Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

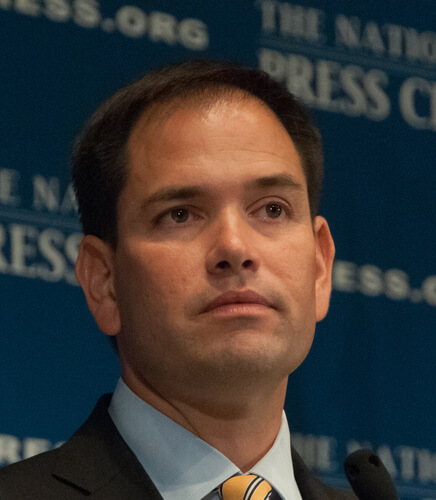

On Marco Rubio’s Supposed ‘Tax Mistake’

On Marco Rubio’s Supposed ‘Tax Mistake’

The Wall Street Journal editorial page recently offered a lengthy criticism of Senator Marco Rubio’s tax plan — “Rubio’s Tax Mistake” — first coauthored with Senator Mike Lee. To be more precise, it’s a lengthy criticism of Rubio’s proposed expansion of the child tax credit. Why does the WSJ hate that credit so much? It argues a bigger child credit (a) does nothing for economic growth and is thus (b) a waste of money that could be better spent on lowering the top personal income tax rate below the 35% rate in the Rubio plan.

The Wall Street Journal editorial page recently offered a lengthy criticism of Senator Marco Rubio’s tax plan — “Rubio’s Tax Mistake” — first coauthored with Senator Mike Lee. To be more precise, it’s a lengthy criticism of Rubio’s proposed expansion of the child tax credit. Why does the WSJ hate that credit so much? It argues a bigger child credit (a) does nothing for economic growth and is thus (b) a waste of money that could be better spent on lowering the top personal income tax rate below the 35% rate in the Rubio plan.

A few thoughts: First, to the extent that higher take-home pay would allow families to invest more in their own kids and reduce family instability and stress, the tax credit does have a pro-growth aspect. Human capital counts, too, and this would be a human capital gains tax cut for the folks creating and raising the next generation of workers. Now the WSJ might counter that a better solution for a struggling middle class would be to supercharge GDP growth by deeply cutting the top rate. Yet note that Rand Paul’s new flat tax plan with its low, low, low 14.5% top rate would only increase growth by about 1 percentage point a year for the next decade, according to the Tax Foundation. We are talking about a Three Percent (ish) Economy not a Five Percent Economy, if you buy the group’s optimistic modeling assumptions. (Indeed, the same Tax Foundation modeling shows a significantly bigger growth impact from the Rubio plan thanks to its sweeping, supply-side investment and corporate tax reform.)

Second, the WSJ fails to consider the possibility that right now a “rising tide” might not not so easily lift all boats in a US economy where globalization and automation are buffeting the middle class. Faster growth is necessary, of course, but may not currently be sufficient for broadly experienced prosperity. What’s more, smart supply-side reforms may take some time to raise US growth potential. (That sure seemed to be the case with the Reagan tax cuts.) For instance: The WSJ points out how the economy flagged after the slow-motion tax cuts of George W. Bush, which also included a larger child tax credit: “…only when Mr. Bush pushed in 2003 to accelerate the rate reductions and slashed the capital gains rate to 15% from 20% did the economy take off and save his re-election.”

Interestingly, then, that productivity growth was markedly slower in the four years after the capital gains tax cut than in the four years previous, 3.5% annually vs. 1.9%, with so-so average GDP growth of 2.9%. Anyway, allowing families to keep more of what they make — via the child tax credit — or supplementing their wages through the earned income tax credit are good income-support ideas as we hopefully engage in deep structural supply-side reform from taxes to regulation to education. (Although the “average is over” scenario should be kept in mind.)

Third, the WSJ says Rubio “let himself be swayed by a coterie of non-economist conservatives who view the tax code as an engine of social policy” and “denigrate marginal-rate cuts as politically déclassé … .” This is a strange criticism when some of the key folks driving the traditional supply-side movement have not been PhD economists, including former WSJers Steve Moore and the late Jude Wanniski (whose supply-side classic, The Way the World Works, is currently sitting on my bookshelf). And I think supporting American families is pretty darn good economic policy. (And a political point from Ryan Ellis: ” All successful Republican tax bills are a mixture of pro-growth and pro-family.”) Lee put it well during a 2013 speech at AEI:

For family is not just one of the major institutions through which people pursue happiness. It is the one upon which all the others depend. More than that, in recent years, the family has emerged as perhaps the most important institution in our economy. The family is an incubator of economic opportunity, and an indicator of economic success. It is every individual’s primary source of human and social capital: habits and skills like empathy, self-discipline, trust, and cooperation that grow more economically important every day. The family is where we learn the skills to access and succeed in America’s market economy and civil society… and thereby create new opportunities for others to do the same. The primacy of family should inform conservative policies about everything from welfare to education to transportation to criminal justice. If there is any single group of people in the entire country whose equal opportunity to pursue happiness we should make sure to protect, it is our ultimate entrepreneurial and investor class: America’s moms and dads.

Now all that said, the Rubio plan is not perfect. But by acknowledging — through policy choices — some fundamental problems with the US economy, it gets some big, important things right. And a child tax credit expansion is one of those things.

Published in Economics

Jim,

I couldn’t agree with you more. I think the expanded child tax credit could in fact be a big multiplier for the economy. On top of that apparently the WSJ is completely tone deaf politically. This is the kind of tax issue that will have huge resonance across the electorate. It is exactly the kind of tax issue that can help get Republican’s elected. Apparently the only kind of tax issue the WSJ is interested in is the kind that attracts big donors. With all the capital in the world in your campaign chest but zero resonance with the electorate you aren’t going anywhere.

Regards,

Jim

Human capital indeed. That is the number one input of the economy. Those developing it deserve a hand just as much as the investor class.

I am honestly sick to death of Larry Kudlow and the Wall Street Journal pushing the donor class agenda. GOP donors are not conservatives for the most part. Their interests aren’t mine, and all of the supply-side, trickle down, rising tide BS has become nothing but brain dead clichés masquerading as economics. I’m tired of the pundits pushing talking points to help their wealthy friends while pretending that they are for the average American.

Tax cuts are not the best way to grow the economy. Deregulation, and replacing Obamacare with a smart healthcare policy which decouples healthcare from employment should be the top priorities of a GOP administration.

I never thought I would see the day when the WSJ would refer to a tax cut as an “entitlement”. Aren’t these the people who remind us that it is our money every time the subject of taxes comes up?

At any rate, the only problem with Rubio’s child tax credit is that it is too small. Parents today spend large amounts on raising their children. But these children will also be supporting the childless in retirement. Doesn’t seem right. We have to cut taxes on the people we are later taxing for retirement benefits.

The Rubio / Lee tax plan is one of the reasons I cannot support Rubio for president. I’m shocked to see republicans support a federal income tax rate of 35% on single incomes over $75,000 and married incomes over $150,000. Who in the heck can support such a high rate, especially starting at such a low level? When you consider SS and Medicare tax, plus state income tax, the (combined levels of) government are basically demanding to split any income you can make over $75,000 with you (or close to it)! And this wasn’t just done to increase child tax credits, but to lower business income tax (their cronies!).

I’m concerned that the republicans have left behind talk of lowered spending and fiscal responsibility, and are now just talking about reorganizing tax revenues to transfer the burden from one group to another. Its a very bad trend.

Rubio’s tax mistake is that he doesn’t toss the code and start from scratch, he uses it for social policy and political demagoguery and while the latter probably works it doesn’t help. The current code cannot be fixed. It is too complex, too corrupt and any attempt to reform it no matter how good sounding, will merely lead to a giant log roll. Gore all the oxen on k street and we can get real reform. Base it on a simple idea that can be defended as an idea, not one reform among a million possible reforms that merely releases the dogs of k street war. Cain’s 999 was an example. The flat tax is another as is the Fair tax. Of all of them I’d make it a variation on Cain, make it 10 10. A 10% vat linked to a 10% flat tax with corporate profits treated as income of the holder of record.

There is no value neutral tax policy. All tax policies are social policies.

All tax policies encourage some behaviors and discourage others, even if they are only “economic” behaviors–e.g. saving or investing, consumer spending or property owning, income taxes versus user fees/tolls and so on. Money is earned in some way, some activity is taxed, and therefore implicitly or explicitly, the tax code picks and chooses. All schemes of taxation involve market distortions and externalities whether we see them clearly or not.

The policy that comes closest not to picking or choosing explicitly would be the flat tax. Even there, however, there are valid arguments about the preferences it implicitly endorses: if taxes are uniformly levied on, say, corporations and individuals….can’t some individuals (investors, say) at corporations rightly claim they’re being taxed twice? Or single individual households versus households with several members paying the same rate?

Value judgments are constantly being made by our tax code: even if the overall goal and design of the tax code is nothing more than maximum efficiency and maximum growth. In that case, we are making a dual value judgment: what method is most efficient means that we must first define efficiency, and secondly that we must prize what is most efficient in this sense above not only other contrary definitions but other values that claim to rank higher than economic efficiency.

I don’t like tax credits because it offers negative tax liabilities for most Americans when you combine them all and compare them to what has been withheld. The credits should go away, rates lowered to a reasonable flat percentage, and more Americans should share the tax burden. Plus, tax credits are DC’s way of manipulating the population into making lifestyle changes that DC agrees with. You don’t want a hybrid junk car? Well how about a $7500 tax credit? You don’t want children or to own a house? Well how about tax credits to make those things more appealing? Philosophically, Washington should not be in the business of shaping and molding society in this manner.

Also, I know that my comment did nothing to address the actual piece. Sorry about that.

Jim & all,

I really find some of the comments here short sighted from a political point of view. We are facing two pressing problems.

1) We are non-competitive world wide and are losing import export opportunities. Domestic non-investment is the result. No jobs. Lowering the corporate tax rate to world average would be a great help here.

2) The family is collapsing. We are down to a 1.5 birth rate. Huge numbers of children are raised in single parent families. A straight tax credit will especially help those who are employed but marginally so. That money will get spent on clothes, books, larger apts and houses right away.

Frankly I don’t think lowering the personal tax rate on those way above the six figure mark is so important. Of course, my local BMW dealer is all for it. Frankly, my dear Yuppie, I don’t give a damn.

Regards,

Jim

So, you think redistribution is a double-plus good as long as its from others to you?

You need to look at the whole economic picture before you just dismiss higher income earners as just being consumers of high-end goods. Its much more complicated than that. You might find you’ve shot yourself in the foot.

This isn’t really as bad as you think. The Rubio plan as compared to the current system is a tax cut for individuals until they hit around $130,000. The effective rate from $130,000 to $411,500 gradually increases vs. the current effective rate, but the highest increase, for people making $400,000 say, is only 2.5%. And if the $400,000 earning individual has any kids, that relatively small increase is offset somewhat.

For married people the Rubio plan is actually a substantial tax cut even before any child credits kick in up until about $350,000. From $350,000 to $411,500, there is a small increase in the effective tax rate. But again, if these high earning married couples have kids, which many, many will, that increase is offset.

So the only people who have any reason to complain about the Rubio plan are childless individuals earning over $130,000. And really it’s only individuals earning closer to $200,000 who are going to really feel an increase more than 1%.

The vast, vast majority of people would get a tax cut under the Rubio brackets, and many of those who felt some tax increase would have them offset if they have children.

Megadittos.

Lily,

Not at all. You are giving me a libertarian strawmanning. I am talking priorities. Both economic and political. I am not talking redistribution but common sense. First and foremost we are talking tax credits which means less trickle-down government. A relief for everyone (except the public employee union parasites). When you create giant bureaucracy and a zillion pages of regulation (like the ACA) then your talk destructive redistribution. Doing a couple tax credits that are not permanent is a very different story.

I am not against reducing the tax rate on high income earners. I am making a distinction between what needs critical relief and what could be good but might just wait a bit. Going into this election we need an approach that can win. I don’t think the Rubio/Lee tax idea is a loser. Only the WSJ wants it to be and the motivation may be suspect.

I don’t have children nor am I starting my corporation so neither tax policy would benefit me. We might not be facing the madness of the ACA if we had simply passed a more generous tax credit for health care. We may well be lucky if that’s all our Boehner/McConnell inside the beltway leadership end up doing.

The politics is more complicated than you think.

Regards,

Jim

Its bad enough, thank you.

I just can’t agree that this is ok just because only a minority of people get screwed. More importantly, its the wrong approach. I voted republican because I thought they were the party of small government and fiscal responsibility. We should be working to grow the economy by lowering the tax burden and regulations – not fiddling with the mechanisms of a large and burdensome government. A 35% federal income tax rate is just too high for any income level, but especially for incomes as low as $75,000.

Rubio should be using his political clout and influence to reduce government.

So, suppose you had kids, but they’re all now out of school (which you paid for with mortgage debt). Now you and your spouse are working hard to pay off the mortgage debt AND save for retirement in your last productive years. And the government comes along and says, “We’ve increased your taxes so we can lower other people’s taxes!” Does that seem fair to you? Does that seem the right approach for ‘conservatives’? (I can think of other examples too)

Government should NOT be in the business of picking winners and losers so support an out-sized welfare system. Nor should it be in the ‘transfer income’ business.

James Pethokoukis = Bruce Bartlett

I don’t know what your definition of being screwed is, but I don’t think 5-10 million tax payers making over $200,000/year having to pay a few thousand dollars more, really qualifies. Especially since the growth effects of a simplified and business friendly code will redound to significant improvement in economic growth and personal income for most tax payers.

I’m sorry but high earning single people can pay more now, because they will be enjoying the fruits of having a productive economy once they are retired provided to them by the children other people had and raised.

Also, if you think there is a politically viable plan “more fair” than this, I think you are fooling yourself. The flat tax is a pipe dream, the vast majority of Americans believe in a progressive tax code. If you want to convince people otherwise, you will have to do so incrementally.

There is not enough money in the world to fund all the promises made by our government. The “kids” you think will grow up and take care of you in your dotage will rebel when they see the reality of the level of taxation it will take to support our welfare systems, and how it will curtail their own lives. And I don’t blame them.

I’m frustrated that the republican ‘leaders’ aren’t even paying lip service to fiscal responsibility and lowering the overall burden of government. A manipulation of the tax system just won’t cover it.

You say I’m the one whose not being realistic. I say the ones who think this system can go on as it is are not being realistic. This is just crazy!

Hmmmm. X pays more so Y can pay less. Common Sense!

Agreed, the Rubio plan isn’t increasing revenue by raising taxes. It is restructuring taxes, a few million will pay a tiny amount more, but the vast majority will pay less. Any revenue increase comes from improved growth, not from tax payers paying a higher percentage of their income.

I’m not expecting kids to pay for me in my dotage. But without people there will be no economy for my retirement savings to be spent on, or infrastructure for me to use in my retirement. I’m not expecting the next generation to pay for me, but there has to be a next generation for me to have a retirement. The people who ensure the continuation of the economy and the society deserve more than those who haven’t made that same type of investment that is a service to all, child having and childless alike.

And I don’t believe that decent, law abiding hard working citizens deserve to be ‘picked clean’ just because you think they have more money than they need, and think you can spend it better than they can. Good grief.

Nobody is being “picked clean” that is just demagogic language. I also don’t think I can spend the money better than individuals can. The fact is that the money is already spent, and virtually all of the spending was voted in before I could ever vote or against my will. But it is spent nonetheless and so all of us are going to be paying that off for generations. So whether I like it or not, I have to find a way to pay for it that is politically viable. Stamping my feet and demanding a flat tax or some other utopian minded tax policy in a manner that will only get more democrats elected isn’t an option I’m much interested in pursuing or encouraging.

Lily,

I am sorry if I have offended. Perhaps I should think more about the fundamentals and not the politics here. Let me talk about tax credit in general and then maybe you will understand what I am thinking. We are always facing the same political problem. Many people especially when the economy is down are facing difficult times. I am not talking about those who have already given up. I am talking about the working people who still pay taxes. The dems come along and sell them the big government lie. Not only won’t they get what they were sold (trickle down government) but burdensome bureaucracy & regulation will guarantee that things get worse. Tax credit is our great political weapon against this. The dems hate it and never will offer it because they want control. We can offer it because if given to those who will use it immediately it will have a big instantaneous effect. The long term negative effects of bureaucracy & regulation aren’t there. As the economy comes up there will be less pressure to maintain the credits and more and more people will be thinking about the tax bracket above them and how they would like it to be lower. That’s the natural political flow.

Maybe I’ve shot myself in the foot with you. I hope I haven’t.

Regards,

Jim

I’m sure the offense was all mine. I feel strongly about limited government – and worry about the future, economically. But, I’ve said all that above –

The Rubio/Lee plan makes a number of tradeoffs. For example, while I’m not a fan of the child tax credit, I’ll swallow it in return for elimination of the AMT.

In general we’re thinking too small. That’s sort of a royal we, meaning conservatives and Republicans , politicians and bloggers. Once we are committed to reform, it is easier politically to toss the code and start fresh. Once we start fresh we can build our proposal and it’s defense on the same high ground. A new tax built on the high ground of a simple idea that falls apart if significantly altered, can win. Breaking open the existing code cannot. For instance, we have defended ourselves from run away protectionism by the idea of free trade. Once we grant that some tariffs are good, and we must craft “fair trade” the whole thing falls apart. It is obviously very hard for folks who have spent much time in Washington to think this way even though it is insider knowledge of Washington that informs the strategy. They must think like the founders. They were sent to amend the articles of confederation but once they abandoned that notion, they chose to raise a new banner and fight for it. It can be done.

I see absolutely zero evidence that this is true. I would ask that you provide some empirical support to back these claims up. Your notion expressed here sounds entirely like a triumph of ideology over reality.

I think doing a repeal and replace of the tax code is a grand idea. I just see no political support for it. I don’t think the average voter cares all that much about the tax code. I also don’t think the average voter grasps in any meaningful way the truth and the threat of the impending fiscal disaster facing the nation.

So, to believe that running on a radical rebuild of the tax code, a subject that makes even many politically attuned voters’ eyes glaze over, would be a winning approach seems very much like wishful thinking.

Bthompson

An insight fighting for a free trade regime and then I saw it in various locations that enjoyed strong leadership. Lobbyists are professionals, what they cared about was not losing to other lobbyists. They could live with equal loss, all loss, all gain, they could not live with a relative loss. One small break in the idea of free, across the board simple, no tariffs, no exceptions and it all comes apart. The founding was evidence and most of the battles over freedom in Washington but you are right, most often we compromise at the beginning in the name of realism so armies of professional lobbyists descend, the log role begins and the default position, creeping socialism, creeping fascism, or just creeping corruption, call it what you want takes over. However, New Zealand’s tax reform and radical free market reforms were an example, as is all of Singapore policy since they were expelled from Malaysia. I’ve seen it over the years in many places. It’s the way the world works when you get great leadership. There is support for a flat tax and for the fair tax. What there is, is a lack of is leadership to sell the ideas. Good lord liberals can make half the population believe anything. Do you really believe solid ideas can’t be sold? Or that we should quit before we begin?

I really don’t think one can extrapolate from New Zealand or Singapore what might be politically possible in the US. New Zealand is a tiny, relatively homogenous culture (yes I know that there is a significant indigenous culture there, but it has about as much political heft as our own indiginous culture here, from what I can tell). It is also a parliamentary system ruling over a very diffuse population and a tiny economy. Singapore was brought into existence and developed essentially by a benevolent dictator. Neither of those situations is analogous to our political system.

I think a fairer, flatter tax code can be achieved, but it will have to be done in increments, just as free trade has been a patchwork of treaties fought for in several battles. Reforming the tax code will involve proving liberals wrong bit by bit and gaining the public’s trust in increments as liberal scare tactics are discredited one lie at a time.

The reason we have such a large federal government and no serious call to shrink it is because we don’t pay for it. The wealthy in our country pay similar taxes as their European counterparts. The middle class? Not so much. The child tax credit is one of the biggest reasons the middle class families pay nothing or very little in taxes. Now we want increase this program that promotes an ever growing state?

I’m ok if they pay such low rates but first you are going to have to cut A LOT of government spending. So get the budget below a trillion per year(impossible) and you can justify the current tax rates paid by the middle class. Adding this type of plan without cutting spending, which I’ve seen nothing in that vain from Rubio, and you’re making a bad tax policy worse and there will be no incentive to shrink the state.

Another thing to think about is what should interest rates be at 4% or 5% growth? 5%? 6%? 7%?. At those interest rates we are paying 700 to 800 billion more per year on our debt service? What does that do to the deficit? Do we not care about that anymore? It’s like the Bush years all over again. We don’t have a small government party. We have 2 big government parties that have different groups they want to benefit.

I’ve seen evidence all over the world that incremental fixes around the edges, just rearrange interests with no lasting effect. New Zealand shows what real leadership can achieve. It’s relevant, it just takes more courage, a clear understanding of the objectives and a long term sales job. Our heterogeneity means we have to keep things simple and decentralized, it does not mean we cannot have leadership, nor that we should quit before we begin. I’d say exactly the contrary.

The Rubio-Lee tax plan has no good faith rational justification.

The posters in this thread prove this conclusively.