Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

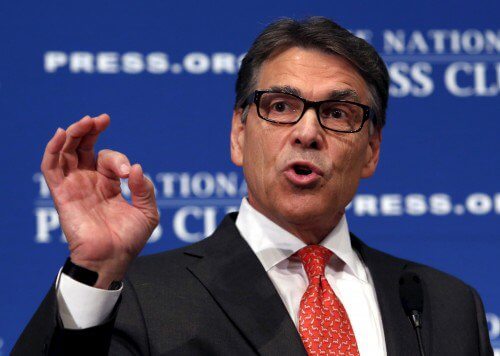

On Rick Perry’s Plan to Reform Wall Street

On Rick Perry’s Plan to Reform Wall Street

Rick Perry has a financial reform agenda (via The Hill):

Rick Perry has a financial reform agenda (via The Hill):

Former Texas Governor Rick Perry is taking a position to Hillary Clinton’s left on financial reform, and pushing for a policy to break up big banks staunchly advocated by Sen. Elizabeth Warren (D-Mass.). The GOP presidential candidate laid out his vision for Wall Street reform in a speech Wednesday. And among his policy proposals, Perry apparently advocated for the return of the Glass-Steagall Act, which established a firewall between traditional commercial banking and investment banking. … In remarks delivered in New York, Perry did not mention Glass-Steagall by name, but floated among several policy proposals one that is practically identical. … Perry also floated an alternate idea of requiring large banks to hold additional capital as a cushion, but the idea of cleanly separating commercial and investment banking was a signature provision of Glass-Steagall.

Perry also called on Congress to wind down housing giants Fannie Mae and Freddie Mac, but did not detail a process for doing so. There is bipartisan agreement that the current housing finance system, in which Fannie and Freddie guarantee the vast majority of new mortgages, is unsustainable, but coming up with a new system has been a significant challenge. … In the meantime, Perry said the two government-sponsored enterprises should be placed under stricter rules regarding the types of mortgages they can back, while encouraging private entities to adopt a bigger role in the marketplace. He also pushed for changes to the Consumer Financial Protection Bureau long favored by Republicans, including bringing its budget under congressional control and reworking its leadership structure.

It would be great if all the GOP 2016ers developed meaningful plans. Not only do we want to avoid future crises and bailouts, but also to purge the cronyism from the American political economy. Now I’ve written about the merits of larger capital cushions and banks funding themselves more through equity than debt. Indeed, the WaPo’s Max Ehrenfreund mentioned my work in his piece on the Perry proposal. Certainly, the Glass Steagall stuff is the eye catcher. Some thoughts on that:

It’s hardly obvious the Glass-Steagall repeal was to blame for the [Financial Crisis.] Certainly a direct causal link is tough to find. Both Bear Stearns and Lehman Brothers were investment banks that failed, while JP Morgan — both a commercial and investment bank — weathered the storm. And if Glass-Steagall’s mandated separation between commercial and investment banking still existed, the big commercial banks couldn’t have absorbed Bear and Merrill Lynch — nor could Goldman Sachs and Morgan Stanley have converted themselves to bank holding companies. But Glass-Steagall’s demise was hardly a non-event. As financial reporter Charles Gasparino has argued, when financial giants such as JP Morgan and Bank of America became oversized financial supermarkets, it nudged investment banks such as Bear, Lehman, Morgan Stanley, and Goldman Sachs to take bigger risks to compete. Economist Luigi Zingales thinks Glass-Steagall helped restrain Wall Street’s political power by giving commercial banks, investment banks, and insurers competing policy agendas. “But after the restrictions ended,” Zingales wrote in the Financial Times, “the interests of all the major players were aligned.” So when the financial crisis hit, Washington got the same collective, pro-bailout message from Manhattan. The megabanks spoke with one voice.

Anyways, here is the Perry campaign fact sheet.

Published in Economics

I t doesn’t matter what Rick Perry’s economic plans are. He may present well to a conference from a report written by incredibly thoughtful conservative advisors, but in a debate setting he is inarticulate, and we can’t afford to have an inarticulate person as our Presidential candidate. Hillary would destroy him in front of America.

I only have an undergraduate degree in economics, so the only way I know for the Fed to affect long-term rates is by buying and selling long-term assets. The Fed wasn’t buying assets during the mid-2000 tightening, so I don’t see how it could be responsible for the inverted curve. Moreover, it wanted mortgage rates to rise and take the air out of the “froth” in the housing market, but couldn’t make it happen.

It seems likely the curve will invert again whenever the Fed finally decides to raise short rates, unless the Fed starts to sell the mound of assets its collected during the QEs. This would depress financial asset prices generally (as it should, given the increase in the effective discount rate). I don’t think the Fed has the guts to try this until it will have catastrophic consequences.

The market was clearly telling the Fed that the Fed was wrong.

ShellGamer, congratulations on your college degree.

I am, after all, and first, a writer of fiction!

BTW I did test my hypothesis and I did find a few smaller deals of the type I described (post 2008 Bank Holding Co IPOs) but the two biggest had no significant investment banking operations (Discover and Ally.) Primerica went public – interesting. The rest were smaller regional banks and they don’t support my assumptions. The big guys (Goldman, Morgan, etc.) were already public. There was a lot of movement in those heady days beforethe S&L debacle and GS’s repeal – banks buying banks, broker-dealers and investment management firms. I was out of the corporate finance business in those days, running a private business so Wall St was not a part of my world. I missed the action in all those years after GS was repealed. I did write something once in support of its repeal, convinced as I was of the fact that traditional banking, as designed in the thirties, was doomed by technology.