.

Medicare is already a de facto national insurance program, as all private insurance is geared to Medicare policy. The supposed tail is wagging the dog. All private insurers link their payments to Medicare allowances, and what they cover to what Medicare covers. Anything that is not covered by Medicare is generally not covered by private insurance. Increasingly pharmacy benefits of private insurers are tied to Medicare coverage policies. CMS essentially dictates the entire healthcare system. And it is not a pretty sight. I can hardly prescribe a drug without having to go through onerous Prior Authorization processes, and more often than not, coverage is denied. I am mostly hamstrung in optimally treating patients by Medicare policies, whether the patient is on Medicare or Private Insurance. The result is suboptimal medical care, for which the patient, employer, insurer, and everyone else blames me, when I have no control over the system.

The Gipper was a Roosevelt Democrat before the was a Republican, and his effort on SS confirms Chesterton: The aim of Progressives is to continue to make mistakes; the aim of Conservatives is to make sure those mistakes are never corrected.

My wife and I are guilty. We have tons of nephews, nieces, great nephews and nieces but no children. You are correct, @kcdavis. There are no guarantees…no 100% certain solutions. Life is a crap shoot. We can’t guarantee a smooth ride for everyone without, instead, turning life into a really grindy and bumpy life for everyone except a very few.

Unfortunately, the problem of too much government doesn’t stop with the Feds. Local property taxes used to fund county governments keep rising, often to the point where fixed income homeowners can no longer afford to continue owning there own home.

I think if more individuals were homeowners, their voting patterns might change. For people paying rent, things like property taxes become more or less invisible. They blame increasing rent on greedy landlords, etc.

You can get 1/3 of that. Plus knock off a few more percentage points for lessening your purchasing power. That’s how we roll in government.

Social Security’s problem is strictly demographics; too few workers supporting too many retirees. This has little or nothing to do with “Federal employees” or “corruption and misdirection,” unless you blame (1) the actuaries who were incapable of accurately projecting that Americans would stop having as many babies as they were when the program began 86 years ago, or (2) Congress and the numerous administrations who were too cowardly to do anything about the problem. The Federal employees who run the program do what they’ve been directed to do by Congress and the President.

Personally, I’d go with #2.

That is probably why the left is trying their darndest to squeeze people into dense urban apartment living and why they seem to dislike the suburbs so intensely.

Overall they’d probably get more total property taxes from people being individual homeowners, but I’ve never accused the left of making sense.

It’s about control. Money is important only as it aids in control.