Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

A Fascinating Little Controversy Proving Liberal Madness

A Fascinating Little Controversy Proving Liberal Madness

Did you ever wonder why, if the country is so much richer than it was when our parents were raising us, our generation seems to have to strain harder to make ends meet? A fascinating back-and-forth over the last couple of days has addressed the question–and caused a little dust to fly.

In the current issue of Weekly Standard, Chris Caldwell discusses Harvard Law prof Elizabeth Warren, whom President Obama named to oversee the formation of the new Consumer Financial Protection Bureau. The Bureau is a lousy idea, and Warren proved ham-fisted in defending it before Congress, so now she’s headed back to Massachusetts, where she may run against Scott Brown for the Senate. But put all that to one side. Chris read her 2003 book, The Two-Income Trap: Why Middle-Class Parents Are Going Broke, pronounced it a “brilliant and counterintuitive work of pop economics,” calling Warren herself “the most misunderstood woman in Washington.”

Chris’s summary of Warren’s findings:

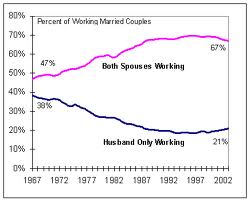

People were going bankrupt at an alarming rate….. Why this was so had nothing to do with consumerism. Parents spent 32 percent less on clothing, and 52 percent less on appliances. What they spent more on was big necessities: mortgages (up 76 percent), cars (up 52 percent), taxes (up 25 percent), and health insurance (up 74 percent). And the reason for all but the last of these was the entry of women into the workplace. Working mothers “ratcheted up the price of a middle-class life for everyone, including families that wanted to keep Mom at home,” Warren wrote. As a result, she showed, two-income families have less disposable income than one-income families did in the old days. What is more, today’s families are deprived of a safety net—a spare worker—of the sort her own family was able to lean on when she was a child. If anything goes seriously wrong in your average two-earner family today, they are in grave financial jeopardy.

Writing over at the Volokh Conspiracy, Todd Zywicki, a law professor at George Mason, has responded–and note that the emphases are his:

Here’s the key problem in Caldwell’s argument: note his list of increased expenses for household “big necessities: mortgages (up 76 percent), cars (up 52 percent), taxes (up 25 percent), and health insurance (up 74 percent).” The problem is that while it is an accurate representation for mortgages, cars, and health insurance, that the expenses increase by that percentage, it is not for taxes. For the other expenses it is the percentage increase in dollars spent on those expenses. For taxes, however, the 25% increase is actually the percentage increase in the percentage of income spent on taxes. So the 25% is not how many more dollars go to paying taxes, it represents the household’s change from paying 24% of its income in taxes to 33% of its income in taxes–a change of 25% in the percentage of income dedicated to taxes, not a change of 25% in spending on taxes….

What this means is that once taxes are converted to an apples-to-apples comparison–percentage change in dollars instead of percentage change in percentage–household spending on taxes actually increased 140%, not 25%….

In fact, based on their data once the math is done the real conclusions of Warren and Tyagi [Warren’s co-author] are inescapable and in fact (as Caldwell will be pleased to know) extremely conservative: the financial problems of the middle class are caused by an astonishing rise in the tax burden on middle class families over the past three decades. Nowhere, however, will one read Professor Warren advocating income and property tax cuts as the obvious policy implication of their book–although that is unambiguously the logical inference.

To summarize the results of this little controversy:

Why are we straining to make ends meet? Because taxes are killing us. The liberals know that–as Todd shows, as prominent a liberal as Elizabeth Warren has run the numbers herself. The liberal solution? More government.

Really, this must end. It just must.

Published in General

We simply cannot afford the amount of government we have, yet many have been led to believe that we cannot afford to live without it. In boot camp I learned what I was physically capable of when I had no other choice. Perhaps the only solution for the nation is to come to a point where we have no other choice but to live without the levels of government we’ve become convinced are necessary. The scary part is what it will take to put us in that situation.

I stumbled on to Elizabeth Warren while searching YouTube vids a few years ago – this is a nearly one hour talk by her entitled “The Coming Collapse of the Middle Class”. I recommend skipping the intro and pleasantries and getting right into it.

http://tinyurl.com/3o6evda

I believe this is from 2007. After watching this, I sold a lot of my stocks, as this combined with other factors made me worry tremendously about what was on the horizon.

She also makes the point that part of the real estate escalation was due to people “buying schools for their children” – ie buying in a certain neighborhood to facilitate enrollment.

It isn’t all taxes, of course, just as with the country, it is spending and unwillingness to defer gratification.

For example, Caldwell points out some very real abuses in the world of credit card banks- but those $35 charges are not issues unless you run up meaningful credit card debt, that is, carry interest-bearing balances month to month by buying what you cannot afford. We did that for 3 months in 1979, and then paid off the bill and determined to never again use a credit card for credit, rather than paying the entire bill at the end of the month.

And compare the sizes of houses over the relevant time periods. Some locales such as, say, Palo Alto or Boston, are ridiculous- but the rest of the country also doubled its average home square footage, while costs were also boosted by Warren-like/approved land use regulation. One “happy hour” can wipe out the rent money if indulged by an undisciplined person. Cars, ATVs, boats, iPhones, electronics……

Whose fault? Our own. We are the spenders.

Chris Caldwell has been growing more and more Europeanized over the last year. I am fearing another Chris Buckley/Rod Dreher apostasy.

I am afraid that is where we are headed. In fact, a certain portion of the GOP freshman House members seem to believe that it is inevitable and thus we are better off taking our medicine now. There is a part of me that agrees with that, though I suspect the consequences will be quite tragic, especially for the “middle class”.

Deleted- double post, probably caused by two concurrent posts.

E.L.,

I thought that was especially insightful too: For couples with children, the increased cost of hosing comes from an effort to “buy” good schools. Childless couples can afford to buy a nice house next to the crummy school, but concerned parents have fewer choices, and more competition for housing in good school districts.

All this deterioration of the middle class points more and more to a leftward lurch:

1) Education – I grew up in a heavily working-class Italian immigrant town in NJ. Our school was very good in 1970’s most of my friends and I received a great education and went on to college and excellent, rewarding careers. Not the case anymore. Schools now don’t teach the fundamentals and are way more expensive. I don’t agree that the schools are actually any better in these more upscale areas where people “buy in”. Where I live in NJ is one of the wealthiest counties in the US and my kids attend a blue ribbon school district, yet almost everyone I know sends their kids to private tutors for extra help (they can afford it). The school district is a direct beneficiary of the actions and fianancial abilities of this community. The kids who don’t have the wealthy parents and can’t afford the remedial help do no better than the kids 2 towns over who attend the “lower performing school”

2) Health insurance and medical costs have skyrocketed because gov’t intervention in these areas has skewed (continued)

(continued) the market for everything from hospice care to doctor visitations. Add in the increase of malpractice insurance over this time and the system becomes rigged!

3) College costs – we now live in a high-tech society. No one can, or wants to, change that. College costs have soared mainly due to government subsidies (thanks to Peter and his recent excellent UK).

I won’t go on, but you get the point. Bigger, more intrusive gov’t has sown the seeds for this demise. How about school vouchers so parents don’t have to compete for schools. How about get the government out of health care and tort reform so medical costs can decrease. Stop subsidizing college education so that costs are corrected by the market. Not to mention that all these things that have actually hurt so much have greatly increased tax burdens on the middle class – talk about not getting your money’s worth!!

“Working mothers “ratcheted up the price of a middle-class life for everyone””

I’ve seen this assertion frequently of late. Economically, it could only be true if these working women are getting paid for doing work of no economic value….otherwise, the additional goods & services getting product would more than balance their salaries.

I’ve seen this assertion frequently of late. Economically, it could only be true if these working women are getting paid for doing work of no economic value….otherwise, the additional goods & services getting product would more than balance their salaries. ·Jul 28 at 1:24pm

I think that we are seeing the consequences of liberal ideology in every facet of our society and culture. The book points to one completely unrelated variable and pins the cause of this crises on it while not connecting the huge dots staring her right in the face.

Especially for the two-earner family, it is instructive to look at another aspect of education. That represents a frightening cost of just maintaining normalcy, along with the tax considerations. Full professors were earning around $45 K when I was in grad school in the early 1980s. The average is now close to triple that. For the rest of us, salaries and benefits have not tripled, within the same discipline, at the same level.

For most two-earner families, sending your kids to college is not a luxury expense, but a budget line item. That expense has increased by over 70% in every decade, since the 1980s.

As to health care costs, just look at what happened since 1986, after the passage of EMTLA, when we turned our emergency rooms into Medicaid’s Primary Care facilities. That’s where you will find your jump, then continual rise.

This may not be true, but it seemed to me that about the time women starting working full-time, the price of houses doubled.

So did the home size, which doubled.

That’s why this “the world has gone completely off the rails” stuff, while all too often true, has to be looked at very carefully in each context.

Compare your 1970 Plymouth Valiant- or whatever- with the 2010 Nissan Sentra. One needed a ring job after 70,000 miles and got 18 MPG, the other goes 200,000 at 30 MPG. This is not apples-to-apples. Same for medical care, even though change is desperately needed in that market.

Her analysis compares 1970-2006. Can someone help me here? Was there any big change in healthcare insurance or providers that started sometime just before 1970 that completely changed the market for these services 36 years later? Maybe some big entitlement program(s)? Maybe these changes might have also caused an uptick in taxes? Can’t seem to put my finger on it.

I thought that was especially insightful too: For couples with children, the increased cost of hosing comes from an effort to “buy” good schools. Childless couples can afford to buy a nice house next to the crummy school, but concerned parents have fewer choices, and more competition for housing in good school districts. ·Jul 28 at 11:56am

Edited on Jul 28 at 11:58 am

Poorer parents who cannot afford to buy in these districts, and who, it can be argued need a good school most, are trapped.

Also a quick comment on vehicles – her comment was that a second car was required because both householders were working – so it’s more than the price of an automobile that’s changed over time.

Professor Zywicki’s analysis of Warren’s numbers highlights an a problem with statistics and the way they are used today. When I encounter this type argument I give myself 2 choices. Spend a lot of time analyzing them or ignore the argument. I more often chose the latter.

The increasing reliability of cars should be reflected in a need to replace them less frequently and to repair them less often, and hence drives cost reductions offsetting increases in the price of those cars. This is not true for larger houses: they are not a quality improvement that saves money, but rather a form of consumption that indeed drives other expenses, such as higher air conditioning and heating bills.