Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Technical Analysis of Futures and Brexit

Technical Analysis of Futures and Brexit

Author’s Note: This post is solely political commentary and does not constitute a recommendation to take a position long or short in the instruments mentioned. Futures trading involves risk well in excess of initial margin requirements to trade these leveraged instruments.

Author’s Note: This post is solely political commentary and does not constitute a recommendation to take a position long or short in the instruments mentioned. Futures trading involves risk well in excess of initial margin requirements to trade these leveraged instruments.

Several members and contributors reference various betting markets and their predictive power for certain political decisions and elections. I always enjoy their posts and comments, but given my daily work in futures markets, haven’t visited the betting markets.

Futures markets, like betting markets, can sometimes be predictive of possible outcomes in that they reflect commitments by a group of people who are well capitalized and hopefully well informed. The size of the British Pound physically delivered foreign exchange futures market is notionally $24T (this is outsized compared to historical norms given the hedging activity associated with Brexit).

I analyze this and other markets using a combination of fundamental and multiple forms of technical analysis. One method of technical analysis, point and figure, is useful in that reliable trend lines and price targets are derived from similarly constructed analysis across different time frames.

Example: If an instrument is trending in the same direction and creating similar price targets across two time frames those trends and targets are reliable and likely to continue and be achieved respectively.

British Pound Futures are exhibiting this behavior in such a way that Brexit seems much more likely than it did just a couple of weeks ago.

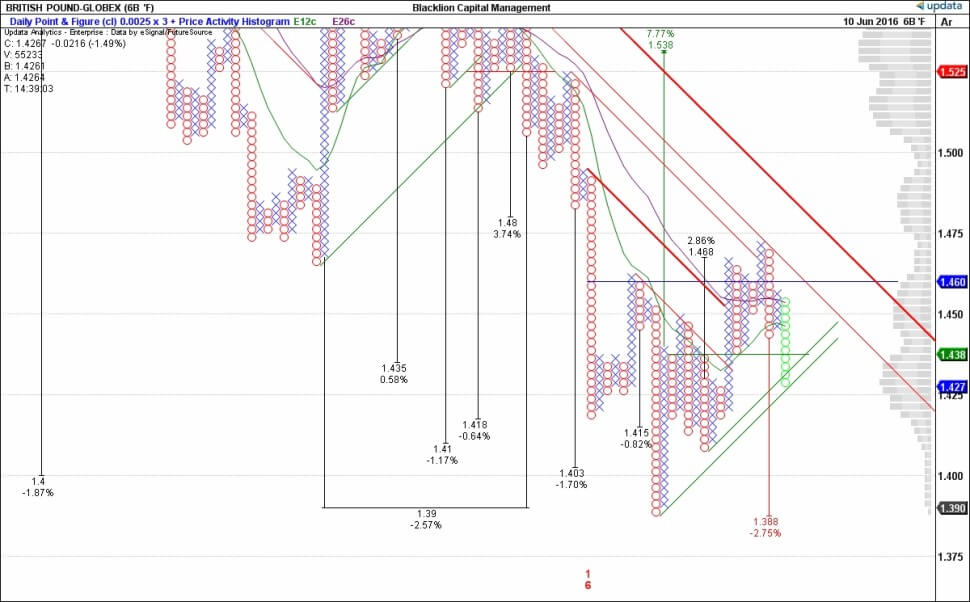

The first chart is a daily chart based on daily closing price. The construction is each box (X or O) = 0.0025 and three boxes are required for a column reversal. Trends and targets are calculated mathematically, not subjectively. This is one reason I prefer this method of analysis though I incorporate others.

Today’s 1.5% decline in June Futures continues the downtrend and activates a price target to 1.388.

Today’s 1.5% decline in June Futures continues the downtrend and activates a price target to 1.388.

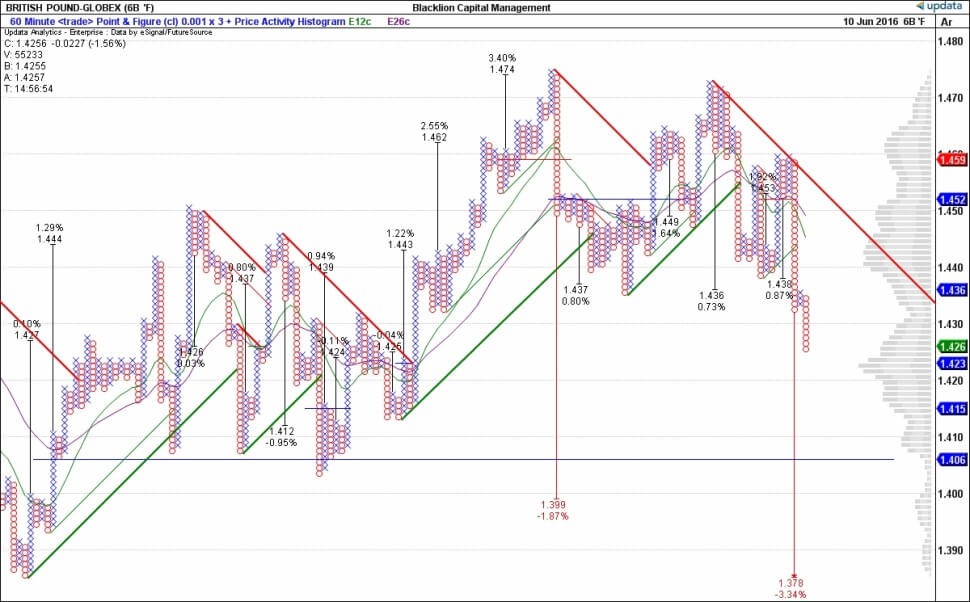

The next chart is constructed exactly the same only on a 60-minute time period.

Today’s decline on the 60-minute time frame activates a target to 1.378, close enough to the 1.388 target on the daily chart as to be coincident. The simultaneous activation of coincident targets across multiple time frames increases the likelihood those targets will be realized, but does not indicate the timing if/when they may be realized.

Today’s decline on the 60-minute time frame activates a target to 1.378, close enough to the 1.388 target on the daily chart as to be coincident. The simultaneous activation of coincident targets across multiple time frames increases the likelihood those targets will be realized, but does not indicate the timing if/when they may be realized.

The notional value of this market is in excess of $24T with more than $1.548 billion in margin capital committed (the actual amount is much higher, that is just the minimum to open a position). These values and commitments behind them drive the price action in the charts and are predictive based on well capitalized and presumably well informed participants.

Conventional wisdom is that a vote to leave the European Union will adversely impact the value of the British Pound Sterling and it will decline. I personally think those fears are overblown, but we operate in the markets as they exist, not those I wish existed.

These futures will roll from June delivery to September delivery next week adding additional volatility to an already volatile situation. Be careful out there.

Published in General

A year ago I taught a 4 part series on Futures and Options on Futures for Christian Financial Concepts. I believe the videos are still available here.

Thanks Brent!