Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Fighting the US Dollar Might Be a Battle Trump Can’t Win

Fighting the US Dollar Might Be a Battle Trump Can’t Win

Donald Trump is frequently compared to Ronald Reagan. Populist. Outsider status. Big tax cuts. And certainly there are hopes that Trump becoming President will be followed by an economic boom, just like with Reagan (eventually).

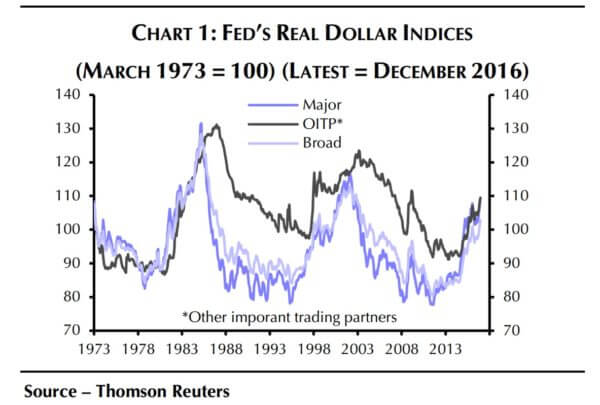

But that was then, and this is now. Economic circumstances are a lot different. We need to be careful with comparisons. For instance, back in the 1980s the US and other advanced economies got together for a currency intervention to knock down the strong dollar versus the Japanese yen and the German deutsche mark. And now here’s Trump in the WSJ, expressing concern over the strong dollar (as seen in the above chart):

In his interview with the Journal on Friday, Mr. Trump said the U.S. dollar was already “too strong” in part because China holds down its currency, the yuan. “Our companies can’t compete with them now because our currency is too strong. And it’s killing us.”

In particular there must be concern a strong dollar will hurt US manufacturing exporters and their industrial Midwest workers, Trump territory.

So will this jawboning sink the greenback? Might it be followed by a coordinated currency intervention as with the Plaza Accord? Here is one take, from Capitol Economics, that offers some interesting observations:

Published in EconomicsToday, by contrast, it is hard to imagine the authorities in Europe or Japan backing a weaker dollar, given the relatively poor health of their own economies and the fact that the US current account deficit is less than 3% of GDP. What’s more, the dollar is nowhere near as overvalued as it was then. The US could try to go it alone. But unilateral intervention without the support of the US’s G7 partners would presumably be far less likely to succeed.

Trump could, of course, continue to focus much of his attention on China instead. But the authorities there have been propping up the renminbi in the face of capital outflows, not capping its rise. If they were to stop intervening in response to pressure from the US, we think that China’s currency would fall a lot further against the dollar than it has already.

Second, the protectionist policies that Trump advocates would be more likely to drive the dollar even higher than bring it back down. For example, imposing large tariffs on goods and services imported into the US would reduce the country’s demand for them, putting upward pressure on the US currency. Even if other countries retaliated in kind, there would probably still be a net boost to the dollar, because the US imports more than it exports.

And third, differing stances of monetary policy in the US and abroad are likely to breath new life into the dollar. Admittedly, there has been a reassessment since the New Year of how aggressively the Fed is likely to tighten monetary policy under a Trump administration, which has taken some heat out of the US currency. But in our view, the Fed is likely to raise interest rates by more than investors are currently anticipating. Of course, Trump might try to meddle with the Fed’s independence, by nominating very dovish appointees to the FOMC in the future. But his ability to re-shape the Committee will be limited.

I’ve seen plausible predictions that the dollar stands to lose, at least with respect to emerging markets, over the next decade. This is at the core of my investing strategy. It has more to do with relative demographics and regulation than anything else.

Yes we beat the yen into appreciation and the Japanese blew their new wealth on a binge of unwise investments, competitive among the giant Japanese trading companies rather than in world markets. China won’t blow it’s new wealth away but will use it to become even more powerful politically, economically and militarily. I hope the new administration leaves the dollar yuan alone and focuses on deregulation, tax reform and energy production, things we can control. One of the reasons we repealed the Glass Stegall act was after the yen appreciation Japan went from owning one of the worlds largest banks to owning the nine largest. We do not want a powerful Yuan and a weak dollar. This is the hubris of progressives. There are far better, relatively controllable and useful ways to fix our current account and trade deficits without the risk of empowering China or collapsing the dollar.