Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Why Those ‘Reagan Recovery’ vs. ‘Obama Recovery’ Comparisons Don’t Tell Us Much

Why Those ‘Reagan Recovery’ vs. ‘Obama Recovery’ Comparisons Don’t Tell Us Much

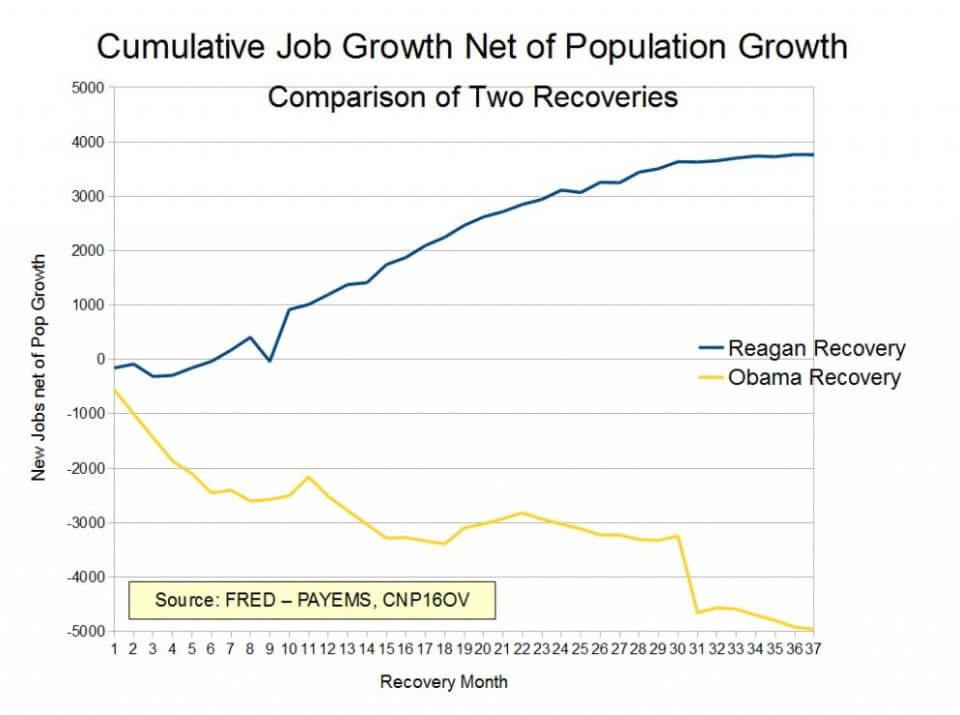

The Drudge Report recently linked (“OBAMA VS. REAGAN ON GROWTH — NOT EVEN CLOSE”) to a Gateway Pundit blog post featuring the above jobs chart, which was first posted at IJ Review. Now, it is hardly the only or first chart to highlight that the economic recovery after the 1981-82 recession was stronger than the recovery we’ve seen after the 2007-2009 recession. I’ve done a few of them myself. I mean, it’s not a difficult point to argue when economic growth was so much faster in the 1980s. In the 23 quarters since the end of the Great Recession, real GDP is up 14% vs 30% after Really Bad Recession. Or to put it another way, the “Reagan Recovery” was twice as strong as the “Obama Recovery.” The Four Percent Recovery vs. the Two Percent Recovery.

But what conclusions should we draw from that comparison? And how should those conclusions inform both economic policy going forward and responses to future downturns? Now, I am not about to write the definite blog post that answers those questions. Instead, I will ask even more questions: Were the two recessions of a similar kind? And if they weren’t — maybe one was driven by the Federal Reserve, the other by debt-laden balance sheets and financial collapse — does that make a difference in the depth and strength of the subsequent recovery?

For instance, economists Carmen Reinhart and Kenneth Rogoff find “the aftermath of the US financial crisis has been quite typical of post-war systemic financial crises around the globe.” Or maybe downturns after financial shocks in advanced economies are “on average only moderate, and often temporary,” as Christina and David Romer argue. Hmm. Then again, Michael Bordo finds it was less the financial crisis than the housing collapse that accompanied the banking shock. Along the same lines, Atif Mian and Amir Sufi argue a “debt-fueled housing boom artificially boosted household spending from 2000 to 2006, and then the collapse in house prices forced a sharp pull-back because indebted households bore the brunt of the shock.”

But maybe the real problem is less the nature of the downturns than the nature of government responses—or perhaps both share the blame. Perhaps the Great Depression, Really Bad Recession, and Great Recession were all just different flavors of downturn caused by Fed tightening (with the two Greats a case of the Fed unintentionally taking an existing downturn and making it much, much worse.) On the fiscal side, Romer and Romer theorize that the “tighter fiscal policy that began in … the United States in 2011 cannot explain the severity of the downturn, but … may have been important to the slow recovery.” Indeed, as Michael Darda has repeatedly pointed out, we’ve seen “the most intense fiscal consolidation since the Korean War demobilization,” including tax hikes. Sufi and Mann say their research suggests $700 billion in principal forgiveness of underwater mortgage debt in 2009 would have produced a $126 billion spending boost and “also have had the indirect positive effect of drastically reducing foreclosures and the associated negative effects of foreclosures on the economy.” Similary, Rogoff recently wrote, “Policymakers should have more vigorously pursued debt write-downs (e.g. subprime debt in the US and periphery-country debt in Europe), accompanied by bank restructuring and recapitalisation.” A more aggressive Fed would have been helpful, too, he adds. Casey Mulligan makes the case that it is government programs — such as food stamps and extended unemployment benefits — which are to blame by “reducing incentives for people to work and for businesses to hire.” Few would argue that policy responses have been optimal.

As for the 1980s, you had the Reagan tax cuts, of course. But also monetary easing starting in 1982. At the same time, the economy was shifting from one of high inflation to low inflation. And Corporate America was undergoing sweeping restructuring as it finally responded to increased global competition.

Finally, you have the various “secular stagnation” arguments, where the slow recovery is part of a longer-term downshift in growth. Maybe that’s because of a chronic lack of demand, maybe that reflects supply-side constraints including demographics and innovation. It’s worth noting that from the end of World War II through the 1980s, it took an average of only 6 months to return to pre-recession job levels. But normalization took 15 months after the 1990–91 recession and 39 months after the 2001 recession. And we know how the job market has slowly recovered this time around. Are trade and automation affecting labor markets in a way they weren’t in the 1980s?

So, yeah, a complicated macroeconomic picture with lots of moving policy pieces. Comparing GDP and jobs gains during the “Reagan Recovery” and the “Obama Recovery” can start an interesting economic conversation — but not much more than that. Then the real data-driven analysis can begin.

Published in Economics

I have to disagree. I think they speak volumes.

Reagan’s basic message was “Yes you did build that. You built it before and you can build it again if government would just let you.” People took that message to heart. And build it we did. Witness the acceleration in new business growth during the 1980’s.

Obama’s basic message is “No, you didn’t build that. Government built that. And government will do it again. ”

And people apparently are taking that message to heart. For the first time in almost forever, new business births have fallen below business deaths.

The results of these diametrically opposed messages are the diametrically opposed growth paths.

I wish somebody had a good Complexity Index to compare how hard it is to start and grow a business in different eras. The need for large HR expertise, environmental expertise and other guidance through the vast Federal, state and local regulatory jungle that not even experienced lawers can claim to know in full are likely a much bigger drag than comparatively small ups and downs in tax rates.

Carter started a process of deregulation and there was certainly a perception (rightly or wrongly) in the Reagan-Bush 1980s that government was less inclined to play ‘gotcha’ with business. Unde Obama, it is pretty clear that some agencies are running wild to bring lefty ideological wet dreams to life (yeah, I’m looking at you, EPA and Dept of Education!). It is a golden age for crony capitalists, skillful lobbyists and hacks. There should be some way to quantify that properly.

Bad demographics explains a lot of it:

Reagan recovery: population growth around 1% per annum and declining dependency ratio (dependents per worker).

Obama recovery: population growth around 0.7% per annum and rising dependency ratio.

Reagan was good but also lucky. He contributed the tax cuts and a pro-business attitude. But the technology revolution, falling dependency ratio and coming of age of boomers had nothing to do with him.

Obama is less business friendly (though more than feared in 2008) and his luck is mixed: we have a tech boom but demography is much worse.

OB, you’re exactly right. At my 1st startup in 1982, we took on the radio communication giants and won two significant Federal contracts from the U.S. Forest Service and the Army. Our portable radios were highly innovative (wide frequency coverage using radio frequency synthesis) compared to the big 3: Motorola, General Electric, and E.F. Johnson. I’m sure that under an Obama (or other Democrat) administration, pay to play would have made it impossible to get such contracts. Why reward a “startup” (with a good track record in aircraft radios) when other cronies are available.

My second startup in 1986 sold low cost (frequency hopping) tactical radios to some government organization such as the CIA. My career would be impossible to recreate today, even with updated technology.

I would argue that U.S. companies under Reagan would invest research and development dollars using American citizens, which allowed spinoffs (such as my examples above) to really push technologies. Now these companies want to invest abroad or use H1B visas to foreigners to solve immediate goals. But foreigners tend not to be risk takers, many growing up under systems that reward crony capitalists. Given the number of potential innovators (engineers, entrepreneurs) internationally, we have very little “tech boom” except in 3D printing and medicine. The new Apple watch is an example – a nice concept but poorly executed.

I really could care less about if the Reagan Recovery was better that the Obama whatever you want to call what is going on now. The whole thing is a moot point. I and most citizens want our current economy to get better, to grow, to employ more people in better jobs. Congress needs to get off its collective rear end and work with the current administration to do what needs to be done to that end. There are too many people that are still unemployed / underemployed while DC crows about how great everything is going and their rich cronies make money while cities riot.

The technology revolution comes with pro business attitude. Technology does not grow on trees. It is created and pulled from the ether by thousands of people and businesses. You tell people they can’t keep what they earn or make it harder for them to do business and create technology then you do not get a technology revolution.

Foreigners tend not to be risk takers? I can’t agree with this statement. In fact, they tend to be more entrepreneurial because they don’t have family and friends of older generations to put them in secure less risky positions.

I am glad you clarified to me that technology does not grow on trees. But then how do you explain Apple? Ahahah.

came out of a garage…

Despite the two recessions being different in makeup and cause, the governing philosophies of the two men can be demonstrated by the chart. Reagan saw that the best way to get the economy growing again was to trust in the people to arrange their lives to their own standard, while Obama viewed the best way forward was to throw money at projects that were a short-term solution at best at the same time take over vast swaths of the economy with the government (health care and banking). I think it is more than obvious which one produces the best results.

If you are talking about foreigners that legally immigrate to the US, then I agree with your statement. However, most 3rd world indigenous populations either do not have the education or the infrastructure to become technology innovators. For 1st and 2nd world countries, crony capitalism throttles many young people from innovation, as is now happening in the US.