Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Grecian Formula €1.55 Billion

Grecian Formula €1.55 Billion

While we’ve been debating the Supreme Court, there’s been a whole lot of noise going on in Europe over the snap referendum the Greeks have called on their loans from the IMF, the European Commission, and the European Central Bank (hereinafter “the troika,” as they are commonly known in Greece and Cyprus — usually with an epithet as a modifier.)

While we’ve been debating the Supreme Court, there’s been a whole lot of noise going on in Europe over the snap referendum the Greeks have called on their loans from the IMF, the European Commission, and the European Central Bank (hereinafter “the troika,” as they are commonly known in Greece and Cyprus — usually with an epithet as a modifier.)

Here’s a guide to what’s happening and what’s at stake, as well as a few thoughts on what we’ll see on Monday.

This is a very odd referendum. Normally, the troika and the Greek government — currently controlled by the left-wing Syriza party that swept to power 8 months ago on a pledge to not borrow more money and get out from under the troika’s economic stabilization plan — would agree to some compromise. Syriza’s leader, Prime Minister Alexis Tsipras, would go on television, announce the agreement, and ask the people to vote to support it. (Chances are the compromise would include his breaking a couple of promises, so he’d want the people’s blessing to do so.) But no, this referendum comes after Tsipras left negotiations and flew back to Athens without an agreement — and he is putting the troika’s deal on the table. It is clear he would like the public to vote no.

Towards what end? That isn’t clear. Should the Greeks vote no, it becomes most likely that they will leave the euro and default on their loans. They get to be Argentina on the Mediterranean. If they vote yes, they then get snap elections for a new government because Syriza’s plan will have been rejected. They will also get major cuts to pensions and other government spending. That is probably best in the long run, but it’s a great deal of short-run pain. Either way, they will be the sick man of Europe for a generation.

Clearly Tsipras thinks he can use a ‘no’ vote to leverage a better deal from the troika. But the troika are in a foul mood. The referendum was a shock to them — and a breach of trust. The Eurogroup issued a press release Saturday morning saying that the referendum is too late (the agreement from the previous extension ends June 30), and that it’s Greece that broke off the talks. European finance ministers have said they wanted to continue talking but see no point. Meanwhile, Greek finance minister Yanis Varoufakis, who has been a pain in the side of the troika, rejected the statement and said that the EU rules do not permit them to kick Greece out. (They also do not permit the funding that Greece has already received. Perhaps we should turn Chief Justice Roberts loose on the Treaty of Maastricht.)

So this becomes a classic ultimatum game (Varoufakis is a game theorist, in case you didn’t know.) The EU believes the Greeks have to blink because there’s pain either way the referendum turns out, and this will probably costs Tsipras his job. The Greeks believe the EU has to blink because opening a door to let Greece out of the Euro also creates a door for Spain, Portugal, and Italy.

How does Monday play out?

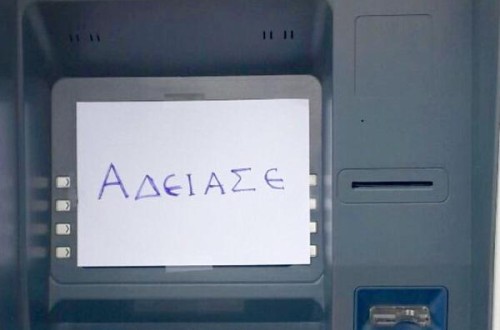

- Given the run on ATMs, there will be capital controls, ala Cyprus, if the Europeans carry through on their threat to stop lending to Greek banks . There’s a much-greater-than-zero chance of bank holidays. There is a €1.55 billion payment due Tuesday to the IMF. It is possible Greece can make the payment and thus buy time, but that’s very uncertain in light of the last 24 hours of bank runs. And it’s most likely a threat point for Syriza to play in this game.

- If all that happens, expect video from Athens of a bunch of bankers burning in effigy. These will include figures more obscure than Frau Merkel, who is herself as popular in Greece as Anthony Kennedy at an evangelical convention.

- Talks will continue. Both sides know something bad can happen, and they have much uncertainty about what that will be. So the desire to get a deal done is there, but it will take a few days to play out.

Europe is, if nothing else, masterful at letting these crises continue for weeks past where you think they’ll hit a tipping point. Don’t be surprised if that happens again here.

Published in Economics, Foreign Policy, General

Couple things on this:

We can argue the mechanics of this particular referendum and the timing of its announcement, but the fact is, the troika and the EU at large have shown themselves to be utterly untrustworthy when it comes to mere people speaking. A couple of years ago, regarding a much better publicized referendum, with much more notice that it would be held, a referendum on exactly this sort of thing, the EU Betters browbeat the Greeks out of having their referendum on whether to accept the then-offered EU…largesse.

There’s more: in the early years of the EU’s formation, when it began to look like the Dutch would reject, via referendum, the idea of joining the EU, the then-extant EU Betters decided not to accept a referendum’s outcome; they would, instead, take the Dutch government’s word for it.

Nor the EU, nor the troika, nor any non-Greek nation of the eurozone have anything legitimate to say about a Greek referendum on the current matter. Not one syllable.

Regarding the ECB’s strait, I offer this (it’ll be going up on my blog tomorrow or Monday):Greek Prime Minister Alexis Tsipras’s unexpected announcement in the early hours of Saturday that Greece will hold a referendum on July 5 on the bailout conditions creates a severe headache for ECB President Mario Draghi and the rest of the bank’s 25-person governing council. The ECB faces a choice between maintaining ample liquidity support for Greek banks and potentially undermining the ECB’s credibility as a rules-based institution, or forcing the closure of Greek banks and enraging Greece’s government and people.

But wonks and misconceptions do add to the artificial complexity of the thing.

Capital controls will not, of necessity, force Greece’s banks to close. Certainly, the weakest of them may close, but weak businesses should be allowed to fail. Nor are capital controls, of necessity, bad things themselves. To the extent they work—a matter of structure and enforcement, not a matter of controls qua controls—they’ll keep cash in the cash-starved country.

Nor would Draghi’s decision force anything onto the Greeks. Greece’s current strait is solely the result of Greek behavior over the years, including their post-global panic refusal to take seriously the need to reform their high-spending, high-taxing ways. An ECB decision to stop the lending would serve only to acknowledge a failure already in place.

Of course, the ECB must stop making short-term loans—loans it can have no expectation of being repaid—to the Greek central bank. Propping up, with what are really grants from the taxpayers of the rest of the eurozone, those banks that are, in turn, propped up by the Bank of Greece does nothing at all to solve the underlying economic and national debt (and so economic) problems faced by the Greek government and the people who elected it.

This is simple. The only thing hard about it—and it is a hard thing—is finding the political will to do the right thing when that thing is an unpleasant thing to do. Eric Hines

Thanks for covering this. I have paid rapt attention to this for years, always watching deadlines, always seeing can kicked down road, always convinced how this all will end, and convinced the sooner it ends, the better for all concerned, especially the Greeks. Dithering is raised to unimaginable heights. The IMF, in the personage of Christine Lagard, is playing the role of the hard man, but even she dithers. I am very sympathetic towards the Greek citizens. I have read stories of 50 year old graphic artists returning to the family homestead to become wood gatherers. Yet I would have voted for Syriza, thinking it would result in Grexit sooner than any alternative.

Varoufakis says he is an anarchist Marxist. What does that mean? He and Tsipras never wear ties and ride around on motorcycles. (So do I, but I’m not a finance minister) So we finally have a country run by the Cool Kids!

And the leftists disparage the bankers, and portray Merkel as Hilter. How long are they supposed to turn the other cheek? And is there a leader anywhere less like Hitler than Merkel?

Milton Friedman said the currency union would last only 10 years. That was amazingly accurate!

This is the only drama in the news I enjoy lately. Thanks for your summary and insight.

You and our BFF Donald Trump. [g]

Eric Hines

I’ll simply repeat something here for the benefit of Eric: This has never really been about Greece in the eyes of the EU Betters. This has always been about the other PIIGS. What makes the most sense is action to punish Greece so as to discourage Spain from thinking about the same trick.

The deal 4 years ago basically bought time for Germany and France to get their banks out of harm’s way in Greece. EFSF is a bad bank that parked all the ugly Greek debt. They’ll write it off. They can’t do that in Spain, it’s too large. So they’ll inflict pain instead.

The Greeks have nothing to lose and the EU has everything to lose. (insert joke about when you owe the bank …)

It has nothing to do with the rest of the PIIGS, either, except perhaps in the minds of the EU Betters. Four years ago, a cascade might have been a possibility. Today there’s no likelihood at all. This is strictly and only about the Betters asserting their superiority, and not only with respect to Greece. That’s made clear from the troika markups on the Greeks’ proposal earlier in the week. The bottom lines are substantially the same; the markups primarily are just assertions of authority for authority’s sake.

Since the outcomes are substantially the same, why don’t the Greeks accept the troika’s position? Perhaps the Greeks have egos, too. Perhaps the Greeks are coming around to having done with EU egos. Perhaps….

Eric Hines

My first thought was to actually see positives in this… hey, Greece leaves and/or gets kicked from the Euro, and the whole project starts to fracture, wounding the dreams of a European Superstate in Brussels. But this week should teach us that in human history, good results are pretty rare from crisis, and there’s usually no way back from bad decisions (Like, joining the Euro).

I’m now afraid we might be beginning to see the stirrings of EU military power. What better way to bring Greece under control again that for Germany and France to agree on marching a joint European force into the place, to “stabilize it”. For the good of all Europeans, of course.

I don’t know if you’re intending to say that Greek egoism is in some way exculpatory or virtuous.

The only virtue I can see to current Greek behavior is that it reduces the sadness that Europeans will feel if they have to go.

I don’t see how you can describe the bottom lines as being the same. The commie version involved the big hits coming from corporations, and particularly foreign corporations (a windfall tax on large companies, a higher corporate income tax). They wanted to increase support for the poor. The Troika version removed that and transferred the costs to a sales tax, because it’s important to the Troika that Greece makes a pretense of good faith. The Greeks wanted to have pension reform hit in 2016 and take full effect in 2017, the Troika wanted action now, to hit in 2015, with full effect in 2016. The Troika wanted the government to make it clear to the courts that they couldn’t undo pension reforms.

Those are only some of the important changes made.

I have no clue where you got that. I’m only saying that perhaps the Greeks are subject to the same strengths and weaknesses of ego games as are their EU Betters.

I don’t see how you can conflate the paths to the bottom lines with the bottom lines. The end results are intended to be tax revenues and spending as per cents of GDP. Both plans achieve substantially that.

Eric Hines

I’m not really aware of moral strengths among the Communists. Perhaps you could highlight one?

Nope. The end goal for the Troika was a financially viable Greece that can repay a portion of its debts. The means (fighting the unions, cutting pensions, protecting the economy, trying to make sure that middle class Greeks pay some taxes) are all aimed towards that.

The end goal for the commies appears to have been to pump their base. They do achieve short term tax revenues at a similar level, but the methods either drive out business and thus reduce long term revenue (higher business taxes, and a windfall tax) or actually increase spending (refundable tax credits for the poor).

Those aren’t similar ideas. They are differences worth fighting over.

That’s your straw man. You’ll have to deal with it without me.

Nope. The end goal for the troika is their GDP numbers. Their claimed rationale for them is Greek growth; certainly they’d like to be repaid. But they have no real expectation of being repaid. They also know their path has about as much chance of improving the Greek economy as the Greek path.

Eric Hines

It really looked like you were drawing an equivalence? Are you not?

Why does cutting government, and particularly welfare, spending and laying off of corporate investment (roughly, speaking, fiscal conservatism) present the same chance of improving the Greek economy as soaking the rich?

The EU wants Greece to be an EU member in 20 years (and longer). That doesn’t just mean next year’s GDP figures matter. It means that they need Greece to become, in some way, sustainable. Their demands seem like roughly what Ricochet might ask for if Ricochet was in the EU’s position (and wanted to make Greece a success rather than expelling it).

I’m now afraid we might be beginning to see the stirrings of EU military power. What better way to bring Greece under control again that for Germany and France to agree on marching a joint European force into the place, to “stabilize it”. For the good of all Europeans, of course.

EU military power, not much. Greece by the way, spends the highest portion of GDP on the military, 2.2%.

I have not been following this issue closely, but I always thought that the best path was splitting the euro into the northern euro and southern euro.

The richer north would get to keep the eurozone in-tact, which like KB said, would provide Spain no precedent for exit. The south would get a devalued euro to boost exports but still have some debt obligations to pay.

If this is no longer an option, I think the EU is on the verge of total collapse.

You’re the only one bringing morality into this, and then proposing that I defend your construct. Textbook straw man.

It has no serious plan for real spending cuts, much less deepening the cuts over time (a per centage of GDP is a fiction regarding real cuts), but the fatality is in the demands to continue to raise taxes. And, neither plan has any serious intent on enforcing even existing tax law, only lip service. The troika’s plan isn’t even good Keynes, much less an actual economic growth plan.

Eric Hines

OTOH, if Greece goes out and suffers that’s a powerful incentive for those other countries to stay in the EU.

I have long sought it absurd that the pro-Grexit forces actually think people will make unsecured Drachma-denominated loans to a second world country aspiring to third world status.

A Grexit is going to end ugly.

Perhaps Greece sells itself to the Russians or Chinese. Part of that price will likely be NATO secrets. Does that cause a military coup? Turkish invasion?

Perhaps the Greeks are betting on an Obama bailout?

Okay. I apologize for misreading your initial statement as about morality. On what grounds are the communists equal to the non-communists?

The pension cuts seem achievable to me, as do some of the other cuts.

Perhaps they’re not, but there are certainly Eurocrats who believe that they are (I don’t know anyone at the IMF or World Bank). Since they’re critical to making Greece sustainable (the alternative is straightforward bankruptcy), they’re essential to the Troika’s bottom line.

Even if you’re correct in believing that the Troika is wrong in its analysis.

Both sides talk about raising taxes; since they can’t cut spending by the amount required by the deficit, and you can’t borrow enough to cover the gap, raising revenue is literally the only way to avoid bankruptcy.

The sales tax is relatively enforceable, which is partly why it’s a bipartisan agreement (although the troika wants it higher).

The key difference in the way that taxes are contemplated is that the commies would do it through a windfall tax and higher business taxes that would drive the economy into the ground and the Troika focuses on natural persons, who are less likely to leave.

I agree that the Troika’s plan isn’t Keynesian in the vulgar sense of the term (although I think that Keynes would actually have preferred it to the commie approach; Krugman economics are something of a distortion of Keynes). On a center right site, though, it seems eccentric to complain about excessively Austrian or Chicago based approaches.

My apologies; we seem to be having trouble communicating. Where have I said communists and non-communists are equals of each other?

I don’t see how. The Greek people are even more addicted to their government handout drugs than we are, and the Greek government folks doing the street corner pushing are even more addicted to their pushing than our own politicians. See the difficulties we’re having achieving even a little reform of our own government-run pensions (I’m using the term loosely). The only way Greece’s pension system will be cut a little, much less reformed, is with an open economic disaster.

Like the Left generally, you seem to be assuming that the only way to raise revenues for the government (leaving aside whether a government needs the revenue; that’s for a separate discussion) is through raising taxes.

In the event, both plans can only fail, even if fully and enthusiastically implemented. Greek debt is too large, and the Greek economy–suppressed by too much government spending and too high taxes, even with either plan implemented–is too flat. The only thing for it is a Greek departure from the eurozone and the EU. That’ll disrupt EU stock markets for a bit, but nothing else will result. Greece will suffer a sever downturn that will end excessive pension payouts and also in prosperity (the two are related, but not tightly) as the Greeks discover fiscal discipline, or the downturn will end with Greece as somebody’s client state. Most likely that will be Russia, in which case, I look forward to Russia being saddled with the handicap.

Eric Hines

Comment #9

“I have no clue where you got that. I’m only saying that perhaps the Greeks are subject to the same strengths and weaknesses of ego games as are their EU Betters.”

Being addicted to something doesn’t increase your access to it. I’m sure they want higher pensions etc.

Sure. That’s why the Troika is engaging in its intervention.

We had a President who was happy to cut before this one. We have a Congress happy to cut now. We need both (or a veto-proof majority). Hopefully that’ll result in reform in 2017.

Municipal and other governments have been able to cut pensions under similar circumstances. Maybe the Greeks are different, but that doesn’t seem obvious to me.

If the government is going to spend, and you make stronger claims about this than I do, it needs revenue. It can also get that revenue from selling assets, and it should get a move on with the achingly slow efforts to do that, but that’s not a long term solution.

Well, perhaps, but wiser and more informed people than either of us disagree. It is possible that the Troika is on to a loser and is spending vast sums on a mere short term delay in Grexit. That doesn’t mean that the bottom line of the Troika and Greeks are the same. The bottom line of the Troika is created by the Troika’s subjective understanding of the situation.

Well, again, maybe. This seems to me like the sort of prediction that no one can reasonably make with confidence. We just don’t know.

Again, you’re not obviously wrong in your conclusions (maybe things will work out as you suggest), but you’re wrong in your confidence; there are other plausible futures for Greece, some of them darker than the presented options. It appears that because of that error, you’re imputing your beliefs to others.

Sorry. I don’t see how communism falls out of a comment about egos and ego games.

True. But it makes reducing the thing extremely difficult to achieve.

So they say, certainly. Their attitude toward self-determination, their being convinced they’re Better than mere citizens makes me as distrustful of their blandishments as the Greeks seem to be, though.

But it’s the Greek [Federal] government, not the municipalities, that are being demanded to cut [Federal] pensions. That has happened, but with extreme difficulty, and I know of no case where it was done by outside diktat and not voluntarily by the population involved. I don’t think the Greeks are very different in that regard.

As that famously conservative American President Jack Kennedy demonstrated, increased revenues for the government also comes from tax cuts and the resulting increasing economic activity. Of course, Kennedy’s cuts were done in conjunction with other economic moves that the Greeks have shown themselves loathe to do.

Those allegedly wiser and more informed are all, or nearly so, Big Government and Regulation kinds of folks. See above, too, regarding their respect for the general, if imperfect, wisdom of the people. On the other hand, maybe it’s us Americans who are…exceptional…and not at all like the Greeks and others. We didn’t get to a Committee on Public Safety in the aftermath of our Revolution, and we haven’t (yet) devolved to Greece’s strait.

Well, it’s certainly true that I don’t lack for self confidence. As to the other, there certainly are a number of intermediate possibilities; I was just laying out what I considered the outer bounds of them.

Eric Hines

Oh, if I wasn’t clear that I was referring to Syriza, a coalition of parties, some of them explicitly Communist and some of them with no principled disagreement with those parties, then I can see how that could have been confusing.

Oh, sure. I didn’t mean to suggest that cutting spending would be easy. It hasn’t been in Detroit, either. It wasn’t impossible, though.

I mean, they’re arrogant; I suspect that anyone whose full time job involved negotiating with communists over the running of the market economy would quickly become arrogant.

I don’t see any reason to believe that they have dominant motives other than a desire for Greece to become sustainable without minimum of outside funding. What other motivation do you believe exists?

Greece isn’t much larger than a large city. Detroit was reformed by outside diktat. I mean, I’m sure that it would take effort, but I don’t see why it would be categorically different.

There could, conceivably, be scope for Laffer Curve reforms, but those would involve making the tax code less progressive, and JFK-like results aren’t available (Greek tax rates are already below the levels that JFK cut to) and Greece needs larger increases than JFK got. I agree that such an approach might work in conjunction with other, tax hiking, provisions, but it seems harder to pass through the current government than the Troika’s position, and the Troika has to pay some attention to what is achievable.

I know plenty of guys in finance who are not fans of big government but believe that Grexit is a possibility or probability rather than a certainty. The markets certainly believe it possible. If you have reason to believe that there’s a less than one in six chance that Greece will remain in the Eurozone until Jan 1 2016, there’s money to be made, even before you start looking at more sophisticated ways of taking positions.

I think that a Greek descent into poverty without significant help from a foreign power is plausible and outwith the bounds of the proposed spectrum.Also, some kind of deal could still be clobbered together, lying outside the proposed spectrum at the other end. If the bookmakers are right about the 1/6 chance, and I’m right about the 1/3 chance of poverty without a major sponsor, there’s a 50% chance that the Greek future is within your realm of possibility.

It probably started out that way. But with the Greeks not enthusiastically accepting these guys’ version of largesse, it’s devolved to a naked push to impose their will. Nothing more.

None of it has a hope of working unless and until the Greek people make some fundamental, and massive, internal changes, beginning with their view of the purpose of money and of the role of government in their society. The Greeks also need to become more obedient to their law, particularly their tax law, and they need to heavily revamp their law, particularly their tax law, so that it’s something worthy of their obedience. That’s going to take an economic disaster to have a chance of coming about.

Even stipulating your view that the troika’s motives are purer than I give credit for, the EU, et al., have poured enough money down this rat hole. The best way for Europe to help Greece now is to step back and let them hit bottom.

Eric Hines

Do you believe that the appropriate analysis has decisively changed since the outline of the Troika’s plans was drawn up? If not, why would it matter that they haven’t taken a step back, even assuming that they haven’t done so?

That was how people were talking about all the PIIGS a few years back. It turned out that it was wrong for PIIS, if not G. Even the Iberians are limping their way back to increase their energy levels to semi-torpor.

I think the troika’s–and the Greeks’–analysis have been fatally flawed from the jump. It’s possible that the troika-men, in the beginning, actually believed their analysis, but now it’s pure ego. It’s possible the Greek pols actually believed their analysis, it’s possible they were carrying out the wishes of the Greeks as understood in the last election (and was held to be understood in that long-ago aborted referendum), it’s possible they were on their own ego trip from the jump, but now it’s pure ego.

Even if both sides stepped back, took a breath, and came back, about what would they talk? Variations on Keynes from the troika and variations on “you owe us” from the Greeks.

It doesn’t matter a whit that they haven’t taken a step back. What matters is how long they’ll prolong the agony before the break occurs.

Many, not all <ahem…>. Too, the PIIS were never as bad off as the Greeks. Ireland, and Iceland to a lesser extent, had to be browbeaten into taking a bailout because they didn’t need it. The Irish still are under unconscionable pressure to raise their taxes on the self-serving fiction that Europe, with its too high taxes cannot compete with the Irish. Both, also, seem to have read the lessons in the Panic of 2008 and found a measure of fiscal discipline. Spain’s strait, worse the Ireland’s, still has been overstated, and they’re also beginning to make needed changes. Italy (the other I after Ireland) simply amazes me. They’ve been on the verge of fiscal disaster for decades, and they’ve not gone over the edge. All I can do here is say, based on their past, they’ll continue to muddle through.

None of those are at risk of leaving or being evicted from the eurozone.

Eric Hines