Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The GOP Tax Debate and the Healing Power of ‘And’

The GOP Tax Debate and the Healing Power of ‘And’

Senator Mike Lee and Rep. Paul Ryan have different approaches to tax reform, at least on the individual side. Lee would modestly cut the top rate and greatly expand the child tax credit. Ryan would sharply lower the top rate to a level not seen since the Coolidge administration. What both approaches, at least as currently outlined, have in common is a high likelihood of greatly adding to the budget deficit.

New Republic’s Brian Beutler predicts the two camps will resolve the philosophical impasse by basically combining the two approaches and accepting massive deficits: “Under the circumstances, the smart play isn’t for the reformicons to out-debate the supply siders, or to negotiate with them, but to buy them off. Give Ryan a big rate cut. Keep the middle-class child subsidies. Don’t bother paying for either, in full.”

Problem: The GOP doesn’t need a fantasy tax plan that is not only fiscally irresponsible but would never come close to becoming law. Recall Rudy Giuliani’s tax-cut plan from his 2008 White House run. It was twice as big as the original Reagan tax cuts and would have slashed or eliminated all manner of federal taxes including the income tax, capital gains tax, corporate tax, estate tax, and alternative minimum tax. On a straight-line basis, it would have cost more than $6 trillion over 10 years. Even with reasonable dynamic scoring, this bad boy was a big revenue loser. At the time, The Wall Street Journal called it “a bid for his party’s tax-cutting wing,” and that is certainly was. It was also completely unrealistic.

But I don’t see Beutler’s Big Rock Candy Mountain compromise happening. First, once you put corporate tax reform into the mix, it becomes rather easy to see comprehensive reform that is, as Ramesh Ponnuru puts it, pro-market and pro-middle class, “pro-growth and pro-family” beyond Beutler’s crude combination.

Second, although Lee’s numbers may not add up right now, Howard Gleckman of the Tax Policy Center says, “it is easy to see how they could.” Indeed, Lee and Rubio are working on, according to Lee, “a new, comprehensive, pro-family, pro-growth tax reform proposal that we hope to introduce later this year.”

Third, voters are plenty aware of America’s debt problem and would be rightly skeptical of a “deficits don’t matter” approach to tax reform. Note that Mitt Romney in 2012 had a flashy tax plan that would have cut marginal rates by 20%, but he also tried to pay for it. While I don’t think a GOP plan needs to be TPC or CBO certified, it probably needs to be in the same zip code. And although liberals might love a 2016 GOP presidential candidate to propose a budget-busting plan that axes taxes for the rich and big companies and jacks them up on the middle class, I don’t see any of the serious contenders doing so.

Given America’s current fiscal situation and the great supply-side progress made on tax reform since 1980, sweeping tax reform is no easy task the days. But that problem is also an opportunity if Republicans add other issues to their pro-growth portfolio including anti-cronyist deregulation, education, and infrastructure.

Published in General

As always, there’s this crazy idea that, if you cut taxes, you should also cut (not “slow the rate of growth of”—cut) government spending.

Stop laughing.

Average individual income tax receipts as a % of GDP by decade:

50’s: 7.2%

60’s: 7.6%

70’s: 7.9%

80’s: 8.2%

90’s: 8.1%

00’s: 7.8%

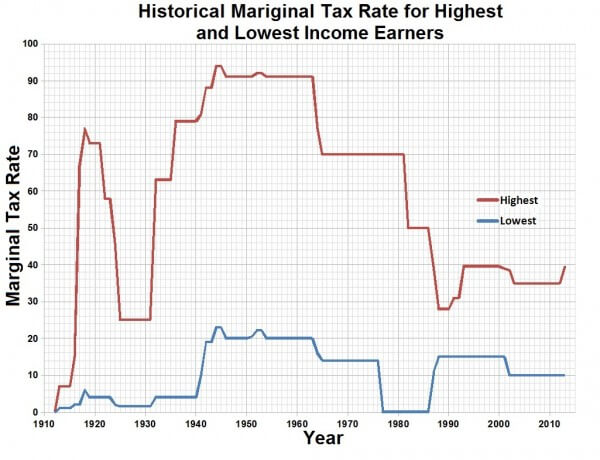

Marginal rates were all over the map post WW2, but mostly descreasing. Somehow revenues as a % of GDP were remarkably consistent.

But I’m sure James P has a very complex formula that proves revenues will plummet.

http://www.whitehouse.gov/omb/budget/historicals

Current marginal tax rates seem reasonable enough, to me, IMHO.

The problem now seems to be tax complexity, and the costs of compliance and enforcement. That’s why tax reform which appears to be “revenue neutral” in theory is still a benefit for the nation.

What GG said. Indeed, were we to go to a flat, 10% tax on all income, regardless of source, and with not cutouts–just add up all your wage, gambling, cap gains, dividends, lootings, etc, and pay 10% of that–based on 2007 numbers (which I pick as the last reported year before the Panic of 2008), there would be a surplus of roughly $700 billion. Dynamic analysis would expand that in the out years, with still increasing revenues to the government–as if the government needs the money.

The loopholes have to be closed, though. The low basic rate makes that not so painful. And it also does what no current tax plan proposal does–it gets the tax code out of the social engineering business.

Eric Hines

Income taxes depress economic dynamism and growth. This is true no matter the type of income tax or the rate at which it is set. Yes, different types of income tax and different rates do more and less harm, but they all do harm. The objective of taxes, tariffs and fees should be to raise the necessary revenue to fund the government. Who would choose a method of taxing that is not only difficult to enforce, cumbersome to administer and depresses economic activity? Why did they choose it? If you come up with the correct answers, you will realize this discussion is a futile one.

This post depresses me, because it is a reminder of how people “wonk out” and miss the forest for the trees.

Spending, regulation, and tax complexity are all MASSIVE problems.

Tax rates right now (the subject of the post) are essentially by the by in comparison.

This country desperately needs some flat-tax solution that allows people to live their lives without fear of being destroyed by an IRS that does not like people who hold certain beliefs.

Then again, a company only needs to move its headquarters (and jobs) to Canada and bypass ever-rising US corporate taxes.

Capital moves to where it’s welcome.

There is only so much political capital to be had. The Republicans need to spend it wisely.

Have we not learned the lesson of Obamacare, in which a President pushed through an ideological agenda, spent all his political capital and has spent subsequent years either on the golf course, at fund-raisers, or occasionally in the oval office, probably practice putting?

What the economy needs now is a modest pro-growth platform that mostly signals a change in direction, not necessarily immediate sweeping change. Taxes aren’t the major problem right now – regulations, an out-of-control bureaucracy, an Islamic caliphate in the making, Russia getting frisky in the ex-Soviet regions, China becoming aggressive in its region, the impending demographic collapse… All of these are going to put demands on the public purse while constraining its ability to grow.

The right needs candidates who can make a persuasive philosophical and logical case for free markets and small government. It needs someone who can actually lead the country and not just the party. That means making converts. You can’t do that and hit them with a fiscal baseball bat at the same time.

This is depressing. James Pethokoukis, our technical finance whiz, is referring to the “cost” of a tax cut. Tax cuts are not a cost. At most, they are forgone revenue. For citizens, they are a savings.

The right needs candidates who can make a persuasive philosophical and logical case for free markets and small government.

That argument can only serve as a one- or two-sentence lead-in to the main argument. The main argument needs to be practicalities: how does the right’s platform help the individual, the individual’s family, in specific terms.

That argument also needs to be made in minority neighborhoods, as well as in the majority’s. It needs to be made in the living rooms, the diners, the local libraries. Etc.

But, again, it has to center on how our plans help the individual, we can’t argue lofty principle alone.

James Pethokoukis, our technical finance whiz, is referring to the “cost” of a tax cut. Tax cuts are not a cost.

Indeed. Too many, who should know better, have drunk this kool-ade. Of course it costs the government not a cent to not receive that which isn’t the government’s in the first place.

Eric Hines

First, I reject the premise that we need to tax the lower and middle class less. They need to pony up to the bar with their pound of flesh like everybody else, if for no other reason than removing unambiguous counter-purposes within the population.

Second, the dissatisfaction with taxation at all levels is a fundamental lack of transparency. Nobody is sure that they are paying their share, or doing it right, and as such via a healthy solipsism is convinced that other people aren’t and the rich are definitely cheating. When talking to individual populists and lefties, you can convince them to support bold tax reform if you can do something about the lack of transparency.

Very true. Back when I was a kid, I lived in the City of Nepean, a suburb of Ottawa.

Nepean had comparatively high taxes, but few people complained because it was well-run, and the taxpayers could see where their money was going. The city had no debt, and in fact had a substantial reserve fund. It built parks, hockey arenas, and swimming pools on a pay-as-you-g0-basis, i.e. raise the money first and then build, instead of using debt to build facilities.

Then, in 2001, the Province of Ontario (it its kingly wisdom) amalgamated all the cities around Ottawa into one, great, big, new City of Ottawa. Nepean’s reserve funds were given to this new city, and quickly squandered. The community of Nepean is now lorded over by the government of Ottawa (and, even more so, the public employees union).

Subsidiarity, people!

Obama was re-elected. Is the lesson that the Obama method works?

I know I’m a simpleton, but the tax code needs to be a single rate with very few deductions and possibly a high personal exemption. I would even prefer that we replace much of the need-based support with cash grant for everyone and they pay taxes at dollar one of income.

If we are concerned about deficits, the tax rate can be set every year at a level designed to match projected spending (recognizing there will always be some error).

If people want more spending, they need to pay more taxes. To paraphrase Jim Pethokoukis in another post, anybody who argues differently is not being serious.