Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Bad Middle-Class Math of the FairTax

The Bad Middle-Class Math of the FairTax

Should we replace the income tax with a national sales tax? Some commonsense on the FairTax by the Tax Policy Center:

Should we replace the income tax with a national sales tax? Some commonsense on the FairTax by the Tax Policy Center:

The tax is designed to protect low-income people from higher taxes via a large new cash transfer program called a “prebate.” Every household would get a cash transfer equal to the amount of tax that a family at the poverty level would owe. (Ironically, this would be the largest welfare program in history.)

The problem is that very high-income households spend only a fraction of their income, while low- and middle-income people spend all or most of what they make. A sales tax, by design, exempts a large share of income at the top. If it includes a prebate to protect people at the bottom and doesn’t add to the deficit, then it must raise taxes on people in the middle.

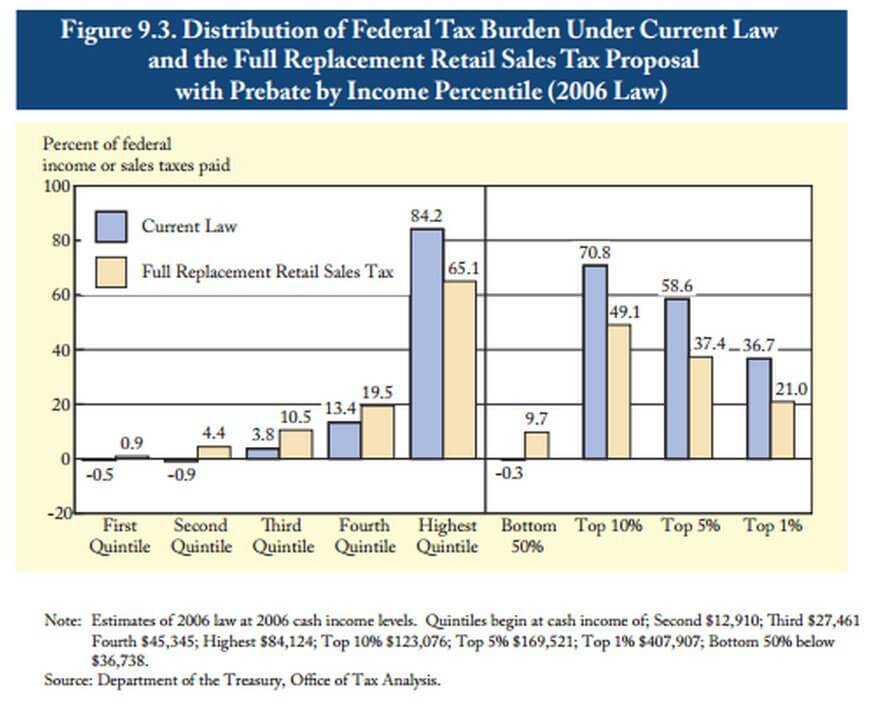

A decade ago, President George W. Bush’s Tax Reform Panel considered a sales tax as a revenue-neutral replacement for the income tax. It rejected the idea after concluding that the rates would have to be much higher than promised by the FairTax people. It also calculated the tax would be very regressive as the [above chart] shows.

The Panel also found that the prebate would be extremely expensive, hard for taxpayers to manage, and complex for the IRS to administer. In addition, the panel was concerned a federal retail sales tax rate of 30 percent or more would result in widespread evasion and create real problems for states that rely heavily on their own sales taxes. FairTax advocates counter that their proposal would also replace regressive payroll and excise taxes (as well as highly progressive estate taxes), but the bottom line is that tax burdens on middle-income households would surely rise while high-income families would get a big tax cut.

This very much syncs with what AEI’s Alan Viard told me awhile back:

Pethokoukis: Whenever I write about tax reform, I always get people asking about the FairTax, which is kind of a national sales tax. What do you think about the FairTax as tax reform?

Viard: I think the supporters of the fair tax have their heart in the right place because they’re trying to find a consumption based tax system that avoids the penalty on saving and investment that’s built into the income tax. The specific proposal they’ve put forward, though, really does have a number of problems. And many, many economists have pointed them out. First of all, a retail sales tax at that high of a rate is really likely to have a lot of enforcement and compliance problems. And countries that impose consumption taxes at that high of a rate, they tend to use a value added tax structure, which is really economically the same as a sales tax, but administratively is different because you collect it at multiple stages. And that just helps with the enforcement and the compliance.

So it would be a pretty modest change, actually, to say let’s do it in a value added tax administrative mode instead of a sales tax mode. But that’s I think the first change you need to make to their plan.

The rate is also not revenue neutral. They’re proposing a 30% sales tax rate and that’s not enough to replace revenue. And I think, given our deficit environment, obviously a tax reform is not going to be viable if it lowers revenue. So – and of course, there you could just raise the rate.

A bigger problem is that, there’s no progressivity in this and they – well, they have pre-bate that introduces some progressivity, but compared to the taxes they’re replacing, this would be a big shift in the tax burden, away from high-income groups towards middle-income and lower middle-income groups. And whatever you think about that politically, I think that’s just not viable.

So you really have to do something different. You either need to adopt a progressive consumption tax, which could be the Bradford X tax, or a personal expenditure tax, or you have to bring in a consumption tax to replace only part of the income tax and it’d probably be a value added tax in that case.

I really don’t think I ever need to write another post about the FairTax. I’ll just tweet a link to this one. Like many novelty tax plans bandied about on the right, the math of the FairTax is simply unfair to middle-income America and conflicts with fiscal reality.

Published in Economics

Would you please define the word “Fair” in this context?

It sounds like you are implying that asking the middle class to pay their pro-rata share of the costs is unfair, so we need to continue to force the rich to pay for far more than their pro-rata share of the costs in the name of “fairness”.

All this presumes that the current level of progressivity is correct, or that it should be higher. I dunno — having 10% of your people pay for 70% of government seems like progressivity may have become too steep.

It’s also a static analysis. If you care about the plights of the poor and middle class, the better question is whether they would be better off in absolute terms — not whether someone else will pay less. If a better-structured tax system leads to better economic growth and higher incomes across the board, the middle class could end up with more money in their pockets — even if their tax rates are a little higher.

Personally, I don’t know whether the Fair Tax is optimal or not. (And FWIW, I think the whole focus on taxes is misguided, until after spending has been brought under control.) But the OP’s analysis certainly does not convince me that the Fair Tax should be rejected out of hand.

My biggest reservation (after regressive effects, disruption of state government revenue streams, enforcement nightmares..) is the likelihood that a Democratic Party in power would reinstate an income tax for “the rich which will quickly mutate into much the same income taxes combined with a new, high VAT.

If this was done it would have to be done with constitutional amendment to prevent this.

The final chapter of “Pity Party” by W.Voegeli explains why this is a good thing for the country. Voegeli explains that – if nothing else – it makes the conversation of who is taking, and who is making, much simpler. The simpler it is the harder it is to hide behind in the discourse. As Mark Steyn would say: The current welfare state is largely feckless make-work programs for compliance program administrators at the department of compliance. As Reagan once said – “It would seem that someplace there must be some overhead.” Lets talk about that overhead in clearer terms, going forward. I think it’d be an improvement for the history of the nation, which we haven’t written yet.

So, for indirect reasons the above explanation doesn’t sway my support. There are other [non-monetary] underlying diseases in our economic system that should be remedied. Let’s take our eyes off merely ameliorating the symptom – and search for an actual cure. The Fair Tax is still a viable candidate.

EDIT: I’m particularly non-plussed by the use of the word Novelty, at the end there. As though what we’ve got now isn’t a laughable 3-ring circus …

But isn’t this the argument for a flat tax rather than the FairTax? It’s not regressive, it’s not progressive. Just flat.

Could it be that if taxes went up on the middle class we might actually wake up to what is going on in society and there might be some change?

As the great Lady Thatcher noted, the problem with socialism is that eventually you run out of other people’s money. There is a limit to progressive taxation. The math on entitlement spending and the math on discretionary spending don’t add up. Either middle-class benefits will be cut, or middle-class taxes will go up, or both. It’s just a matter of time.

I am with Son of Spengler. Let’s quit worrying about taxes so much as how our Federal Government spends the revenue we already give them.

The Fair Tax would hurt the lower middle incomes (3rd quintile) the most.

These are the people that live pay check to pay check. The 2nd and 1st quintiles live government check to government check. Generally, retirees on SS make up the 2nd quintile, and people on welfare and disability make up the first quintile. People do transition through these quintiles due to life events, but mainly only these categories of people reside in those brackets long term.

What most people don’t realize is that the US has the most progressive tax system in the developed world. The European middle classes pay way more taxes than the American middle class.

I don’t know…I think people are pretty awake to the issues that affect them…they often just have ideas that don’t agree with yours. As to “change”…well…Obama promised and brought “change.” Change is only ever an instrument, and is value-neutral in itself.

I strongly suspect that if taxes on the middle class went up, we’d just see a further retrenching of the “squeezing” effect we’ve seen over the past decade or so. That doesn’t help anyone.

I completely agree with SOS but in this media climate I don’t see how you could possibly sell a plan that is “easier” on the rich to the American people. I’ll grant you that I’m in a deep blue state (California) but all that I hear is that the rich aren’t tax enough. (It’s usually expressed as their “fair share” though when I ask what that share would be I usually just get yelled at)

Yeah, it’s frustrating. I’ve managed to shock a couple people by pointing out the sheer incongruity between the tax revenues we get from the “rich” and the magnitude of the fiscal hole we have, but the basic “fairness” sentiment is quite strong. I’m not sure I blame them either, considering what lengths our culture goes to in order to rub everyone’s nose in all the luxury that’s out there. Ah well.

Well, and the politicians promising you benefits paid for by somebody else.

It’s always annoyed me that it is illegal in this country to buy votes with your own money, but perfectly legal to buy votes with other people’s money. Now we can add, it’s not fair to ask you to pay for the promises the politicians are offering you.

I also think focusing on taxes isn’t quite right. They’re a problem, but I think generally a symptom. I see spending and regulation as the disease.

The regulatory costs of the tax code rival the receipts of the income-tax generate themselves. Sure, we pay 1.8 trillion in income tax, but what about the cost of all the damn rules we have to follow? We can only estimate, but even low estimates put this in the trillions. Unlike taxes, which actually do something somewhere (even if we don’t necessarily like it), regulatory costs can’t be spent.

In addition to government spending big, we also have regulatory burdens forcing businesses to spend big. They are forced to pay these costs and either raise prices or lower wages to accomplish it.

Seems to me that the income tax rules and rates isn’t the major term, it’s a symptom. I see spending and regulation, which might fairly be called ‘forced spending’, are the pillars of our economic plight.

I don’t think anyone at or near retirement age would think of this tax as “fair.” After working for years to save some money out of what is left of take home pay, after the government took half of it in income tax, you can now look forward to paying 30% more tax on the very same money when you try to spend it. Great. Just great.

So the problem with a consumption tax is… that it only taxes consumption. And we’re going to declare it to be regressive by measuring how it treats

consumptionincome. Because when rich people plow a portion of their earnings back into stocks, bonds, and other job-creating investments instead of spending it on yachts or Paris Hilton’s cat… that investment needs to be taxed.By this logic, we also need to do away with:

I do think switching from an income based tax to consumption based tax just as the baby-boomers is retiring is punitive. I wouldn’t necessarily call it unfair, given their long history of voting for more spending and less taxes, but I do agree it places most of the burden on a single generation.

If we want a progressive consumption-based tax, I’ve always supported the idea of allowing people unlimited contributions to an IRA with no-penalty for early withdrawal. That way, we tax people on the income they consume each year.

This allows us to switch almost all the way to a consumption tax while maintaining the politically-popular (let’s not call it fair) progressivity in the tax system without hurting the boomers that saved up money in after-tax savings.

My understanding is that the Fair Tax proposal makes an effort to address this, by providing a check to everyone in an amount designed to cover basic spending. I’m sure it’s not a full solution — and again, I’m not advocating the Fair Tax — but it’s important not to exaggerate the burden that it would place on retirees. If you’re going to criticize the proposal, it’s important to acknowledge and engage its own efforts to address your concerns.

From what I read earlier in the thread, only up to level of poverty (though it’s not clear how consumption of owned housing would be taxed). So retiree that actually enough to fund a comfortable retirement (ie, not living in poverty) will still be paying consumption taxes on savings they already paid income taxes on.

Any full time switch to a consumption tax will always have this issue, which is why I prefer to do it through a simple add to the tax-deferal element of the IRA.

But poverty (for the purposes of these analyses) is defined by income level — and retirees who live off savings have very low incomes. I strongly suspect that the vast majority of retirees who were middle-income earners during their working years are included in the graphs above in the 2nd or maybe 3rd quintile. Maybe even the first.

Suggest folks look at New Zealand’s tax, like so many of their radical market reforms it was extraordinarily successful. They combined a 50% cut in income taxes with a 10%, uniform, across the board, no good excepted, VAT. It is basically self collecting and revenues from income taxes increased the first year, i.e. no growth effects just the magic of the combination. We could do the same. Frankly progressiveness is part of a political narrative, there is nothing magical about it and a lot wrong. Back of the envelop calculations tell me a 10% VAT and a 10% income tax, with corporate taxes paid by owners, not the abstraction of Inc. is sufficient to continue to overspend. Everyone must pay so they pay attention. Any candidate who says he’s going to reform the tax code is blowing smoke. A thing that can’t be understood, that is the accretion of a century of special deals, can’t be reformed, it can only be log rolled into a different shape. Not good enough. It must be tossed.

That was my understanding too, and that was why I rejected it. You really want to get the vast general public, not just the poor, into the habit of waiting for a government check? I think that would be corrosive. There is no practical way that I can see to have a consumption tax and maintain progressivity.

Aren’t they already? I would say 80% of the people I know are just “waiting for that refund”.

Looks like a very modest change in the tax burden to my eyes.

The change in % of total Federal (income?) taxes paid are approximately 1%, 5%, 7% and 6% for the first 4 quintiles.

What is Unfair is that under current law 20% of the people pay 85% of the Federal (income?) taxes and that the first 2 quintiles actually pay NEGATIVE Federal taxes. That is, overall, the Federal tax structure pays them.

Isn’t that precisely the concern? Retirees are dis-saving (they are spending more than they earn), so while they might be in first quartile with respect to income, they would show up in a higher quartile with respect to consumption.

And to address that concern, the Fair Tax sends a check. As I said, it may not be enough. But it’s a distortion to argue that retirees would be paying double taxes. They would only be paying double on their consumption to the extent it exceeds average consumption.

To clarify, not average consumption, poverty level consumption.

Yes — thank you, the point is well taken. Do you know how much consumption tends to vary? I’m under the impression that the distribution of consumption is much tighter than income.