Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

June Jobs Report: 6 Years Into Economic Recovery, Is This The Best We Can Do?

June Jobs Report: 6 Years Into Economic Recovery, Is This The Best We Can Do?

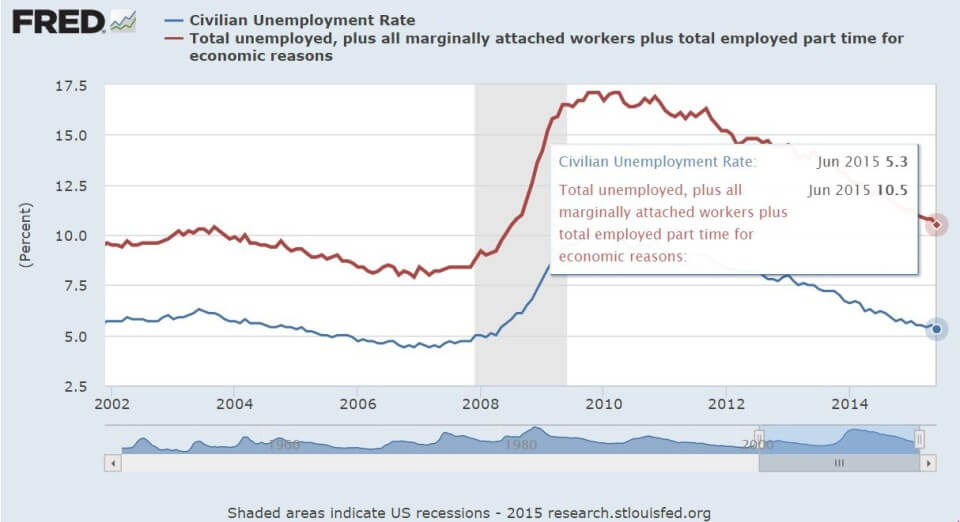

Nothing in the June jobs report to suggest any approaching US economic acceleration or surging inflation — or reason for the Fed to raise interest rates. The top line numbers were decent: 223,000 net new jobs, the unemployment rate fell to 5.3% from 5.5%. Also a big drop in the U-6 unemployment-underemployment rate.

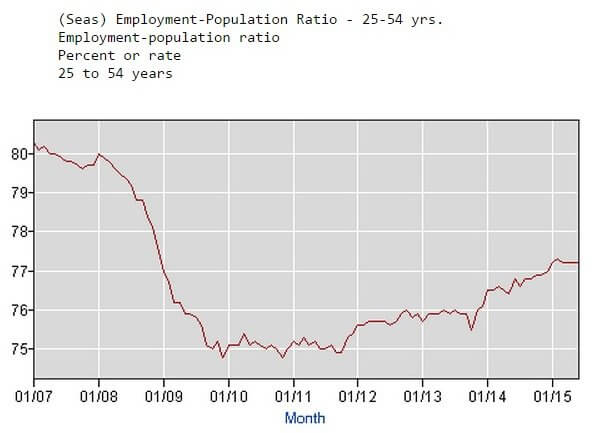

The internals were less decent: The participation rate fell, the employment rate fell, the labor force fell by 432,000, April and May jobs were revised lower by 60,000, nominal wage growth was flat. What’s more, 2015 job growth of 208,000 a month is markedly lower than the 260,000 monthly average for all of last year. And if the participation rate had merely held steady from last month, that big jobless rate drop would have turned into a jump to 5.7%. Maybe this chart best sums up where we are six years into economic recovery (June was the anniversary month):

The employment rate for Americans in what should be the prime of their working life looks stalled at a depressed level. Sure looks like there is plenty of slack in the US labor market. As economist Justin Wolfers tweeted, “Every month that we learn that we can get more people back to work without stoking inflation is fantastic.” Or to put it another way, via AEI’s Mike Strain:

Yes, given who’s running the government these days. They NEED an under-class, and they are happy to be adding to it, since it increases their power. ObamaCare, minimum-wage laws, Dodd-Frank all heavily weigh on the economy, with no end in sight. Any growth you see is in spite of everything the administration can do, not because of anything they do. They extort huge monetary settlements from big banks, oil companies, and other producers in the economy-is the stagnation any wonder?

There isn’t a recovery and never has been for a simple reason: Keynesian stimulus policies don’t work. All we’ve done since 2008 is paper over problems with cheap money and blow bubbles in bonds, real estate and stocks. Nothing has changed since 2008 except that we are much deeper in debt and this time, when the bubbles pop, what is the Fed going to do? It’s out of ammo with zero percent interest rates.

Get ready for a rough landing.

Thank you for providing the prime age employment rate! Republicans citing the drop in labor force participation with Democrats rote response about the aging population was getting old. There is truly something wrong with this recovery. In my business, apartment rentals, buildings are selling for astronomical price-to-rent multiples, way beyond what historically can be justified by low interest rates. Investors are desperate to hold anything other than dollars. Now, with the Supreme Court’s help, the Administration prepares a major regulatory assault on the housing industry, one of the biggest drivers of the economy, all because states are putting low-income housing in low-income areas rather than high-income areas. This feels like 2007, except that we have already played the quantitative easing card. What next?

In 07 we had became aware of that we had a debt crisis. The establishments solution was more debt. The thing I can’t understand is why economists some how believe that this would or could work. The establishment was able to open the tap again for awhile which allows the party to go on, but the beer being dispensed is watered down which explains why things are not as upbeat. The problem is that the political establishment has been buying votes with borrowed money. This not not just an Obama problem, remember TARP, bank bailouts, auto bailout and the first stimulus were all brought to us by the POP ( Pathetic Old Party).

June jobs report. DISASTER! We LOST 349,000 full-time jobs! Yep.

Since January, on average, the economy has added 64,800 jobs per month. That is just awful.

But no one…not even James, will tell you that. Why is that?

But you can see for yourself at the St Louis Feds easy to use website. Look for data series LNS12500000. This is from the same data set used to calculate the unemployment rate, so the source is unimpeachable.

No, we didn’t.

Anyway, lots of things thrown around: obviously, Obama, Fed, TARP, Keynes, Inflation Debt. Bla bla.

The reality is that whatever the US economy is doing, it is far better than everyone else’s economy. So putting things a bit in perspective.

Second, labor participation rate is a long term trend that turned negative around 2000. It started diminishing already since 1980.

It’s hard to say “Obama” when this is a trend from 35 years ago, or to blame US policy when the rest of the globe is doing worst.

The main drivers of diminishing labor participation rates have been two:

1) Teenage labor participation rate

2) Young people’s labor participation rate

Both of these are easily understandable simply by looking at college enrollment figures. Young people are going to college in much larger numbers, and thus not working. They are also staying in college longer, getting higher levels of education, and thus delaying their entry into the workforce.

None of these things are “bad”. They’re the sort of thing you’d expect to happen in a high-tech economy that competes on innovation. I.e., you can’t get the sort of competitive economy you want…with 19 year olds working as plumbers. Sorry, you can’t. You get that with people getting advanced degrees in advanced fields…but that ultimately means “depressed” labor rates.

As, ahem, others have noted, the participation rate has long been decreasing – largely due to the aging of baby boomers, etc., and the declining birth rates. But it took a nosedive after Barry was elected and is particularly correlated with the reduction in the unemployment rate. It’s well below the numbers seen in the prior decade.

Which is not something Barry touts when he talks about the lower unemployment rate. Turns out when you provide incentives to not work, people will take you up on that offer.

I wonder what else happened around that time.

Seems to be pretty uncorrelated.

Not really. Boomers have increased their participation in the labor force.

Labor force participation rate has more to do with the definition and measures of it, than anything else. The biggest decline by far has been in the young population. But that also happened to be the decades when more and more of them were going to college. Hence, if college participation rates keep increasing, the way the BLS measures labor participation must necessarily decrease.

As you can see below, the rate of teenage and young people’s participation rates has been decreasing the more affluent the household. I.e., they’re rich enough not to have to work, and much more likely to be going to college.

Nor can the blame be placed on “incentives not to work”. The labor participation rates among the lowest income households have been increasing, not decreasing. They’re decreasing at the top.

Hi AIG

Fyi. We LOST 349,000 full time jobs in the June Report

St Louis Fed data series LNS12500000

Employed Usually Work Full Time

May was 121,402,000

June was 121,053,000

Arithematic suggests a decline of 349,000 Full Time Jobs

And since you clearly know how to use FRED, I am forced to conclude you either chose not to look at the data before replying “no we didn’t” or you looked but chose to misrepresent the facts.

If someone retires, is that a “loss of a full-time job”?

Second, seasonal adjustment. Let it happen first, then look at the numbers.

Hi AIG. If a full time employee retires and is not replaced … Yes that is the loss of a full time job.

These numbers Are seasonally adjusted.

By that logic, 1 million 546 thousand jobs were “created” between November 2014 and June 2015.

Unfortunately, that number doesn’t reflect “jobs” created or “lost”.

Hi AIG. Your statement, with all due respect, ridiculous, Maybe that logic works in AIG-land… Not here. What you are talking about is regular turnover on a functioning economy. not losing a job is NOT the same thing as creating one. Unless you are following some version Clintonian logic … where not getting caught in a lie is the same as telling the truth.

Turnover numbers are different from these numbers. Turnover numbers are multiple times bigger.

So when you’re saying that when this number is -, its “lost jobs”. But when its +, its not “created jobs”

I agree on both counts, it’s neither.

Ahhhh. “What we have hearah is a failure to communicate.”

Hi AIG. Since we had been talking about retirees I assumed you were making an argument along the lines of …

If a full time employee retires and is not replaced you are counting that as a job lost, then if a full time employee retires and IS replaced we should count that as a job created. And that the number you quoted – 1,546 million – somehow represented retirees since Nov 2014.

That is the argument I thought you were making and that is what I called ridiculous.

I see now that I was mistaken. You never said where the 1,546 was from and I guessed wrong.

Ok. 1,546,000 represents the change in the REPORTED number of full time employees from Nov 2014 to June 2015.

That number indeed represents the change in full time employment … But not since Nov 2014. Why? Because Jan 2015 really has an asterisk.

Backstory. This data comes from the Hoisehold Survey. As the name suggests, they don’t actually count every job. Rather they estimate that total from the survey. One of the numbers that goes into that calculation is Population.

Begining in Jan 2015, they began using an updated Population number. They DON’T go back and restate all the prior month’s numbers. They just start using the new (larger) Population number in calculating Jan 2015. So the change from Dec 2014 to Jan 2015’s number is really a composite figure. One part is the actual Jan 2015 number and one part represents the lump sum adjustment since the last time they updated their Population numbers. ( this is done periodically, but I’m not sure how often. Not more then annually. )

So, strictly speaking, the numbers from Jan 2015 and forward are not comparable with Dec 2014 and prior. ( Its not as bad as apples to oranges … more like navel oranges to juice oranges ). Presumably the actual numbers for Dec 2014 and prior would be higher if they were restated based on the updated Population.

So 1,546,000 indeed represents the number of full time jobs created from Nov 2014 to June 2015 AND including an adjustment back to whenever it was since the previous Population adjustment. So, yeah, 1,546,000 are real full time jobs created, just not since Nov 2014.

Which is the long way around saying that yes, we lost 349,000 full time jobs in June.