Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The April Jobs Report: Is That All There is to This Economic Recovery?

The April Jobs Report: Is That All There is to This Economic Recovery?

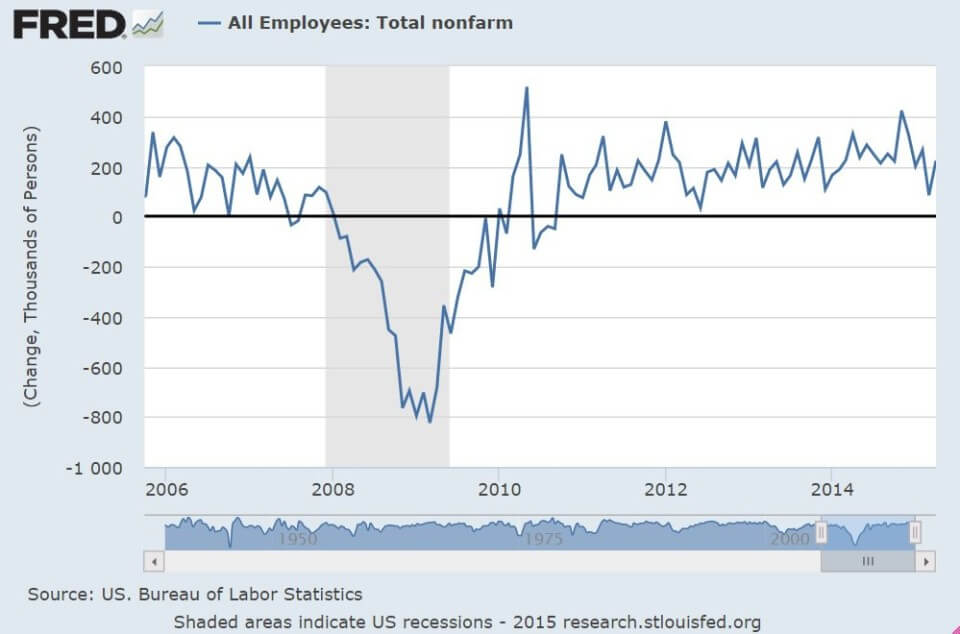

So, a decent snapback in the US labor market. Net new jobs increased by 223,000 in April — matching the consensus forecast –while the unemployment rate fell by 0.1 percentage point to 5.4%, according to the Bureau of Labor Statistics. Labor force participation ticked up, making that jobless rate improvement look a bit stronger. The U-6 underemployment rate edged lower. Also, some more progress in the long-term jobless numbers.

Not so decent: The employment rate went nowhere. The March jobs number was revised lower from 126,000 to 85,000. Over the past three months, job gains have averaged 191,000 per month vs. 260,000 monthly in 2014. And, once again, weak wages: The broadest measure of average hourly earnings was up 0.1%, leaving average hourly earnings up 2.2% over the past year. Average hourly earnings for production and non-supervisory workers were up 0.1% and 1.9% year over year. (Double that rate would be nice.) What’s more, the US may still have a 3-6 million “jobs gap.”

Like I said, decent but not dynamic. And hardly the year of economic acceleration many were predicting/hoping heading into 2015. But the numbers do greatly reduce fears that weak first-quarter GDP — which may have been down nearly 1% — is an omen of darker things to come.

It’s also worth noting the growing skepticism about the predictive powers of the GDP report, as it relates to jobs. In a recent note, JPMorgan economist Jesse Edgerton point out that since the early 2000s, “GDP’s ability to forecast payrolls growth has dropped dramatically. In the last 10 years of data (excluding the recession), first print GDP growth is actually slightly negatively correlated with payroll growth in the next quarter. … [And where] GDP was once better than payrolls at forecasting next quarter’s change in the unemployment rate, GDP’s forecasting power has dropped essentially to zero in recent years. … Payrolls, private domestic final purchases, and overyear-ago GDP growth all perform better in real time. With these indicators less weak, we remain comfortable with our forecast for a tightening labor market.”

Maybe so, but the “new normal”/“average is over” economy of so-so GDP growth (shaping up to be another 2%ish year), OK job growth, and stagnant wages continues. Of course, maybe we are getting the GDP numbers all wrong and growth/productivity are stronger than they appear. Then things are even weirder. Even so, policymakers should be focused on pro-growth policies from taxes to regulation to immigration to education to infrastructure to income support. Faster, please …

Published in Economics

Actually, the REAL story is this:

FULL TIME EMPLOYMENT DECLINED BY 252,000 IN APRIL!

Whenever we are talking about the health of the economy, my go-to number is “Employed-Usually Work Full Time.” Full time jobs are the kind of jobs that give an employee the opportunity to build a life around. Part time employment, not so much. This number comes from the Household Survey. The Household Survey is the same data set used to calculate the official Unemployment Rate. So the data is unimpeachable. Today’s report shows that Full Time Employment declined from a level of 121,024,000 in March to 120,772,000 in April. A loss of 252,000 Full Time jobs. (You can easily find this number yourself at the user friendly St. Louis Fed’s FRED site. Look for data series LNS12500000)

A bit of history. Full Time employment peaked in November 2007 at a level of 121,875.000. That’s right. The economy has yet to generate the number of Full Time jobs that we last saw over seven years ago. Currently, we are over 1.1 Million jobs short of where we were in November 2007!!! And this is without trying to adjust for the additional population growth of over 17 Million since November 2007.

Six full years of the Obama economy with trillions of dollars in additional debt and we are still short over one million full time jobs. Wondering about the decling median income in America? Look no further.