Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Democrats Push $1 Trillion Infrastructure Plan As Deficits Are Rising

Democrats Push $1 Trillion Infrastructure Plan As Deficits Are Rising

Senate Democrats on Tuesday offered a plan to spend $1 trillion on transportation and other infrastructure projects over 10 years, challenging President Donald Trump to join them on an issue where they hope to find common ground. Democrats estimate their plan would create 15 million jobs. The plan includes $210 billion to repair aging roads and bridges and another $200 billion for a “vital infrastructure fund” to pay for a variety of transportation projects of national significance.

An example of the types of projects that could be eligible for financing from the fund is the Gateway Program to repair and replace rail lines and tunnels between New York and New Jersey, some of which are over 100 years old and were damaged in Superstorm Sandy in 2012. The project, which would double the number of trains per hour using the tunnels and help enable high-speed Amtrak service, is estimated to cost about $20 billion.

This issue is a real window into Trumponomics. How much does the POTUS really care about the deficit? For that matter, how much do GOPers in Congress? The Trump plan, such as it is, favors tax credits — some $150 billion worth, more or less — over direct spending. But there is an obvious deal to be had here. A bit more direct spending than Republicans would prefer, more reliance on tax credits than Democrats would prefer. Or some such.

And all of this is happening against a particular fiscal background, as the CBO outlined yesterday in its new 10-year forecast:

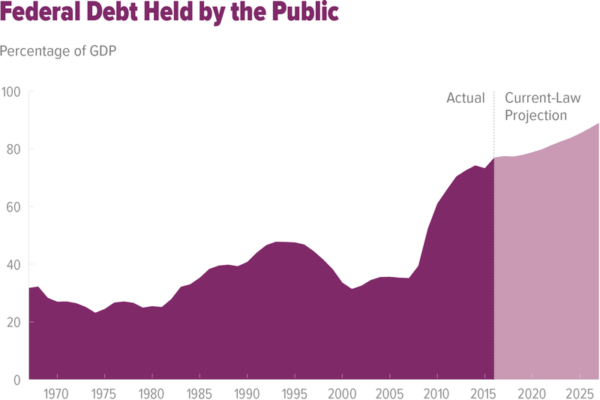

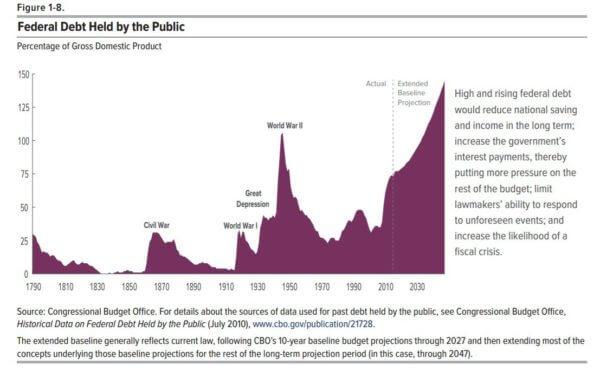

In fiscal year 2016, for the first time since 2009, the federal budget deficit increased in relation to the nation’s economic output. CBO projects that over the next decade, if current laws remained generally unchanged, budget deficits would eventually follow an upward trajectory—the result of strong growth in spending for retirement and health care programs targeted to older people and rising interest payments on the government’s debt, accompanied by only modest growth in revenue collections. Those accumulating deficits would drive debt held by the public from its already high level up to its highest percentage of gross domestic product . …In CBO’s baseline projections, budget deficits remain below 3.0 percent of GDP through 2019. But subsequently, continued growth in spending—particularly for Social Security, Medicare, and net interest—would outstrip growth in revenues, resulting in larger deficits and increasing debt. By 2027, the deficit would reach 5.0 percent of GDP—$1.4 trillion. … As deficits accumulate in CBO’s baseline, debt held by the public rises from 77 percent of GDP ($15 trillion) at the end of 2017 to 89 percent of GDP ($25 trillion) by 2027. At that level, debt held by the public would be the largest since 1947 and more than twice the average over the past five decades in relation to GDP. … Beyond the 10-year period, if current laws remained in place, the pressures that contributed to rising deficits during the baseline period would accelerate and push debt up even more sharply. Three decades from now, for instance, debt held by the public is projected to be nearly twice as high, relative to GDP, as it is this year—and a higher percentage than any previously recorded.

And in chart form:

I agree that both congress and Trump most likely don’t care about the debt/deficit as much as I, and many others I am sure, would like.

However, I do wonder whether Trump has had any effect.

Rand Paul made an interesting speech about the budget that the GOP congress was trying to pass in order to repeal Obamacare. I thought that it was especially telling how the GOP would try to repeal Obamacare in this way which seems so similar to the issues that many had to how it was passed in the first place.

The really interesting point though, is that it did not get spending under control and this is without Trump even being in office it looks like. The “not a budget, but yeah really a budget” added some 9 trillion in debt over ten years. That is not Trumpenomics, that is congress, or at least, I would make the argument that it is more congress than Trump.

It would be funny if Trump actually become a check on GOP congressional spending, oh my fantasies ;) .

My question is whether Trump limiting federal power and growth, like with his hiring freeze and how Trump seems to be eliminating so much of the agencies, may make more of a difference than congressional actions? Despite his infrastructure plan, maybe Trump will have a net positive effect on reducing the deficit and ultimately the debt as he has indicated he wants to do.

Not just no, but heck no (and I don’t mean “heck.”) The last “stimulus” was a profound waste of resources, a veritable font of political and abject corruption, crony capitalism and bailout. The federal government simply funded state and local capital projects, many of which were unnecessary. Local politicos lined up like pigs to the trough. And as for the monies spent on clean energy and telecom infrastructure, more cronyism and waste, as politically connected private heavily subsidized “rural” telecom and power companies lined up for some more free capital. The Indian reservations took billions so that they could build housing for reservations that could then be leased back using yet more HUD subsidies in a cycle of subsidy that even Keynes would question. Big Power got their share too, building heavily inefficient alternative energy sources with federal monies, plants that barely make a dent in actual delivery requirements. Government motors and all the other car companies got theirs with the “clunkers” program.

In short, if there was a bad idea to fund, so long as the right people had their hands out, we wasted money on it. In my city of Chandler, AZ nearly every single street crossing was torn up so that pink tile insets could replace the sliced concrete that had been (under previous regulations) used to warn the blind of an impending crossing. Really? Is there a crisis of the blind blundering across streets and being wiped out by motorists that I’m unaware of?

We don’t decide to spend. We fix things as we go and as needed. Let the states and municipalities deal with and fund their own issues. If their airports are run down, let their already corrupt “transportation authorities” fix them.

BTW, a private entrepreneur built a wonderful ferry system from Hoboken to Manhattan. He actually built a “free” for ferryboat riders, bus system in the city and it is great. The taxpayers don’t need to and shouldn’t spend another dime on NYC. The hundreds of millions we spend on AMTRAK, NYHUD, SNAP, ACA and welfare in NYC, billions and billions and billions, every year, is enough.

I want an impenetrable barrier on the southern border. I want it electrified. I want a moat on each side of it, filled with sharks with freakin’ laser beams attached to their heads!

Do that first. Then we’ll talk about more federal money for local projects.

@dougkimball I agree with your post.

I would also like to add that massive deficit spending projects are unlikely to achieve any economic growth, because for such “investments” to produce growth, the must provide a measurable economic return. The statistic “Marginal Utility of Debt” as tracked by the federal reserve really shows this to be the case.

The best thing they could do with $1 trillion dollars, is leave it in the private hands of those who earned it, encourage them to invest it in the new industries, creating the new jobs and export markets.