Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Why Expanding the Child Tax Credit is Pro-Growth, Supply-Side Tax Reform

Why Expanding the Child Tax Credit is Pro-Growth, Supply-Side Tax Reform

Perhaps the most talked about bit of “Room to Grow,” the reform conservative policy agenda, is its call for dramatically expanding the child tax credit (including letting it apply to both income and payroll taxes).The short-version: A married couple with two children earning $70,000 would get a tax cut of roughly $5,000 per year vs. current law. The idea has generated two lines of criticism from the center-right:

Perhaps the most talked about bit of “Room to Grow,” the reform conservative policy agenda, is its call for dramatically expanding the child tax credit (including letting it apply to both income and payroll taxes).The short-version: A married couple with two children earning $70,000 would get a tax cut of roughly $5,000 per year vs. current law. The idea has generated two lines of criticism from the center-right:

1.) “It is an attempt to subsidize parents into having more kids.” Or as Ben Domenech writes at The Federalist: “But why is it conservative or even an example of limited government to use tax policy to essentially reject that steady decision-making over the course of decades?

If people want smaller families, that’s their choice, right? Right, indeed. And natalist policies have a poor record at nudging people into having more kids than they want.

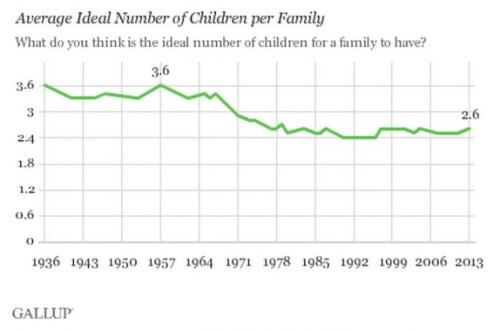

Except that American families are having fewer children than they would like. Basically, on average, parents would prefer an additional half kid, more or less. It’s a preference that’s been steady since the late 1970s, according to Gallup polling. What’s the problem? Well, according to Gallup, 76% cite financial or economic reasons. Specifically, 65% mention “not having enough money or the cost of raising a child,” and another 11% name “the state of the economy or the paucity of jobs in the U.S.” Wouldn’t tax relief help? As Robert Stein writes in “Room to Grow,”:

For some families, the extra money could be just the boost they need to be able to send their kids to a better school. Coming at a time in life when many parents and potential parents are considering whether they can afford an additional child, the extra credit would directly make carrying the burden (and generating the future social benefits) of a growing family somewhat easier.

Moreover, expanding the credit wouldn’t be a subsidy. Rather, it would partially offset an existing economic distortion created by government policy: Old-age programs like Medicare and Social Security reduce fertility rates. Moreover, entitlement programs give a person the same benefits whether or not they have spent the time, money, and effort that parents do raising the future taxpayers needed to support the safety net.

Again, Robert Stein:

By making so much of the economic benefit of children accrue to society collectively—and thereby reducing that benefit for the individual mothers and fathers who make the decisions about how many (if any) children to raise—federal policy distorts family formation.

2.) “It violates the supply-side approach to pro-growth tax reform. Or as Ira Stoll writes at Reason, ” … count this columnist as one supply-sider who is, as predicted, cringing at the idea of slapping an income tax increase on childless individuals for the express purpose of redistributing the funds in tax breaks for those with larger families.”

The supply-side of the economy is about more than just the supply of work or investment — and how those factors are affected by marginal income tax rates. It’s also about the supply of risk-taking and ideas. And a younger society with a higher birth rate, enabled by a tax code that offsets anti-family government policy, would be more dynamic, creative, and entrepreneurial. It’s a human capital gains tax cut.

As the late economist Gary Becker wrote: “Low fertility reduces the rate of scientific and other innovations since innovations mainly come from younger individuals. Younger individuals are also generally more adaptable, which is why new industries, like high tech startups, generally attract younger workers who are not yet committed to older and declining industries.”

Of course, there is nothing in the “Room to Grow” tax plan which precludes, say, lowering business taxes, an already much discussed idea on the right, or other comprehensive reform ideas.

Now, the expanded child tax credit won’t pay for itself, at least according to Washington budget math. Stein offers a number of options, from raising the 25% marginal tax rate to 35% — keeping in mind most of the revenue would come from people who already pay the higher rate — or, alternately, the 25% bracket could be left as is with “extra revenue generated by more quickly limiting the mortgage interest deduction to the middle class or perhaps limiting the exemption for interest on municipal bonds.”

Bottom line: By reducing government policy distortions, expanding the child tax credit would strengthen both families and the overall economy.

Published in General

Republican welfare, and other such cynical vote buying programs with no basis in anything other than bad faith aren’t any better than the democrats.

James:

I posted on this a couple months ago. http://ricochet.com/demanding-more-from-the-childless/

I think there is great merit in this idea. This is not just an economics question, but a question of justice, and of cultural needs as well.

I don’t know, as one of those single childless males I find it hard to approve of anything that makes me pay more in taxes. I guess I can be out voted, but this isn’t going to get me out there to vote.

As a rabid natalist and new father, I hope to see this happen someday. The tax system actively discourages more kids from the families who are in the best position to create new innovative and productive citizens.

I can’t help but think this is a band-aid on a band-aid. Certainly it would be good for married couples to have more children, but let’s get to the root of the problem (if it is a problem) first. Otherwise this strikes me as social engineering. There is good principle behind not social engineering, just look at most of what the Democrats have done. For now, count me as a ‘no’ vote.

Those who don’t see a benefit to a “stimulus” for increasing birth rates in the U.S. can look to Europe for evidence of where that leads. It means more immigration, legal or otherwise. It also means a steady decline and disintegration of our culture (beyond the damage being done by our Liberal/Progressive enemies). Without children we have no future. Those who don’t have children of their own still want my children to fund Social Security and Medicare in the decades to come. Since children are an essential part of our Nation’s “infrastructure”, I think it is only fitting that parents get some help from the Government in the way of larger tax credits.

I don’t know about that. We have many policies that greatly help family formation, and defray the cost of raising children. From mortgage deductions to public education all of them are meant to socialize the cost of family creation. By putting forth your children as excuses for preferential tax treatments you are only incentivizing the nationalization of children. If as Pelayo says children are viewed as part of our Nation’s “infrastructure” they will be treated like that legally. Good luck trying to raise your kids the way you want if you let the government get more hooks into them.

The numbers on European countries that have tried incentivizing couples to have children show only marginal increases in the fertility rate after the implementation. Several show no change at all.

I’m skeptical that a few thousand dollars in tax credits is really all that is preventing people from having more kids than in days past. Trends such as people getting married later and waiting longer to have kids (thereby shortening their window for having them) seem to be a much bigger factor.

I’m not going to virulently oppose such tax credits, but I’d be shocked if we don’t find ourselves back here in a decade talking about how the fertility rate has only gotten worse.