Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

How to Respond to Thomas Piketty’s Inequality Alarmism — James Pethokoukis

How to Respond to Thomas Piketty’s Inequality Alarmism — James Pethokoukis

As with physicist Stephen Hawking’s A Brief History of Time, economist Thomas Piketty’s 700-page Capital in the Twenty-First Century is a bestseller destined to have a steep purchased-to-read ratio. For many on the left, it will be enough to simply know that Piketty’s grand theory of capitalism affirms their preexisting worldview: capitalism drives inequality ever-higher, superrich CEOs don’t deserve their fat paychecks, massive taxes on income and wealth are necessary to avoid an inegalitarian death spiral. For many on the right, it will be enough to simply know that Piketty is a French inequality researcher who teaches at the Paris School of Economics. Let the eye-rolling commence.

As with physicist Stephen Hawking’s A Brief History of Time, economist Thomas Piketty’s 700-page Capital in the Twenty-First Century is a bestseller destined to have a steep purchased-to-read ratio. For many on the left, it will be enough to simply know that Piketty’s grand theory of capitalism affirms their preexisting worldview: capitalism drives inequality ever-higher, superrich CEOs don’t deserve their fat paychecks, massive taxes on income and wealth are necessary to avoid an inegalitarian death spiral. For many on the right, it will be enough to simply know that Piketty is a French inequality researcher who teaches at the Paris School of Economics. Let the eye-rolling commence.

But Piketty is a first-rate scholar whose magnum opus is well worth reading, whatever your ideological inclination. His thesis is straightforward. At its center are observations and forecasts about the return on capital, economic growth, and the relationship between the two. Some economists, such as Paul Krugman and Martin Wolf, think Piketty’s probably got the story right. Others, including AEI’s Kevin Hassett, Tyler Cowen, and Joshua Hendrickson, take the other side of the trade.

Yet even if Piketty is wrong, there is reason to believe technology and globalization might sharply increase immobility, as well as boost income and wealth inequality—and lead to long-term wage stagnation for the vast majority of workers. The good news here is that many of the most realistic responses — even Piketty thinks his own end-game policy agenda is utopian — are intrinsically good ones. Since slow economic growth worsens inequality, we should want to pursue policies that might boost birthrates (tax relief for parents) and innovation (remove regulatory barriers to entry).

Indeed, Piketty has said as much. If capital ownership is becoming too concentrated, then we should try to broaden it (universal savings accounts) and turn more workers into owners. Cowen highlights “deregulating urban development and loosening zoning laws, which would encourage more housing construction and make it easier and cheaper to live in cities such as San Francisco and, yes, Paris.” And, of course, both primary and secondary education need a strong dose of disruptive innovation to meet the changing needs of students and workers.

If policymakers start giving such ideas greater thought, then Piketty’s book, right or wrong, will have performed an immensely valuable service.

Published in General

There is a difference between finding a job and starting a business. I was being concrete, but maybe I should have said “Creating opportunity.” Whatever the case, social programs like welfare and unlimited unemployment allow people to wait, slide by, not take chances, risk nothing, drink another beer. Government regulations has the same effect. Suppression.

I completely agree with you there, I think the problem is that several generations have been taught to “do what you love” when better advice would have been “hey, you’re pretty good with tools, ever considered a career as a mechanic? I know you’d rather be a rock star, but you can keep playing the guitar in your spare time, at least you’ll have something to fall back on.”

I agree with JimGoneWild. As long as there are unmet needs or desires, jobs exist to fill them. The one caveat, of course, is that government doesn’t get in the way. Yes, new technology eliminates jobs, but it also creates new opportunities. For example, gizmos such as 3D printers and numerically-controlled embroidering machines will spark countless small businesses producing radically personalized goods.

So what did the government do during the Great Depression to cause the 25% unemployment rate?

To be fair, the government did make a lot of mistakes (starting with not forgiving Britain’s WWI debt and rapidly sliding downward from there). Trade wars, bad monetary policy, an international balance of payments crisis that was really our fault (well, and France’s)–we made a lot of mistakes.

Wow, where do I start? An explosion of regulations, price controls, wage controls, new taxes, higher taxes, constant verbal and legal attacks on various businesses, crony capitalism, and constant experimentation all served to create an uncertain economic climate that made businessmen reluctant to hire and invest. Unfortunately, Obama appears to have based many of his policies on FDR’s. For more, check out my Freeman article from 2009. For a lot more read FDR’s Folly by Jim Powell or The Forgotten Man by Amity Shlaes.

I’m familiar with the argument that FDR’s policies made the Depression longer and worse than it would have been otherwise. My point is that FDR did not cause the stock market crash of 1929, just as Obama did not cause the financial crisis of 2008.

A periodic cycle of a boom, a bubble, a crisis, a crash, a recession and then a recovery seems to be baked into the dynamics of the free market, even if the government stays out of the way. Or do you disagree?

No, you are right, Hoover signed a trade bill that started the rolling. He raised taxes too. FDR just doubled and tripled up on Hoover’s mistakes. Introduced fascist policies and generally ran the government as king.

I agree that universal “do what you love” is often terrible advice. I thought that it was a very unfair reading of what Jim wrote, though, which was clear from the first comment. Give people freedom and enough of them will find uses for surplus labor that you’ll be able to maintain a sensible level of unemployment. You don’t need everyone to be doing what they love, but freeing up some people to do that has wonderful effects on the economy as a whole.

Joseph,

I do disagree [referring to post #37]. Every boom is preceded by inflation. The government prints money or expands credit (debt). The newly introduced money has to go somewhere. In the case of the Great Depression much of it went into the stock market, while in the case of the “Great Recession” government policy all but dictated that it would go into housing. The resulting boom can last only as long as the government continues to pump money into the economy. Once they stop – or merely ease up – the boom ends.

Is it your view that Americans have less house than they used to? That’s not the view of the data. This is a look at the growing size of the average American house, combined with the shrinking number of average occupants. If you want to break that down into income segments, this is a pretty good guide; no matter how rich or poor you are, housing has been improving. Those houses are more energy efficient, so heating bills are lower, but use a ton more electricity because they now have refrigeration, air conditioning, TVs, computers, etc.

Hoover was pretty terrible, a classic progressive paleocon, but the depression wasn’t his fault. As with 2000 and 2008, recessions are a part of the cycle of life. 1929 happened all over the world. FDR’s genius did not lie in creating the depression, but in turning it into the Great Depression. America can handle the shifts in industry (in FDR’s day, leaving agriculture for manufacturing and services, leaving manufacturing for services today). Overexcited responses to the shifts are much more difficult to cope with.

Excellant!!!

There is some saying, something like “Shoot for the stars. If you miss, you’ll still get pretty high.” I butchered it but you get the point.

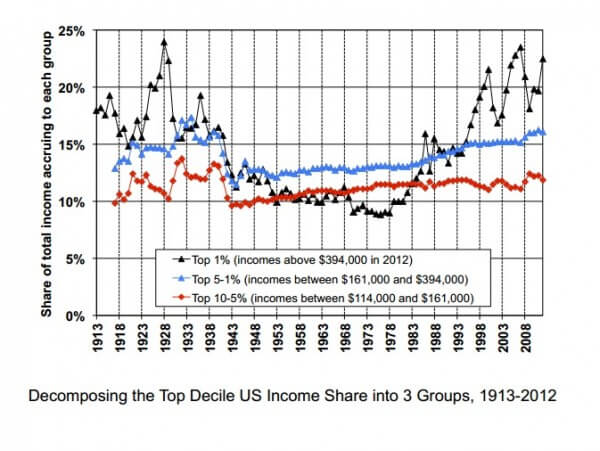

To me, the lesson of the graph is that periods of great technological change create temporary wealth disparities. The roaring 20s boom was created by massive technological shifts associated with the invention of the electric motor, probably the most important technological shift in the history of mankind. Great technological change creates massively large companies that didn’t exist a decade before. The computer age, internet age, and mobile tech age of the last two decades have created similar billionaires seemingly overnight.

If government did nothing now, income inequality would eventually revert to normal levels as the disruptive technologies become boring and mundane and the overnight billionaires squander their wealth on drugs and women. Shirt sleeves to shirt sleeves in three generations will still be true for the grandchildren of the the VAST majority of today’s tech billionaires.

Richard Fulmer

Joseph,

I do disagree [referring to post #37]. Every boom is preceded by inflation. The government prints money or expands credit (debt). The newly introduced money has to go somewhere. In the case of the Great Depression much of it went into the stock market, while in the case of the “Great Recession” government policy all but dictated that it would go into housing. The resulting boom can last only as long as the government continues to pump money into the economy. Once they stop – or merely ease up – the boom ends.

Joseph, Just about everything you said in this post is wrong. Are you saying the Fed. Gov. purchased stock under FDR? Under Obama, very little of the bailout money went to “housing”, if you mean mortgages. Most of it went to public employee union pension funds. Some when to banks in the form of loans, and even smaller amounts went to mortgage restructuring programs. The Fed. Reserve Banks are buy U.S. Gov. debt. The boom may end, this is good because it’s a fake boom. But a real recovery will begin.

Incidentally, I thought that this article was by far the most effective response to Piketty’s book. I haven’t read Piketty yet, but I would be surprised if this was not a very telling theoretical flaw in the work.

As for effective counter, I really liked this (and the other pieces along the same line grouped with it on NRO). Mostly for the shock value of the headline. There’s likely not a flaw in the argument, only in any assumption that we can’t all become rentiers. An ungodly number of us have in my lifetime–and in my case without a whole lot of effort or intelligence or inordinate luck.

On the “lack of work” argument percolating above: I thought for sure I’d be living in a Player Piano world when I grew up. Didn’t happen and I’m no longer sure why I ever thought it would. Malthusian arguments–like learned explanations of why bumblebees can’t fly–are for entertainment purposes only. Or maybe to get you thinking about the thing in a more useful way as Jimmy P suggests.

Our pre-crisis current account deficit of 7% had nothing to do with it? I rather think that was the bigger driver.

This is something I keep trying to get libertarians to understand. A credit boom caused by inflation is very different from one caused by a current account deficit. Inflation destroys at least part of the debt it creates, while a CA bubble can actually magnify it.

The economy grew as much in the 70s as it did in the 80s, despite repeated inflation crises. Inflation crises “bounce back” in ways CA crises do not.

JGW,

I was referring to the pre-crash bubble creation, rather than attempts by FDR/Obama to deal with the aftermath. The Fed’s easy money policies helped feed the bubbles – unsustainably high stock prices in the case of the 1929 crash, and unsustainably high housing prices in the case of the 2008 bubble collapse.