Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Is optimism realistic?

Is optimism realistic?

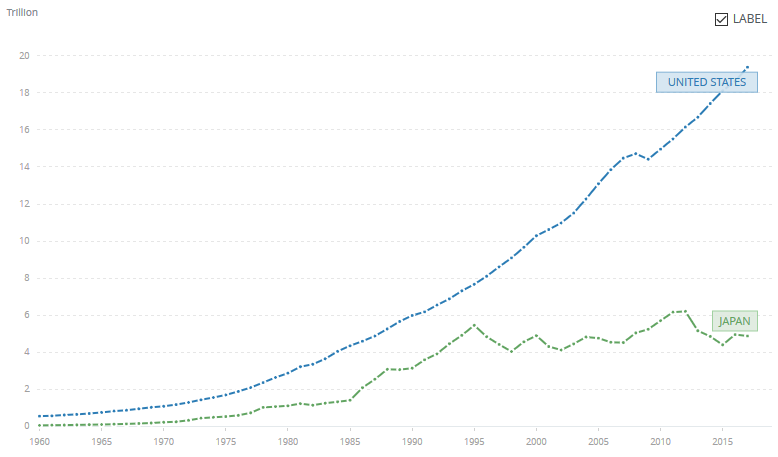

From the 1935 to 1975, Will and Ariel Durant published 11 large volumes on “The Story of Civilization”. Over many of these books they recounted the rise and fall of societies or civilizations. Again and again, the decline and fall of a society had two major components: (1) financial failure and (2) social failure. If we look at the current financial state of the USA, the key measurement is here:

This debt level would put us in range for hyper-inflation and a currency collapse if we follow past trends. To be sure, we have been able — so far — to kick that can down the road. But how far can we go? Historically speaking, we are well along the “Durant scale” for fiscal collapse.

The other failure component Durant noted in many societal failures was the erosion of what made the society grow in the first place. In 1968, as the major book series was wrapping up, the Durants wrote a short book “The Lessons of History,” where they summarized what they had learned writing the history of many societies over many years.

Was Durant a perfect forecaster? No. For example, he thought that by now the US would be largely Roman Catholic because he assumed the Catholic birth rate would dominate the US population. (He didn’t foresee massive immigration, for example.) But I think he had some interesting (and even eerily prescient) views on how societies rot from within.

Here is one short quote from The Lessons of History:

And another:

To me, these passages remind me A LOT of where we are socially.

This is why I do not share the optimistic view of the future.

Published in Culture

That looks all the world to me like an exponential curve. If you plot it on a log scale, it will be a straight line.

And more specifically (checking…) yep, it doubles every 10 years.

Exponential curves are a “fingerprint” of one very specific process; positive feedback. For every increase in the value, the rate increases. Like compound interest. Like Moore’s Law.

Which means Congress, which controls the budget, has this mechanism where every time it increases spending, that causes the rate of spending to increase.

And that will keep on going like this until the process changes.

Which means the solution involves changing the way Congress operates.

I think Donald Trump understands this, and that it’s entirely possible he will push Congress into adopting a mechanism that substantially reduces spending instead of exponentially increasing spending.

Solutions could include:

And that’s just scratching the surface.

Optimism is necessary. Fortunately I think it is realistic. The positives are big: technology is advancing apace again, billions are less poor (or dead) than they once would have been, and resistance to the narrative is spreading. The negatives – well, our ‘elites’ are so awful surely they can’t last. Unless, of course, they succeed in suppressing progress and optimism.

Question: How does this compare to other nations? Is the US debt effectively relative to other nations, and it’s not that bad compared to the others? I dunno. The obvious Wikipedia page seems wildly incorrect.

Fire their asses and sell the buildings.

Not to be flip – I think it doesn’t matter what the neighbors do. It’s our house whose roof is leaking. Badly. But I also think it’s awful everywhere. Symptoms vary – in the US it’s welfare, agriculture and medical malfeasance. In Europe I think it’s nonenergy, non energy, non energy and more not energy.

All of that is necessary but isn’t sufficient. Congress will NEVER adopt these measures. They get elected by buying off voters with ever more grandiose promises of “free” stuff. Spending is the source of their power. It’s a straight quid pro quo. And it won’t stop until the eventual financial collapse arrives.

Unless…there is a near miraculous change of heart among the electorate.

The Ruling Class has been awful since World War II.

` Inflationism grows debt and government. They don’t even measure inflation even close to what it really is. Then the system gets reliant on almost indiscriminate, credit growth, otherwise known as debt growth. The social problems increase because it can’t be managed. So then, all of the tech Giants donate to the Democrat party to manage the social problems which doesn’t happen. Gated community socialists.

Everything the economy does in particular: automation, computers, AI, and globalized labor markets creates massive deflation. So they create inflation anyway.

The Fed should have switched to a deflationary posture the second the Soviet Union fell. We should have gotten the unfunded liabilities in order. Now it’s too late.

Government Is How We Steal From Each Other™

The Ludwig von Mises Institute Is Right About Everything™

Sixty percent live paycheck to paycheck. 60%.

Trillions in unfunded liabilities.

Pure genius.

You have inflation (compounding), productivity (compounding), and population (usually compounding). That is why it is better to show debt as % of GDP. Still a scary trend.

Yes, the voters are the problem. Politicians should try to educate voters, but 80% of politicians like not making hard choices and don’t want to educate the voters. Eventually, the voters will get it good and hard.

All is revealed here:

http://financialrepressionauthority.com/2017/07/26/the-roundtable-insight-george-bragues-on-how-the-financial-markets-are-influenced-by-politics/

This is a whole page and a half. I would say government interferes with most of this and most people agree that it’s all a good idea.

https://mises.org/mises-wire/were-living-age-capital-consumption

I think these unmoored generation seems to fit our culture, but I don’t think it is caused by debt or inequality. It seems to a problem of Leftism (anti-religion) and too much largess (people expect free stuff from other tax payers). It might just be phase.

What is not a phase is inequality. We have a global economy. If we look back at the economy as global, American workers were very prosperous in the 1950’s (dominated global manufacturing). As the rest of world has re-industrialized and corporations have globalized, there has been prosperity for people in the world and less for Americans. That cannot be undone. Corporate leaders have become more prosperous as the scale of global corporations has increased, which is natural. American workers will be poorer compared with ruling class.

When is debt too much? Japan has very high debt/GDP ratio and has seen stagnation the last 30 years. That might be partly because of population stagnation or because of measurement, but I don’t see how the US escapes this fate going forward.

Japan has very high debt/GDP ratio and has seen stagnation the last 30 years. That might be partly because of population stagnation or because of measurement, but I don’t see how the US escapes this fate going forward.

I think the big wall facing the US is the Baby Boomers retiring. The post WW2 baby boom was a global phenomenon that ended with the rollout of hormonal birth control. The global economy is in the midst of a great retirement of all the Baby Boom workers that are switching from maximum earners and savers to retired dis-savers. That means there will be a *lot* less money for governments to borrow. That means either interest rates go way up (positive feedback on debt) raising the cost of capital and lowering growth or, the debt is monetized bring out huge inflation with the wage stagnation (stagflation). That will continue until the Boomers all die. In the meantime the next generation of workers is forever screwed.

You can do all of this a lot better under deflation.

Nobody wants to think that the money THEY get is the problem. The money other people get is the problem.

Everybody has to take a bit of a hit …and soon… or we will all take a huge hit later.

I haven’t actually heard members of Congress promising much in the way of free stuff lately.

They’re not bothering to do that anymore. It’s old school. Lowered expectations and all.

Much of the spending now just goes directly to pure waste; climate change, Ukraine, funding illegal aliens, virology labs in China, …

One of the major mechanisms is the way government agencies are operated, without any mechanism of improvement such as performance criteria, audits, a “report card”, or course correction.

So it ends up working like this:

This is very similar to the way the Soviet economy failed.

But it’s worse here because there’s technically no limit to how sucky a job you can do.

Sometimes the agency does such sucky job that it makes the problem much, much worse. Mayorkas’ DHS, for example, is literally paying people to come in illegally.

The USSR was a command economy lacking the information provided by prices. A flaw the Red Chinese identified and evolved to avoid.

Making is more difficult to fire a government employee than to hire one.

Being the global reserve currency, the Dollar is driving the financial systems of most countries, and they’re sort of forced to follow the US fiscal lead. Any inflationary crisis will come to the US last.

Yep.

There are attacks on that front: Petrodollar loses force

That would be wonderful, but I’ve never heard Trump mention cutting anything.

The way to do this is to go into constant deflation.

Basically everything we do creates deflation, except for the Fed. Globalized labor markets, automation, computers, AI, etc. As long as the government isn’t involved, the prices usually go down.

True, but Wilson’s and FDR’s cohorts were no better.

I know, but I’m talking about ***all*** of them, not just the jerks with direct government power.

Wilson made his progressive bones as an academic POS. That implies the academy was corrupt well before he was elected.

Wilson, FDR, and LBJ created a ton of permanent destruction.

I can’t understand how Wilson was such a racist while being a nominal minister. What a creep.

FDR screwed over a lot of Jews for reasons I don’t fully understand. He wouldn’t even let 40,000 of them land in Haiti even though the president of Haiti wanted them. What was the big deal?