Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Yes, Reaganomics Sure Does Need a 21st Century Update

Yes, Reaganomics Sure Does Need a 21st Century Update

“The GOP is Debating Whether Reaganomics Needs an Update” is a must-read piece by Washington Post reporter Jim Tankersley. One side answers the “What would Reagan do?” question by offering a nostalgic return to the 1980s Reagan agenda. Another prefers to apply the Reagan principles — a dynamic private sector, strong families and neighborhoods, upward mobility, work — to modern economic reality with different conservative policy results. Tankersley:

“The GOP is Debating Whether Reaganomics Needs an Update” is a must-read piece by Washington Post reporter Jim Tankersley. One side answers the “What would Reagan do?” question by offering a nostalgic return to the 1980s Reagan agenda. Another prefers to apply the Reagan principles — a dynamic private sector, strong families and neighborhoods, upward mobility, work — to modern economic reality with different conservative policy results. Tankersley:

Leading Republicans are clashing over a signature issue the party has treated as gospel for nearly 40 years: the idea that sharply lower taxes and smaller government are enough by themselves to drive a more prosperous middle class — and win national elections. That simple philosophy has been the foundation of every GOP platform since the days of Ronald Reagan. Now, some of the party’s presidential hopefuls — along with some top conservative economists and strategists — are sending strong signals that they believe today’s beleaguered workers need more targeted help, even if growth speeds up.

For some context, here are a few then-and-now stats:

1.) When Reagan was elected president in 1980, the top income tax rate was 70%. Today, the top income tax rate is 40%.

2.) When Reagan was elected, the top 1% paid about a fifth of federal income taxes. Today it’s about a third.

3.) When Reagan was elected, the bottom 90% paid just over half of all federal income taxes. Today it’s around 30%, with 40% of households paying no federal income taxes.

5.) When Reagan was elected, 8% of national income went to the top 1%. Today, it’s nearly 20%.

6.) When Reagan was elected, inflation had averaged nearly 9% over the previous eight years. Today, inflation is less than 2% and has averaged around 2% the past 15 years.

7.) When Reagan was elected, US publicly held debt was 26% of GDP. Today, it’s 74% of GDP with a whole lot of entitlement spending quickly headed our way.

8.) When Reagan was elected, more than 19 million Americans worked in manufacturing. Today, just under 12 million Americans work in manufacturing.

9.) When Reagan was elected, health care spending was 10% of GDP. Today, it’s 17% of GDP.

10.) When Reagan was elected, China’s GDP, in nominal terms, was 3% of America’s. Today, China’s GDP is over half of America’s and about the same based on purchasing power.

Let me also add (a) there is good reason to believe that faster GDP growth is not lifting all boats, (b) upward mobility is stagnant, (c) slowing labor force growth and productivity suggest it will be harder to generate fast growth in the future than in the past, (d) automation has taken a toll on middle-class income and jobs, (e) labor force participation by high school-only graduates has fallen by 10 percentage points over the past 25 years, and (f) inflation-adjusted market income for the top 1% has risen by 174% since 1979 vs. 16% for the bottom 80%.

So given all that, shouldn’t center-right policymakers, pols, and pundits at least try and think afresh about what sort of economic agenda would best promote growth, upward mobility, and economic security in the 21st century? Sometimes that would mean tax cuts (the corporate code is a cronyist mess and bad for workers), deregulation (end Too Big To Fail and barriers to startups), and less spending (entitlements.)

But not everywhere and always. For instance, let’s say you believe work is a conservative goal. What’s the best welfare program? A job. So what is the “conservative” reform, cutting the Earned Income Tax Credit — ostensibly shrinking government — or expanding it? AEI’s Michael Strain notes that the EITC “is a very effective anti-poverty tool because it supplements earnings and incentivizes employment. Expansions of the EITC have been very successful at encouraging work, particularly among single mothers during the 1990s.”

I would argue that a pro-work EITC expansion — not a money-saving reduction — is the conservative reform. And probably so would Reagan. Nor should one forget that the Reagan tax cuts were hardly some purist, supply-side experiment. Also, a 15% flat tax and return to the gold standard — what some on the right are proposing — hardly constitute a return to the Reagan agenda. Or more to the point: Is the right move for America in 2015 a return to the economic policies of 1915?

Published in General

Don’t hold back, John.

Tell us how you really feel.

Better question. Do we still believe in individual liberty, private property, sanctity of contracts, free market capitalism, and limited government?

If the answer is yes, then Reagan is your guy. That government governs best which governs least.

If the answer is no … Then just throw in with the Progressives. Its only a question, then, of whose friends get preferential treatment from the government.

So, as I’ve stated many times before…this is all about winning elections. Not about economics.

I.e., how can we transfer wealth to people who are going to vote for us at the expense of those who won’t.

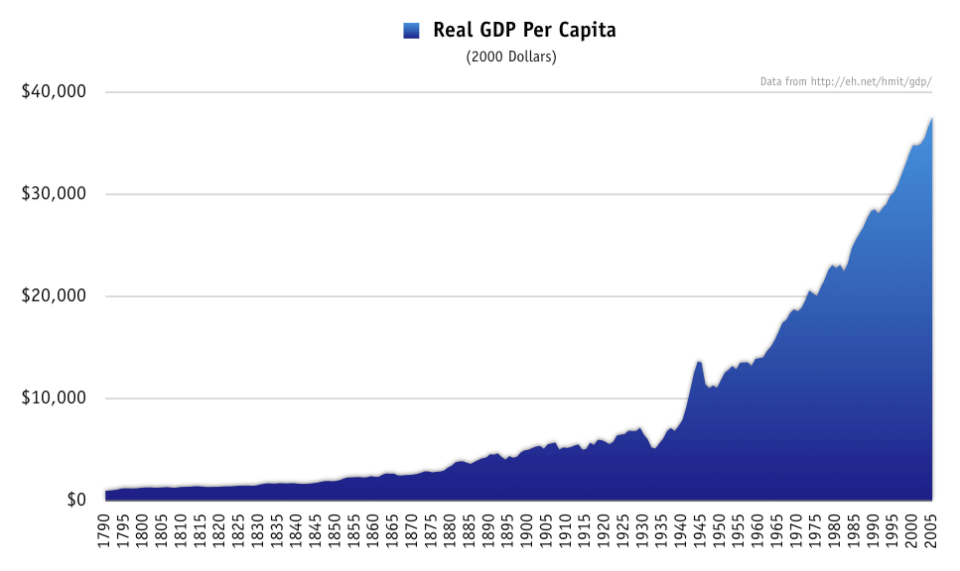

All the points made here can be disregarded by one single chart:

There’s no such thing as the “middle class” anymore.

The effects of making a more…competitive and efficient market (not dynamic, that’s a meaningless term)…is to move people out of the middle class and into higher income classes.

Which means dilution of voting blocks. Which is bad for politicians because they can’t appeal to “Joe the Plumber” anymore, because there’s less Joe the Plumbers, and more Joe the VP of R&D.

So “Reagan’s” economic policies worked precisely as they were intended in “destroying the middle class”.

Now the “upper class” constitutes a voting block that is almost as big as the “middle class”.

It’s strange that…to politicians and policy wonks…more rich people is a “bad thing”, precisely because they don’t have a single voting block they can appeal to and promise goodies, and more powerful blocks of voters who will refuse you taking money from them and giving it to the “middle class”.

Which matters because?

Which is an irrelevant point because inflation was put under control precisely during Reagan’s period. Also, coincidentally, when we actually figured out how to control inflation ;)

Which means what?

It only means no more “blue collar conservatives” for Rick Santorum to appeal to. That’s about it.

We also didn’t have half the innovations in healthcare at the time as we do today.

Which has nothing to do with anything.

Which means what? Nothing. Stagnant isn’t 0…stagnant means the same rate as it was in the past.

Which is the point of all economic activity in human history.

So I guess that means you better get more than a HS education.

The market rewards more those who produce more? I’m shocked

No

1) Your chart shows virtually no change in growth. Which means, there’s no evidence for your case.

2) Tariffs were…hugely…higher prior to this period than they were in the past few decades. Effective tariff rates today are probably the lowest they’ve ever been, in history.

3)

Seems to me there’s a remarkably higher rate of per capita GDP growth since about 1945, than in the entire history of the US.

Of course, I’m not going to make the case that it was…because…of government or regulations. It was almost all due to technological and market innovations (the same automation that…destroy…jobs).

But I’d also say that the regulations etc are also a…result…of more complex economic activity. When all you did was farm, there’s not much need for complex regulatory schemes.

4) As far as gold and money supply and Fed etc…

You see those enormous spikes up and down?

Well, that’s really really bad when it comes to making long-term investments. So I’d certainly say that a contributing factor in the economic…explosion…of the last half century compared to the previous centuries is in part due to stabilized inflation rates.

So I see no evidence to support your arguments either.

I was curious to see what this inequality means in actual per-person, inflation adjusted, dollar terms, considering that total income and population has increased over that same time period.

In 1980, US Gross Domestic Income (GDI) was about $6 trillion. The US population was about 226 million. If the top 1% received 8% of national income, that works out to about $212,000 per one-percenter, and about $24,000 per 99percenter.

In 2013, US GDI was about $14 trillion. The US population was about 310 million. If the top 1% received 20% of national income, that works out to about $903,000 per one-percenter (an increase of about 10% per year), and about $36,000 per 99percenter (an increase of about 1.5% per year).

(All figures in 2013 dollars.)

I’m unclear how only eliminating downward

spikescorrections qualifies as “stability”.To my eyes, the period from 1870 to 1900 looks a heck of a lot more “stable” than the period from 1970 to 2000.

Stable doesn’t mean 0. Stable means predictable.

Over the last 30 year we’ve had…stable…inflation rates.

It’s hard to invest money if you don’t know what the inflation rate will be at the time when you have to cash out, or pay your debtors etc, if from year to year it can swing +/- 30%, and you have no way of knowing which year you’ll fall into.

When it’s a steady 2 or 3% or whatever…that it doesn’t matter so much that it’s positive. What matters is that you know that 10 years down the line it will still be 2-3%, and hence can plan accordingly.

In inflation, the level doesn’t matter so much. What matters is volatility. This is why when people only show charts showing how much prices have increased over the years they think “look how terrible inflation is!”…they’re actually showing the opposite. A stable 2% rate will lead to those charts. A volatile +/- 30% will show flat changes over time.

But volatility kills long-term investment.

I still see

The period between 1870 and 1900 still looks more predictable and less volatile than the period between 1970 and 2000.

If the Civil War hadn’t caused that one big spike, the second half of the 19th century would have been way more predictable than the second half of the 20th.

Heck, if you took out every spike caused by a war, the latter half of the 20th century starts to look like the most volatile period.

Seems to me that could be interpreted as evidence that it was war (rather than gold) that delayed the “economic explosion” until 1950.

I only see stability taking hold after 1980.

“the idea that sharply lower taxes and smaller government are enough by themselves to drive a more prosperous middle class ”

If you add to that a fair tax system (one that is simple, and not punitive), and Federal government spending that only addresses real things (no studies examining the mating habits of arctic foxes if their rectal temperature is under 90 degrees Fahrenheit, or building bicycle paths in Morganton, West Virginia), then you get the economic update we need.

I’m tired of having to swear under severe penalty of law that my taxes are correct, when it takes a goddam computer program to do them. If all elected officials – House, Senate, the top tiers of the Executive Branch – had to manually calculate and file their taxes, then maybe we’d get the needed reforms . . .

“Expansions of the EITC have been very successful at encouraging work, particularly among single mothers during the 1990s.”

I agree 100%. If you want to expand the ranks of single mothers the EITC is probably the best tool in the government’s tool box. If you’re old fashioned enough to think our long term human capital situation would be better off with children raised in a two parent home an increase in the minimum wage would be a much more productive government policy.

Just thinking out loud here …

Why should we expect a vibrant economy to be ‘predictable’?

I understand why, from a long term investment point of view, predictably is nice … But is it really a desirable trait?

Then you’re looking at a different graph from me.

You mean, constant deflation? What does deflation do? ;)

You must be looking at a different graph from me, again.

Yeah, that’s exactly my point. 1980 is about the time we figures out how to control inflation.

Not the economy.

The inflation rate.

Different things. To get efficient allocation of resources, you need to decouple the value of the resource from the value of the dollars which denominate it.

I.e., the dollar has a supply and demand curve of its own which impacts the costs of things denominated in the dollar. That’s called…inflation.

To know how much x is worth, I have to denominate it in terms of y. But I want y to be as stable as possible over time, otherwise the value of x over time could just be a reflection of the change in y.

Imagine if I went to a bank and told them: can I have a loan to pay back in 10 years, and I’ll give you 30 ounces of gold for it.

The bank has no idea what 30 ounces of gold will be worth in 10 years. If the inflation rate of the dollar remains stable over time, however, then the bank knows pretty close how much $10,000 will be worth in 10 years, and can figure out whether to give you the loan or not.

Yes, but your argument still doesn’t hold in rate of change.

1790-1910 rate of growth in real GDP/capita: 1.45%

1910-2005: 2.17%

1950-2005: 2.22%

But the problem with your argument is more fundamental than that. You’re assuming first order effects of government regulations…over 2+ centuries of data.

Government regulations are at best second-order effects here.

I.e., we did not have the modern corporate form of governance, the modern firm, the modern stock market, the modern debt markets, the modern technologies, the modern labor markets etc etc…150 years ago. These were developed around the time of the end of the 19th century, and didn’t really take off until the later part of the 20th century as we got more efficient communication and transportation systems.

These things are going to have huge consequences for economic growth, as they allow more efficient allocation of resources, and hence more efficient generation of rents from these resources.

Government regulations are probably insignificant here. And, as I mentioned before, are likely caused by more complex forms of economic activities themselves.

So your argument is just not going to work out, because the period you describe was one of lower growth rates, lower regulations, and higher tariffs. The current period is one of higher growth rates, higher regulations, and lower tariffs.

But, of course, you can re-arrange your argument to focus on the second order effects.

PS: And of course, the assumption that all regulations -> less economic freedom, less efficiency etc., is not true.

If one purpose of the law is to better delineate and protect property rights, then economic systems with more regulations in doing so are going to provide greater economic freedom and greater economic efficiency that systems with few such laws.

But as property itself becomes more complex (as in it’s not just a piece of…land…anymore. But now you have different property claims over different uses of a single entity, for example), then regulations delineating these rights have to be more complex.

In the absence of these rules, some economic activity simply doesn’t get done. The transaction costs of overcoming ambiguities and lack of delineations or expectations…on a case by case basis…would simply prevent a lot of case-by-case transactions from ever happening.

So it’s too much of an over-simplification to say “lets go back to the good old days”, without recognizing that the entirety of the modern economy simply wouldn’t function.

PPS: Now of course, I know someone is going to say “well as things get more complex, we need more simple rules! not more complex!”. Well ok, but simple is not the same thing as the volume of regulation. And second, that’s ignoring transaction costs which are now transferred to the individual transacting parties, which will simply make many transactions impossible.

Even a simple rule like “thou shall not kill”, can’t prevent any of 1,000 different ways in which killings is justified, within this rule.

I actually didn’t mean to challenge you, John, but I am glad took up the challenge.

There is a nexus of Economics, Politics, and Policy where, hopefully, responsible elected and governing officials try to work out economic policies that best serve their constituencies and will be accepted by those constituencies. I have no idea what to dowhen I go to that nexus, and wish I did.

I am glad that there are people like you, James Pethokoukis and the rest of the people who have commented here to help fill that void in my knowledge base.

“You see those enormous spikes up and down?”

“Well, that’s really really bad when it comes to making long-term investments.”

Yup. Right. Like investment in canals, railroads, ships, steam engines and all the other infrastructure of the industrial revolution. Somehow, all that long term investment took place just the same.

Re: Predictable. Banks and other lenders can easily insulate themselves from the effects of inflation. Variable rate loans anyone? Borrowers pay back the same value they borrowed (plus a risk premium)

Re Property: “If one purpose of the law is to better delineate and protect property rights, then economic systems with more regulations … are going to provide greater economic freedom and greater economic efficiency.” Um….No.

My knee-jerk vote would be for 1915, but I suppose I don’t really won’t to argue about tariffs at Thanksgiving or how dumb we are in dealing with the problem of monopoly (except at Thanksgiving when the all-important battle for who gets to be the race car will always need to be fought). We should at least look long and hard at 1915. Even if our economy is qualitatively different–and I’m not persuaded it is–the argument will ultimately be about free markets: do they work or don’t they? Milton Friedman pointed out that the efficiency of a free market is really irrelevant: it’s a mechanism that lets us work things out among ourselves as much as possible. Even if it didn’t make us rich, it would be worth having. And it does seem to make us richer than the alternatives. Bonus.

On the EITC: it should be less expensive. One of the arguments for negative income taxes is that you can eliminate the friction (usually largely useless social services and inadequate cheat suppression) in delivering a dollar to some one who needs it (who can then buy whatever social services they deem necessary for their situation for themselves). Friedman quoted a $3 to deliver $1 figure in 1980. Not sure where that is now, but I’m pretty sure it’s still a fat prize. If you went the whole hog on a negative income tax, you could conceivably 86 everything else in the safety net at some savings and improvement of service. Whether we would do the replacement is a valid question, politicians and the citizens who vote for them being what they are. Not doing so would be a sound reason to oppose the idea.

Pretty sure the gold standard was in the half a loaf Reagan didn’t get. Also the tax reform he did get was as ding-danged close to flat as anything in my lifetime. That it puffed up again so quickly is just a cautionary tale. Wasn’t his fault.

That’s called buying votes. That’s what politicians do.

All peanuts compared to today.

Of course they can. There just won’t be anywhere near the amount of transactions as there are today.

So sure. If you want to go back to a time when only 1% of the population had access to capital, by all means…go for it.

But don’t expect there to be any modern economy.

The argument you need to make is whether the market in 1915 was more efficient than it is today.

There is…no way…it was.

Now of course, if you want to argue that you should have “freedom” for the sake of freedom without regard for its outcomes, that’s fine (and of course, you’re going to need to define…freedom…in economic terms. It’s just a word, but what does it mean?)…

…then you have no right to complain about China or about growing incomes or about growth rates etc., since you’re explicitly saying that economic outcomes or competitiveness don’t matter.

But they do.

And certainly, that wasn’t Milton Friedman’s argument. His was a positivist argument: economic freedom is better because it leads to better outcomes.

But, that doesn’t follow that today we have less economic freedom than in 1915, or whatever arbitrary date. It’s rather self-evident: walk into a supermarket today and look at the options and variety. How did that happen?

Thank God, Reagan had real economists advising him, instead of the hacks circling around the GOP today.

Doesn’t look to me like they’re gone anywhere since then.

I don’t think I would pick a year out of the Wilson administration to use as my economic model. Better to use the Harding/Coolidge years.

James ridicules the idea of using policies from a long time ago, but good economic policy is timeless. Why? Because it is a list of don’ts not do’s. Here are some of the don’ts:

All of the above don’ts have been violated for a long time, but since 2001 all of the don’ts except #2 have been increasingly ignored at an accelerated rate. Don’t #2 has also been violated, but not as badly as the others. As a result the economy stinks.

Recovery begins when the government starts to respect the above don’ts. It doesn’t matter what year it is.

This post is written as GDP, once again, slowed “unexpectedly”. If the price of oil had not fallen in the last year, this economy(and Obama’s popularity) would be in big trouble.

A Reaganesque, supply-side tax cut would gun the economy, just as the much-maligned “Bush tax cuts” did.

The problem is they cannot pass a drug test to get those jobs and actual work ethic of most of the under 30 demographic is horrible. Thus, we are importing workers to fill this gap.

Calvin Coolidge on July 4th, 1926:

The progressives were arguing that society had changed so much since 1776 that the simple nostrums of the Declaration were no longer applicable. That is, plain old “liberty” was insufficient for this complicated society. Woodrow Wilson had been explicit about this.

Coolidge’s Republican successor craved more government involvement in the economy. He got his wish.

Fast forward to the 21st century. Again we have conservatives (Hoover’s descendants?) saying that free markets are insufficient for these times. I have heard people say that the conservative movement needs to be about “more than” free markets.

Sadly, that kind of thinking will always be with us.

Don’t change the value of your currency implies EXACTLY…what the Fed did.

I’m not sure what’s not understand here. How do you keep a stable price level…in a supply and demand curve?

So, don’t do drugs, and don’t raise lazy kids.

No one is saying that.

I’m confused about your statement. Are you saying the Fed didn’t change the value of the currency, or that it did? Also, why the shouting?

Or are you saying that the Fed needed to change the value of the dollar to achieve price stability?

Please be less loud and more clear.

Reformicons such as Ross Douthat and David Frum have said exactly that, though not recently. Some of the reform movement’s defenders here at Ricochet have said that, too.

From the Reagan administration through the Clinton administration the price of gold was relatively stable. By “relatively” I mean compared to the periods before and after those 20 years. During those 20 years we almost had a de facto gold standard, and we had prosperity. It was the only prosperous period we had since the US left the gold standard in 1971. George W. Bush started a major devaluation that continued into the Obama administration. How has the economy been doing?

BTW, Reagan campaigned on making the dollar as “good as gold,” and did his best to keep that promise.

The gold standard was in the half a loaf that Reagan didn’t get. Too bad he didn’t get it.

I’m not an economist, not even an amateur one. I would describe myself as an amateur historian, in the sense that I read a lot of popular biographies and histories.

I go back to first principles. Less government, less taxes, and most especially, percentage wise, a majority of our taxes should be going to our states, not the feds.

EITC? I was for it at one time, now I’m against it. Perhaps it sounds perverse to say this, but it’s just another big government scheme. But more importantly, since the recipients still vote, they’ll also vote for more big government schemes they don’t have to pay for.

It’s why I’m for a flat tax that everyone pays regardless of income. As a matter of fact, at the federal level, I’d get rid of all other taxes, which are too hidden for my taste. I’d also abolish withholding. If everyone has to write a check at the end of the year, they’ll get it.

First principles. Not more ways to encourage big government.