Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

A Trisagion for Europe

A Trisagion for Europe

I invite the community to pause and consider what the weekend ahead may mean for Europe as a concept.

I invite the community to pause and consider what the weekend ahead may mean for Europe as a concept.

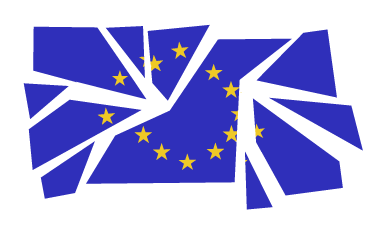

Though their prime minister insists otherwise, this weekend the Greek people will vote on whether the mid-range future of Greece is as part of the European currency union or if Greece will begin moving toward a messy, painful withdrawal or expulsion from the Euro. If Greece leaves the Euro, it will mark the first significant setback in the process of European integration in a generation, and arguably the most serious blow to Europe as a unifying idea since the descent of the Iron Curtain following World War II.

We tend to take the concept of Europe for granted, but it is a much newer, much more important idea than many of us realize. Europe as a landmass has existed since the disintegration of Laurasia, and has been occupied by humans for 50 millennia, but it has only come to be widely viewed as a united and stable peacetime political entity in the past hundred years. In times of external threat – Tours, the Crusades, Lepanto, Vienna – rhetoric for the defense of Europe as a whole would swell; absent that, Europe was defined not by its unity, but by its bitter and bloody differences.

It was only in the wake of the most bitter and bloody manifestation of those differences that Europe truly came to realize that Europe existed. With all due respect to Victor Hugo and other early dreamers, it took the near annihilation of Europe in the early 20th century for the broad mass of Europeans to appreciate the need to cultivate the idea of Europe in peacetime and strive toward the goal of a self-aware, integrated Europe, one that would never again be a threat to itself or the world.

With an often forgotten, but critical assist from the twin pillars of global stability – American might and American cash – the postwar European project has unquestionably been one of the great achievements in the history of humankind. The per capita GDP of Western and Central Europe has more than tripled since 1950. For centuries, every period of substantive economic growth in Europe was strangled by the near-immediate descent into war. For the first time since the Third Century, Europe has known both lasting prosperity and real peace, and it has forever changed how Europeans live and how they think of the role of Europe in their lives.

This transformative period of prosperity and peace has been accompanied by a constant deepening of the economic and political ties among what were once perpetually warring states. Through the Cold War, the reunification of Germany, the resurrection of Eastern Europe, and the challenges to European identity of the early 21st century, the march toward ever-tighter union has been the imperative of European politics that has kept the Continent rich and quiet through difficult times.

But this weekend, we may see a violent blow to European unity struck right in the ancestral birthplace of Western Civilization. I am not suggesting that by Monday morning, Germany will have retaken the Sudetenland or even that much will immediately change in the day-to-day lives of Europeans not directly invested in the Greek economy.

But if this weekend proves to be the high-water mark for European integration, and if the loss of Greece for the Euro begins the steady unraveling of hard-fought battles for the idea of Europe as something unique, uniting, and worthy of sacrifice and defense, the future of Europe may look alarmingly like its past.

Published in General

I am sympathetic to what you’re saying, Danny. No one stormed the beach at Normandy thinking, “I’m here risking my life to guarantee that one day there are bureaucrats that can dictate the proper degree of bendiness for bananas across the entire continent of Europe.”

But America’s role in the post-war European project is not best understood through the prism of the Second World War proper. In the same way the First World War left Europe bitterly divided and poised for a second descent into existential madness, the U.S. could easily have walked away from Europe after 1945 and left its peoples to pick through the rubble. But the U.S. stayed.

That — the decision to stay — is what set Europe on the path it has followed since and, with the occasional side trip to Asia, it has been the principal foreign policy project of the United States since our grandfathers came home after the war. I would argue that the army of American diplomats and business people that stormed Europe after our grandfather’s generation liberated it have quietly and profitably kept our generation from having to retake the same ground our grandfathers won at so high a price.

Like I said in my post, tanks won’t roll based on this weekend’s vote. But for those of us who remember what a divided Europe is capable of, anything that suggests a turning of the tide is ominous, indeed.

For my money, the move to the Euro was premature. It would have been a good idea at some point, but as with so many things in Europe, the timing was wrong. A slower, more cautious pace would have prevented weekends like this one.

You raise a fascinating, but in my mind separate, question: how do you maintain a genuine identity and independence for the nations of Europe while still furthering the interests of Europe, collectively?

Unlike many, I don’t see European identity and national identity as mutually exclusive, but rather as mutually reinforcing, if the balance between the two is struck correctly. However, finding that balance is intensely difficult.

#31 Carthago

I understand, appreciate, and in fact anticipated what you say. And indeed, what you say is true.

But we’re talking past each other.

What *I’m* saying is that Europe ran away from its postwar/post-Holocaust moral reckoning. In the early stages of postwar recovery (and of girding the collective European loin for the stresses of the Cold War), I recognize that priorities (including for US governments of the period) were realistically elsewhere and otherwise.

But that situation and those exigencies have long ceased to obtain. Meaning the moral reckoning is long overdue.

What Europe has chosen to do during the past twenty or so years, however, amounts to something close to a moral (and accordingly) policy inversion — certainly it amounts to a moral *per*version. It’s not that lessons have not been learned, nor that the illustrative material for the lessons is not ready to hand. Rather, there has been an active refusal to learn the lessons, coupled with an arrogant assumption of a moral role to which Europe has no legitimate claim.

So we Jews get this:

http://www.timesofisrael.com/unhrc-endorses-gaza-report-with-european-support/

A travesty enabled by antics detailed here:

http://www.ngo-monitor.org/

And then there’s that tiny matter of a Europe so besotted with Iran that it is prepared to look the other way at another Holocaust in the planning.

A divided Europe is not capable of anything worse than what a united Europe is.

One more, then I’m caught up.

Remember: Greece is financially shattered. Greece is not a few savvy decisions and a well-structured bailout away from being the Hong Kong of the eastern Mediterranean. Even if Greece agrees to all of Europe’s demands and Europe responds with mountains of cash, we are still talking about a country that will languish on fiscal life support for years to come.

Europe has a financial incentive to stabilize Greece, but no other player stands to gain economically from engaging with Athens. If there are gains to be had, they will be strictly political and they will come at great cost. No one is going to take on Greece as a very expensive client unless the political benefits are large, soon, and certain.

Also remember: Europe gets first bite at the apple. Because of the role of the Euro and because Europeans are Greece’s primary creditors, no other player can swoop in while Europe is in a position to dictate terms. It would only be after Europe decisively turns its backs on Greece that another player could really enter the game and by then Europe will have reckoned with much of the political fallout to follow.

So if no one but Europe could benefit financially from bailing out Greece and if the political benefits of supplanting Europe as Greece’s lifeline are delayed, limited, and uncertain because of the role Europe plays in this tragedy, you have to ask . . .

Who would bother?

Carthago and Claire,

It is with no glee whatsoever that I observe this unravelling of Europe. For 15 years I have been closely observing this situation from California, and much appreciate Claire’s on-the-ground opinion. Regarding European unification, you can’t just try to do something, you have to do it carefully and honestly. You should get the consent of the governed. You should be humble and have realistic ambitions. You should be the servant of the governed rather than being sure you know best and shoving this disaster down the throats of the people. You have to realize when its not working and be prepared with a plan B. The class of leaders in Europe has not been even close to up to the job. There are many take-aways from this situation that validate a conservative’s world view, and I think that is what you seeing rather than glee.

I certainly cannot really feel superior, can I, hailing from Obama’s USA and California? And when the creepy finance minister finishes his romp through Europe, the University of Texas will no doubt welcome him back into their economics department where he can resume teaching anarcho-Marxism.

It has been awhile since I’ve been to France and Germany, but are we still worried about the two going to war again? It seemed unimaginable a few years ago.

I’m no economist. I happen to live on the periphery. My modest understanding is that low interest rates that suited the centre drove uncontrolled growth throughout the eurozone and that countries that didn’t have the underlying fundamentals to handle the growth blew up. In Ireland there was a property boom which generated huge transactional taxes which generated massive current spending increases which became unsustainable when the property market collapsed which has left us in a dreadful state. We do seem to be turning a corner but based on austerity rather than Greek-style gamesmanship. We’ll see who took the better approach soon enough.

Your perspective on Europe takes us down a dangerous road that most people — even on a website like this one — may find hard to walk. Not because you’re wrong, but rather because if you’re right, it’s terrifying. Introducing an element of Apocalyptic judgment to the calculus not only dooms modern Europe, it dooms modern man. Here’s hoping our merciful God is patient with humanity just a little longer.

It invites an interesting question. If Europe could be persuaded of the need for continental atonement, what would be a proper approach to take to the moral rehabilitation of Europe? If tomorrow the leaders of Europe set aside the cause of political and economic integration as their animating principle and embarked instead on a program of European spiritual hygiene, where would they begin?

No. I have absolutely no worry about that scenario. France is a nuclear power. Germany will not dig trenches, mobilize troops, and invade France. The future won’t exactly reprise the past. But there are other ways for the idea of Europe, flawed though it’s been, to break down. One obvious way (certainly not the only one) is through the rise of what are effectively pro-Putin political parties. That’s not all they are, but it’s an aspect of these parties that makes them alarming.

Next-up as a worry: Consider the implications of what I wrote. France won’t ever again be invaded by conventional arms. Why? Because it has an independent nuclear deterrent. If we keep seeing the invasion and occupation of countries on Europe’s periphery with no vigorous response from NATO (no less the EU), what incentives does that create? QED.

#36 Retail Lawyer:

I’m with ya.

In much the same way Americans can cherish their country’s founding principles, but in the next breath denounce the whole American experiment as going to Hell in a handbasket, we need to make a distinction between the idea of Europe and the lunatic kleptocrats minding the store over there.

In other places I have argued vociferously that Europe has made the classic technocratic blunder of putting the government cart before the cultural horse. There is still enormous work that needs to be done building a shared European ethos and that ethos must precede more formal arrangements if those arrangements are to prove enduring. European leadership has repeatedly pushed for structure before culture to ruinous effect.

But denouncing in full throat the way the European project has been pursued is entirely different than rejecting the project itself. Reform, even painful reform, is necessary. But it must be undertaken for the benefit of Europe, not at its expense.

I used to live over there, but I’ve been stateside for years; I can’t report on troop movements near the Franco-German frontier any better than you can. But my guess is, if you march to the sound of the guns, you’ll be marching well east of the Rhine.

#37 Charles Mark

I love Ireland. I nearly froze to death one night in Galway many years ago. A local cab driver showed me how to break into a city bus to use as an emergency shelter, but with the strong recommendation that I be gone before the sun came up. My suite for the evening:

You’re right; interest rates better suited to the core overheated the economies on the periphery of the Eurozone, leading to a dramatic boom, followed by a hard crash. But it does not necessarily follow from the rockiness of the ride that it wasn’t a trip worth taking.

Consider:

In 2000, Irish GDP per capita was $26,001 (U.S. Dollars). If the Irish economy had grown at a robust (by European standards) 3% per year steadily across all 15 years with no recession at all, 2014 GDP per capita would have been a handsome $40,509.

But as it turns out, GDP per capita in Ireland stands at a far handsomer $53,317 and is growing modestly.

If given the choice between a slow and steady climb to $40,509 or a rollercoaster ride to $53,317, which would you take?

This is a point that is not made nearly enough.

If Greece is bailed out now, then a: that’s a near bottomless money pit in itself and b: every other nation will be told that there is no limit on how badly they can behave. In this currency unit, it may be wise to kill a country from time to time to encourage the others.

It would probably be cheaper to rescue Greece in a few years’ time, after the union contracts had broken down, and bankruptcy forced a lot of the fraud off the books. There is a complex and powerful system well designed to suck money out of Germany in place right now. Cut off the funds and you break that machine, which may make rebuilding the country more effective.

Greece currently exports a surprising amount of extremism, or at least it used to. When I was slightly involved in communist politics in the 1990s in the UK, it was Greeks who formed the hardest of hardline factions. When my brother was involved in the Stop The War Coalition a decade back (he headed the largest group at what was, briefly, the largest march in history), he found that the Greek radicals were the chief stumbling block to practical politics. I’m told that they perform a similar function elsewhere.

I don’t think that that’ll get much worse if they’re cut off. Refugees passing through Greece would probably be easier to turn back at the land borders than to keep out of Greece. There would be some horror stories, but a brief period as a failed state doesn’t seem like the worst possible outcome for Greece (it’s not the best, either; the best outcome would be for them to come back from the brink, accept austerity, and grow up).

What terrible outcome do you fear from it? You’re not going to get a lot of Islamic terrorism there (Greece is the world’s most Christian state unless you count Pitcairn or the Vatican). They don’t have anything in common with the Norks. They’ll politically support the Russians for a while, but they’ll do that no matter what the outcome.

I’m not saying that it wouldn’t be catastrophically awful, but I don’t understand why it would be.

James Of England

Carthago:

If given the choice between a slow and steady climb to $40,509 or a rollercoaster ride to $53,317, which would you take?

This is a point that is not made nearly enough.

It’s a fair point as far as it goes. But I wonder whether the GDP figures reflect the enormous levels of personal debt afflicting so many people who bought their homes and/or invested in property during the boom? So many hard-working citizens who find themselves waiting for the letter from one of our loathed banks calling for repossession of their home. Or those who have decent earnings but are caught between high tax rates and punitive mortgage repayments leaving little or no scope for the type of discretionary spending that helps drive the economy. People like this tend to struggle in silence, unlike our Syriza-like types who rage against any reduction in benefits, including those brought in during boom-times all the while claiming that the higher -earners “got away scot-free”.

By the away, my preference right now would be to join an Anglophone Alliance.

It’s true that all economic statistics at that level of abstraction fail to tell the stories of those who are suffering, but the Central bank of Ireland thinks that Household Net Worth has been going up, albeit not as fast as economic growth (because debt really is a thing).

There’s been a lot purchased with the debt, though; to me, at least, Ireland seems a pleasant a place to spend time. Ireland’s place in the global life expectancy tables and other quality of life indexes shot up. People are more educated and gained experience at the cutting edge of the international markets.

The social policy side hasn’t worked out as well, but the economic stuff seems mostly good to my poorly informed eye.

Carthago

#37 Charles Mark

I love Ireland. I nearly froze to death one night in Galway many years ago. A local cab driver showed me how to break into a city bus to use as an emergency shelter, but with the strong recommendation that I be gone before the sun came up. My suite for the evening:

CB – A Bus, a Bed

Hi Carthago, As it happens I’m due to stay in Galway on Tuesday night but due to the massive number of American and British tourists enjoying the weak euro I’m having trouble getting accommodation. I might end up in similar quarters yet!

#43. James of England

I am entirely with you, James, if we confine ourselves to thinking about this moment in isolation.

But, as a guy who spends too much of his time with his nose in history books, I tend not to see Greece’s troubles (or much of anything . . .) as an isolated issue in need of a careful solution, but as a potential inflection point in the broader post-War European story. The history buff in me tells the economist in me to shut up about interest rates for a second and look for the bigger story. And I worry that the bigger story — in the jargon of the economist in me — is that we’re watching the sign of the second derivative change in the arc of modern European history.

“The Sign of the Second Derivative”. Sounds occult. Could be the title of a satirical novel about how attorneys at the IRS have secretly turned to ancient rites of divination to determine what the unreadable U.S. tax code says.

I tend not to see Greece’s troubles (or much of anything . . .) as an isolated issue in need of a careful solution, but as a potential inflection point in the broader post-War European story.

#44. Charles Mark

An excellent point. What good is income if it all goes to debt service? However . . .

According to the Central Bank of Ireland, per capita household debt in Ireland stood at €35,694 in Q4 2014, or $39,670 American.

What does it cost to service all that? For a very rough proxy, I did the math for if I walked into my local bank and set up a 60-month uncollateralized personal loan for the full $39,670. Obviously, that’s exceedingly rough, but on balance, an uncollateralized personal loan is going to be on harsher terms than overall household debt.

Cost to service my loan at prevailing rates? $10,438 per year.

Did average income go up by more than that? Yesterday, our rough numbers suggested the rollercoaster ride got us to $53,317, where a slow-and-steady approach would have yielded just $40,509. That puts the average Irish citizen $2,460 per year in the black . . . and you get to keep all the stuff you bought.

Now, even if these half-crazy, back-of-an-envelope figures are enough to show the Irish are better off, as a nation, even wildly in debt, it doesn’t change the fact that many individual Irish people may be nowhere near the average and I would argue there is a high moral burden on Ireland as a whole to tend to the victims of excess.

But on balance, Ireland’s still in the clover.

#46. Charles Mark

Well then, allow me to fill you in on that ancient cabbie wisdom (the cabbie was ancient; not so much the wisdom).

Assuming Galway has the same city buses they did almost twenty years ago (gosh . . .), if you give a quick, hard push to the extreme lower right of the main entry door up by the driver, it triggers a mechanism that overrides the lock and allows you to easily open the door. According to the cabbie, it’s a safety feature so firefighters and ambulance personnel can quickly force the doors open if one of the buses is in an accident.

Enjoy!

I agree that it’s important to look at the bigger picture, but that’s why I feel like Greece being cut off (and properly cut off; expulsion from the EU), would be helpful, since it would induce greater responsibility from other countries with a potentially Greek future. Also, it would mean that those of us with family in the UK, France, and Ireland would no longer be ruled by a partly Greek government; it’s not like these guys are only incompetent and corrupt domestically.

You may well be right, James. Sometimes, you have to shoot a hostage to show the other side you’re serious. Maybe the time has come to put a bullet in the Greek economy.

Or maybe it’s past time. Had the Eurozone responded to the initial crisis by shoving the Greeks into the Aegean, it would have sent a powerful message to the world that the Euro will remain unimpeachably sound and thus unquestionably safe. Prioritizing the Euro itself about the constituent nations of the Euro may have been and might still be the only long-term answer.

But we also need a short-term answer. Without a strategically and fiscally sound short-term answer, the Euro won’t be around for a long-term answer. And I’m not smart enough to reconcile the two.

Any ideas?

The short term survival of the Euro always depended on the Greeks not taking a bunch of countries with them; Greece in itself is pretty trivial. If the Greeks continue to spin out into ever greater heights of rhetorical and financial excess, they’ll make it harder for would be sympathizers in the rest of Europe to support them. A Greece with a lot of social pull leaving the Euro would be a short term existential threat. A Greece with a little social pull with Cyprus but with no other friends can leave the Eurozone and give the market a headache, set a precedent that makes life harder for other struggling countries, but isn’t going to unravel anything this year or the next. Other countries will have to demonstrate their non-hellenicity, but the Greeks are making that ever easier with each passing day.

One super helpful thing is Tspiras constantly emphasizing that he’s a master of game theory; i.e. that he’s not negotiating in good faith. Apparently this plays well in Greece, but it makes it a lot easier to turn him down than if he was simply earnestly asking for support for the victims of the crisis, and that helps isolate the problem.