Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

What 50 HP Execs Said About Carly Fiorina — And What That Says About What Kind of POTUS She Might Be

What 50 HP Execs Said About Carly Fiorina — And What That Says About What Kind of POTUS She Might Be

Just how good a corporate boss was GOP presidential candidate Carly Fiorina? Well, Stanford’s Behnam Tabrizi interviewed more than 50 Hewlett Packard executives and mid-level managers who worked for the technology company in the 2004 to 2007 period. These are folks who worked with Fiorina and her successor, Mark Hurd. Many of them reported directly to the two CEOs. Here is what Tabrizi learned about Fiorina, as he writes in Harvard Business Review:

When Fiorina came to HP, the culture that she walked into was very much “aim, aim, aim and fire” — a slow culture, during a time when companies were moving very fast. In that context, she was what we want our change leaders to be — bold and disruptive. … Although the early merger integration was successful, it ultimately missed key mid- and long-term goals under Fiorina. She was weak in execution and implementation, a problem that would dog her tenure at HP. … And yet several executives who worked with her found her to be inspiring – “a rock star, and a dazzling performer on stage.” Fiorina attacked many different aspects of the company, including reorganization, cost cutting, and vision setting. … She was the disruptive leader she needed to be at the time, but she missed one key element. She never took the time to develop rapport with individual employees, and therefore never got buy-in or support for her initiatives. …

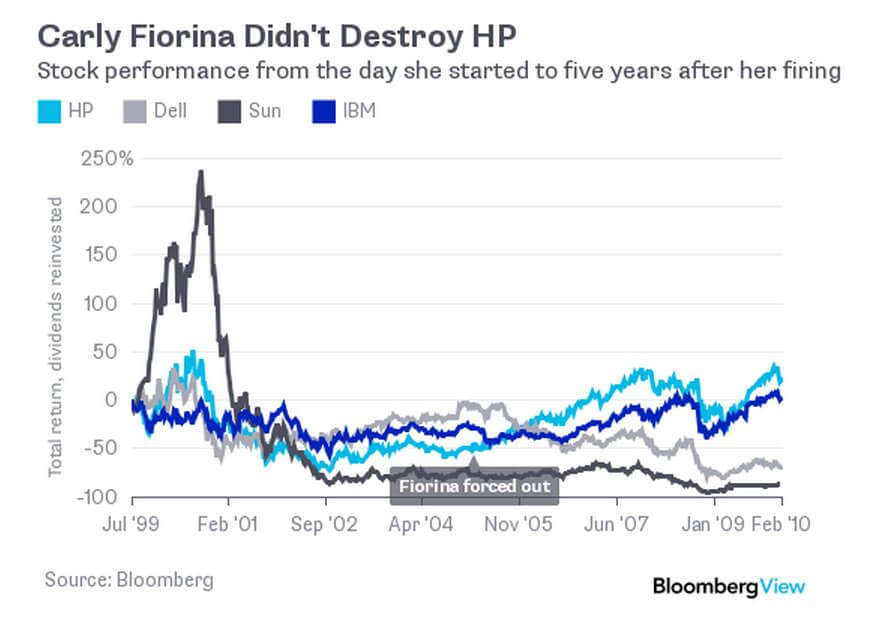

Hurd also connected with executives and managers in ways she did not. … And Hurd, in contrast to Fiorina, could be seen walking around HP with spreadsheets, constantly keeping people accountable. As one senior manager noted, “he knew the operations and its numbers better than many business unit heads.” But Hurd never mentioned the word “strategy,” according to the HP executives I interviewed – not in a single memo during his tenure as CEO. He was basically implementing the strategy that Fiorina had put in place – and Fiorina had been a brilliant strategist, putting the company on a footing to compete with the likes of IBM and Sun Microsystems. One executive told me, “Carly was looking so far ahead, you couldn’t keep up with her.” During Fiorina’s tenure, HP stock dropped 65%, while during the same period the S&P 500 dropped 15%. During Mark Hurd’s tenure, HP stock doubled, while during the same period S&P 500 dropped by 8%.

Fiorina, big on vision but less so on the deets. Her successor, just the opposite. Tabrizi cites her biggest failure as “not bringing someone like Mark Hurd.” She should have “brought in a second-in-command, a COO, to enable her to focus on what she did best – strategy and vision.” This is another source suggesting the game plan that boosted HP was Fiorina’s, even though someone else executed it.

So how might all this translate into Fiorina as president? After all, Ronald Reagan was often criticized for not being detail-oriented — thus the famous SNL skit portraying him as just the opposite, a control freak into the minutiae of everything.

Then again, you don’t want the POTUS, say, personally reviewing all requests to use the White House tennis court. And Barack Obama has been described as a bit chilly and aloof, at least with members of Congress.

What Tabrizi describes as Fiorina’s best qualities: being a visionary, strategist, status quo disruptor, inspirational communicator and performer all sound like really important attributes for a 21st century president. Reagan himself said, “How can a president not be an actor?”

Likewise, the qualities that might make a fine White House chief of staff could give us a tennis court scheduler as president — a green eye-shades manager who can’t inspire the American people.

Of course, the vision and strategy need to be sound, driven by a strong knowledge of economic and foreign policy. And government is very different from business. We’ll give Tabrizi the final word: “The bottom line is that Carly Fiorina is not as good as she says she is, but she’s not as bad as her critics say. In politics, you’re either good or you’re terrible. But in business, the picture is often more nuanced.”

One more thing: It’s also worth checking out this piece on Fiorina’s record by Bloomberg’s Justin Fox, from which the above chart was taken.

Published in Politics

Vision is good, but you also need execution. That fact that she couldn’t see that she needed to appoint someone to carry out her vision is not to her credit. Perhaps she has learned this since her HP days.

Interesting perspective on Carlie. Sure, you need vision and execution, but we can find someone for execution. Heck–make Romney chief of staff or something. We have lots of people who can get things done. I still worry that the HP record will greatly harm her chanced for election, but maybe not so much against Hillary, who doesn’t have vision or execution skills. And Carlie could debate circles around her. I still think I favor Rubio, but food for thought…

Big on vision –squandering $20B to enter a fading commodity PC market when other companies (e.g. IBM) were exiting the PC business and ignoring the services and software opportunities. Like Bush I, Fiorina had a problem with the vision thing.

Well, she certainly appears to be a quick learner when she needs to be. I’m not deterred from supporting her.

The last time the Republican Party said, “Trust us, this is candidate is totes conservative,” we ended up with John Roberts as Chief Justice.

Maybe she learned a thing or two since then.

This is misrepresenting the Compaq merger. Remember that at the time HP bought them, Compaq had absorbed DEC and Tandem, neither one a notable PC vendor, and had their own server business. The DEC/Tandem technology may have been a bit long in the tooth, but their legacy customer base was valuable and a good fit to HP’s intended move towards services: engineering market weighted on the DEC side and financial on the Tandem side.

I’m not saying the move was optimal – that’s unknowable – but it’s a canard to say it was about entering the ‘PC market’.

The remark in the OP about the HP culture that Fiorina inherited is on the mark. HP was and is what I’d call ‘deliberate and deliberative’ with a lot of consensus decision making. In a word, slow. I’ve heard a Silicon Valley venture capital rule of thumb: Never back a venture founded by HP veterans, unless they’ve had a least one other gig outside since leaving. Their built-in HP process orientation makes them unable to move as fast as needed in the start-up environment.

HP was already in the UNIX market with it’s own hardware, DEC was a fading legacy with no future as was Tandem -Tandem didn’t register a blip on the enterprise radar.

There was no fit what between DEC VMS and HP’s UNIX business. DEC committed business suicide, Compaq bought DEC before it was pronounced dead, HP bought a well known corpse.

It’s not the desktop business she wanted from Compaq so much, it was their server and laptop sectors.

See my comment above. DEC and it’s VMS was legacy with no future and fading quickly. Compaq’s PC products were all on the back side of the power curve.

Nothing said here that would prevent me from voting for her for President of the United States … and still hoping we will all get the chance.

That is an excellent idea!

I’ve often–half-jokingly–said that Romney would make a great Sec of Commerce. Chief of Staff seems to be a much better use of Romney.

Sounds to me like here weaknesses would be a strength as President and her strengths are exactly what we need.

I was an employee at HP during the time of Fiorina and Hurd. I was actually hired at Compaq about a year before the merger and wound up an HP employee along the way. Although I was merely a low level “worker bee,” the post pretty much matches my observations during that time.

Compaq was an utter mess operationally when the merger happened and I don’t think Carly Fiorina, or anyone at HP for that matter, fully realized what they were getting into. It was a long slog getting the two companies to work as a single entity. Frankly, there are still remnants to this day of “pre-merger Compaq” and “pre-merger HP” that continue to give employees and customers fits (don’t get me started on “fixed” versus “flexible” service support).

Mark Hurd brought a huge improvement operationally and the company really seemed to start humming when he came along. I can’t help but think that if Carly had Mark as her COO during the merger the whole thing would have gone more smoothly.

Is this the B movie star argument? What was Winston Churchill ‘s success before the War? Vision matters.

The only reason to have a Secretary of Commerce is to hand out severance checks and turn off the lights. Heck, I can do that. Don’t waste Gov. Romney’s talents in that closet.

So, she’s good at vision, but not so hot at execution.

Sounds like an endorsement of Bobby Jindal for VP.

When tech companies buy or merge, it generally isn’t to take over product lines, but to absorb a talent base and particular area of expertise.

The future of printing in the aughts was in a more complex internal computer within the printer, as well as streamlined software/language processes.

HP, like TI entered the 2000s as lumbering dinosaurs and needed to adapt to the new, nimble, creative competition.

They both succeeded to a degree, although I know working for TI still remains soul-crushing.

In the early to middle 1980’s, TI was the 3rd largest computer manufacturer.

Awesome.

Now explain Lucent, where she walked away with a $100 million dollar payout just before the company went bankrupt.

I can see it now- The GOP runs ads praising her as a great visionary at HP, describing how she fought against an entrenched bureaucracy in the form of HP’s board. Democrats eviscerate her candidacy by telling voters who don’t care about HP how she connived to stuff her pockets at Lucent, jumping ship just before it all collapsed.

And the stupid party will lose, again.

Great post Jimmy P; valuable information about a potential president.