Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Will This Be the No-Fun Presidency for the Next POTUS?

Will This Be the No-Fun Presidency for the Next POTUS?

Why does anyone want this job if you can’t do the fun stuff that makes voters happy: cutting taxes and spending money? From the WSJ:

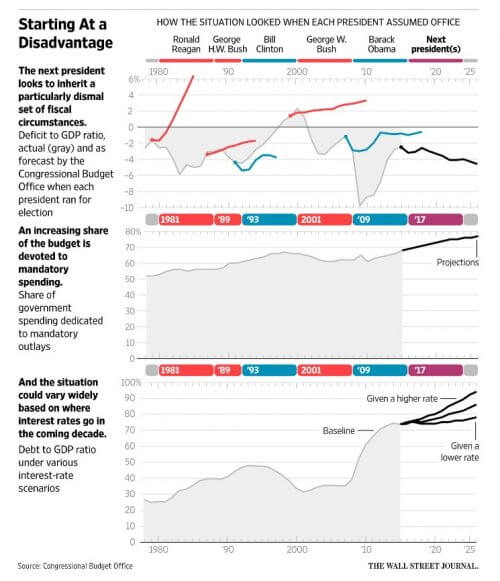

Donald Trump and Hillary Clinton are likely to recite their varied promises for fresh government spending at Monday’s first presidential debate. One reality they’re unlikely to note: Whoever wins in November will enjoy far less latitude to spend money or cut taxes than any president since World War II. Not since Harry Truman will a new leader enter office with a higher debt-to-GDP ratio. And for the first time in decades, the new president will face the specter of widening deficits despite a growing economy. “The next president, no doubt, is going to be very constrained,” said Rep. Charlie Dent, a Pennsylvania Republican who sits on the House appropriations committee and hasn’t endorsed anyone for president.

This chart sums up the supposed fiscal constraints, including the historically high debt-GDP ratio:

As WSJ reporter Nick Timiraos points out, “A President Trump or Clinton could try to barrel ahead anyway, of course.” Indeed, they could. On the GOP side, Trump has shown no substantive concern about debt. He has proposed a giant tax cut, a $500 billion infrastructure concept, and opposes entitlement reform. How many Republicans will learn particular lessons from his success? Keep in mind, also, his GOP partners in the House GOP have offered a tax cut that would reduce federal revenue by over $2 trillion on a static basis, according to the Tax Foundation.

Now, as Timiraos adds, “Mrs. Clinton, in particular, is likely to be checked by the opposing party’s control of at least one chamber of Congress.” In that scenario, maybe the debt-GDP ratio climbs more or less in line with CBO forecasts. Then again, Democrats may push hard for more fiscal stimulus given that “secular stagnation” thesis — particularly influential on the left — suggests more fiscal room for debt and infrastructure spending may pay for itself.

Perhaps the Fed is a bigger potential constraint than all those debt statistics and forecasts. If the Fed thinks the US is at full employment and growing at potential, might not inflation concerns nudge the central bank to offset new fiscal stimulus with higher rates? As economist Scott Sumner has written:

Published in EconomicsIf the central bank is steering the economy or, more precisely, nominal aggregates, such as inflation and nominal GDP, then fiscal policy would be unable to impact aggregate demand. As an analogy, imagine a child attempting to turn the steering wheel of a car. The parent might respond by gripping the wheel even tighter, offsetting the push of the child. Even though the child’s actions would initially change the direction of the car, ceteris paribus, the parent will push back with equal force and correct this turn to keep the car on the road.

They’ll keep spending until the country is forced to hyperinflate or default (Trump’s “haircut”).

Why do you assume that spending money is where the fun is?

If you elect me, I will cackle gleefully as we burn executive orders and mountains of regulations. Not to mention holding open-air huckster-style auctions of massive tracts of federal buildings and land. What fun!

“If the central bank is steering the economy or, more precisely, nominal aggregates, such as inflation and nominal GDP, then fiscal policy would be unable to impact aggregate demand”

The good news is that it never could. The Central bank can monetize debt or not. If not, the Treasury will face increased interest rates as it tries to sell its debt. If it monetizes the debt the government will keep spending, taxing and regulating and the economy will limp along in the current stagnation until the rest of the world begins to worry about dollars. That could take long enough to eliminate the last of constitutional government and market economics. The Federal government can positively affect investment by getting out of the way, eliminating most regulations and the opaque corrupt distorting tax code. That a Trump administration might not do this is a different story. Isn’t it a time we stopped with these 1950’s macroeconomic stories. They, like all things progressive, are false narratives. It was never true. It has never been demonstrated to be true and it is based on a nonsense theory. Other than that the Keynesian models makes economists and politicians happy, so I suppose they serve a purpose.

Thanks James for the post.

From my point of view the Fed has painted itself into a terrible corner.

A. It can’t raise interest rates because the bond, stock and real estate markets have all priced in near zero interest rates and to raise interest rates without some other offsetting stimulus would cause a tremendous recession if not a full blow depression like no one alive has ever seen.

B. On the hand, the Fed has to raise interest rates because the insurance companies and pension funds are getting positively hammered in the near zero rate of return investment environment. Those entities plus many retirees on limited fixed incomes depend on a reasonably positive rate of return which they clearly are not getting. Long term the foundations of the economy are being eaten away because at some point we need insurance companies to be solvent, and they are heading towards insolvency.

Add to that the pro Corporate Crony anti small business and innovation policies of our governing elite of both parties and you have a real problem.

The Obama Administration and the Fed have driven the economy into a post capitalist and corrupted heavily state managed economy which will sooner or later collapse.

The only way out is to enact a radical low tax much lower regulated pro growth set of policies that produces very high growth that will offset the heavy pain that will come when we try to return our economy to a capitalist one.