Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Who Wore It Better: Obamanomics or the Bernanke Fed?

Who Wore It Better: Obamanomics or the Bernanke Fed?

The other day I asked, “So did Obamanomics work or not?” It is a complicated question, one that cannot be satisfactorily answered just by comparing today’s jobless rate or GDP growth rate to what they were when Barack Obama took office in 2008.

Now there’s one specific complication I mentioned in passing, but deserved more emphasis: monetary policy. How much credit does the Bernanke Fed deserve for staunching the bleeding, strengthening the recovery, and offsetting austerity? For instance: Some economists credit the third round of the Fed’s quantitative easing program in 2012 for offsetting 2013 tax hikes and sequester budget cuts — and avoiding a double-dip recession.

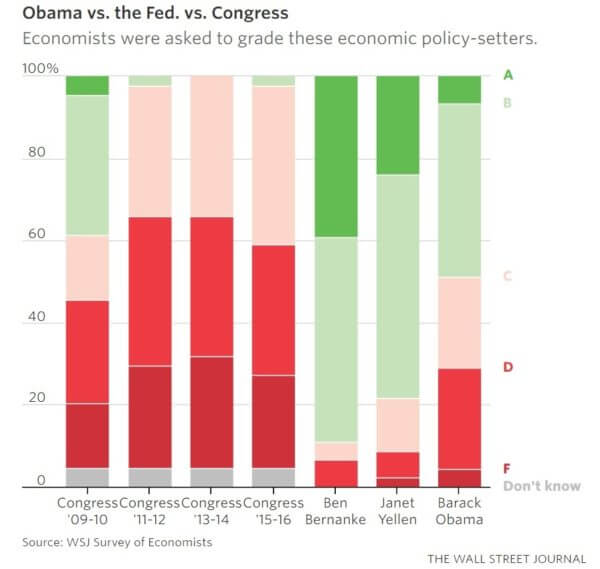

So with all that in mind, take a look at this Wall Street Journal survey of economists, a group that seems to think fairly well of Bernanke’s efforts:

As the WSJ’s Josh Zumbrun notes:

Asked to grade the performance of specific officials, economists assigned highest marks for Fed Chairman Ben Bernanke. Though he was criticized for being slow to recognize the severity of the unfolding crisis, he took aggressive actions in 2008 and 2009 to respond. He was given high marks—an ‘A’ or ‘B’—by 89% of the respondents, and failing marks of ‘D’ or ‘F’ by just 3%. Mr. Obama’s grades were more mixed, with 49% assigning high grades and 29% failing.

One more thing, and it’s a biggie for me: When it comes to analyzing various aspects of Obamanomics, the bit economists were most negative about is how it boosted prospects for long-term growth. Zumbrun: “On this score, economists saw little accomplishment from Mr. Obama, and 63% of economists gave him a negative grade.” When you look at officially US productivity growth, for instance, such negativity is understandable.

Published in Economics

Huh? Austerity? Obama spent 9 TRILLION dollars we didn’t have!!!!! Austere?

Nobody personified the arrogance of intellect more than helicopter Ben. History will be unkind to him as well as whatever economists thought well of him.

I disagree. Were it not for Ben Bernanke and his understanding of Milton Friedman’s scientific work, the US would probably still be in a recession.

I’m being hyperbolic, but if you want to see what it would have been like if the Fed had not engaged in its unorthodox policies, see the actions of the European Central Bank over the first two years of the recession.

Are recessions something to be always avoided? Eight years of very easy money have led to bubbles which will burst in an ugly fashion.

I don’t know that’s actually a comparable case, because the European Union has the unusual feature of being a monetary union without being a fiscal union. Which complicates monetary policy immensely, because differences in fiscal policy between countries effectively means that Euros sitting in Greece are not worth the same as Euros sitting in Germany.

Well a couple decades from now I’ll buy you a beer and we can hash it out with more hindsight.

There are differences in fiscal policies among states. Furthermore, a dollar in one state does not have the same value as a dollar in another state.