Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Progressive Tax Triumph That Wasn’t

The Progressive Tax Triumph That Wasn’t

It is often said that conservatives suffer from entirely too much nostalgia for the past. To be perfectly honest, there is a degree of truth to that criticism. We would do well to remember that the good old days were never quite as good as we remember them. Liberals would do well to remember that this phenomenon is hardly exclusive to the right. Bernie Sanders is a self-identified socialist, Democratic candidate for president, and all around crackpot (but I repeat myself). He also longs for the days of a top marginal tax rate of 91%.

It is often said that conservatives suffer from entirely too much nostalgia for the past. To be perfectly honest, there is a degree of truth to that criticism. We would do well to remember that the good old days were never quite as good as we remember them. Liberals would do well to remember that this phenomenon is hardly exclusive to the right. Bernie Sanders is a self-identified socialist, Democratic candidate for president, and all around crackpot (but I repeat myself). He also longs for the days of a top marginal tax rate of 91%.

“Ninety-nine percent of all new income generated today goes to the top 1 percent. The top one-tenth of 1 percent owns as much wealth as the bottom 90 percent. Does anybody think this is the kind of economy we should have. Do we think it’s moral?”

He continued.

“Sorry, you’re all going to have to pay your fair share of taxes,” he asserted. “If my memory is correct, when radical socialist Dwight D. Eisenhower was president, the highest marginal tax rate was something like 90 percent.”

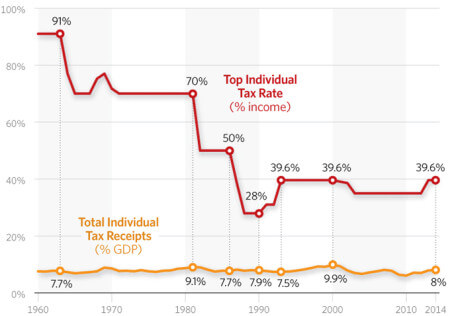

Bernie’s memory is on point, but his critical thinking skills leave something to be desired. It is true that the top marginal tax rate was once 91%. It’s also true that this rate lead to no greater revenue for the government.

How can this be? The reason is simple: almost no one actually paid the 91% rate.

In 1958, the top rate applied to income over $400,000 (not inflation-adjusted) for couples. This number must be multiplied by eight in order to compare to current dollars. For Sander’s claim that a 91% rate wouldn’t harm the economy to hold up, he would have to set this rate only for income exceeding $3.4 million per year.

How many Americans make over 3.4 million a year? Not many. The exact number is difficult to nail down, but can be approximated. The Saez analysis of tax return data shows that the top .01% of income earners make an average of $3,238,386 per year. We therefore know that the number of families this rate would affect is best measured in the tens of thousands.

This is consistent with the data we have from the IRS from 1958. Approximately 10,000 taxpayers were affected by the two highest tax brackets (The IRS only kept data by income ranges at the time). So few Americans actually fell into the bracket that it barely had any negative impact on the economy, and correspondingly had no real effect on revenue to the government.

What Sanders doesn’t make explicit, but we can all safely assume, is that he would lower the income threshold for his higher rates significantly beyond just a few thousand taxpayers who can successfully shelter the bulk of their income.

What Sanders would get is the situation France suffered through recently. The nation abandoned their 75% top tax rate after two years of utter failure. We shouldn’t be surprised that Sanders is unfazed by the failures of his preferred policies. The man is a socialist in 2015. Blindness to failure is a prerequisite for a man in his position.

Published in Economics, General

Like.

It’s not about revenue. It’s not about the rich adding to the common good (as liberals think they should add to the common good). It’s about punishing those damned richies. It’s about making those capitalist pigs squeal.

Socialism is indeed about equality in one respect: it’s about equality of misery. In their minds, it’s better if everything sucks for everyone than if some prosper and others do not.

Yep…”morality” as defined by the left.

Point of clarification, please: are you saying that because there were only 10,000 taxable units paying the 91% rate back in the day, that it didn’t have a huge effect on revenue. But because there many times that number of taxable units today, it would have a huge affect on the economy? By your own logic wouldn’t it also be true that revenue would go up if the 91% were implemented today?

I had always understood that it was primarily due to tax deductions that the 91% was never a true rate. Am I wrong?

Hmm it’s complicated. Many of the highest earners today got there through cronyism. Because cronyism cheats the system, I am not going to lose sleep if we raise their tax rates to 90%. Because under true capitalism, many of them would be completely bankrupt. Obviously the preferred solution is not higher tax rates but getting rid of cronyism. Good luck with that.

It was far fewer than 10,000 paying the 91%. 10,000 includes the top two brackets, as the IRS didn’t keep records that specific in 1958. Estimates of the number affected by the 91% rate sit in the hundreds of people.

Revenue would only go up if you positioned the 91% rate so high that few people were affected. If the tax hits too many people, it depresses the economy to the point where the Laffer curve begins to flex its muscles.

I didn’t address deductions, but yes, this is how many people avoided the top rate. There are now limits on deductions that make it impossible to do the same now.

“The top one-tenth of 1 percent owns as much wealth as the bottom 90 percent.”

Does anyone else question this? I live in a town with a population of about 3,000 people and it’s not a rich people town, nor is it a slum. I highly doubt that the richest three people in my town have greater assets than the poorest 2,700. Maybe Sanders is thinking of Zimbabwe?

Due to their ideology, progressives do believe taxing the well-to-do increases fairness. However, as Frank points out, just raising taxes on high end earners is unlikely to increase tax revenues at all, let alone enough to make a dent in annual deficits or pay for additional spending and/or new programs. The problem is that due to both ideological and political reasons (most people including middle income earners do not want to pay higher taxes) they are unwilling to raise rates ( at least directly) for middle income earners. I am coming around to the belief that we will not fix our unsustainable spending levels without some sort of intervening financial catastrophe.

I want a True Alternate Minimum Tax – everybody, even the poorest schlub, even my pre-teen kids, pays 5% of their adjusted gross income.

[Edit: That should read AT LEAST 5% – i.e. the greater of calculated tax due or 5% of AGI.]

The rich are clustered in towns further away from you. I have no reason to doubt the premise of Sanders number. The better question is why does their wealth matter? It isn’t a zero sum game.

What he says is true, but he’s pulling a bait and switch by using the term “wealth” instead of “income” in order to emphasize an unfavorable comparison that is irrelevant to the discussion of income taxes. We talked about this a while back. I’ll even quote myself:

“Are those numbers really that bad in absolute terms? We’re talking about accumulated wealth, not income levels, which is a function of frugality, industry and age. Frankly, these numbers look good to me. The top 10% are clearly business owners, the next 10% own nice homes, the next 20% own most of their homes.

As somebody in the 4th quintile, I don’t have any problems being here. We probably won’t expect to break into the next quintile for a decade, but so what? We’re working on building our savings while closing on a modest but nice starter home. Life is good!”

-E

There’s a Fishtown-Belmont aspect to those figures that richie Leftist demagogues like Sanders want to elide.

So, that figure (which is questionable*, not impossible, maybe not even implausible, but definitely questionable) addresses households, and not all households are created equally.

Anecdote: In my previous neighborhood, my next door neighbor was a single mother of three. Her children had two different fathers. That’s three households to my one. I have no doubt that the “top 25% of households” in this story has accumulated more wealth than than the “bottom 75% combined,” and I have little doubt that the gap will grow pretty drastically over time.

Obviously that’s just one story, but I’d bet that controlling for age and marriage reduces those gaps by more than a bit.

*The economists who did the study don’t have actual wealth figures to draw upon, since lists of all historical assets and their respective market valuations don’t exist. They relied on income figures to attempt to determine wealth.

So what, pray tell, is Bernie Sanders’s net worth? How much has his net worth increased since he became a Senator?

In 1950 the bottom tax rate (income from $0-$2,000) was 20%. Income over $16,000 was taxed at a marginal rate of 50% or more. If Bernie Sanders wants to bring back those rates, let him tell his constituents all the numbers. In fact, let’s have an up or down vote in Congress on reverting to the 1950 tax code. I can see Hillary’s new bumper sticker now: “Take That, You 47 Percenters!”

There are always ways around it. The more complex a system is, the more loopholes are inherently created.

“Only the little people pay taxes.”

A 91% tax rate would only certainly apply to salaried people. Do you know many salaried people who pull down $4 million a year? I don’t.

These are points worth mentioning. I left them out because many people’s eyes glaze over when they see discussions of tax rates and charts. I tried to keep the word count down.

There are a lot of other issues with that 1950s 91% tax rate – and the structure around it.

For one thing, a lot of the high-earning people got ridiculous perks – which were not treated as taxable income. A company president could have multiple company-owned homes in various places, with full domestic staff for each, along with a chauffeur-driven limousine… and not pay any taxes for them. The company got to write them off as expenses, too.

Capital gains tax was only 25%.

…but the biggest issue is marginal versus effective tax rates. Sure, the highest marginal rate was 91% or so – but the amount paid was much, much lower – less than 50% (some claim that the effective rate was 30%, when you look at loopholes and unreported income). Don’t forget that you could deduct things like interest payments, business travel (take the wife along with you, deducting her costs as well), along with pretty much anything else that looked vaguely business-related.

An old Socialist like Sanders believes the game is fair only when the outcome is identical for everyone involved. So he won’t be happy until we are all equally miserable.

A Conservative believes the game is fair when the same rules apply to everybody. So I won’t be happy until Congress stops picking winners and losers and agrees to simply ref the game.

My wife worked as an accountant before the 1986 tax code rewrite, and had some fascinating stories of how her firm’s wealthy clients made all sorts of economically inefficient maneuvers to shelter income in ways that still allowed them to enjoy the benefits of that income. Most of the maneuvers involving ways for some company they owned to have the enjoyable assets – cars, houses, horse farms, airplanes, etc. that the owner “employee” could use but not pay taxes on.

Your anecdote is borne out in some statistic I have seen (but can’t find to cite right now). The historically high rates of having what used to be one family living in one household (mom, dad, kids) now being multiple sub-families living in multiple households (mom and kids in one household, dad in another) drags down “average” household income.

Sowell addresses this concept in Basic Economics, though he doesn’t cite statistics.

-E

I think this still plays out in Hollywood as I understand it. They have a “production company” that they are an employee of that owns everything they use and they pay themselves a small salary that keeps them out of the crosshairs.

Regarding the strength of the 1950s economy despite high marginal tax rates: I’ve long said there’s nothing wrong with the US economy that a 6-year conventional bombing campaign against the rest of the industrialized world can’t fix.