Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Misery Index is at a 56-Year Low. It Needs to be Replaced.

The Misery Index is at a 56-Year Low. It Needs to be Replaced.

If you judge the US economy according to the 1970s-created Misery Index, times are pretty good. Inflation is low (thanks in part to low gas prices), unemployment is down (the Not-So-Great Recovery continues), therefore the Misery Index suggests an economy brimming with joy and contentment. And some other measures confirm that take. As the WSJ’s Josh Zumbrun notes in his piece on the index: “Economists may have caveats about the Misery Index; but consumers have fewer hang-ups. The Conference Board’s measure of Consumer Confidence and the University of Michigan’s Consumer Sentiment index in January reached the highest since 2007 and 2004, respectively.”

If you judge the US economy according to the 1970s-created Misery Index, times are pretty good. Inflation is low (thanks in part to low gas prices), unemployment is down (the Not-So-Great Recovery continues), therefore the Misery Index suggests an economy brimming with joy and contentment. And some other measures confirm that take. As the WSJ’s Josh Zumbrun notes in his piece on the index: “Economists may have caveats about the Misery Index; but consumers have fewer hang-ups. The Conference Board’s measure of Consumer Confidence and the University of Michigan’s Consumer Sentiment index in January reached the highest since 2007 and 2004, respectively.”

A few points here:

First, among those caveats that Zumbrun mentions is that the official jobless rate may be giving a misleading picture of labor market health. While the 5.7% U-3 rate is just 1.3 percentage points above its pre-recession low, the broader U-6 unemployment-underemployment rate is 3.4 points above its pre-recession nadir. What’s more, the employment rate — the share of non-jailed, non-military adults with any job — is still way closer to its recession low than its pre-recession high. And while job creation is up, wage growth has been pretty stagnant.

Second, cheaper gasoline has brought down the inflation rate. Great. But prices weren’t rising very fast even before the oil price plunge, and that was probably a holdover of the Great Recession’s adverse shock to demand. Low inflation isn’t always a good thing.

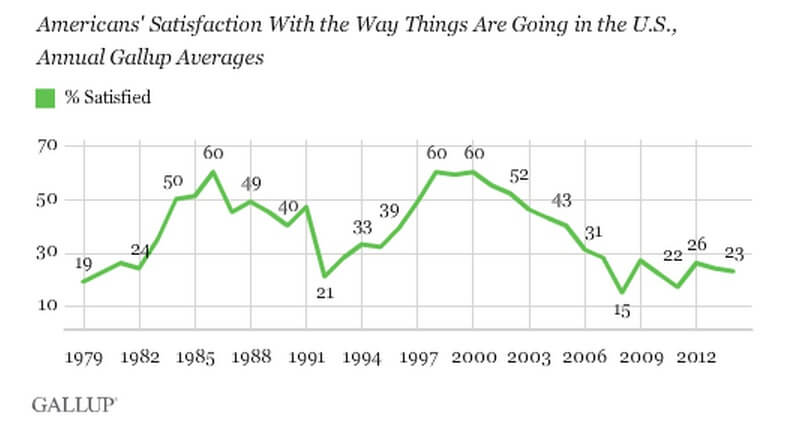

Third, while consumer confidence numbers are up, the higher savings rate may suggest a lack of confidence in the recovery. More from the WSJ: “Americans are taking the money they are saving at the gas pump and socking it away, a sign of consumers’ persistent caution even when presented with an unexpected windfall.” That attitude seems more in line with this gloomy chart:

Fourth, so what might a new-and-improved Misery Index be and show? Well, how about combining the 11.3% U-6 rate with about a 3% college tuition inflation rate, of great concern to many American families. That would give us a 14.3% New Misery Index, comparable to what we saw in the 1970s. Yes, I know it’s not perfectly comparable, but that may give a better rough sense of modern American economic well being than that of the old Misery Index

Fourth, so what might a new-and-improved Misery Index be and show? Well, how about combining the 11.3% U-6 rate with about a 3% college tuition inflation rate, of great concern to many American families. That would give us a 14.3% New Misery Index, comparable to what we saw in the 1970s. Yes, I know it’s not perfectly comparable, but that may give a better rough sense of modern American economic well being than that of the old Misery Index

JP – if we measured the components right the misery index would work fine. Which, I suppose, gets to your point of finding different measures like U6 and college tuition.

How about we add increases in health insurance (my premiums went up 20%) and labor force nonparticipation rate (I think around 37%). That gives a cheery misery index of 57. This may be a bit of an exaggeration, but would be a step up from the sunshine and unicorns we use now

It shouldn’t be that hard to recreate the misery index using the labour participation rate rather then the unemployment rate.

Make it happen, Jimmy P.!

;-)

Misthiocracy – I don’t want to embarrass you but you spelled labor wrong. I’ve also noticed that you spell flavor, color, and humor wrong

So…we don’t like what this index shows, because it takes away our talking points…so….lets get rid of it!

Great. I guess, you just can’t accept the fact that the economy is recovering. I guess that’s a good thing only when a Republican president is in power, not when the other party is.

So we’re back to…scoring cheap political points, not doing an actual analysis of what’s going on

How about we combine the tidal wave index with the position of Jupiter and the median wage of welders?

Why not? These have about as much meaning, and as much in common, as U-6 and college tuition.

As for college tuition: let me get this straight. We want…lower prices on college…but we want…fewer people to go to college (because we don’t like college, cause!)…while we want them to…raise tuition in Wisconsin.

You realize all three are contradictory policies?

And of course, you’re ignoring what the…actual…price of tuition ought to be. Tuition ought to be a lot higher, but it is being subsidized by state funding, making tuition lower for students, which leads to much higher enrollment rates.

What you really meant to say is…how can we transfer more money to the “middle class” so we can buy votes from them. I.e., “reform conservatism” in one sentence.

James,

What you suggest would involve an integrity that the current politics simply does not support. I am a older than you and can remember a time when this level of distortion was not in play. That’s quite a while ago by now. Men like Milton Friedman roamed the University. They were in the minority but were respected. Nobody thought that you could just get by with smoke and mirrors.

I hope that some level of common sense returns to our political climate. If we simply define away the problems, as this administration is so completely bound to do, we will never make any real progress.

Regards,

Jim

AIG: You’ve gone and read about supply-demand curves but missed half the lesson. Yes, if the price goes up the demand goes down. You got that part. But if there’s a secular drop in demand, the price goes down. And that’s what I think “we” (broadly speaking) would like to see. It’s not that college is bad, but that it is bad that a college degree is required for entrance to a middle-class lifestyle.* This seems silly, and it didn’t used to be this way. Cut the demand for college and the tuition will drop (or at least its rate of increase will slow).

* And a host of other ills, such as the fact that people are willing to pay a lot for a degree that is unlikely to earn them much. Part of the reason for that is insane student-loan policy, but that can be a discussion for another day.

Except that none of this is true.

I.e., any way you slice the data, a college degree is associated with higher returns. And higher levels of college degrees, are associated with even higher levels of return.

So what’s the justification for being against college?

Purely political.

The “it used to be” argument is irrelevant. It used to be that being able to read in the 8th Century AD provided with you with a higher income than those not being able to read.

As everyone become able to read, the marginal benefits of being able to read were eliminated. Hence, greater levels of knowledge and specialization were required to provide you with a higher level of return.

It used to be...that in the times when a HS degree was sufficient to provide you with a “middle class lifestyle”…we didn’t have computers, the internet, high tech industries etc etc.

So if you want a return to the…”good old days”…then you better be prepared for a return to the “good old days” ;)

…the “good old days” of much higher poverty, and far fewer “rich people”.

Capitalism is by definition an economic system which rewards specialization. Specialization in a high-tech world implies greater levels of education, in order to become specialized. Specialization is what created the modern world, and what rendered those people without the ability to specialize, or who specialized in the wrong skills…redundant.

What all of this “anti-college” rhetoric misses…by 15 miles…is the fact that this is all market-driven.

Saying “why do employers require a college degree” is about as meaningful as saying “why do employers require a HS degree”? Or “why do employers require the ability to read?” That’s not fair!

But that’s the reality. Employers are saying…we want higher levels of knowledge and specialization, and will reward for it.

The why is self-evident: employers compete on human capital, and compete…for…human capital.

Why does Space-X or Google or Apple or Microsoft or McKinsey only hire from top university programs in the country? Because that’s what they have figured will provide them with a higher chance of grabbing the higher quality talent.

Ignoring this fact…is the equivalent of implicitly arguing that all employers are stupid.

Not much of an argument to argue that all employers are stupid, and that you’ve discovered this new thing…that they should just hire HS graduates because that’s good enough, because it was good enough for grandpa, then it’s good enough for me.

We don’t live in the same world as grandpa. We live in a world where competition is much higher, where high-tech dominates, where innovation matters…and where the overall level of education in society is much higher to the point of resulting in diminishing returns on lower levels of education.

Just as reading no longer provides you with a competitive advantage, neither does a HS degree do so anymore. Neither will a BS in 20 years time.

If you want to go back to the time when a HS degree was sufficient, then you better be prepared for an economy where a HS degree is sufficient. That’s not an economy you’re going to like.

I think that issue with today’s economy is that it all that bad, it is just that it seems sluggish. Basically, the economy is growing and people have jobs, but all just seems sluggish as compared to the mid 2000’s let alone the late 90’s.

Employment churn is down, business churn is down, but unemployment is down and profits are up. It seems nowadays that there is no point in taking risks to try to get ahead. You are better off staying at the same job, living in the same house, and saving conservatively for retirement than quitting your job to start a new business, selling your house and moving to Colorado for that new job, or investing in that vacation property.

AIG,

I think a lot of the anti-college sentiment comes from the idea that a HS graduate from 40 years ago was better educated than a person with an Associates Degree from a community college is today.

The secondary education system in the US is pretty worthless. The majority of students that enter college now have to take one or more remedial courses before they can take college courses that actually go toward a degree.

AIG – Good data and strong verbal jousting in your retort but in the end it is a thoroughly incomplete and unsatisfying analysis. You don’t address the signaling effects of college that could be achieved in a much more cost effective manner. Doesn’t address the dearth of candidates for skilled trade jobs such as a tool and die maker that require no college degree. Doesn’t address other reasons why college tuition costs have increased so significantly…much of which has virtually nothing to do with teaching “skills” that increase one’s earning power. I would have to grade this analysis as Incomplete.

None of any of that justifies the annual increase in tuition prices that are 3x historical inflation rates. Also note that your salary data does not capture the most recent graduate cohorts, whose incomes do not correlate with the historical data.

We subsidize colleges. What happens when you subsidize something? You get a lot more of it. So, we get expanding college enrollments, lots more college graduates, but that does not mean anything, not a thing, about what jobs are available for the graduates once they’re out of the ivy.

By slapping record levels of debt on all graduates, I imagine that an updated Misery Index would reflect some of that misery incurred by doing 4-5 years at the U (at Dannemora Regional Correctional Facility, they call that a “nickel”) and coming out into a job market that, at least in the last half-decade or so, is going to take most graduates on a rough ride.

Then…let’s not single out college. U6 hasn’t been tampered with yet, and total indebtedness could be measured in a number of ways, not the least of which is credit ratings. These last are a good index of lender confidence, and so far there’s been no Community Reinvestment Act to mess with them.