Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Another Virtue Signal Goes Broke

Another Virtue Signal Goes Broke

Samuel Bankman-Fried with US Rep. Maxine Waters, D-CA, outgoing chair of the House Financial Services Committee.

While I’ve heard of Bitcoin, Ethereum, DogeCoin, and maybe one or two other cryptocurrencies, I’d never heard of FTT, SBF’s creation. I never knew about all the love SBF bought from cultural icons like Larry David or football legend Tom Brady, who did commercials for FTX I never saw.

I was unaware that Sam Bank-Friendman was the Democratic party’s second-largest individual donor – over $10 million for Joe Biden’s presidential campaign in 2020 and another $39 million for the 2022 election – behind George Soros and ahead of Michael Bloomberg.

I was unaware of SBF’s numerous conference appearances, testimony, and $300,000 in financial contributions to House Financial Services Committee members. From the Washington Free-Beacon:

While Bankman-Fried has donated to Republicans, more than 95 percent of his contributions have gone to Democrats and Democratic committees. Along with top FTX executives, he contributed to seven Democrats and two Republicans on the Financial Services committee. They gave to five members of the committee’s Digital Assets Working Group, which Waters launched last year to “support responsible innovation that protects consumers and investors” and to craft regulations for the industry. To date, the Digital Assets Working Group has not proposed regulations for the industry, which some lawmakers say would have blunted the impact of FTX’s bankruptcy on its customers.

Garcia was the biggest recipient of Bankman-Fried cash. Bankman-Fried’s political action committee, Protect Our Future PAC, spent $199,851 on ads supporting Garcia, who serves on the committee’s Digital Assets Working Group. Bankman-Fried contributed another $2,900 to Garcia’s campaign.

Bankman-Fried and his associates gave to four other members of the Digital Assets Working Group, Reps. Ritchie Torres (D., N.Y.), Josh Gottheimer (D., N.J.), Jim Himes (D., Conn.), and Sean Casten (D., Ill.).

Bankman-Fried and his brother Gabriel gave $40,300 in all to Torres’s campaign and two of his political committees, the Torres Victory Fund and La Bamba PAC. Bankman-Fried and the head of FTX’s regulatory division gave $16,600 to Gottheimer, while other Bankman-Fried associates contributed $500 to Himes and $9,100 to Casten.

And frankly, I’d never heard of “effective altruism.” It looks like old-fashioned philanthropy to me, except when it’s not.

Since I know little about cryptocurrency other than the promises of blockchain technology – which is very cool with terrific supply chain benefits – I’ve stayed away from it.

Until now. This scandal has all the hallmarks of a terrific book and movie – already underway via “The Big Short” and “Moneyball” author Michael Lewis – and the corrupt interchange between “woke capitalism,” politics, and the government regulators who turned a blind eye, and worse. There’s even sex involved, apparently. Quick poll: who plays SBF in the movie? Too bad Seth Rogan is too old for the role. There aren’t many frumpy 30-year-olds with unkept perms in Hollywood. From Yahoo!News:

The top Republican on the Senate Banking Committee, Senator Pat Toomey, writing in a tweet, quote, “Congress’ failure to pass legislation creating regulatory guardrails for crypto trading, combined with the complete hostility and lack of transparency by the SEC (Security and Exchange Commisssion), has generated a debilitated amount of legal uncertainty.” The SEC reportedly met with FTX and former CEO Sam Bankman-Fried several times before the crypto firm filed for bankruptcy.

Rumors have surfaced that SEC chairman Gary Gensler helped Bankman-Fried with regulatory loopholes, trying to avoid certain filings, though that has not been corroborated. Representative Tom Emmer (incoming US House Assistant Majority Leader) tweeted, quote, “Interesting. Gary Gensler runs to the media while reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We’re looking into this.”

Who says money doesn’t buy you love in politics? Very altruistic! Why do Democratic scandals always seem to happen after elections? Well, not all, but those get censored.

We may have been ignorant of all this, but we’ve heard about it now. Perhaps you’re one of the million or so FTX customers who may have lost your investment in what has been described as fraud, a “Ponzi scheme.” I’m sorry.

Sam Bankman-Fried is the Bernie Madoff (another reliable Democratic contributor) of this generation, eclipsing Theranos founder Elizabeth Holmes (a reliable Republican contributor), who was sentenced to jail last week. And those who do not learn from history are doomed to repeat it. Many old lessons are being retaught, even to the best and brightest among us. On Holmes’s sentencing, courtesy of the New York Post:

She was ordered to begin serving the sentence April 27. Her lawyers have two weeks to file an appeal and are expected to ask the judge to allow her to remain free on bail during the process.

Holmes’ 135-month sentence was below the 15 years requested by prosecutors, who also sought $804 million in restitution for 29 investors.

The amount covers most of the nearly $1 billion that Holmes raised from a list of sophisticated investors that included software magnate Larry Ellison, media mogul Rupert Murdoch and the Walton family behind Walmart.

Davila ordered Holmes repay $121 million to 10 investors, including Murdoch and former Wells Fargo CEO Richard Kovacevich, who sat on the company’s board, according to the New York Times.

Welcome to the world of risk, my millennial friends and family. All the old sayings remain true. If it is too good to be true, it probably is.

If you are still struggling to understand the story behind the FTX scandal, Business Insider has a superb primer. Michael Green, writing for former New York Times editor Bari Weiss’s Substack site, Common Sense, has more. These two posts will get you caught up. The Ringer will give you an even more sordid, if cynical deep dive.

Even the Biden Administration’s politically-tainted law enforcement agencies won’t be able to ignore this one. I suspect they will get a very capable assist from the incoming chair of the US House Financial Services Committee, Patrick McHenry (R-NC), who termed this an “Enron moment.” Speaking of financial scandals.

Speaking of FTX, much is being made of SBF’s connection to Ukraine, including suggestions that tax money was laundered through FTX back to the US to help politicians. There’s no doubt of a Ukrainian connection that is worth exploring by investigators. That is a severe allegation. The Daily Wire:

Earlier this year, Bankman-Fried launched an initiative alongside Ukraine’s Ministry of Digital Transformation to fundraise for the embattled nation, which has received billions in humanitarian and military aid from the Biden administration, marking “the first instance of a cryptocurrency exchange providing a conduit for crypto donations to a public financial institution,” according to a press release from a Ukrainian-based cryptocurrency firm. FTX converted the donations into fiat currencies and transmitted the funds to the National Bank of Ukraine.

But as the legal, law enforcement, publishing, and other communities sort this out, the rest of us should give the hairy eyeball to how woke fads such as “Effective Altruism,” or EA, are used to hoodwink everyone from investors to employees. It is summarized, charitably, by the title of a book by Scottish philosopher, vegetarian, and Climate Change alarmist Will McAskill, “Doing Good Better.” One commentator at goodreads.com, an open forum book review site, further explains: “It’s important to use evidence and reason when evaluating the impact you can do, both in terms of donations and using your career to make a difference.” Like this?

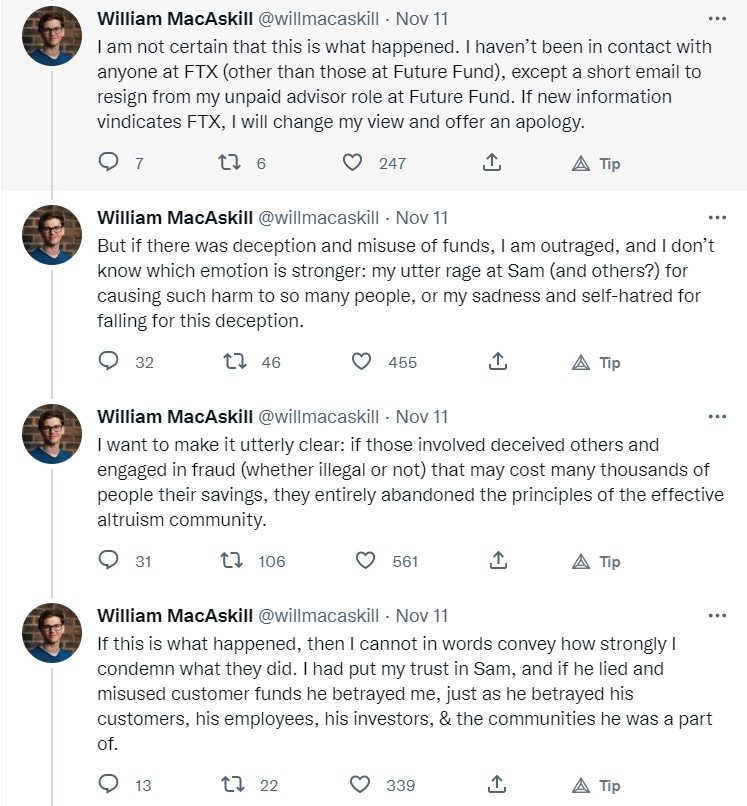

McAskill, who famously lunched and schooled SBF over EA a decade ago, took to Twitter after FTX’s collapse:

I don’t question MacAskill’s sincerity or anger and respect his sentiments. But perhaps he might better understand this more cynical view of EA, again from The Ringer:

A supposedly enlightened inversion of the old moneybags mantra “greed is good,” the school of effective altruism contends that maybe good … needs … greed? Earn to give, bitches! Effective altruism, often referred to as EA, is a real Rorschach test of financial morality: It is an ethos that combines an old-timey and genuinely philanthropic you-can’t-take-it-with-you spirit with a futuristically steely and extrapolated paper-clip-maximizing mindset. (EA adherents vary wildly on the ideal ratio between the two.) . . . EA has the ear of, and significant influence over, a lot of the extremely rich and powerful. Bankman-Fried is—was—one of them, though his commitment to the philosophy remains an open question.

As the Carolina Journal notes, “The group (FTX) also held utopian visions of how they would save the world through their philosophy of “effective altruism.” Part of this altruistic worldview apparently involved making major donations to the Democratic Party.”

Spectator USA’s Jennifer Sey has this take:

In reality, today’s very trendy woke capitalists assume the pose of do-gooders while filling their bank accounts with outsized wealth. And the world is charmed by their charade, which not only allows them to get away with fraud and theft, but prompts cheering from those whom they are stealing from. It’s quite the trick!

The simple truth, as Caitlin Flanagan has written, “is that you cannot simultaneously dedicate yourself to making untold fortunes for a giant corporation and to championing a social good.”

Another champion of EA is philosopher Peter Singer, best known for his enthusiastic support of voluntary assisted suicide and defense of infanticide.

I have another thought about EA. Maybe give back or contribute these tainted dollars to charity. “Two such candidates, Rep. Kevin Hern (R-OK) and Rep. Jesus “Chuy” Garcia (D-IL), donated their respective $5,000 and $2,900 contributions to charity after FTX filed for bankruptcy, according to a report from The Block,” noted The Daily Wire. Good for them. That should probably go for contributions to right-leaning causes and political committees made by SBF’s FTX co-CEO, Ryan Salome.

To turn an old phrase, the corrupt will always be with us. We’ll see more of these fraudulent get-rich-quick schemes in the future, human nature being what it is. Maybe we will all get better at spotting them. Sometimes, people aren’t as brilliant, successful, or “altruistic” as they look. Gullible people are born every minute, as a famous carnival showman is attributed to having once said.

As for “essential altruism,” it should involve giving without expecting a quid pro quo. That, by definition, exempts political parties, whose currency is precisely that. There’s nothing “altruistic” about giving $39 million to political committees, which should have been a big red flag to someone.

SBF also “invested” in several left-leaning media sites, including The Atlantic, The Intercept, ProPublica, and Vox, and provided startup money for Semafor. Not much altruism there, either.

If these politicians and political entities really want to do good, they can start by doing the right thing, as Reps. Hern and Garcia did. And corporate virtue signalers should ask for their money back from corrupt causes and do a better job of due diligence. Shareholders should step up and demand no less. Virtue signaling is a bad look, especially when it’s under pressure to act quickly.

As constitutional lawyer Ilya Shapiro notes, “The right thing to do is the right thing to do.” I will be delighted to recommend several excellent non-profits that effectively “do good better.” And they don’t include political parties.

Published in General

I had never heard of Holmes or Theranos either before all the news about the scandal.

Yeah I don’t play in this sandbox myself either. Interesting story about a classic scam – just on a massive scale. I’m worried that this will be used as an excuse to regulate the only non-state-owned form of currency exchange, thereby capturing it.

Perhaps there is some way to bring accounting principles and reports to bear, but I don’t know. Crypto been here a good while now, and this seems to be the outlier.

SBF’s virtue signal was blinding!

Clipping the sheep who would rather feel good about themselves than think things through. It doesn’t sound like any of them ever saw a balance sheet. It does sound like FTX couldn’t even produce a balance sheet.

The M Lewis book should be good, as long as he doesn’t turn a blind eye either. He didn’t have much to say about the fed’s responsibility for the housing crisis in The Big Short.

I don’t see government playing an effective role in this, except in a punitive sense. Having the Feds regulate crypto is a waste of time. Consider the outgoing chair of the House Financial Services Committee, Maxine Waters! I loved the picture of her and SBF above!

My opposition to government regulation is in spite of the fact that my personal online crypto account was robbed and I lost $4000. I had built a small crypto mining rig and ran it for a couple years. I was lazy about moving the proceeds offline and lost it all. Lesson learned.

I have always said that digital currency was literally nothing. That’s why I’m selling ownership certificates for my own Flicoin, genuine Large Gold Foiled Milk Chocolate Coins for only $188 per 1LB Bag. Not only do you actually own each Flicoin, but I store it for you in my new top opening freezer. You can always redeem your certificates of ownership for your hard currency of delicious gold foil wrapped chocolaty goodness, but if the price ever goes to Zero, you can eat it. Shipping and handling does apply.

I’m not sure who is more ugly; Maxine Waters or Bankman-Fried’s girlfriend. I don’t believe that I’ve ever seen a picture of her in which she has washed her hair.

https://nypost.com/2022/11/14/meet-caroline-ellison-sam-bankman-frieds-rumored-ex-girlfriend/

Damn

Yes, those are real tortoise shell glasses, too. From the Bahamas. Voluntarily harvested.

She’s got that puberty blocker look, along with Greta.

Well put. I think all those stories about orgies at FTX were completely made up. Who in the world would want to see either Sam or his girlfriend in action???

Ten other people similarly (dis)favored?

It’s economical, if nothing else. Keeps a lot of ugly off of the streets.

Nothing we know about this guy is truthful.

EA, effective altruism. As soon as anyone discusses that philosophy or topic. RUN, it seems to be a highly effective red flag for frauds. (along with photos with lefty politicians) Does this ideology create the mindset for fraud, as the ends justify the means. Like a self-appointed Robin Hood or does this Altruism ideology provide the smoke screen for frauds from the outset…

His lifestyle arrangement – being in sexual ‘Chinese Imperial Harem’ with 10 people, also strikes me as false. Could it be that the entire management team can be discredited from testifying against other biased on their interpersonal, sexual relationships? Could they be inventing this controversial lifestyle as dodge from testifying against each other?

Also look at this guy, SBF doesnt look fit enough to be a vegan – let alone to be maintaining 10 sexual relationships. Either he’s fit enough, to have the opportunity to have those relationships – or the acts of those relationships get him into shape. Not to be mean, (ok, I am being a little mean) but he’s got a giant pair of man jugs there…

Nothing the media has on this guy is true. Lets start with that assumption. I think you’ll come closer to the truth if you ignore the smokescreen of lies.

Found this gem supposedly written by Caroline… What is she getting wrong? She didnt lose all of the money, if the trade went down $10, there is a bottomless pit of possible losses here… Even if you dont have any other funds – I think with such extreme leverage, most traders would get a margin call once all of their equity was lost on the position…

I think the key takeaway is from the tweet by SBF (the scammer)…

“…this dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.”

To me, this is the business model spawned by woke ideology. Why nickel and dime the system shoplifting from Target or Waldgreens? The FTX thing is stealing sneakers from the Nike Store writ large. If you are a member of the preferred group, you can do whatever you want with no repercussions. SBF realized he could buy his way into the select club by spreading around a tenth of one percent of the take to the right people and “say all the right shibboleths” and he would be home free. And he was. He wasn’t stopped by the regulators, nor caught by financial crime investigators. No, he was undone by capitalism. One of FTX’s main competitors finally got some notice publishing what FRX and SBF were up to and that eventually caused a panicked ‘run’ on FTX. Capitalism works.

Think about Bernie Madoff for instance. Who was the major beneficiary of the Madoff Ponzi scheme? The US Treasury! Think of all the income tax and capital gains taxes paid by Madoff clients over the years on ‘gains’ that were fictitious. No wonder the G-men were uninterested. They were silent partners.

Same here. It’s not a case of “get woke go broke” … it’s good old fashioned payolla but in a digital world.

Maybe we should have had some of this type of reaction when the jab was being foisted on us or over the years as other harmful drugs and foods have been pushed into the marketplace. We need some real ethics and truth across the board.

Toomey clueless as ever. Bankman-Fried and FTX were angling for regulation. Why? To keep competitors out because they were so well connected. The entire scam was with another company that was rating Bankman-Fried’s enterprise. That company was run by Bankman-Fried’s girlfriend, who was the daughter of the top SEC regulator. Talk about regulatory capture.

These were a bunch of Harry Potter game players living together, living in a fantasy world. Literally.

Word of the day. I was trying to think of it earlier.

Maybe even word of the year. This whole project seems to demonstrate that if you know the proper untruths to espouse, you can walk off with a truckload of cash, without a second look.

I think it also highlights the lack of value the US Dollar has. The Fed has set the future value of the Dollar at 0% for so long, many of the investment firms are staffed (at least at some junior ranks) by people who know nothing else. These investment firms ‘invested’ hundreds of millions of dollars in this firm without any diligence at all. FTX had no accounting system or controls, and would not have stood up to any kind of investigation or diligence on behalf of investors at all. Would it have been different if the investment firms valued their dollars higher?

As far as casting, I see Harvey Guillen from What We Do in the Shadows (TV show)

As hard as it may be to believe, this FTX scam may be even more bizarre and politically connected :

Excerpted from Jeff Tucker at the Brownstone Institute

The COVID/Crypto Connection: The Grim Saga Of FTX & Sam Bankmanp- Fried

A series of revealing texts and tweets by Sam Bankman-Fried, the disgraced CEO of FTX, the once high-flying but now belly-up crypto exchange, had the following to say about his image as a do-gooder: it is a “dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.”

Very interesting. He had the whole game going: a vegan worried about climate change, supports every manner of justice (racial, social, environmental) except that which is coming for him, and shells out millions to worthy charities associated with the left. He also bought plenty of access and protection in D.C., enough to make his shady company the toast of the town.

As part of the mix, there is this thing called pandemic planning. We should know what that is by now: it means you can’t be in charge of your life because there are bad viruses out there. As bizarre as it seems, and for reasons that are still not entirely clear, favoring lockdowns, masks, and vaccine passports became part of the woke ideological stew.

This is particularly strange because covid restrictions have been proven, over and over, to harm all the groups about whom woke ideology claims to care so deeply.

Regardless, it’s just true. Masking became a symbol of being a good person, same as vaccinating, veganism, and flying into fits at the drop of a hat over climate change. None of this has much if anything to do with science or reality. It’s all tribal symbolism in the name of group political solidarity. And FTX was pretty good at it, throwing around hundreds of millions to prove the company’s loyalty to all the right causes.

Among them included the pandemic-planning racket. That’s right: there were deep connections between FTX and Covid that have been cultivated for two years. Let’s have a look.

Earlier this year, the New York Times trumpeted a study that showed no benefit at all to the use of Ivermectin. It was supposed to be definitive. The study was funded by FTX. Why? Why was a crypto exchange so interested in the debunking of repurposed drugs in order to drive governments and people into the use of patented pharmaceuticals, even those like Ramdesivir that didn’t actually work? Inquiring minds would like to know.

Regardless, the study and especially the conclusions turned out to be bogus. David Henderson and Charles Hooper further point out an interesting fact:

continued from last post:

Among the organizations most affected is Guarding Against Pandemics, the advocacy group headed by Gabe that took out millions in ads to back the Biden administration’s push for $30 billion in funding. As Influence Watch notes: “Guarding Against Pandemics is a left-leaning advocacy group created in 2020 to support legislation that increases government investment in pandemic prevention plans.”

Truly it gets worse:

FTX-backed projects ranged from $12 million to champion a California ballot initiative to strengthen public health programs and detect emerging virus threats (amid lackluster support, the measure was punted to 2024), to investing more than $11 million on the unsuccessful congressional primary campaign of an Oregon biosecurity expert, and even a $150,000 grant to help Moncef Slaoui, scientific adviser for the Trump administration’s “Operation Warp Speed” vaccine accelerator, write his memoir.

“Leaders of the FTX Future Fund, a spinoff foundation that committed more than $25 million to preventing bio-risks, resigned in an open letter last Thursday, acknowledging that some donations from the organization are on hold.

And worse:

The FTX Future Fund’s commitments included $10 million to HelixNano, a biotech start-up seeking to develop a next-generation coronavirus vaccine; $250,000 to a University of Ottawa scientist researching how to eradicate viruses from plastic surfaces; and $175,000 to support a recent law school graduate’s job at the Johns Hopkins Center for Health Security. “Overall, the Future Fund was a force for good,” said Tom Inglesby, who leads the Johns Hopkins center, lamenting the fund’s collapse. “The work they were doing was really trying to get people to think long-term … to build pandemic preparedness, to diminish the risks of biological threats.”

More:

Guarding Against Pandemics spent more than $1 million on lobbying Capitol Hill and the White House over the past year, hired at least 26 lobbyists to advocate for a still-pending bipartisan pandemic plan in Congress and other issues, and ran advertisements backing legislation that included pandemic-preparedness funding. Protect Our Future, a political action committee backed by the Bankman-Fried brothers, spent about $28 million this congressional cycle on Democratic candidates “who will be champions for pandemic prevention,” according to the group’s webpage.”

I think you get the idea. This is all a racket. FTX, founded in 2019 following Biden’s announcement of his bid for the presidency, by the son of the co-founder of a major Democrat Party political action committee called Mind the Gap, was nothing but a magic-bean Ponzi scheme. It seized on the lockdowns for political, media, and academic cover. Its economic rationale was as nonexistent as its books.

There is much, much more with a long list of scam charities that fight the Pandemic in all the politically correct ways. For more see the Jeff Tucker post at Zerohedge.

But like Bill Gates, Sergey Brin, and Mark Zuckerberg before him, Bankman Fried was a Cabal-promoted entity, who may or may not have realized how his little monetary scheme was promoted above all other such schemes for various purposes not totally under his control or for his benefit. But being set up to be the pass through business account to aid America’s political class did give him spectacular, although brief, personal benefits. Too bad he didn’t realize how he was being used. (Or maybe he knew all along.)

The public will be better able to figure things out when the next chapter in the young man’s story plays out. An Epstein-style ending would not surprise me.

The Cabal knows exactly who to pick, what the game plan will look like, and when it is to the Cabal’s advantage to dump some scandal on a Chosen One. (Example: look at the timing of Bill Gates Anti trust scandal, and what was happening that led to it being that moment in the 1990’s for him to take a hit.)

Like Catherine Austen Fitts keeps saying, any time that a “special golden Boy-Genius” suddenly shows up and is the darling of media, watch out.

End Of Part One

Part Two

In the case of FTX, it is clear that the game plan was for a way for the Dem candidates to pickup hundreds of millions or billions of dollars of donations, from a company generating wealth due to the promotion of the company by such financial luminaries as Jim Cramer.

It is not only the “Boy Genius” label that alert us to the idea this whole situation was Cabal-created. The soft interviews that came Bankman Fried’s way are another indication. Most people without an actual history of producing notable profits year in and year out rarely get on TV shows to be interviewed. And if they would, the questions asked of them would not be soft and gentle queries but fact demanding queries relating to how the new company would be able to fulfill the promises made to investors.

The Talking Heads’ attitude toward Bankman Fried focused on how he was just too tousle-haired adorable a dude to need to explain a thing about FTX’s business plan. That attitude in itself should be a warning signal that not all is as it seems.

When the government makes it too hard to make money legally, the people willing to make it illegally thrive. That’s the real lesson.

Might depend on how much they’re paying for an audience?

Okay, yeah, I can see Bankman-Fried being willing to bang that occasionally to keep her SEC father out of things.

A big problem is the number of voters who see something like that go “Duuuhhh, whut?”

Kedavis:

A big problem is the number of voters who see something like that go “Duuuhhh, whut?”

I know, I know…..I get it ……..but somebody has to say something about it.

The depth of this depravity actually says more about the Democratic/ Progressive power structure and how it finances things and cons millions than about this A-hole Bankman Fried character who knew he was defrauding tons of people out of millions.

But ya know as punishment for so many not trying to understand this really complex mind boggling stuff you know I may but probably won’t , unleash another post, even longer, even more mind cramping, from this guy who can explain this whole thing in a very long post kind of way that really, really wants to make you say “Duuuuhhh, whut” on how how this whole FTX thing was really a massive con from the git go, with all sorts of massive fraud which should have been easily recognized from the regulators all over the place but wasn’t that was always, always meant to go bust at some point, while they were collecting millions and millions , even billions, in the grift. These FTX people were essentially creating collateral out of thin air and selling these concocted worthless ” FTX tokens” that they had assigned value and were using that to get unbelievably huge loans from all the right people to con even more people in even bigger ways , and using all sorts of really bogus excuses why this or that wasn’t working in a ways that should have fooled no one but did because they were pushing all the right politically correct causes in a very smooth, politically connected kind of way. Wink, Wink. Oh ya and his Dad was connected big time.

How many “professional Investors” were fooled by this man?

I don’t know how deeply Jim Cramer has looked into crypto, but he called SBF “the new J. P. Morgan” for extending credit to other crypto institutions back in June.