Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Notes on the Decline of US Crude Oil Production

Notes on the Decline of US Crude Oil Production

My first job after the Navy was running operations, compliance, and finance for a small exploration and production company based out Farmington, New Mexico. I remain involved in the industry through non-operated working interests in Kansas, drilling consultancy in the Permian Basin, upstream operations consulting moving drilling rigs, and am the principal of Blacklion Capital Management, a Commodity Trading Advisor.

My first job after the Navy was running operations, compliance, and finance for a small exploration and production company based out Farmington, New Mexico. I remain involved in the industry through non-operated working interests in Kansas, drilling consultancy in the Permian Basin, upstream operations consulting moving drilling rigs, and am the principal of Blacklion Capital Management, a Commodity Trading Advisor.

We’re in the middle of the downstroke of an oil cycle that starts with over-production and/or a decline in demand (this time, both of those, combined with a rising dollar) that causes prices to fall, exploration to dry-up, and production to slow. However, given how many steps there are between a rig and your gas tank, it takes a while for this information to process through the industry before the upstroke can happen. Rising oil prices are in our future, though exactly when is not certain.

North American Crude Oil Market

In July 2014, NYMEX Light Sweet Crude Oil began a precipitous decline from more than $100/barrel to less than $50/barrel. By late October, oil began dropping exploration. When oil subsequently dropped below $80, operators started disassembling and storing (stacking) drilling rigs as further exploration and new production became uneconomic and short term funding for operations became scarce.

Exploration and Production

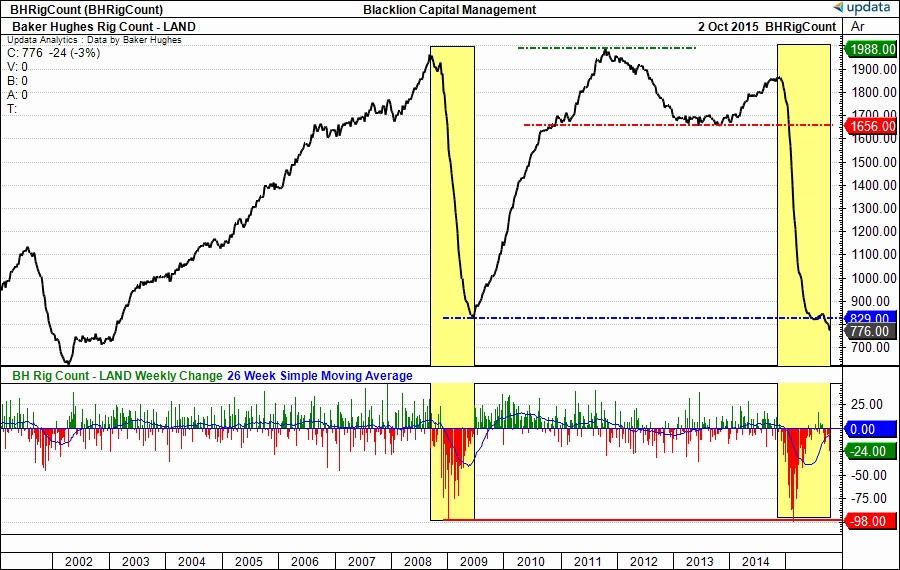

The total count of land rigs in North America peaked in November at 1,864, dropping to 760 in the latest report, a 59% decrease in almost a year, as detailed below:

Figure 1, Total Rig Count

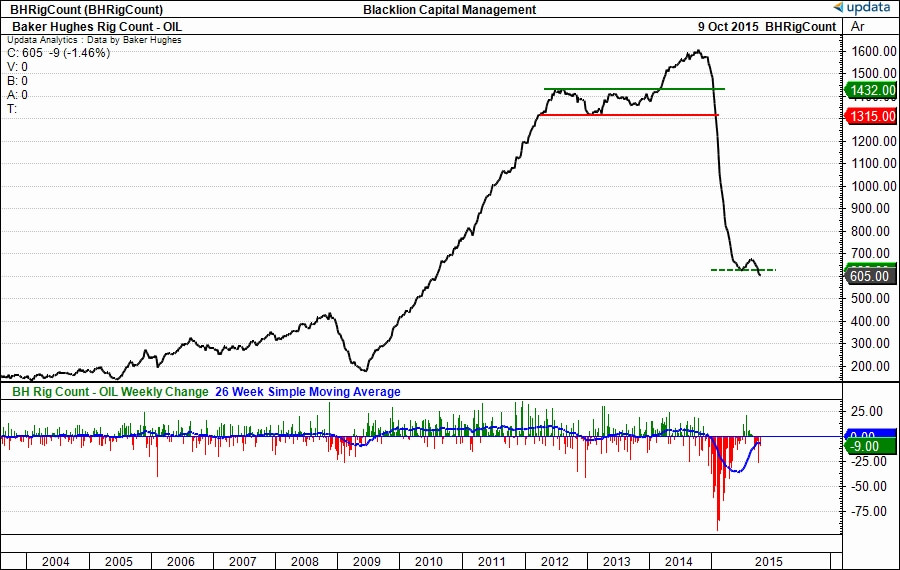

Similarly, land rigs exploring for oil peaked at 1,609 in October 2014 and declined to 605 in the most recent report, a 62.4% decline:

Figure 2, Exploration Count

These declines were expected and prudent with falling oil prices (prices fall, supply contracts). The sharp reduction in exploration and production activity should curtail hydrocarbon production, reduce storage, and ultimately bring supply and demand back to equilibrium and stabilizing prices.

US Production

But even as exploration and production activity began declining in the fall of 2014, US oil production — i.e., how much oil we were actually pulling out of the ground — continued to to set weekly records, months after rigs had started to be stacked out.

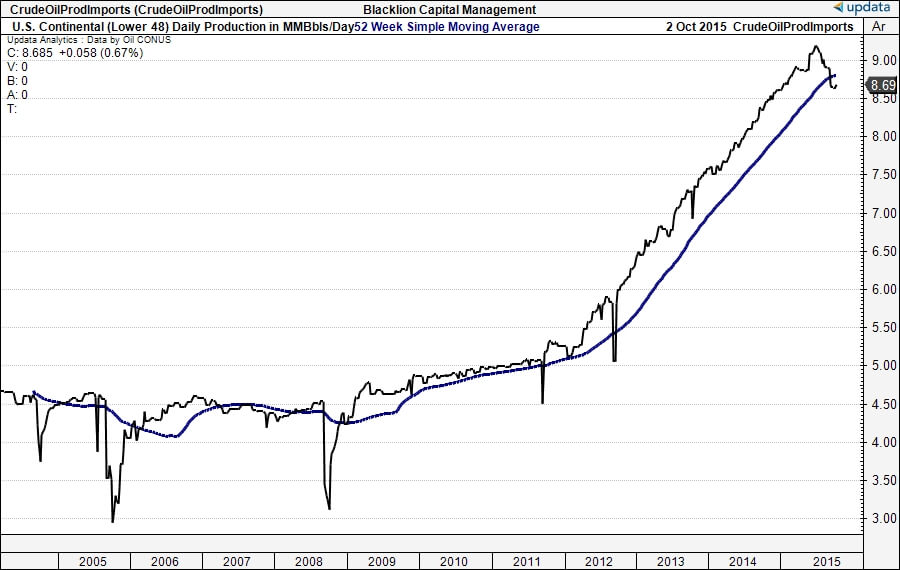

US continental field production — i.e., production in the lower 48 states — was 8.6 million barrels/day in late October 2014. By June 2015, that had risen to 9.2 million barrels/day:

Figure 3, US Continental oil production in millions of barrels/day.

Since then — about a year after rig count began declining — production has dropped to 8.7 milllion barrels/day, though that’s still above the figures from last fall.

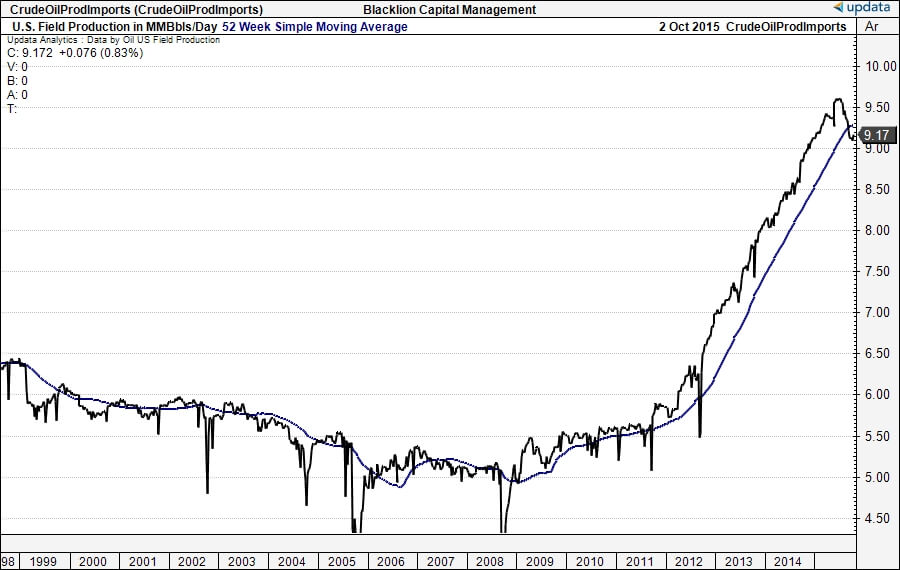

Similarly, total US production (i.e., including Alaska) peaked at 9.6 million barrels/day, and has declined to 9.17 million barrels/day, which is still above the 9 million barrels/day production rate from the fall of 2014:

Figure 4, Total US oil production in millions of barrels/day.

The drop in production is intuitive and consistent with a more than 50% decrease in exploration and production activity. The lag in production and storage response to rig count decline continues to impact petroleum storage and ultimately prices.

Petroleum Storage

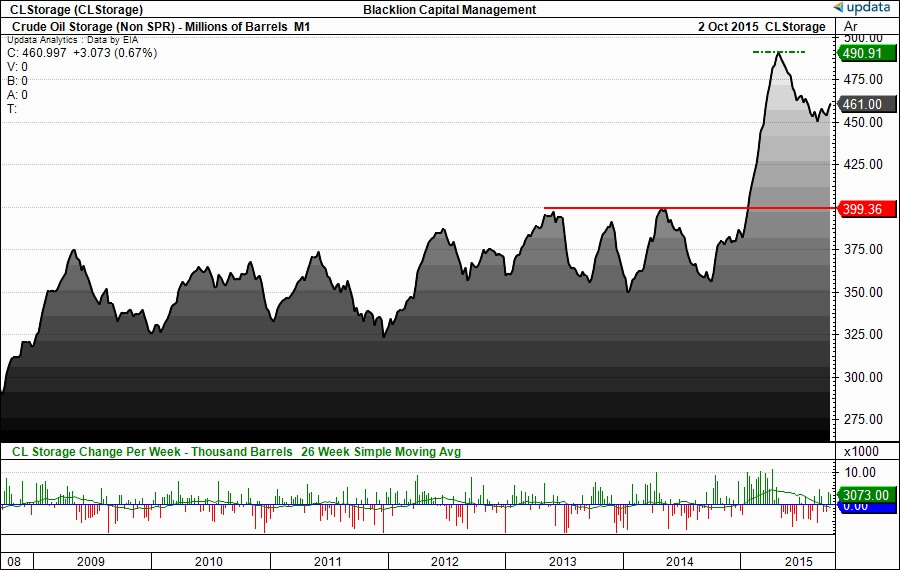

Commercial Crude Oil Storage (non-Strategic Petroleum Reserve) continued to climb while production rose until storage peaked at its all-time high of 490 million barrels in April 2015:

Figure 5, US commercial petroleum storage.

Commercial crude oil peaked and then began its seasonal decline associated with spring and summer driving season, but total petroleum in storage continues to rise as the lag in exploration and production activity filters through the industry.

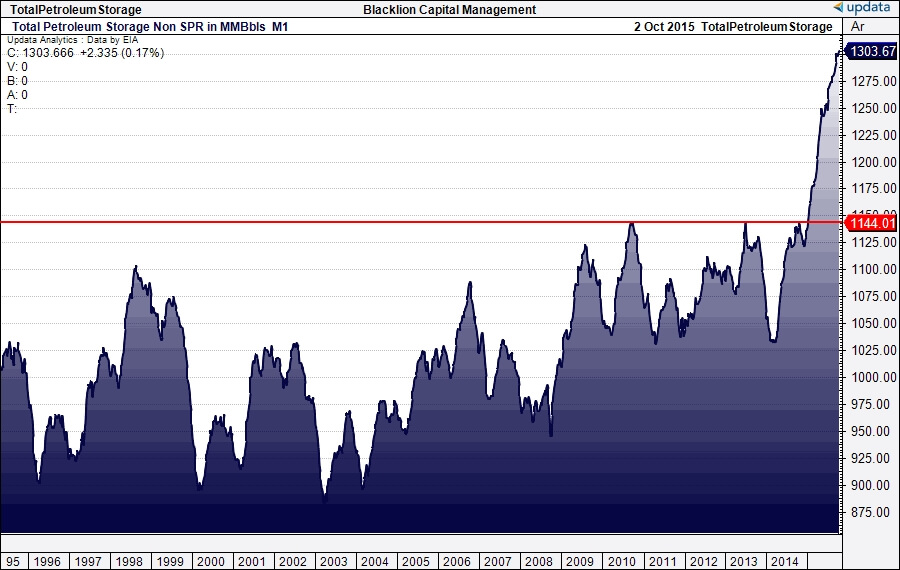

Likewise, Total Petroleum Storage — the total of twelve refined products, plus commercial crude oil storage tracked by the Energy Information Administration — has continued to set new records almost every week:

Figure 6, Total Petroleum Storage

Summary – Timeline

The significant lag in supply responding to a more than 50% price drop in crude oil continues to pressure prices and it is still early to call the bottom in oil prices.

The following timeline highlights the lag in the hydrocarbon supply chain:

- July 2014 – NYMEX Light Sweet Crude Oil trades above $100 for the last time in recent history.

- October 2014 – Operators begin stacking out rigs.

- April 2015 – Commercial Crude Oil Storage peaks prior to summer driving season.

- June 2015 – US Field Production peaks.

- ??? – Total Petroleum Storage peaks.

The continued rise in refined products turns attention to weakness in demand while reduced exploration and production works its way through the upstream supply chain.

Published in Culture

Mike. There is a new site called Oil Pro that looks like upstream linked in.

I think OGJ is still the industry standard.

Energy Information Admin is still the best for statistical data, API – not so much.

Well, this didn’t make me feel very good for my friends and colleagues still in the business:

http://fuelfix.com/blog/2015/10/12/tph-many-oil-companies-virtually-abandoning-exploration/#34823101=0

“TPH: Many oil companies ‘virtually abandoning’ exploration”

Thanks for the OilPro site. Just bookmarked it. It looks like a great site.

In the short run, yes, but this is just the cyclical part.

A lot of folks don’t have insight into the land rush leasing that occurred 2012-2014. Those leases mostly had 3-year primary terms with 2-year kickers in them. It was epic and there are top leases on a lot of those.

Drilling costs have come in and success rates are so high (89%+ by EIA’s last estimate) that drilling to retain the minerals still makes sense even at these prices.

In this environment there isn’t much appetite to acquire shooting rights and lease options to do 3D seismic on 100 sections and then go wildcatting into unknown structures.

Brent,

I think your next post needs to be a dictionary on oil industry terms. what the heck is wildcatting?

Wildcatting is drilling an exploratory well in an area without existing production or drilling to a different horizon that hasn’t been produced before. This would be a test well. A lot of engineering, science, geology, testing etc. to better understand geology.

Once the well is drilled to total/target depth it will typically be tested via drill stem test and even sidewall cores to determine if it will be economic to complete and produce. Then the operator makes the casing point election to set production casing.

Hopefully these wells result in discovery wells and fields are drilled out from there.

There is an SEC term for exploratory wells that is much more restrictive that public companies must adhere to in their reserve reports.

Very little if any of this is happening right now. All of the wells I am aware of are development wells being drilled into know formations and horizons in known producing areas. Most of the wells are being drilled out of necessity to hold minerals by production, some of them are true development and in-fill drilling.

I am not sure Ricochet has the bandwidth for that. There is a ton of lingo in the industry.

Schlumberger makes and Oilfield Glossary app that I recommend all the time. Additionally Baker Hughes makes an app for their weekly rig count and Halliburton put their red book in an app. I remember going through this phone book thick tome and calculating capacity and displacement and now we just plug data in a phone.

There are a few reasons that it makes more sense to upgrade existing refineries than to build a grassroots plant near production wells.

First, governments, rightly or wrongly, are much more stringent on a new facility than on an existing one. When a new regulation comes out, there is often a grace period, or even grandfathering of older units, whereas they impact all future new units immediately.

Second, refineries require a LOT of utilities. They consume tons (literally) of water, electricity, hydrogen, etc. Existing refineries already have access to much of this infrastructure, but a new facility (especially one located in a remote location) will have to build those utilities in addition to the process units.

Because refineries are so complex, they often synergize with neighboring facilities. For example, the gulf coast refiners all have an inherent advantage in being close to each other because they can move products and feeds around amongst themselves to find the most optimal solution. That new refinery in ND will have to be entirely self-sufficient, and if one unit goes down, likely the entire refinery will come down too, unless they paid millions more for tanks to store their products.

-E

One last thought.

Building a refinery close to the field might lower their costs to transport feed, but that puts them that much farther away from the markets for their products. Now, in a booming oil field, the producers might become a customer for some refined products, but you can only get so much diesel and gasoline out of crude oil. Furthermore, now the refineries success is tied to the fate of the field. In 30 years, the whole thing might just end up shut down. It happened in Alaska; it could easily happen in ND.

-E

Brent,

Thanks for this post. Always helpful to have someone close to the well to give some color around what’s going on in the industry.

I find it interesting to see the EIA projections show only a relatively small decrease in crude production in the US for 2015 and early 2016, before rebounding in late 2016 – despite the large reduction in the active rig count. Seems to me that producers are getting more productive by leaps and bounds – lower service costs, less upward pressure on wages, more wells drilled per rig, etc. Is that what you are seeing?

Also, re: refineries – would be great to see the regulators get out of the way, so we can build newer, more efficient, safer refineries. Additional (expansion) capacity has come online over the years, but the total bpd throughput is nothing compared to what could be done in the right regulatory environment.

EIA is great for statistics, not so much for predictions. IEA is worse.

To your point regarding efficiency – yes – tremendously. Almost every rig drilling is a self contained walking rig capable of pad drilling.Whether they are actually pad drilling is driven by different factors.

Many rigs were ordered during the boom and still coming out of the yards, the old iron is being sold to Mexico or cut up.

Productivity per rig in some basins is 300% better than it was 2-3 years ago.

C and E is the in house expert on those. There are some economic limits to adding much more refinery capacity. We export diesel and gasoline now and manage our own demand well.

Funny story about regulations getting in the way of safer refineries…

I just got back from an industry conference last week, and one of the major topics of discussion was safe operation of electrostatic precipitators in FCC flue gas service. The recent explosion in California has deservedly garnered a lot of attention, and it could have been much worse. In one of the sessions, it was brought up that this type of accident has happened 7 times now in the industry (which is a lot), and all of them during start up of the unit.

At one point, it was brought up that environmental regulations actually put pressure on refiners to operate the ESPs unsafely. The EPA wants everyone to have the ESPs powered up at all times, but that is very dangerous in this FCC flue gas service because of the increased likelihood of sending rich (i.e. unburnt) flue gas mixed with oxygen into the ESP where sparking can occur. Since the EPA only cares about emissions, they have been unsympathetic to requests for leniency during startup.

-E

It is also interesting that a number of wells drilled have not be fracced. (My E&P friends often dislike the recently coined FRACK and brochures from the early 1980’s use the term frac)

Hydraulically fracturing is NOT new but 65 years old last February. Most conventional wells have been fractured and that has been the case for DECADES.

The modern technology is more due advances in accuracy of geosteerable drilling perfected in the 1990’s in wells drilled in the Gulf of Mexico off of Louisiana. With that ability came the way to play with fracturing fine tuning on a field by field basis.

The one commodity that the U.S. is awash in is condensate. Condensate was erroneously lumped in with crude oil in the legislation to ban exports in the 1970’s. It is NOT crude oil but does allow oil producers to include it in their inventories. It is NOT good for refining other than cutting heavier crudes. While it produces more light products when refined it top loads the crude unit distillation column and decreases refining capacity drastically, say 30% more or less.

The recent sales to Mexico have been condensate. A few exporters have found a loophole to get exports of condensate approved to more than just Mexico. Due to the fact that we cannot load supertankers at U.S. ports (none are deep enough) I do see actual crude oil exports as being competitive with freight rates other than regionally or occasional.

I disdain the term FRACK or ‘Frackers’.

It has been around, but doing multiple stages is relatively new. Additionally, the proppant loads in today’s frac jobs are much more advanced.

The term has also been used interchangeably with other forms of stimulation. I remember ‘acid frac’ in carbonate formations where all we did was acidize the well.

Very good point. I remember when drilling a 500′ lateral would get you on the cover of OGJ.

Brent, do you have a list of online trade journals which you like for insightful content, besides your own analysis -which is excellent.

As someone who has been involved in buying, selling and relocating refineries, it is NOT as simple as building new refineries. That is a simple and ignorant of the complexities and economics kind of statement better suited for pundits and politicians.

We have built new refineries within the last decade. We have expanded refining capacity overall while having demolished several large (but not major) refineries within the last decade. Up until at least 5 years ago, permits to build and operate a refinery were obtainable, depending on the state a refinery was to be located in.

Crude oil is not some monolithic commodity that just any old refinery can process. Crude oil differs in its chemical makeup from oil field to oil field and more has to be considered than sulfur content or how heavy it is. Also, the target market for an individual refinery must be considered as well as access to market. After these are considered, then the various TYPES of processing units within a refinery can be planned, and not before. In general for such capital intensive undertakings, ROI is quite low and many refineries lose money many a year. Recently, they’ve been making money. It is their long haul investment stability that gives investors some comfort, otherwise it would be difficult to raise enough capital to build any.

Jetstream, pretty much anything out of Pennwell is very good. I have a small library of their books.

EIA sends out weekly and monthly newsletters you can sign up for.

Some of the best sources are small town newspapers around active basins.

Not really, the major inputs into a refinery are only crude oil, natural gas (or hydrogen), electricity and water. There are many product streams with some being far away markets better suited for ocean transport (due cost).

There were a number of refineries in Kansas and Oklahoma that were demolished in the 1980’s and 90’s. Feedstock sources can change in a few decades as well as type of crude oil feedstock. Refineries are capital intensive and require longterm commitment of resources.

Wrong about no new refineries. Stop listening to pundits.

Thank you for the correction!

Building a refinery takes a lot of capital with low ROI but longterm safe investment. I could get permits 5 years ago. We have built at least one new refinery in the last 5 years. We have more refining capacity than demand.

BTW, North Dakota is one of the most difficult states in regulatory practice. It’s as bad as California or Ontario. While Texas is also as bad as California (it really is on emissions) it is much more pragmatic with application to facilities overall.

Brent, Oil and gas are corrosive, right? How does this play into equipment life and investment strategies. Is stacked equipment really expected to come back on line when the prices and demand are favorable?

Thanks, great post.

Thanks Jim.

Crude oil and natural gas by themselves aren’t very corrosive. What is corrosive is H2S that is produced with them, especially in known high concentration areas like Andrews County TX.

We drilled through an H2S laden formation there 2 years ago and ruined a set of drill pipe.

We intend to use equipment again. One of the rigs we stacked early this year was ~3 years old, latest auto drill system, a high performance walking package, in short a hole drilling machine. It was pressure washed around the clock for 3 days before it was trucked to the yard and stacked.

There are consumable parts, pump liners, and other components that have to be gone through bringing a rig back out of the yard. Fluids need to be changed, etc. Typically the surface section of the first well it drills is a frustrating series of fits and starts, but after that they are usually good to go.

A 1,500 HP rig is a $25M+ investment with tubulars. They are maintained well.

On the refining side, there are quite a few additional compounds in crude that cause us corrosion issues, including water, naphthenic acids, metals, and salts. Plus, sulfur speciation can be just as important to choosing a crude as total sulfur content.

-E

Great post and discussion. Thanks to all.

Per a close friend who operates small fields for others, CO2 can be more corrosive as well as active microbes in formations. At a small old field, H2S was the least of his worries with casing corrosion. The CO2 and microbes were a much greater problem and a high alloy casing was needed. CO2 by itself isn’t corrosive but the CO2 extraction plants in gas fields for reinjection, that I have been to, are all stainless steel. None of the constituents of the produced gas stream was really corrosive by themselves.

Kermit:

You mention a few times that we have build new refineries in the past 5-10 years. Can you give specifics? I recall hearing about a new refinery in North Dakota (I think) but very small in scale compared to Gulf Coast refineries.

Thanks for the insight.

I am not sure about the CO2. The microbes are a cause of H2S corrosion. We are seeing in mature fields where cotton seed hulls and other bio mass was used for loss control material (LCM) when drilling the surface portion of the well that the decay from the bio mass and the microbes associated with it give off enough H2S. When combined with ground moisture the surface casing is becoming pitted and leaking.