Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

US Recession Dead Ahead?

US Recession Dead Ahead?

Hedgeye.com

Shorter: Absolutely, without a doubt.

Longer: Absolutely, without a doubt. But when?

As a business advocate, my firm and network is on the front lines of the economy with Americas largest employer: small and mid-sized businesses (SMBs). Our clients represent most business categories throughout North America and what we are hearing can be summed up in one word: uncertainty.

But don’t take my word for it. The National Federation of Independent Business (NFIB) recently conducted a survey of small-business owners.)* It found them in an uneasy mood:

Sixty-three percent of small business owners think the country is on the wrong track. Sixty-seven percent rate the business climate fair or poor. And nearly two thirds are very concerned about the size and growth of the federal deficit. …

67 percent of small business owners think their taxes are too high. Only six percent believe they don’t pay enough. A large plurality of small business owners think the personal income tax inhibits growth compared to other federal taxes. And a plurality of small business owners think that Washington’s top economic priority should be getting the federal budget under control.

“Compare what’s important to small business owners with what official Washington is doing and there isn’t much overlap,” said [NFIB research director Holly] Wade.

*Note: NFIB was the plaintiff in the landmark case, NFIB v. Sebelius, in which the Supreme Court upheld Congress’s power to enact most of the provisions of Obamacare.

But the concerns are not held just by SMBs:

On The Macro Show earlier on Thursday, Hedgeye Financials analyst Josh Steiner joined CEO Keith McCullough who responded to a subscriber’s question during the interactive Q&A portion of the show regarding how far along the U.S. is in the current economic cycle.

“[The U.S. expansion] is long-in-the-tooth and slowing,” Keith said. “It’s already showing up in the cyclical and industrial sectors…You don’t have a consumption recession, yet, but the employment and consumption pieces [of the economy] are clearly rolling over as they do at the end of every cycle.”

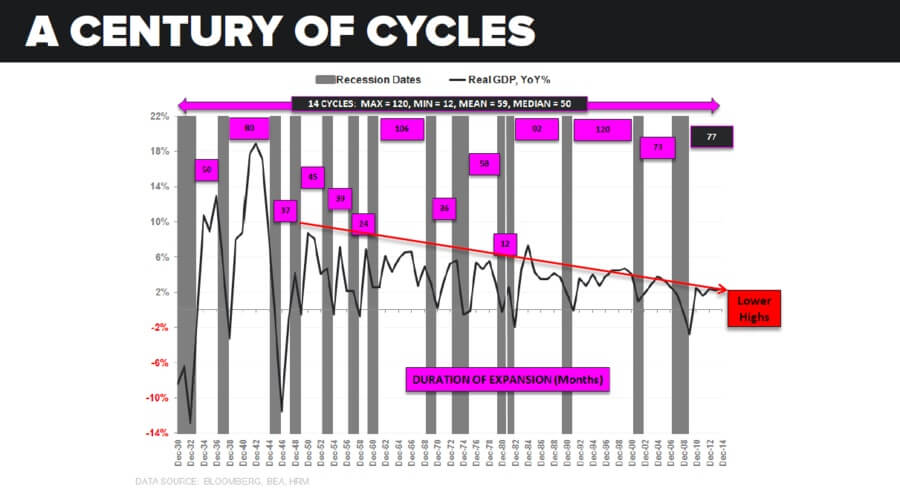

To prove his point, Keith pulled up a thought-provoking slide from our macro team’s recent 73-page presentation of our top 3 Q4 2015 Macro Themes.

As you can see in the slide below, it shows the past 85 years of economic cycles. Our current expansion stands at 77-months. To put that in perspective, the median expansion typically lasts around 50-months.

Datasource: Bloomberg BEA HRM

In other words, we’re in the twilight of U.S. economic expansion. Hence, our new macro theme, #SuperLateCycle.

“What comes after the SuperLateCycle?” Keith asked rhetorically.

A recession.

Geologists talk this way about the San Andreas fault. The Big One is long overdue.

The Federal Reserve delayed raising interest rates due to concern over US deflationary indicators and slowing economies worldwide, specifically China, the emerging markets, and Europe. This means they are aware of dark clouds. Free money may be good for equities, but not the overall economy.

“Europe is almost certainly heading into recession with “unequivocally red” data out of Germany”.

And then there’s this: Leading statistical indicators are pointing to some deeply concerning numbers. These suggest that Black Swan risks have risen to the highest level ever. If you reread that last sentence, it’s enough to ensure your generators and freeze dried food stocks are current. As John Melloy of CNBC reports,

“Players are pricing in the highest chance of an outlying black swan event in the next 30 days,” wrote Roberto Friedlander, head of equity trading at Brean Capital. …

There’s tremendous uncertainty as to whether the Federal Reserve will raise interest rates this year or not and whether this a rate hike will scuttle the economy. The central bank will decide on this at its two-day meeting beginning Oct. 27, within the 30-day window investors are fearing a market collapse.

On the geopolitical front, traders are growing increasingly worried about Russia’s emerging presence in the Middle East.

And, of course, October is known for market crashes like the “black Monday” collapse 28 years ago this month. But that’s true every year.

Politicians are self serving animals, some more than others. We can no longer expect to get raw economic data from any White House, Congress or even so-called non-partisan government analysts such as the CBO. Numbers are cooked for political expediency, primarily in the way reports and survey questions are asked. If not, the CBO would have shown the true impact of Obamacare costs when the act was debated in 2009, which would have looked more like a hockey stick. But, hey “Let’s just take out that pesky Medicare cost explosion and all is good.”

So what can we do? Hope for a rate increase.

My discussions with SMB clients revolve around restructuring, debt mediation, and capital acquisition. Cash is king. Credit, while very inexpensive, is still not easy to qualify. Banks are less eager to lend when the risk-to-reward ratio benefits the borrower. If the Fed finally raises interest rates, this could actually benefit small businesses, because the banks will be more inclined to lend. Borrowers will borrow, which could be a boon for small business expansion, hiring, and start-ups. Banks would lend and make money. Win-win.

So why doesn’t the Fed just let off the ZIRP pedal? Because there’s a risk to raising rates. If not done carefully, it may cause a teetering economy to fall into a tailspin. Fed Chair Janet Yellen is not a politician, but she’s surrounded by them. No politician, especially this President, wants a recession on his watch. Therefore, consistent with the rest of this its policies, this Administration is figuring they’ll let the next folks deal with the repercussions of zero-interest-rate policy, quantitative easing, and the next recession.

The problem with this economic steering is that most economies are living, breathing entities. They contract and expand naturally. When fiscal policy aims to manipulate economic natural flow, we get bubbles that cause systemic problems. We saw that in 2008. Unfortunately, nothing much has changed.

Whether it happens now or after the election, it will most certainly happen. You don’t have to be an economist to know that no matter how one tilts the table, water always finds its own level.

Published in Domestic Policy, Economics, General

I had an alert that someone had liked a comment I made, and I reread the whole thing, and now I revived it! It deserved to be. PM on the way.

@David Sussman- “what made you dig up this post?”

@RightAngles- “I had an alert that someone had liked a comment I made, and I reread the whole thing, and now I revived it! It deserved to be. PM on the way.”

I think I started this. Another thread listed this as relevant, so I went to it and liked a comment by Right Angles.

(Which I may have just done again!)

Finally, someone puts together a list of all the programs which should be eliminated. Thanks Bern!

Oh yeah it was you! You did a good thing. And by that I mean liking my comment of course.