Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

A Silicon Valley Investor’s Bold Essay in Praise of Income Inequality

A Silicon Valley Investor’s Bold Essay in Praise of Income Inequality

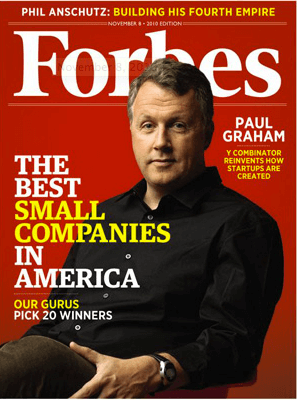

Venture capitalist Paul Graham has written a lengthy essay on the value of increasing income inequality — at least the kind that comes from founding startup firms that generate consumer-relevant value. Here is some of it:

Venture capitalist Paul Graham has written a lengthy essay on the value of increasing income inequality — at least the kind that comes from founding startup firms that generate consumer-relevant value. Here is some of it:

Since the 1970s, economic inequality in the US has increased dramatically. And in particular, the rich have gotten a lot richer. Some worry this is a sign the country is broken. I’m interested in the topic because I am a manufacturer of economic inequality. I was one of the founders of a company called Y Combinator that helps people start startups. Almost by definition, if a startup succeeds, its founders become rich. And while getting rich is not the only goal of most startup founders, few would do it if one couldn’t. …

I’ve become an expert on how to increase economic inequality, and I’ve spent the past decade working hard to do it. Not just by helping the 2500 founders YC has funded. I’ve also written essays encouraging people to increase economic inequality and giving them detailed instructions showing how. …

If you want to understand change in economic inequality, you should ask what those people would have done when it was different. This is one way I know the rich aren’t all getting richer simply from some sinister new system for transferring wealth to them from everyone else. When you use the would-have method with startup founders, you find what most would have done back in 1960, when economic inequality was lower, was to join big companies or become professors. Before Mark Zuckerberg started Facebook, his default expectation was that he’d end up working at Microsoft. The reason he and most other startup founders are richer than they would have been in the mid 20th century is not because of some right turn the country took during the Reagan administration, but because progress in technology has made it much easier to start a new company that grows fast. …

I’m all for shutting down the crooked ways to get rich. But that won’t eliminate great variations in wealth, because as long as you leave open the option of getting rich by creating wealth, people who want to get rich will do that instead. …

You can’t prevent great variations in wealth without preventing people from getting rich, and you can’t do that without preventing them from starting startups. … It would only mean you eliminated startups in your own country. Ambitious people already move halfway around the world to further their careers, and startups can operate from anywhere nowadays. So if you made it impossible to get rich by creating wealth in your country, the ambitious people in your country would just leave and do it somewhere else. Which would certainly get you a lower Gini coefficient, along with a lesson in being careful what you ask for. …

And while some of the growth in economic inequality we’ve seen since then has been due to bad behavior of various kinds, there has simultaneously been a huge increase in individuals’ ability to create wealth. Startups are almost entirely a product of this period. And even within the startup world, there has been a qualitative change in the last 10 years. Technology has decreased the cost of starting a startup so much that founders now have the upper hand over investors. Founders get less diluted, and it is now common for them to retain board control as well. Both further increase economic inequality, the former because founders own more stock, and the latter because, as investors have learned, founders tend to be better at running their companies than investors. …

If our goal is to decrease economic inequality, then it is equally important to prevent people from becoming rich and to prevent them becoming poor. I believe it’s far more important to prevent people becoming poor. And that therefore decreasing economic inequality should not be our goal.

Pretty blunt. Pretty unapologetic. Over at Vox, Gregory Ferenstein — who has been researching the economic, political, and policy views of Silicon Valley — notes that the essay has caused quite a stir in the VC world. “Tone deaf” is what one fellow investor called it. Yet, as Ferenstein concludes, “Paul Graham is not much of an outlier among Silicon Valley’s elites when it comes to the relationship between ability and financial rewards. Most successful technology moguls know better than to be as blunt as Graham, but deep down a lot of them believe that a small minority — like them — create a hugely disproportionate share of the world’s wealth.”

And American entrepreneurs, in particular, do the heavy lifting of global wealth creation and innovation. I really like that Graham suggests a difference — it’s pretty important! — between wealth resulting from value creation versus rent seeking and cronyism. But you can be in favor of economic dynamism while making sure, as much as possible, that its benefits are broadly shared.

Ferenstein points out that Graham’s colleague at YC Combinator, Sam Altman, also grappled with inequality issue, leading him to a favorable view of a universal basic income. That’s something my AEI colleague Charles Murray also favors as a way of replacing the current welfare state with something better. Let me also note that some on the left worry that Washington Democrats are too obsessed with inequality rather than with economic growth, and at a time when the economy seems stuck in low-gear.

Published in Culture, Economics

Usually I disagree strongly with James P’s posts. Not this time. Excellent essay, worth sharing with moderate and liberal friends.

Democrats have a good thing going. They gain power for themselves by creating a centralizing regulatory regime that causes a good share of our income inequality. Then they blame it all on the Republicans, who help make their case by asserting that income inequality is just fine.

An interesting aspect that Paul Graham alludes to in the excerpt is that internet technology allows start-ups to grow very large very fast. Prior technology booms like automobiles, airplanes, electronic appliances were all constrained by the need to physically construct objects. This allows more of the revenue to be shared among fewer people – higher inequality. Also, because geography is not a barrier to commerce in the internet age there is more competition and the best product will rise to the top quicker – does anybody remember the founder of MySpace? This also leads to higher inequality.

In fact if you look at the numbers for new business formation they are down significantly from previous era’s – except that the average size of new businesses is growing. Which means there are fewer but larger businesses, which tends to also increase inequality.

A good article, but also important to emphasize the malign role of runaway credentialism, of the educational kind. Most people will accept that a Bill Gates or Steve Jobs has created value, but the inequality created by the strong preferential treatment of Ivy League graduates in certain industries (finance, government, consulting, academia) is not so readily accepted, nor should it be.

See my post The Ivy League in American Life for further thoughts and some insightful comments by Peter Drucker.

Finally a James P post I heartily enjoyed!

The Reticulator gets it right. The article doesn’t. The problem isn’t the great wealth captured by the big global successful entrepreneurs and their early supporters. It’s the wealth not being created because the regulatory regime is crushing small business, discouraging new business, and extorting rents at every stage. What we need are more entrepreneurs and fewer rent collectors. The fact is there are toll and rent collectors on every little bridge, charging tolls coming and going. At the center of this rent seeking, initiative destroying system are big government liberals in both parties. The issue is real. The solution is simple.

Bravo!

Again, very well done James! Good points.

Harsh? A bit. Viable politically? Less than those who stand here might want to admit.

Universal basic income – an idea I can’t quite get my head around. Bread, wine and games in Rome? Replacing welfare? A good idea, that once in place can fall to de Tocqueville’s admonition against the people being bribed with their own money.

Something for nothing becomes an entitlement. Valued by the rich because it removes guilt. Devalued by the recipients because they must do nothing to recieve it. The entire comment is laced with deep and profound moral quandaries.