Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Want to Prevent a Debt Crisis? Here’s What Real-World, Center-Right Reform Looks Like.

Want to Prevent a Debt Crisis? Here’s What Real-World, Center-Right Reform Looks Like.

Democrats have big spending plans. Republicans have big tax cut plans. Debt and deficits? No one much talks about those things any more, apparently. But they should. Sure, as Wall Street Journal reporter Nick Timiraos notes, the “U.S. budget deficit ended last year at its lowest level since 2007, marking the sixth straight annual drop.” The federal budget gap deficit ended 2015 at $478 billion, or around 2.6% of GDP. Timiraos explains why we no longer have the trillion dollar deficits of the Great Recession years:

Democrats have big spending plans. Republicans have big tax cut plans. Debt and deficits? No one much talks about those things any more, apparently. But they should. Sure, as Wall Street Journal reporter Nick Timiraos notes, the “U.S. budget deficit ended last year at its lowest level since 2007, marking the sixth straight annual drop.” The federal budget gap deficit ended 2015 at $478 billion, or around 2.6% of GDP. Timiraos explains why we no longer have the trillion dollar deficits of the Great Recession years:

After the financial crisis, the U.S. government in 2009 ran deficits not seen since World War II as revenues fell sharply and stimulus flowed. Deficits began to recede in 2010 as the stimulus faded and revenues stabilized. Congress cut spending further after Republicans took control of the House in 2011. Government spending started to rise two years ago, but deficits continued falling because of strong receipts to the Treasury, in part from tax increases that took effect in 2013. Outlays last year rose 5%, roughly the same pace as the year before. Revenues were up 6%, versus a 10% gain in 2014.

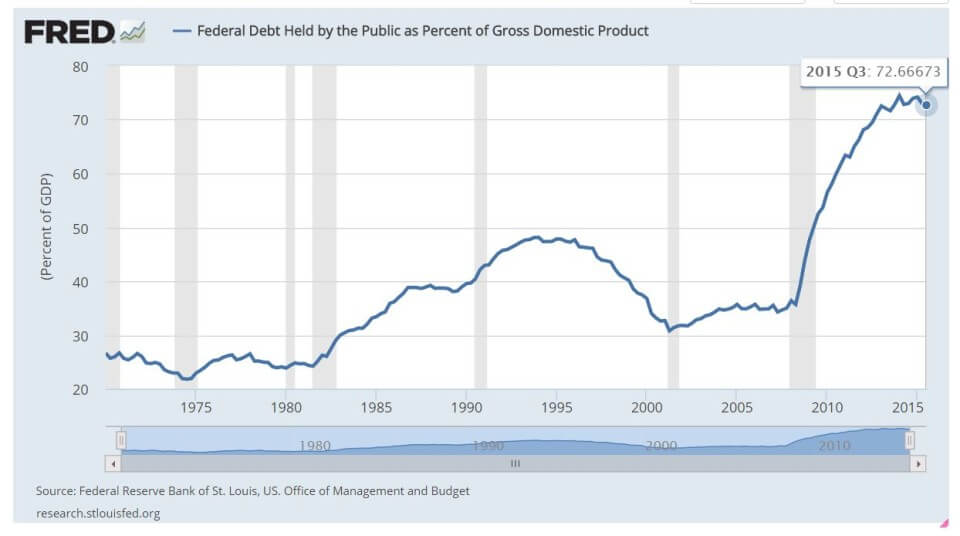

The US has still added nearly $8 trillion in debt since 2007, more than doubling the debt-GDP ratio to around 73%. And the current deficit numbers may mark the bottom:

Outlays last year rose 5%, roughly the same pace as the year before. Revenues were up 6%, versus a 10% gain in 2014. Government spending will rise further after last fall’s bipartisan agreements between President Barack Obama and Congress that boost discretionary spending caps through September 2017 and extend a series of tax breaks for businesses and households. Economists at Goldman Sachs estimate the deficit could rise to $650 billion, or 3.5% of GDP, in the fiscal year ending Sept. 30 and to $575 billion, or 3% of GDP, in fiscal 2017.

I would add that CBO’s forecast shows a steady rise in mandatory spending — including Medicare, Social Security — as a share of GDP starting in 2019 from 13.1% of GDP to 14.1%. And then up and up afterward to 16.0% in 2040. And there’s your trouble. Old people — or, rather, the promises made to them.

Let me put it this way: Last May a group of AEI scholars updated a comprehensive 25-year budget plan. And by any measure it contains sweeping reforms to how Washington spends.

Medicare? Its benefit structure would be modernized so it competes with private Medicare plans under a premium-support system.

Social Security? It would provide a flat, universal benefit that would virtually eliminate poverty in old age. Benefits would increase for poorer retirees but middle- and upper-income individuals would have to save more for their own retirement.

Medicaid? Replace federal matching payments with block grants that grow with the economy and permit states to manage their Medicaid programs more efficiently.

Obamacare? The ACA’s subsidies would also be converted to state-level block grants, and the current tax exclusion for employer-provided health insurance would be replaced by a refundable health insurance tax credit that provides a flat dollar subsidy, with higher payments to those with lower incomes and greater health risk. In short, our welfare state would be make fiscally sustainable with more of its benefits directors to the neediest.

And how does this all shake out financially? Federal spending as a share of GDP would rise by a couple of percentage points, from 20.5% in 2015 to 22.5% in 2040. Disappointed? Nonsense. That increase is three percentage points less than the CBO forecast. And the debt-GDP ratio would decline to 63%.

More good news. That’s way less than the 107% CBO forecast. Now that isn’t 0%, and it is about 30 percentage points higher than pre-Great Recession. And no balanced budgets (at least not when including debt payments.) Also, all these numbers include higher tax revenue, rising from about 18% today to 21% in 2040. The income tax would be replaced by a progressive consumption tax, and all energy subsidies, tax credits, and regulations would be replaced by a modest carbon tax.

So there you have it. One version of what smart, conservative reform looks like when applied to the real world. There are others of course. But if you see a plan that assumes minimizing the safety net and welfare state or slashing taxes back to 1920s levels or counts on hyperfast economic growth — or one that dreams 90% tax rates and a 1990s Scandinavian-style social democracy — be skeptical.

So there you have it. One version of what smart, conservative reform looks like when applied to the real world. There are others of course. But if you see a plan that assumes minimizing the safety net and welfare state or slashing taxes back to 1920s levels or counts on hyperfast economic growth — or one that dreams 90% tax rates and a 1990s Scandinavian-style social democracy — be skeptical.

I agree with some of these things disagree with others. I really enjoy the clarity of comprehensive plans. But, plans that run through more than one election cycle will not be followed through on. As situations change and political will is lost longterm plans are not hewn to. For instance, a slight carbon tax would be as pumpable as any VAT. And marking spending levels consistent with current outlays as “nonsense” does nothing to help Conservatives in their fight for longterm fiscal restraint.

AMEN!

JP makes many good points, but I don’t like being told that it is “nonsense” to be “disappointed” that federal spending, as a share of GDP, would grow from 20.5% to 22.5% between 2015 and 2040 under the supposedly “center-right” reforms that he cites.

I don’t think that such projected government growth is “center-right.” It is “center-left.” Pretty much by definition, if we consider the present level to be the “center.”

It is troubling that, without the type of reforms cited by JP, things would get far worse by 2040, with federal spending projected to grow to 25.5% of GDP. The reforms he discusses would help. But I submit that to be worthy of the name “center-right,” a package of reforms needs to target an overall reduction in federal spending, at least as a percentage of GDP.

My prior comments were directed toward the spending portion of the AEI plan, which is sensible as far as it goes, but does not go far enough.

I did not focus on the tax discussion at the end of JP’s post, which reveals tax increases from about 18% of GDP today to 21.2% in 2040.

Frankly, this post is highly illuminating. We are told that “center-right” means a massive spending increase (20.5% to 22.5% of GDP) and a massive tax increase (18% to 21.2% of GDP). I have a better understanding of the frustration of the Trump enthusiasts.

Now I agree that the Dems would be far worse, and I don’t think that Trump is likely to deliver the improvements for which his supporters hope.

But if the program outlined by JP’s post is the plan of the GOP establishment, I’m inclined to respond in the words of the old Quiet Riot spiritual:

Our focus needs to be on freedom, choice, and markets- and, in a departure from some conservative orthodoxy in a world where the public absolutely demands certain things- where if a cost is essential to run up, we actually pay the check instead of deficit spending that pushed the bills off onto future generations.

AEI understands that general principle, even though I may not agree 100% with all of the recommendations.

A 25 year plan? Yea that’ll work out just as planned. If we get a chance to do something, we have to do it. Some of this stuff is good, just not good enough.

That jumped out at me, too. Completely unrealistic. Each Congress is its own creature, and the first one that wants to break out from that budget will. Wholesale reform of how Congress does business is needed.