Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Has Congress Gone Deaf on Deficits?

Has Congress Gone Deaf on Deficits?

In Applied Economics, one of his many great books, economist Dr. Thomas Sowell explains the incentives politicians face when making decisions:

In Applied Economics, one of his many great books, economist Dr. Thomas Sowell explains the incentives politicians face when making decisions:

Elected officials’ top priority is usually getting re-elected, and their time horizon seldom extends beyond the next election. Laws and policies that will produce politically beneficial effects before the next election are usually preferred to policies that will produce even better results some time after the next election.

There is no better model for this than government spending. Politicians love to spend lots of money because it’s the easiest way to make it look like you’re trying to solve real problems. Politicians especially love to spend borrowed money because they can stick future taxpayers, and not current voters, with the bill. When Congress returns from this year’s August recess, it appears we’ll be seeing this irresponsible behavior on full display.

To note, government funding for the current fiscal year is set to expire in October, which means Congress must approve new rounds of spending in order to keep the government open. Some politicians, with guilty parties on both sides of the aisle, are now calling for increases in spending next year above the spending caps that were put in place back in 2013. President Obama himself has said he will veto any legislation that does not increase both domestic spending and defense spending.

In a perfect world, government spending should increase periodically to account for economic issues like growth and inflation, as well as isolated events such as wars or natural disasters. However, the blanket increases being called for next year are nothing short of completely reckless and ignorant towards our current budget situation.

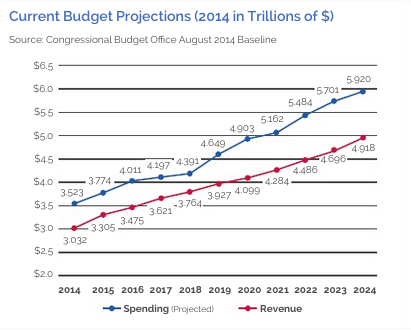

The big spenders in DC are being spurred on by reports that the deficit, the annual measure of how much more goes out via spending than comes in via taxes, has fallen to its lowest level in real and nominal terms since 2007. While this is certainly good news, there are three important things to remember: 1. The federal government is still running a deficit, which means the budget is not balanced. 2. The falling deficit is in part a result of the spending caps that Congress and President Obama may be looking to scrap. 3. The deficit is projected to increase even with these spending caps still in place.

The current deficit for 2015 is projected at $426 billion. Compared to the $1.4 trillion deficit in 2009, that is certainly a very large improvement, but it shouldn’t be considered a finish line. That is still an enormous amount of money being borrowed that must ultimately be paid back some day. Further, that $426 billion will grow because of the associated interest on that debt. Current interest payments on the accumulated national debt of over $18 trillion are projected to be roughly $230 billion for 2015 alone. All we’re doing is adding to the accumulated national debt of $18 trillion to the tune of nearly half-a-trillion a year, which is still a major failure of fiscal policy.

Apologists for this recklessness claim that government spending has the ability to spur sustainable economic growth and that investments made today are worth the cost for the benefits they’ll provide tomorrow. The problem with that logic is reality itself. Government spending is notoriously wasteful and is too often directed towards endeavors that do not generate wealth or value. As the old saying goes, you never spend someone else’s money as wisely as your own. Is there anything else politicians really do other than this?

There are endless examples of poor government investments, from the Solyndra debacle to the extravagant spending by agencies like the General Services Administration. They were the agency famous for hosting lavish employee conferences in Las Vegas forever personified by this guy:

The GOP needs to accept some of the blame for poor government investments as well. Republicans in Congress tend to vehemently defend every penny of defense spending. While a strong national defense is one of the few things our federal government now provides that is actually enumerated in the Constitution, there is plenty of room for reform at the Pentagon. Quite frighteningly, it is becoming abundantly clear that the F-35 Joint Strike Fighter, the product of a $1 trillion-plus program and arguably the most expensive single weapon in human history, is an ineffective and all around terrible aircraft.

Finally, and perhaps most in keeping with Dr. Sowell’s warning, current deficit projections are downright dismal. By 2025, as in less than 10 years from now, deficits will surpass $1 trillion annually under current law. Let’s add emphasis to that under current law part as prominent members of Congress and President Obama are now suggesting we actually increase spending from a position where we’ll already be adding at least a trillion dollars in new debt each year within the decade.

There are undoubtedly important roles for government to play in our society and these things have to be financed. That being said, continuing to play fast and loose with the nation’s finances is unacceptable. Further, the excuses for higher spending surrounding our “lower” deficit are downright pathetic and emblematic of the worst of Washington.

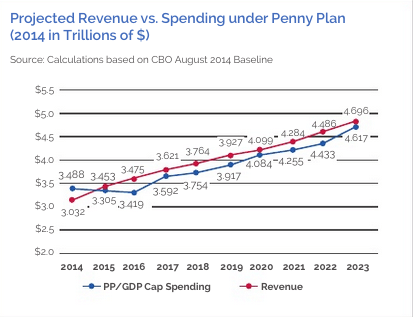

Government spending should be pegged to the size of our economy at a level that would produce consistent surpluses and be in line with historical spending averages. This would be somewhere around 18 percent of GDP. A proposal called the “Penny Plan” would include such a measure and balance the budget within two years.

If we implement this policy, nothing stops Congress from spending more money; they’ll just need to make sure the private sector is growing as well. Our best and brightest elected officials would quickly figure out the best way to do that is to simply get out of the way.

Published in Economics

I find it amusing that the so-called lowest deficit in almost a decade is equal to President Bush’s largest deficit. Obama spent $1 trillion on a stimulus that raised the deficit to $1.4 trillion and now brags that he has reduced that deficit back to where it was and it only took him six years to do it. What a freaking genius.

‘Not convinced. Congress can do this now, but they won’t. If implemented, there will likely be more than 1% worth of loopholes. Or more likely, 3% worth of loopholes so the debt increases faster.

——

I think the real problem is that there’s no incentive to spend less. It’s like, “Whee! Government funding! Whee! No limits! Whee! Let’s happy dance!”

So incentives are needed.

One powerful incentive would be for each federal program to be audited, tallying the value of all of its costs and benefits. Make it the responsibility of each program to convince the American people that this is money well spent. If they can’t, it would be that much easier to give those programs the axe.

Another powerful incentive is to adopt a rule that members of congress cannot run for reelection if the budget is not balanced. This would encourage efficient use of funds and at the same time allow funds to be spent in times of emergencies, but at a focused political cost. And it would cycle in new members of congress who would be more prone to thriftynesss.

Yes, essentially he lit the house on fire and expects us to be happy he brought over a garden hose the next day.

Also quite amusingly, if we can ignore how depressing it is, is the fact that the president is taking credit for the product of spending restraints which he fought tooth and nail against.

Has Congress gone deaf on deficits? When were they paying attention to them.

The late 90’s were primarily a fed induced anomaly.

Thanks for bringing up what for me is the #1 issue. The problem is that it will be very difficult to do anything about spending and budget deficits without taking on entitlements. The defense budget used to be the 1000 pound Gorilla, but now it is a small part, <18%, of entire budget. Entitlements have to be reformed immediately.

I’m all for giving such programs the axe.

This is actually a great idea, and I wish it could somehow be put into effect. It’s very much like an old Jackie Mason joke about how if you want the Congress to run the country at a profit you have to put them on commission.

Agree with the gist. With more baby boomers retiring in the next 20 years, the deficit is going to rise quickly. Raising the retirement age to 70 for Social Security and Medicare is pretty much inevitable and would help a lot.

Only silver lining is we are now paying a very low interest rate on the debt, only about 1.3%. At least, they didn’t screw up this part when rates collapsed.

The problem with the Penny Plan is that since the sequester caps were implemented for the discretionary side of the budget we have been implementing the Penny Plan. Entitlements are the only real driver current driver of our deficits. There is definitely wasteful spending throughout government, but it all amounts to a hill of beans next to the deficits in Social Security and Medicare. Social Security has been running a deficit since about 2008, and the so-called Medicare savings from Obamacare never materialized.

One thing we have going for us is that we seem to be entering a deflationary period with lower commodity prices (namely oil). This means that the Fed will be free to keep loose monetary policy, which means continued low and very low interest rates.

The national debt never needs to be payed back. It just needs refinancing.

Nobody cares, The wall is more important

I wonder if that’s necessarily true. If the bond buying public loses faith in our ability to service the debt as it goes from $18 trillion to, say, $40 trillion under the next two Democratic administrations (if Hillary beats Trump and Chuck Schumer becomes majority leader) and the interest rate goes up from zero to rates seen in the Carter years, then what happens? Who will buy the govt bonds then?

And even if they can be sold, after debt service will there be any money left in the federal treasury to pay for entitlements, the military, or free community college?

The best thing about more government spending is it buys more government employees to vote Democrat and conduct partisan operations, and it funds more programs to make people dependent on the government and vote Democratic. Of course, it also helps a few Republicans keep their jobs for a while, too.

Rejoice, Rejoice, O Victory!

Congress: We tax your children and pass the savings on to you!

Dittos, Reticulator, Dittos.

Frivolous idea: Different tax rates for government income and private income.

(I fully understand that doesn’t have a chance of getting through.)

I think we should discuss applying the concept to student loans. Even if it doesn’t get passed, it’s good for them to know we’re thinking about them.

Here’s an even more frivolous idea: Declare that the student loan program, if it is truly worthwhile, should pay for itself. Which would mean that borrowers ought to be responsible, to some degree, and thus pay for, the cost of others’ defaults.

(Maybe it’s not such a frivolous idea; it’s an elegant example of Socialism. Talk about running out of other people’s money…)

The overall effect would be to scare away new borrowers, and thus return to private funding of student loans.

Debt needs to be retired, in terms of it being paid back – and yes, that debt needs to be paid back. Else you won’t find anyone buying a T-bill again, ever.

Essentially they’re issuing new debt at a rate that far exceeds the retirement of existing debt, which is why it goes up every year. And what you’re missing, too, are the interest payments as a percentage of the federal budget, currently 6% of the federal budget in 2015. In 2020, it’s 11% – doubled in 5 years.

Following those projections, it’s easy to see that debt service alone – forget paying back the principal piece – will gobble up a bigger percentage of the budget every year. If the interest rates go up – ZIRP be damned – it’ll gobble it up faster.

I checked the Constitution and guess what? The President can’t make a budget, be it balanced or otherwise. Only Congress can. In fact, all spending bills must originate in the House. There’s no such thing as a “Bush deficit” or an “Obama deficit.” This is a rhetorical slight of hand that only perpetuates the problem, which is a lack of accountability. Every single one is a “Congressional deficit.” Congressmen and Senators love it when voters think there’s nothing they can do to fix a problem, but that instead the fault lies elsewhere. As long as we perpetuate the notion that somehow Presidents alone control Federal deficits and our national debt we will never fix this problem.

Mostly true, but don’t forget the president’s veto power. Without 2/3 majorities in both houses the president can force either a budget on terms he likes reasonably well, or force the government to run on continuing resolutions that tend to be inefficient in the extreme.

Who owns the budget has also become a bit of a joke – given the entitlement slice of the pie, the discretionary spending piece gets smaller every year. And it becomes the President’s budget when he or she or Biden control the actual spend going on (DoD, etc).

Put a better way: The process is built such that ownership and absolution are both available to Congress and a President regarding budget responsibility. Bill Clinton’s budget, all 8 of them, called for deficits, yet due to unanticipated receipts the USG went into the black in (I think) six of the 8 years.

Then Clinton ran out and took credit for “balancing” the budget. Laughable. But expected.