Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Loosening Home Lending Standards — What Could Go Wrong?

Loosening Home Lending Standards — What Could Go Wrong?

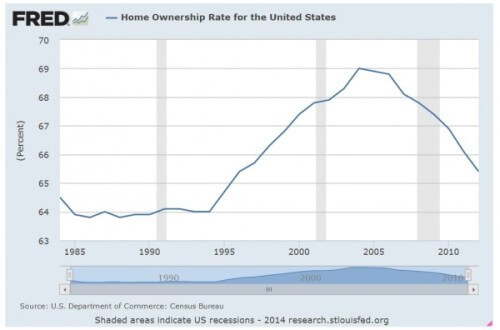

After a near-depression and worst-ever financial crisis that cost the US economy as much as $14 trillion, one might think Washington would be careful to avoid repeating the same policy mistakes. One might think, for instance, Washington would think twice and then thrice before loosening mortgage lending standards to boost home ownership, particularly among low-income borrowers. Because, you know, loosened mortgage standards seem to have played some role in helping set the stage for the catastrophic mortgage meltdown.

After a near-depression and worst-ever financial crisis that cost the US economy as much as $14 trillion, one might think Washington would be careful to avoid repeating the same policy mistakes. One might think, for instance, Washington would think twice and then thrice before loosening mortgage lending standards to boost home ownership, particularly among low-income borrowers. Because, you know, loosened mortgage standards seem to have played some role in helping set the stage for the catastrophic mortgage meltdown.

Recall three conclusions from the National Commission on the Causes of the Financial and Economic Crisis in the United States:

1.) From the majority report: “We conclude collapsing mortgage-lending standards and the mortgage securitization pipeline lit and spread the flame of contagion and crisis.”

2.) From one of two dissenting reports: “The causes of the mortgage bubble and its relationship to the housing bubble are also still poorly understood. Important factors include weak disclosure standards and underwriting rules for bank and nonbank mortgage lenders alike, the way in which mortgage brokers were compensated, borrowers who bought too much house and didn’t understand or ignored the terms of their mortgages, and elected officials who over years piled on layer upon layer of government housing subsidies.”

3.) From the other dissenting report by AEI’s Peter Wallison: ” … I believe that the sine qua non of the financial crisis was U.S. government housing policy … which sought to increase home ownership in the United States through an intensive effort to reduce mortgage underwriting standards.”

So surely government regulators would avoid taking any action to reduce lending standards again, right? Better safe than maybe $14 trillion in the hole, right? Not so much. From the Wall Street Journal story “In Reversal, Administration and Fannie, Freddie Regulator Push to Make More Credit Available to Boost Housing Recovery”:

The Obama administration and federal regulators are reversing course on some of the biggest postcrisis efforts to tighten mortgage-lending standards amid concern they could snuff out the fledgling housing rebound and dent the economic recovery. On Tuesday, Mel Watt, the newly installed overseer of Fannie Mae and Freddie Mac, said the mortgage giants should direct their focus toward making more credit available to homeowners, a U-turn from previous directives to pull back from the mortgage market.

And who have been the folks crying about those tightening standards, such as forcing borrowers to put 20% down if the bank didn’t retain at least 5% of the loan before it was sold to investors. The usual suspects, (via the WSJ):

The March 2011 proposal triggered a huge outcry from lawmakers, affordable-housing groups and the real-estate industry, all of whom said it would put the brakes on homeownership for millions of credit-worthy borrowers, particularly first-time buyers and minorities.

Here is AEI’s Ed Pinto:

This is ‘deja vu all over again.’ It will put into motion policies which will fuel another housing boom—in the effort to put families with limited resources and poor credit histories into highly leveraged loans. This policy has been a failure since it began around 1960. It places low income borrowers with a high degree of income volatility into loans with the greatest amount and varieties of leverage so as to enable them to buy homes in neighborhoods with the highest levels of house price volatility.

My take: This is one party cronyism and one part the left-wing again trying to stream the welfare state through the housing market via government subsidized and enabled mortgage credit, what social scientist Monica Prasad has termed “mortgage Keynesianism.” This may not be the worst economic policy Team Obama has dreamed up, but it’s sure hard to think of one as bad.

Published in General

Those who will not learn from history are adamant that the rest of us experience it all again.

Who didn’t see this coming? The attempts under way in Congress to “reform” Fannie and Freddie have been little more than a sick joke.

Hell, the fact that Fannie and Freddie were not immediately wound down following the financial crisis showed pretty clearly no one was particularly interested in learning from failure. Leaving the machinery in place all but guaranteed this result.

Anybody out there read Steve Sailer? He’s written a lot of excellent stuff on this issue, showing how the housing bubble was the result of ethnic politics in California and Florida in particular.

Has he predicted they would do it all again?

I remember during the early part of the crisis – various groups were protesting Wells Fargo acquiring Wachovia because wells fargo hadn’t made enough bad loans.

As someone else has already noted, this is Housing Bubble 2.0. The lower end of the market isn’t seeing anywhere near the mortgage origination rates as the higher end of the market, so how to fix this? More cowbell.

If at first you don’t succeed, throw more gasoline on the fire.

Democrats are incapable of learning anything, because they already know it all.

Just out of curiosity, what morons are going to buy these bundled mortgages this time?

Last time they had the excuse of not knowing. This time not so much. Let me guess. This time the Feds will be the ones buying up all this trash paper directly, thus avoiding a middleman like the last catastrophe….