Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

How Should We Rate the Obama Economy?

How Should We Rate the Obama Economy?

This is a difficult question to answer. After all, the incumbent of the White House cannot determine the performance of the huge and complex US economy. Indeed, policy initiatives usually have a modest impact. But the story of Mr Obama’s presidency is a little different from the usual, since it began amid the worst financial crisis since the 1930s. If we consider the disaster he inherited and the determination of the Republicans in Congress to ensure he would fail, his record is clearly successful. This does not mean it is perfect. Nor does it mean the US confronts few economic challenges. Neither statement would be close to correct. Yet it does mean he has laid a strong foundation.

A few thoughts:

- It’s hard not to be laudatory if you look at things from the European perspective. Eurozone unemployment is still near 10%. And as my colleague Desmond Lachman writes, “there is every prospect that Italy will be the next country to succumb to the European sovereign debt crisis.” That would be a headwind for EU growth, to say the least.

- Although Wolf does mention the Bernanke Fed in the piece, I think it underplays the role of more active monetary policy in creating a better US vs. EU recovery, especially in terms of offsetting US austerity in 2013.

- Judgment here also depends on what you blame the slow recovery on. For instance, Goldman Sachs concludes “the post-2008 U.S. recovery has not been unusually weak or prolonged relative to other financial crisis episodes.” Do you blame weak growth on that or … ObamaCare and Dodd Frank or … long-term problems such as weak productivity growth?

- Credit to Wolf for mentioning two of the more worrisome outstanding problems:

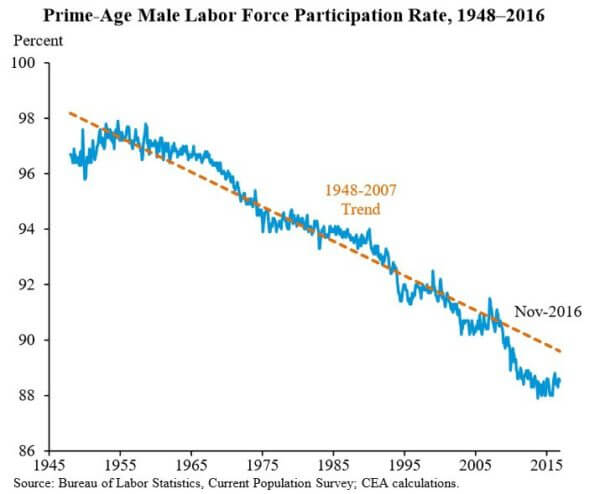

… the participation in the labour force of prime-aged males (25 to 45) has been on a 60-year downward trend, while that of prime-aged females has flatlined for three decades. This is a poor performance by the standards of most high-income economies. It is impossible to argue credibly that this is the result of particularly generous US welfare benefits or particularly high minimum wages. The failure is deeper.

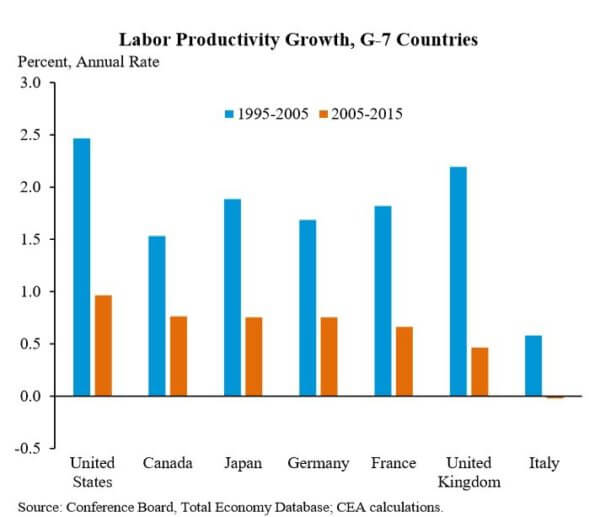

Third, growth of labour productivity has slowed sharply, though it was still higher than in other members of the Group of Seven leading high-income countries between 2005 and 2015. The reasons for this slowdown are a puzzle. Possibilities include the post-crisis weakening of business investment and a broader post-crisis loss of animal spirits. It is also likely that the underlying rate of innovation is slowing. Some argue that this is the result of excessive regulation. The next administration is set to test that hypothesis to destruction.

Two charts White House charts on these points, which drive Wolf’s analysis:

I would add that US productivity growth, while better than competitors over the past decade, has been dead in the water — as officially measured — during the recovery.

Published in Economics

“After over ten years of crippling exhaustion, abnormal (but not too abnormal) test results, and multiple different referrals to varying specialists…”

Oh, sorry, that’s the post about Fibromyalgia; but it has analogues to the Obama economy.

As I tell anyone who will listen ( and those who won’t ) my go-to number on the economy is Full-Time jobs. The prior peak was November 2007 when the BLS household survey showed 121,875,000 Employed-Usually Work Full Time. The economy did not surpass that level until October 2015 when the BLS reported 122,071,000 Employed-Usually Work Full Time. Nov 2007 through Oct 2015 … Nearly a Lost Decade.

The most recent report for December 2016 showed 124,248,000 Full Time jobs. That number represents a LOSS of 8,000 Full Time jobs since August 2016.

If you chart about anything against federal debt and/or debt growth, or taxes collected and spent, against this slow growth economy, it is not good.

A trillion dollars is a lot of money! Let’s say that your average small business runs on $1 million a year. That’s a thousand businesses a year that could run on one years’s annual debt. That is shocking. You have to ask how many startups did this kill? How many businesses closed? How many employees businesses would have had to hire in order to grow or meet demand? That’s just the spend side.

Last, we should have roared back from the financial crisis. But instead we limped along for 6 or 7 years. It should have only taken 2 years, tops, to recover. Obama, out of the gate, hamstrung banks and financial institutes, cause the crisis to deepen.

There are 93 million people who have dropped out of the labor force, so are not counted among the unemployed. This is unconscionable, and the Obama administration has been ignoring this glaring elephant in the room.

This post is also complete and total nonsense.

What is he friggin’ kidding me? This is one of the worst economic performances in the history of our country. He didn’t even exceed 3% growth for any given year in his eight years, and he started at the bottom of a huge recession. Bull crap to perfect. It isn’t even below average. It’s way below average. Obama didn’t even solve the great recession. GWB did that in his last quarter in office.

The Limbaugh Theorem operates. Obama is not seen to be responsible for anything that his administration destroyed. Someone else always gets the blame, and he is always seen as “fighting” the malevolent interests.

Yup. The liberal press is so desirous of socialism working, they’ll throw out everything to help it. In Obama’s case, saying–or not saying–bad things, bad outcomes on him. And if there is blame, its because the Republicans wouldn’t allow them to spend enough.

You also need to consider the increase to the national debt in this analysis. It doubled over eight years.

Whether or not that is an issue right now, it will be a long-term drain on the economy for decades to come. It will obviously require future tax revenues to be diverted to paying off the Obama credit card, rather than providing services or being used in the private sector. Increase taxes too much, and a death spiral starts (underground economy, businesses moving offshore, fewer people start businesses or take risks).

We have nothing to show for that roughly $10 trillion. That’s the worst of it.

To get a clear answer to an economics question, we always start with a clear question. That means Assumptions and Definitions. We can postpone thinking about these temporarily, as long as we don’t forget to go back as needed. We always find that we made defective assumptions or assumptions that were not accepted by others, or that we used definitions that were defective or were not used by others.

To that end, we start by asking, “What is ‘the Obama Economy’?”

We can start with Ekosj ‘s report on full time jobs. Simply dreadful.

Then add that our debt ratio is the highest since WWII and climbing towards deadbeat nation status.

Then add the fact that for the first time in my very old lifetime, we are losing more small businesses that are creating. By a bunch. When our Savior Buraq took office we still were creating something like 10,000 new businesses a year. Now we are losing between 30-50k a year. Small business was America’s secret sauce to success. Not anymore.

But the Obama/Bernacke/Yellen ‘s greatest achievement was to turn America effectively into a “managed”economy, and to make returning to a thriving capitalist economy a very difficult endeavor.

By driving down interest rates to near zero, and keeping them there for nearly eight years, the stock (S&P P/E at 26+), bond and real estate markets have all “priced in” these rates. So if rates start to rise to “normal” rates, these markets will all take a hellacious beating and throw the economy into a deep depression. To add insult to injury, raising interest rates will also hammer budget deficits by many hundred of billions of dollars.

Our economy is very sick. We no longer raise capital for new endeavors, thus jobs. Pension Funds and Insurance companies are having a tough time remaining solvent at Bernacke rates. We need desperately to return to market rate Capitalism, but it ain’t gonna be easy.

It’s incredible to argue that economic incentives don’t matter when you’re discussing economics. If you offer to pay people to not work for a year, a whole lot of them will take you up on that. If you create incentives for businesses to hire fewer full-time employees (due to Barrycare regulations), a whole lot of them will take you up on that too.

The “possibilities” comment is mildly astounding. The “possibility” of investment being part of the slowdown doesn’t address the root cause – an increase in regulations and an anti-business climate ginned up by the Barry administration to bolster his election chances. You are less likely to increase capital spending when uncertainty rises to a level where the risks of investment outweigh anticipated benefits.

So you sit on your capital. That’s the result.

These two things are intimately related. There is a great study by the Census Dept showing that, ordinarily, almost all job growth comes from from NEW businesses. You always hear ‘small business is the driver of job growth’ and that’s kind’a true but not completely. The actual driver of job growth is NEW business…most of which happen to be small.

Because new business development just plain stinks, job growth is slow and the overall economy is sluggish.

The new, tighter mortgage rules hurt a lot. Historically, lots of of new, small businesses financed their startup with second mortgages or home equity loans or some other loan collateralized by the entrepreneur’s house. That has almost ceased. High capital gains taxes and all the DoddFrank regulatory deadweight makes it extremely difficult to substitute equity financing for the mortgage debt financing. Add in Obamacare, income and corporate taxes, enormous government debt, regulation and eight years of “you didn’t build that” badmouthing of private business and here you are.

You’re off by three orders of magnitude. One thousand $1M businesses is one billion dollars. A trillion is a million million. It truly is a number that is hard to get one’s mind around.