Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Unraveling

The Unraveling

Day One:

The grocery carts stopped moving, as all the customers listened in on the din from the front of the store. A young mother with three young children was furiously yelling at the check-out clerk. Apparently, the uproar occurred as the clerk would not allow the woman to take her groceries until her debit card was approved or another form of payment was provided. The young woman continued the commotion by shouting that there was money in her account and she needed the milk and food for her babies.

The same situation occurred at the same time down the block, across town, and throughout the entire country. Widespread complaints of customers to store clerks echoed throughout retailers nationwide.

Within only a few hours, freight trucking companies called back tens of thousands of long-haul and short distance delivery trucks, not allowing supplies to be delivered to supermarkets, retailers, restaurants, gas stations, hospitals, etc.

Day Two:

As supply chains break down, restaurants without reserves of food decide to close and retail stores shuttered. Utilities start having problems delivering water, power, and electricity to their customers. The States immediately announce “temporary” widespread electricity, water, and gas rations and subsidized public utilities.

Rumors on social media, television, and radio all referred to a collapse of the U.S. monetary system. Block-long lines formed outside local banks. People tried to withdraw their money, but banks cannot meet their deposits and run out of cash immediately.

Day Three:

Civil disobedience, looting and crime began in every metropolitan area. Gasoline supplies dried up and the airlines grounded their fleets. Public transportation was ‘temporarily suspended’ while truckers became stuck on the sides of highways with the last of their remaining products, but no ability to sell them. Some of them fall victim to random assaults and theft. Civil breakdown spread from the inner cities to the suburbs. Law enforcement could only standby and watch.

…and that was just the beginning.

Pulp Fiction, right? Except, in September of 2008, the greatest economy in the world, the United States of America, found itself 10 days away from the above events actually occurring.

Claire Berlinski responded to a comment of mine and requested further explanation on Larry Kudlows post “Will Anyone Defend Banks,” where I mentioned how there are still some really bad players in the banking industry, some five years after Frank-Dodd was supposed to have fixed it all.

Most people understand why the crisis occurred. I called it the unholy trifecta:

- The financial industry (read Wall Street) lobbied Congress in the 90′s through Robert Rubin and Sandy Weil to repeal the Glass-Steagall Act: a Depression era law created to prevent another economic collapse seen in 1929 by seperating investment banks and commercial (main street) banks.

- In response to the dot-com crash and subsequent attacks on 9-11, former FRB Chairman Alan Greenspan dramatically lowered interest rates to send a message to world that America was still a safe bet.

- Congress (in their infinite wisdom) felt that every American should own a home. They encouraged Fannie Mae and Freddie Mac to start buying up conventional and subprime mortgages, thereby allowing banks to make risky loans.

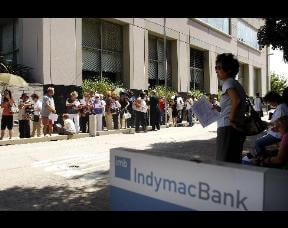

Not the Depression – Lines of customers at IndyMac Bank unsuccessfully trying to withdraw their money

In Spring of 2008 the house of cards started to collapse as we saw the end of Bear Stearns. Six months later, the economy fell into complete crisis. Most people — while they knew things were going from bad to worse –were not fully aware of how close the U.S. to the precipice.

While the media were focused on horse race politics (aghast!!! John McCain’s ‘political considerations’ of canceling a presidential debate to head back to DC!), what was happening behind the scenes terrified the most experienced financial service professionals and economists.

The unfolding crisis was painful as the stock market along with real estate collapsed. Except, things were about get a whole lot worse.

New York Fed Chairman (soon to be Obama Treasury Secretary) Tim Geithner was in deep crisis mode. Just six weeks before a presidential election, he and Hank Paulson (Bush Treasury Secretary) forgot politics. They worked together each day with Ben Bernanke (Federal Reserve Board Chairman) trying to avoid the unthinkable.

What if the banks suddenly became insolvent? This was not only a real prospect, it was happening: Lehman Bros. was about to become the next casualty.

What had them so worried? A student of the Great Depression, Bernanke knew that the lifeblood of any economy is cash flow: the movement of money. If banks and financial institutions suddenly find themselves insolvent, the system breaks down. The Unraveling happens quickly and takes no prisoners.

After arm-twisting Nancy Pelosi’s Congress, as well as some reticent Republicans, Paulson pushed TARP through, which provided the much-needed cash infusions into the banks. This allowed the economy to continue, and for most people, their only real concern was watching their personal wealth deteriorate: a relatively minor concern compared to the collapse of the entire economy which would lead to a social breakdown.

Most economists agree that what transpired over six years ago was never fixed. It was merely stitched up with silly putty and Elmers glue.

We are now in our seventh year of the post-crisis economy. While the stock market has doubled, there is no credible source of economic news that suggests the economy has truly rebounded as in previous post-recessions.

Most agree the stock markets jubilant return to it’s lofty heights are due to ZIRP (zero interest rate policy) and QE (quantitative easing), both tools of the Federal Reserve Board to prevent the economy from sliding into recession. The problem with these tools is that they were only viewed as temporary. The Federal Reserve balance sheet of $4.5 trillion – yep, with a “t” — is fueling the stock market which is akin to leading lambs to the slaughter.

Whatever you think of bankers, they are not stupid. 2008 is in their rearview mirror, but not far enough behind to forget about. Many of the same bankers from then are still in positions of power, and they all tacitly acknowledge that QE and ZIRP have artificially inflated the economy. While many of the largest banks are sitting on massive cash reserves, they have kept it sidelined. Business owners are still finding it’s very hard to get business loans from main street banks. Mortgages are not easy to secure.

Banks operate under the guidelines and oversight of the FDIC and FRB. There are several banks that have caused tremendous hardship against their customers by way of illegal actions that only get reported if the customers are knowledgeable about protections afforded them by the FDIC and FRB. Most people do not realize they have recourse to fraudulent appraisals, mafia-like tactics, and blatant gouging through fees. Banks are acting like they are still in survival-mode even though they are flushed with cash.

So after six years of the Fed flushing the banks with cash, why are they not parting with the money, while others may even be acting in bad faith? Financial service professionals seem to all agree, and FRB Chairwoman Janet Yellen has all but stated that it’s a matter of when, not if the Federal Reserve raises interest rates.

What impact will that have on the economy? Even with QE and ZIRP, the GDP is still at a very disappointing annualized 2-3%. Can you imagine what the GDP would be without the Fed’s tools? Bankers know this. They also know one very real and incontrovertible fact: TARP caused the largest banks that were too big to fail in 2008 to become even bigger. Bank of America gobbled up Countrywide; Wells Fargo took over Wachovia; etc.

If another crisis happens — China, Europe, Terrorism, War, etc., could each catalyze one — the economy could very quickly go into crisis mode again. The largest banks which were too big to fail in 2008 have all grown larger. Today, bankers know they are now too big to save.

Published in General

David, thanks very much for replying to my question. I asked one other thing, which was whether you thought any prominent politician–on the right or the left–made sense in discussing any of this. Do you? Given what you’ve outlined, do you think Elizabeth Warren is basically correct to be saying the banks must be broken up?

I somehow suspect she is.

I’d add that the bailout of Bear Stearns was a critical mistake. Rather than taking a failure that could be managed, the Treasury, Fed, and industry gambled that they could keep the casino open a bit longer.

Also, I’m not sure I’d be taking Hank Paulson’s word on anything. His “no milk on the shelves” comment is exactly the kind of scare tactic progressives have used to ratchet up regulation and spending for ages.

WSJ just put this up from the former head of Lehman Brothers. He points to government officials who pushed for lower home-lending standards and homeowners who saw their homes as “ATM accounts.”

http://blogs.wsj.com/moneybeat/2015/05/28/fuld-in-rare-public-remarks-says-perfect-storm-caused-crisis

Claire,

My view is that most politicians are owned by a major benefactor or an entire industry. Banking, much like the legal community, invest in both right and left politicians. For example, Dodd-Frank, while presented as a consumer protection against the banks was (and still is being) written mostly by and for the banks.

For this reason, there are very few common sense voices. I am a free-market thinker, so I shudder when I say I agree with Bernie Sanders, Elizabeth Warren and L.A. Congressman Brad Sherman (all dedicated Leftist/Socialists) ‘if an institution is too big to fail, it is too big to exist’. That the government (taxpayers) should not be on the hook for the malfeasance of a few.

Meanwhile, their coronated nominee, Hillary, is mui simpatico with Wall Street Banks.

The contenders on the Right will be asked this question at the debates: “Do you support the repeal of Dodd Frank?” (If Candy Crowley asks, she will add: “and it’s consumer protections”). The answers will define who is serious about preventing the next crisis.

I’m curious what you think of Scott Sumner’s take on this which is that the housing bubble alone would just have led to a mild recession but that it was the Fed’s tight money policy that transformed 2008-9 into a major crisis?

And along similar lines to Sumner from the Idiosyncratic Whisk

Interesting that he doesn’t mention any problems with Lehman when he talks about the “perfect storm”. The housing bubble was certainly aided and abetted by government policies but the financial crisis of the fall and winter of 2008 was aided and abetted by the opaqueness of the financial instruments designed by Wall Street which made it impossible for investors to understand what they actually owned and the value of these securities leading to a panic and the near-disaster that David Sussman talks about in this post.

And, by the way, Dick Fuld was a major Democratic party donor.

One thing I never understood though was why a bank bailout was necessary? It has always seemed to me that a better course would have been a depositor bailout. That is, extending FDIC insurance to all deposits. That would have eliminated any potential panic, while holding the bank owners responsible for their actions.

In the 1970s and early 80s, a lot of banks in the midwest thought that farm real estate values could only go up, so they loaned every penny they could to every farmer that came in. When ag prices collapsed and inflation came down, farmers couldn’t pay their mortgages, and many of these banks went under. The bankers went back to work for different banks, but it is interesting that banks in the midwest do not have anywhere exposure to real estate that they did in the 70s, even at the height of the recent boom. Could it be that they learned a lesson by being allowed to fail?

David, I’m a free-market thinker too, obviously, so my shudder is just as violent as yours, but I agree: If an institution is too big to fail, it is too big to exist; although I’d add an extra provision: If an institution is too big to fail and the odds of it failing are not trivial, it’s too big to exist. And this seems to me a) common sense; and b) not whatsoever a leftist or socialist position–if anything, the contrary.

It seems to me an epoch mistake (about as big a mistake as can be made) to surrender that point or this issue to people like Sanders and Warren, when it’s clearly something for which a party of free-markets should lead the charge. The language of the Too Big to Fail, To Big to Exist Act is too vague, but it’s otherwise the basis of something the entire Republican party should enthusiastically back–only it should be clearer and more detailed.

As I understand it, the reason no one backs it, or the reason they claim they don’t back it, is because they believe the odds of these institutions failing again is trivial now that they’re been properly capitalized, are less dependent on overnight financing, and are put through more rigorous stress tests. But the language of the bill actually takes this into account, or could do so with no ambiguity with maybe an extra paragraph of precision. The Act isn’t just saying, “break up the banks,” it’s saying, “We need to conduct a full review within a precise timeline, and if, following that, an entity is determined to be at non-trivial risk of failure and too big to fail,” it should be reduced in size so that their failure wouldn’t end up on the taxpayer dime. It would also provide other very serious incentives to stay off that list.

The Act isn’t just a crude directive to break up big things, it’s an instruction to assess them by a host or relevant criteria, even as written now. “The term ‘‘Too Big To Fail’’ means any entity whose failure, due to its size, exposure to 15 counterparties, liquidity position, interdependencies, role in critical markets, or other characteristics or factors [my emphasis], would have a catastrophic effect on the stability of either the financial system or the United States economy without substantial Government assistance.”

Obviously, that language is far too vague; the terms should be much more precise; and to some extent that’s what’s already happening when regulators threaten banks like Citi that can’t get their acts together. But this is a good opportunity to make the define more precisely the conditions under which these entities could pose a risk despite increased capital requirements and to stipulate the kind of punishment (and enforcement mechanism) that would get these entities to take getting their houses in order a lot more seriously. Or so it seems to me.

I have no idea why this issue has been taken over by people who claim to be socialists, while the soi-disant free-marketers are ignoring it, even though if these banks fail again, it will be because, in effect, we turned them into state-owned enterprises, or ones that become state-owned by default whenever they screw up.

There was a point I read a while back (probably on NRO, but I don’t remember) questioning the necessity of breaking up large banks. The article pointed out that many nations (Canada being the prime example) only have a few large banks, yet have never experienced a banking crisis, while the US has had many (going back over a century). So perhaps the push to end TBTF is misguided. Perhaps the root of continued US financial instability is rooted in other problems like our weird branch laws, meddling in loan decisions, etc.

Larry,

While there are certainly partisans who blame deregulation, most financial folks understand that this was a combination of factors, as mentioned in the post. The lesson here is that we are repeating the same mistakes which is leading us toward another crisis. In addition, now the world is emulating the FRB’s easy credit policies, as we see with the ECB and JCB.

What was is Einstein said about the definition of insanity?

I don’t disagree politicians use crisis to forward their own agenda. Both sides do this, and Dodd-Frank was a direct result of the 2008, but the bankers essentially wrote the blasted thing. Much like OCare before it was passed, no one has any idea what 95% of the law states.

THIS is why I spend more time on Ricochet than all other Social media combined. Kudos!

There is not much I disagree with here, but regarding free-market thinkers distancing themselves from TBTF/TBTE, I believe it is due to the often misunderstood tenet that any additional regulations lead to increasing gov’t largesse.

Pure capitalism does not exist in America (or anywhere I can think of). We have a quasi capitalistic economy that relies on centralized government to ensure the food, water, roads, air, air travel, etc. are safe. Regulations are required to ensure corporations do not rip-off consumers, and true free-market thinkers appreciate there must be a dependable and reliable foundation to commerce.

Since banking is the bedrock of the free flow of capital, lending, retirement savings, etc. stress tests of the banks are welcome. Although I have read numerous articles how there are manipulations.

Fin-Cons need a voice to encapsulate the benefits of ensuring bank solvency and how the economy relies on liquidity.

Enter Mr. Rubio?

Thanks for the reminder.

Criticisms of totalitarianism/socialism have little purchase with Marxists because they say it wasn’t pure Marxism and we need to keep trying.

Why not turn that argument against those same people when they bring it up.

“On the contrary, your criticisms of Capitalism are problematic because we don’t have true Capitalism. We nee dot keep trying.”

Could be. But that’s so silly that it’s very hard to believe so many intelligent people would believe that, since it’s exactly backward. Once the government is committed to cleaning up failure (to largesse, in other words), it has a huge interest in reducing the likelihood of that failure. Players who know they won’t or can’t be faced with market discipline have a significantly reduced incentive to regulate themselves and a much greater incentive to take risks.

If the cost of something failing is so high that the government won’t permit it to fail, then the government is de facto committed to regulating it or cleaning up after it, and it has a huge interest in ensuring that failure is less likely. (We can’t ever say “zero” risk, but given what recently happened, worrying about this kind of thing is hardly being hysterical, and the public has every right to be concerned.)

We accept this relationship between “too big to fail” and “needs more safeguards and scrutiny” with many other kinds of business. Nuclear power plants are too big to fail. We regulate them as much as we do because the failure of a nuclear power plant is a much bigger deal than the failure of a pizza chain. Realizing this doesn’t mean we’re anti-business or anti-nuclear power (or it certainly doesn’t mean I am, I love nuclear power). But of course we understand that if a nuclear power plant melts down, the cost of this goes way beyond the disappointed shareholders who took a bath on Ace Nuclear Power Plants. It’s appropriate to regulate nuclear power plants more than you do Jake’s Pizza Shacks; it’s appropriate to inspect them more often, it’s appropriate to shut down the ones that aren’t meeting reasonable standards–because if Ace Nuclear starts melting down, people aren’t going to say, “Oh, just let it burn through the core of the earth, it was a bad investment decision”–they’ll (first) throw a ton of taxpayer money at the thing to try to forestall the emergency; and if they fail, you’ll have a failed nuclear plant where a state used to be.

I’m not necessarily persuaded that smaller banks are safer, but it does seem like perfect common sense–it spreads the risk. Fewer eggs in one basket.

Why is this not a conservative, pro-market way to think?

Came across this chart at John Cochrane’s blog on federal government guarantees of financial sector liabilities. It’s $26 trillion of which 13 is from banks.

The counter argument to this is that consolidation has helped many other industries, why not banks? We mandated lots of small independent banks through most of our early history and the US economy went through some very massive banking crises throughout the entire 19th century. Other nations (Canada, Britain) have not had these crises, even when they were less regulated than they are today, while having just a few monolithic banks.

Also, mandating lots of smaller banks actually creates lots of regional hegemonies with their own attendant corruption issues. Look at Comcast in the cable business for an example of what happens to customer service when you’ve got a franchise lock on a given territory.