Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Bad Middle-Class Math of the FairTax

The Bad Middle-Class Math of the FairTax

Should we replace the income tax with a national sales tax? Some commonsense on the FairTax by the Tax Policy Center:

Should we replace the income tax with a national sales tax? Some commonsense on the FairTax by the Tax Policy Center:

The tax is designed to protect low-income people from higher taxes via a large new cash transfer program called a “prebate.” Every household would get a cash transfer equal to the amount of tax that a family at the poverty level would owe. (Ironically, this would be the largest welfare program in history.)

The problem is that very high-income households spend only a fraction of their income, while low- and middle-income people spend all or most of what they make. A sales tax, by design, exempts a large share of income at the top. If it includes a prebate to protect people at the bottom and doesn’t add to the deficit, then it must raise taxes on people in the middle.

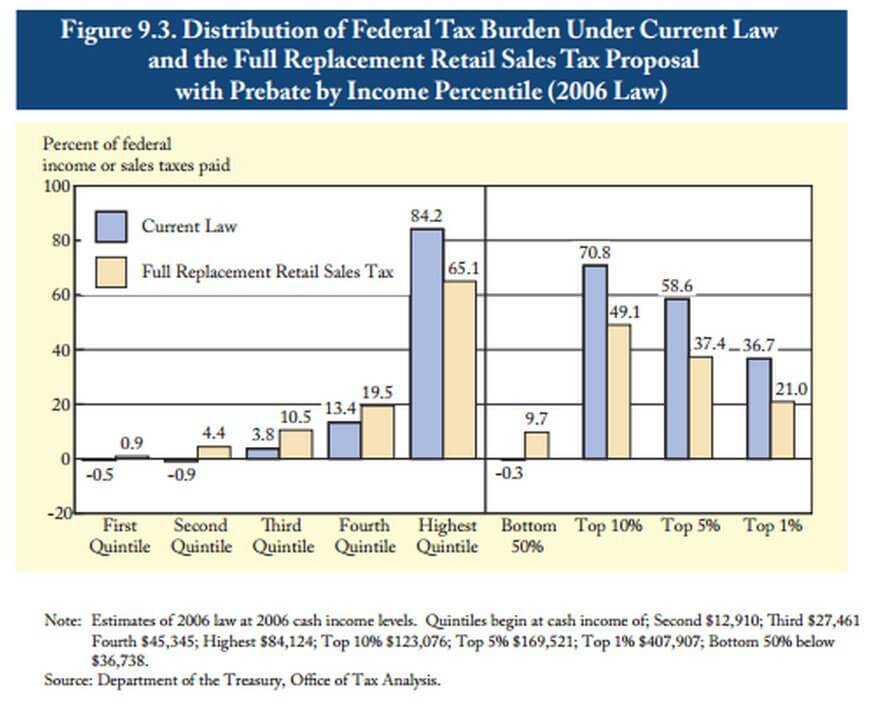

A decade ago, President George W. Bush’s Tax Reform Panel considered a sales tax as a revenue-neutral replacement for the income tax. It rejected the idea after concluding that the rates would have to be much higher than promised by the FairTax people. It also calculated the tax would be very regressive as the [above chart] shows.

The Panel also found that the prebate would be extremely expensive, hard for taxpayers to manage, and complex for the IRS to administer. In addition, the panel was concerned a federal retail sales tax rate of 30 percent or more would result in widespread evasion and create real problems for states that rely heavily on their own sales taxes. FairTax advocates counter that their proposal would also replace regressive payroll and excise taxes (as well as highly progressive estate taxes), but the bottom line is that tax burdens on middle-income households would surely rise while high-income families would get a big tax cut.

This very much syncs with what AEI’s Alan Viard told me awhile back:

Pethokoukis: Whenever I write about tax reform, I always get people asking about the FairTax, which is kind of a national sales tax. What do you think about the FairTax as tax reform?

Viard: I think the supporters of the fair tax have their heart in the right place because they’re trying to find a consumption based tax system that avoids the penalty on saving and investment that’s built into the income tax. The specific proposal they’ve put forward, though, really does have a number of problems. And many, many economists have pointed them out. First of all, a retail sales tax at that high of a rate is really likely to have a lot of enforcement and compliance problems. And countries that impose consumption taxes at that high of a rate, they tend to use a value added tax structure, which is really economically the same as a sales tax, but administratively is different because you collect it at multiple stages. And that just helps with the enforcement and the compliance.

So it would be a pretty modest change, actually, to say let’s do it in a value added tax administrative mode instead of a sales tax mode. But that’s I think the first change you need to make to their plan.

The rate is also not revenue neutral. They’re proposing a 30% sales tax rate and that’s not enough to replace revenue. And I think, given our deficit environment, obviously a tax reform is not going to be viable if it lowers revenue. So – and of course, there you could just raise the rate.

A bigger problem is that, there’s no progressivity in this and they – well, they have pre-bate that introduces some progressivity, but compared to the taxes they’re replacing, this would be a big shift in the tax burden, away from high-income groups towards middle-income and lower middle-income groups. And whatever you think about that politically, I think that’s just not viable.

So you really have to do something different. You either need to adopt a progressive consumption tax, which could be the Bradford X tax, or a personal expenditure tax, or you have to bring in a consumption tax to replace only part of the income tax and it’d probably be a value added tax in that case.

I really don’t think I ever need to write another post about the FairTax. I’ll just tweet a link to this one. Like many novelty tax plans bandied about on the right, the math of the FairTax is simply unfair to middle-income America and conflicts with fiscal reality.

Published in Economics

I don’t have good stats, but clearly among working aged people, consumption is tighter than income because of transfer payments that don’t get recorded as income. Clearly it is taxing this form of consumption that is a) what people are trying accomplish and b) part of what makes this a regressive tax (at least in terms of relative impact).

When I was a young radical proposing a consumption tax, my boss used to tell me that the number one indicator of consumption was income. This is probably true for working age people, but it seems to fall apart for retirees living off their savings and trying to (as I am) have the last check I write bounce (whatever I want to give to my kids, I plan to give it to them before I die, so I can see them enjoy it, rather than watch them waiting with baited breath for my breath to cease.

And to the extent they didn’t funnel their retirement savings through a 401K.

Yeah, the answer to every objection to this system is “the government is going to cut you a subsistence level check before it takes everything else you got, so shut up and eat your dog food.” Call me unimpressed.

JP’s point is that the “Fair Tax” means a big tax increase for everyone except the top 10%. Good luck with that one politically. As the fictional Pres. Hayes said on Stargate, never going to happen.

If you do the math, even the people in the second income decile (i.e. the 80th-90th income percentile) would pay 16.0% of the “Fair Tax,” compared to 13.4% currently.

I think that JP is right. His chart shows that the “Fair Tax” is a political non-starter.

The only thing that I would add is the calculation that I provided above — i.e. expressly show that even the second income decile would pay more.

While I agree it is politically unfeasible, that is not what JP said. He said it would be unfair

I certainly didn’t know that. Where do we find the data?

No, because the declining middle class would be outvoted. They could wake up all they want, and it wouldn’t matter.

Whatever plan you come up with, there is going to be unfairness as perceived by the voters. There is no single absolute fairness indicator that everybody goes by.

The best you can do is cut government and make the inevitable unfairness an issue that doesn’t matter.

Probable Cause

Son of Spengler:And to address that concern, the Fair Tax sends a check. As I said, it may not be enough. But it’s a distortion to argue that retirees would be paying double taxes. They would only be paying double on their consumption to the extent it exceeds average consumption.

And to the extent they didn’t funnel their retirement savings through a 401K.

Does the Fair Tax do away with corporate taxes? In that case, you should expect to see the value of your 401(k) equity holdings rise as much as 54%. Again, I don’t know all the ins and outs, but the effects would not be as simple as “retirees get shafted”.

So the problem seems to be that the rate would have to be too high and it would put too much burden on people. To me that is the best part. Everyone feels the burden. It gives people incentive to vote for people who will shrink government. It would make it harder for politicians to implement policies that would force the tax rate to go up.

The problem is not the design of the tax, it is that government is too big and the people can’t afford to support it.

Technically that’s your own money back. Waiting for a check for progressive tax compensation is actually getting a handout.

But surely it would be based off of how much tax you have already paid right? I mean I live in a state with income tax only so it is really easy to deduct the amount I paid in state taxes (it is write there on my W-2). In states with a Sales Tax don’t you have some type of “suggested number” you use to say how much sales tax you paid in a year?

Wouldn’t a Fair Tax be doing the same thing? It you say you live in X state you make X money this is how much you probably paid in taxes on “essentials” here have some money back.