Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Cyber Monday Advice: Don’t Buy the Extended Warranty

Cyber Monday Advice: Don’t Buy the Extended Warranty

For a change in pace from all the politics, I thought I’d offer a little consumer advice as we head into the Christmas shopping season. To wit, buying an extended warranty is almost always a bad idea.

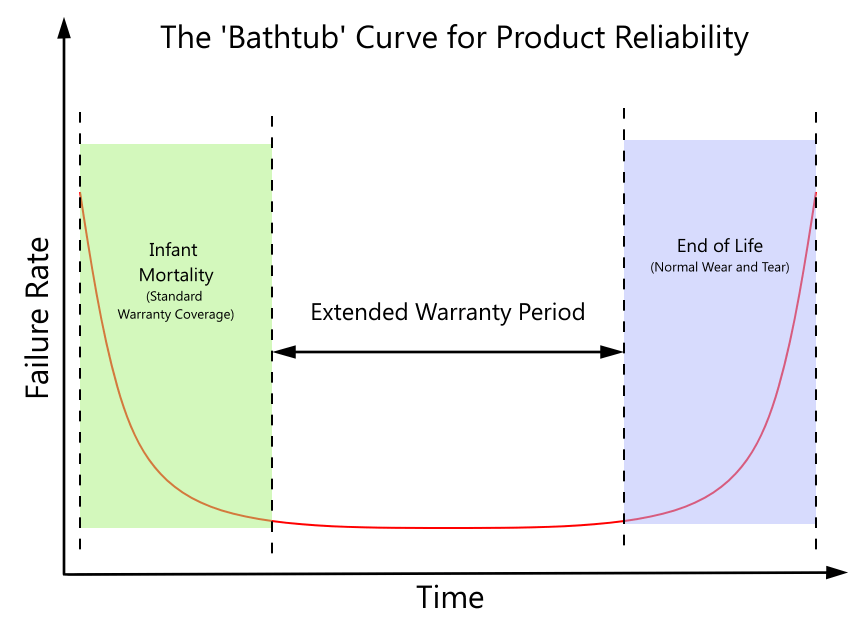

To explain why, let me show you a graph of the typical life-cycle of a manufactured product. In engineering we call this a ‘bathtub curve’ because of its resemblance to the shape of a bathtub:

Allow me to explain. Any product goes through three phases of reliability in its lifespan. First is the “infant mortality” phase, denoted by the green box above. This is the time when products fail due to manufacturing errors, design errors, materials issues, etc.

The second phase is the normal life of the product; i.e, once the early failures have left the market, what remains tends to work properly for the rest of its design life, with very low overall failures. That’s the white section in the graph.

Finally — as a product reaches the end of its design life — it begins to wear out. Things start to fail because of normal wear and tear. That’s denoted by the blue area in the graph.

Now, a manufacturer’s warranty protects you from the infant mortality phase. If parts on your car or toaster fail here, it’s because something was built wrong, and the warranty covers you in that case. And protecting you from manufacturing flaws is precisely what a warranty should do.

An extended warranty applies to the “middle” phase, and is timed to end before normal wear and tear starts causing failures.

Manufacturers of products have the data that allows them to predict these phases. They know where the period of high reliability starts and ends. You, on the other hand, do not. Magazines like Consumer Reports or independent research like JD Power reports may give you good information about the early failure rates, but they aren’t going to be able to tell you when the thing you are buying will begin to wear out.

What this means is that the manufacturer in this case has an advantage over the consumer: a classic example of an information asymmetry. That allows them to offer a “warranty” at relatively high cost that protects you from product failure during the period the product is least likely to fail. And since you have no idea how likely that is but they do, they can use that information to price the extended warranty such that a healthy profit for them is baked in.

In a complex product like a car, there are many “bathtub curves.” Each sub-assembly may have different failure patterns. So, when you look at an automotive extended warranty, you’ll usually find that certain things aren’t covered, sometimes inexplicably. The engine may be covered, but not the alternator. The transmission may be covered, but not the torque converter. Why? Because the extended warranty is optimized to maximize profit for the auto dealer, and sometimes that means leaving things out that are likely going to be too expensive to fix because they are most likely to fail during the extended warranty period, or because their lifespan is too dependent on variables like driving habits or road conditions to be predicted with enough accuracy to work into the formula.

In fact, it can be worth looking at the extended warranty when considering the purchase of a car not because you want to buy the warranty, but because looking at the list of excluded items can tell you a lot about what the car company expects will fail first on the car. That can help inform your knowledge of the vehicle’s overall reliability.

Other Reasons to Avoid Extended Warranties

This advice about avoiding extended warranties doesn’t just apply to vehicles, but to all consumer products. I won’t go so far as to call them a scam, but they are usually a very high profit item for the seller, and therefore very poor value for the consumer. Here are some other reasons why:

- You may forget about it. If you have a habit of buying extended warranties, how do you know that the product that just failed is covered by one? Do you remember which of your goods is covered by warranty and which are not? Do you have all the paperwork? Did you think to check for it before tossing the thing in the trash? The statistics show that many extended warranties are never claimed, even when they are valid. That’s pure profit for the seller.

- You may replace the product before the warranty is out. A five year extended warranty on a laptop is useless if you tend to replace it after two or three years. Or, you may break the product in a way that invalidates the extended warranty anyway. Every car wrecked during its initial warranty period is a car that will never claim extended warranty coverage, coverage that might have cost thousands of dollars.

- The warranty may be invalid. Some items have very specific conditions for a valid warranty claim. They may require you to have a copy of the contract and the invoice for the product. They may inspect the product and decide it wasn’t used correctly. The specific failure may not be covered by the warranty. There are many reason why an extended warranty may not be claimed.

- The warranty isn’t transferable. Many extended warranties cannot be transferred. So, if you sell the item covered, that value is lost. And even if it is transferable, is the new owner going to know that? Is he or she going to care? Can you extract value from that warranty by charging a higher price? Almost certainly not.

- The warranty costs you now, but has no value until the factory warranty runs out. Think about that one: if your car has a 5 year warranty, and you pay up front for a 5 year extended warranty, the car company gets the use of your money for five years before it has to worry about possibly paying it back. If you could have earned 5% per year on that money, the warranty cost you 28% more than the up-front price.

There are other reasons to avoid extended warranties, but these are the big ones. In general, an extended warranty violates the principle that you should never pay for insurance when you have the finances to self-insure. Insurance is always a negative-expectation bet, with the insurance company selling you risk mitigation at a cost. It’s never a good deal, but may be necessary if you can’t bear the risk. In the case of most consumer goods, that’s not true for most people.

A Good Alternative Strategy

Here’s a good strategy for managing risk while saving money: set up a savings account called “product insurance.” Every time you are offered an extended warranty, refuse it and put an amount equivalent to the cost of the warranty into that savings account.

When a product you own fails outside of the normal warranty but within the extended warranty period, replace it with money from that fund. You’ll almost certainly find that the account grows in size over the years, and perhaps very substantially. Every dollar in that account is a dollar that did not go to line the pockets of the salesman and the company that sold you the product.

Happy shopping!

Published in Culture, Economics

Bought my husband a $20 cordless mouse today. Cashier tried to get me to pay $5 for an extended warranty. Never had one break….new computers came with one or I bought cordless ones to replace the wired ones. This time, my husband left his behind and needed a replacement.

No value against a lightning strike that hits your house wiring. None. Under high voltage, the electrons will chase across a fuse link with impunity.

A lightning rod for your home, however, would be a good idea.

I get the “no questions asked” universal warranty on my smart phone. This one pays for itself in my case. Something about being very active, and having lots of kids…

Excellent post.

As a comment, you should point out that the chart’s time axis is logarithmic. Put another way, with a linear time axis the right side of the bathtub curves upward so gradually that it will not look bathtubish.

I generally agree with the advice in the OP, but I did buy a protection plan on couches I purchased this summer.

For $150, I protected $2,000 worth of white couches against spills, stains, and rips for 5 years. Since my extended family includes a lot of toddlers, the cost of the warranty is worth the peace of mind knowing that if grape juice gets spilled, the couches don’t immediately become garbage.

As in all things, there are sometimes exceptions to rules. If you have knowledge about the way you use something that the seller doesn’t, that might make extended warranties valuable in some cases. A good example are the ones that have instant replacement programs. If a product failure causes loss of work, it doesn’t take much time waiting for a replacement before you’ve spent more than the cost of the protection plan.

In commercial use, this type of protection is usually provided through service contracts, but the consumer equivalent may well be baked into an extended warranty program.

However… When evaluating whether extended warranties have value, be on guard for confirmation bias. We tend to forget about the plans we bought that were never used, and we always remember the times when an extended warranty was useful. This can cause us to develop a distorted view of just how often those plans pay off.

One good piece of evidence of just how much profit is baked into a typical extended warranty: The amount of effort sellers expend to get you to buy one. There is so much profit in these plans that often the extended warranty will earn more for the store than the margin on the product itself – maybe much more. There is so much profit that the store can offer its salespeople large commissions or Spiffs for selling those contracts, which is why they can be so insistent on selling it to you.

In fact, it is not uncommon now for the expensive thing (say, a large screen TV) you are buying to be sold at cost or near cost, with the profit really being made by upselling the customer on warranties, cables, stands, and other peripheral goods that have huge markups. A cable that cost $5 to make may be sold for $200. An extended warranty that has an average cost to the seller of $5 may be sold for $50. The TV itself may only have a margin of 5% or less.

So extending this advice past warranties, be careful about buying all the other add-ons the retailer will try to foist on you. Never buy expensive hookup cables. Shop around for wall mounts and other add-ons, and don’t just buy whatever the retailer offers you with the sale.

Don’t EVER buy Monster cables. I’m in electronics, I’ve taken their cables apart, and they are a total and complete rip off.

Great post!

Definitely. Absolutely.

That’s for sure. You and I could probably write a book on the ways consumers of electronics are ripped off.

It’s good to have a systems engineer in your contact list.

It’s one of my favorite curves.

I just spent a year battling Sears over a defective stove they sold me and installed for me about a year ago. We did not buy the extended warranty when we purchased it, for all of the good reasons in the excellent original post.

What I have gone through with Sears on a stove that they deemed defective is unreal. I ended up spending six weeks without any stove and have mastered hotplate cooking. (I may make some money out of this ordeal after all when I write my book: Replace Your Expensive Stove with a $20 Hotplate!) The repairer from Sears told me that wires had been installed improperly on the back plate. This had been done at the factory. The wires eventually overheated and burned up, melting into the protective plate on the back. It was a slow-to-reveal-itself defect.

It blew my circuits three times–every time we tried to turn it on. In my negotiations with Sears, I insisted on a new computer package as well since the stove had been through several self-caused surges by then.

I hate this stove. I don’t trust it. I hate it. And I love to cook. It has taken all the fun out of cooking for me. (Emotional wear and tear?) And now I would not give Sears the time of day. Is bad PR a concern of anyone at Sears?

[continued from comment 43]

If I did not know better, I would swear the retail industry, in some sort of overt or covert plot, is trying to sell these extended warranties by harassing consumers who buy defective products. I say this because every single time I communicated with someone at Sears, the person’s first response was, “Did you buy the extended warranty? No? That’s too bad. If you had, you would have had this taken care of without any problem.” The sentence was scripted.

In my year of trying to get some justice for my defective stove, I have learned that all of the companies are doing the same thing. It wouldn’t help me to go to Home Depot or my local KAM Appliance.

We considered taking the stove to the dump and buying a new stove from our local KAM store. We looked at a gorgeous KitchenAid $1,000 stove, and the guy wrote up the ticket for us, but by the time we bought all the warranties, the price was $1,400. I decided to continue to work it out with Sears which wouldn’t cost us anything.

But, wow. the entire industry needs to take a look at this.

First, they’ve created a big vulnerability. The first company that comes along and goes against the pack and says “The sticker price is the total price” will walk away with everyone else’s business (think Blockbuster and Netflix with its no-hassle late returns).

[continued from comment 44]

When I say they have created a competitive vulnerability, I’m recalling LL Bean’s dramatic switch to not charging for shipping. Obviously, someone at the company went to a brick-and-mortar shoe store and noticed that the price of the shoes included the back-end costs. The retailers weren’t bothering customers with the intricacies of their profit-and-loss statements.

The current crop of lawyers may have found a way for the appliance companies to make some extra money, but it will last for only a little while, just until it dawns on someone in the C suite that the cost of replacing or repairing a defective appliance should be built into the sticker price, as it once was.

I should note that what a lot of people are talking about with their phones/tablets aren’t really warranties. A warranty is for workmanship and materials. If a plan covers drops, spills, and other consumer abuse, then it’s more of an insurance/pre-paid cleaning and repair plan.

I make this distinction because calculating the worth of an insurance plan for you has much less to do with the manufacturer’s bathtub curve and much more to do with one’s own use patterns and tendency towards bad luck. I replaced three HTC Ones (a $600 retail phone) on my insurance plan — they didn’t make any money selling me that plan!

This is true, but it cuts both ways. One shouldn’t say that he wasted his money on, say, disability insurance because he didn’t become disabled. Insurance has value even if it turns out that you didn’t “use” it.

The way I like to look at these plans is to ignore the profit the seller is making (I am a capitalist, after all) and to compute my own expected cost with or without the plan and choose the lower cost alternative. On bigger ticket items, such as cars, TVs, and appliances, the lower expected cost is usually to buy the warranty. Of course, a warranty that is too pricey could shift the decision the other way.

Deciding not to buy a warranty creates another kind of decision problem.

If and when the product does go bad and needs repair, you will have to decide whether to pay for those repairs, which are almost always expensive, and by doing so extend the life of the product for a while, or to buy a new one. This can be a difficult decision on which mistakes can be made.

For example, should you pay for an expensive transmission repair on a 9 year old vehicle? Maybe, maybe not. But I have a 10 year warranty so I don’t have to.

Recently my Macbook Air stopped working. It was out of warranty, and so I had to fork over $400 to have it repaired. But it’s 4 years old, and many friends advised me to just buy a new one. Tough call.

With the warranty this question doesn’t arise. The seller will pay to repair or replace.

One more (final?) argument in favor of certain warranties is the moral hazard issue. But flipped.

I love not having to care about how many times I hit the buttons that open and close the doors on my cars, or dozens of other things on the car (or HDTV set) that could break if overused, but, with a warranty, it’s not my problem. I can use the thing without worry. It’s very freeing.

Keeping mowers working is not fun for my kids.

Bought a mower last year. And a three year, no-charge, “we will fix it anytime it breaks” deal with it, at Sears.

So far, it has gone in for fixing twice.

And the catch? Each time, they keep it for 4-8 weeks. During the grass growing season.

<head bang>

A strike that hits your house wiring directly will almost certainly burn it down. Doesn’t matter if the surge was caught at that point.

A whole-house suppressor will knock down most neighborhood strikes, though, especially when paired with cheap suppressors at the outlet. When I lived in SC, the power company offered one with a warranty covering replacement of your electronics. Only once, though :-)

8 weeks to fix a mower? That should be a 4 hour job. But based on my own experience I would never buy any gas-powered products at Sears. They were using junk motors years ago and I doubt they’ve changed.

Many expenses make more sense in a business environment where additional factors such as time-criticality, product/service downtime sensitivity, lost man-hours due to workers idled while getting systems back up.

One of the biggest adjustments I had to make in going from grad school to the business world was the sudden, dramatic appreciation of the value assigned to my time. If I need something right now to run a critical experiment on a reporting deadline, overnight freight can be cheap at thrice the price.

As long as the warranty evaluators don’t simply determine that you were using the product outside of the manufacturer’s indicated specifications. That’s the main reason I reject them all out of hand: I have zero confidence that, even if I have a valid claim under a common understanding of the thing, there’s language in the terms that allows them to void the coverage in just about all circumstances.

… has much less to do with the manufacturer’s bathtub curve, and much more to do with how often the device is in close proximity to a bathtub. :-)

However, these warranty companies can do some good:

Honda’s lead over everyone else is just stunning.

I appreciate the concern you raise, but that argument has never been used against me for any of the scores of warranty claims I have made during my long life. Not for warranties on automobiles, appliances, electronics, musical instruments (including pianos), or my HVAC system in my home. I have never used any of these things for purposes other than those intended, and have never been accused of doing so. No claim has ever been rejected on those grounds. I’ve had claims rejected because the damaged part wasn’t covered, but that’s only fair.