Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Upside-Down Economics of Welfare

The Upside-Down Economics of Welfare

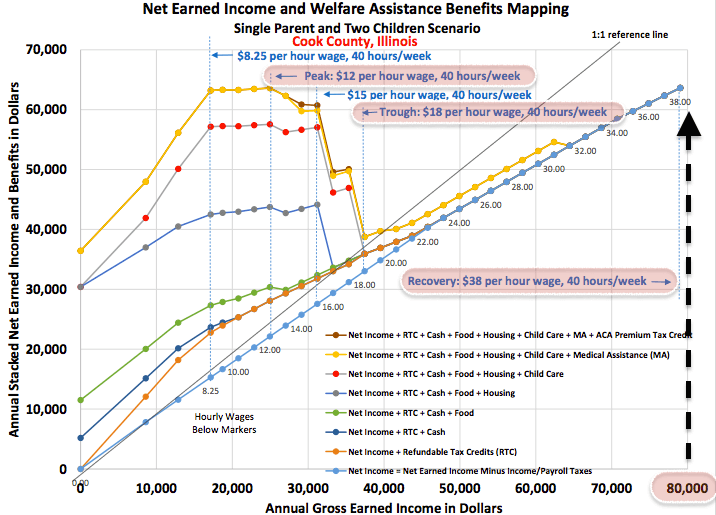

The welfare trap is deeper than I ever imagined. It occurs when a person on welfare finds that working harder provides no benefit, or actually costs more than it brings in. Repeat: the welfare system makes it so people can lose money by working more, and enjoy fewer benefits by getting a raise.

“That’s no trap,” one might say, “that’s Utopia.” I say no. When you do no work, you gain no skills and lose your future prospects. Your social interactions decline. Your attitudes become entitled. Your self-esteem shrivels. Worst of all, there is no reason to believe your situation will improve, let alone that you can improve it. Those are just the costs to the recipient of the welfare who — you’ll recall — is the supposed beneficiary.

Imagine what is lost on the donor side. How many men forfeit family and community to pay for that trap? How many women sacrifice family and home life for that trap? What would our communities be like if their time, money, and energy were gainfully employed?

An old Quebecois folk singer coined a phrase that aboriginal reformers in Canada have taken up: The best way to kill a man is to pay him for doing nothing.

Published in Culture, Domestic Policy

The other half of that equation is that to be able to pay benefits to an increasingly number of non workers you must expect those that are working to work harder for less. Where is that incentive? That is why socialism always ends in totalitarianism.

That’s a great visual.

A possible solution: welfare benefits decay by some percentage each month.

The “safety net” would then function as an actual safety net instead of a subsidized lifestyle. Since the change happens gradually, the recipient is able to optimize the point where they leave the safety net.

I see potential!

Canada does something similar with unemployment benefits. People who regularly claim EI (I’m looking at you, fishermen.) find that the EI deal gets worse every year. I guess they have to wait longer for benefits, they last for less time and the benefits are lower.

Add this tweak: When you introduce the decay factor, set the initial welfare benefits higher, and with that you can claim that you’re actually increasing the safety net. Thus the legislation would have a better chance of getting through.

——

Though, sigh… what I’m doing here is presenting an example of an engineering approach to solving a political problem.

A far superior and constitutionally correct solution is to relegate it all to the states.

Thanks. The Federal government is not capable of managing a welfare system for the entire country, they are not accountable for the harm they do, they don’t spend their own money and they benefit by expanding programs. States aren’t capable either because they are not accountable and don’t spend their own money. If welfare, a helping hand is to do more good than harm it must be provided by people who personally know the beneficiaries. That’s not impossible but it isn’t easy and probably can’t be done by government at any level outside the immediate community and that community must spend it’s own money. We continue to speak of dependency as safety nets, helping hands using Christian images like social justice and charity. It is none of those things, it is probably the most destructive evil thing we do.

Another mechanism is to simply reduce benefits by, say, 35 cents for every dollar earned. That way, you never lose money by working more.

How about a progressive reduction so that the more the make the more you stay ahead. At the moment there is a wall sort of thing when you make X dollars things stop happening.

Thank you so much for this post. I have heard people say that working would mean a paycut but this puts it in perspective.

Is it a coincidence that $15 is the edge of the cliff and that is what Liberals are claiming should be the new minimum wage?

Here is a thought for Republicans to consider: should we sabotage Liberal efforts by insisting that if the Minimum Wage is raised that it should be $16 an hour instead of just $15? Based on this chart it looks like that would save the Government a lot of money on entitlement spending or it would cause many low-skilled workers to simply quit their jobs rather than lose benefits. Either way it would completely undermine the effort and we would have people begging Congress to reduce the minimum wage. Judo anyone?

That graph is based on theoretical potential of benefits. Do people actually manage to avail themselves of those benefits to that degree? Because the cliff, practically speaking might actually be less steep, because of the inefficiency of benefit collection.

Very often, people have help. For example, social workers are trained to help their “clients” maximize the benefits available to them.

I happen to already have the money graph from the first link in my image library.

Thereby maximizing the utility of the social worker, while building their clientele. It’s why the social worker went into the field, and why they feel they are doing God’s work.

This will work well for the major beneficiaries (state workers and their clientele) until the supporting system collapses due to its disconnection from the market and reality as it exists. The system described exists on spinning debt forward into infinity. Eventually, the paper becomes worthless. This is another form of “bad luck.”

Love the visual.

It’s worse than that. Even if the welfare client has an opportunity to scale the cliff and be better off at the outset (unlikely event), there is also the risk analysis: if the new opportunity does not work out, then it’s back to the end of the line for housing assistance, it’s waiting periods to get back online for various programs and a tough transition back to dependence.

I had a consulting gig for county government for a year. I re-learned that Federal agencies are tunnel-visioned, turf-building zombies. State and local welfare agencies in contrast have needed to be really creative to create one-stop shopping so eligible people don’t have to do a dozen different conflicting aid applications at a dozen different windows. If those local folks had complete flexibility, authority to customize and sufficient resources to aid and rebuild the people they serve, it would be miraculously better and could not possibly be more expensive, wasteful or ineffective than the status quo.

Back in 1985 my mom and step-dad got divorced and we became a single parent household in which I was the oldest child at age 17. I had three younger siblings, one of whom was profoundly disabled due to a malignant brain tumor and the resultant complications. My mom was an entry level level worker with virtually no experience. She received food stamps for us, and SSDI for my disabled younger sister. I don’t recall how much or whether there was any AFDC (welfare checks). My mom got a minimum wage job, which cut our benefits significantly. (May have even been the death knell to the AFDC.) She went to a we-finance-anybody buy-here-pay-here used car lot and bought a 1972 Gremlin to use to get back and forth to work. Her case worker lived in our neighborhood and would drive past our trailer. She saw the car and called my mom in to interrogate her about where she’d gotten the money to buy a car. We lived in a dilapidated trailer with almost no furniture, and my mom worked at a grocery store in the dairy department where her boss allowed her to bring home out of date food to supplement our grocery budget. I never forgotten the lesson of what a trap welfare can be. Those who do ‘well’ do so because they live on unreported income or have domestic partners supporting them about whom their case workers know nothing.

You kind of lost me — what do you mean by “progressive reduction?”

According to my 35 cents scheme, you do make continuously more. For example, if you get $40K in benefits, and you work some part time job for $10K, you would lose $3500 in benefits, for a total of $40K + $10K – $3.5K = $46.5K. So you bring home $6.5K more than if you didn’t work at all.

If you work a job and make $20K, then you’d lose $7K in benefits, for a total of $53K. Etc. There’s no cliff.

< satirical devil’s advocate mode = on >

Yabbut, don’t we want the single mom spending more time with her kids rather than working for “the man” at $69,000 per year? Opportunity costs, my man!

< satirical devil’s advocate mode = off >

True, but I doubt this leads to 100% efficiency. My question still stands what is the actual level to which people benefit, do we know this? Can we know this? When we do these kinds of analysis we should be conscientious of the fact that these are all theoretical numbers. I don’t wish to be excessively contrarian but it is always poor science to conflate ones model for reality without actually validating it with real data. This graph represents a theory that under our welfare scheme such a cliff exists, I would like to see some real world data that shows this effect is real.

I absolutely believe this.

That is true. In public adoptions, for example, the county gets paid by the feds for every dollar they get allocated to a family that has adopted. These payments are payed to the family monthly and to the county on some sort of regular basis. Basically, social workers spend at least 10% of their time ensuring that the families get all their benefits so that, surprise, the social worker can remain employed.

Ask me how I know.

Even if not every single parent avails themselves of these benefits, it still is a problem because it unfairly benefits those that game the system to get all the benefits, rather than encouraging the ones that are trying to work and get out of the welfare trap.

Social workers need their clients more than the clients need them.

The following is an interesting read from the Mackinac Center ( a response to a stressed social services worker) about why the current system does not work and cannot work: https://www.mackinac.org/12080

Hey Brandon, How do you know that?

I hate to be nosy but I am curious as well.