Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Can Trumponomics Shift the US Economy into a Higher Gear?

Can Trumponomics Shift the US Economy into a Higher Gear?

Some interesting comments on that subject over the weekend at the annual American Economic Association meeting in Chicago. Now apparently no one was talking about what I call “hypergrowth”—4% or more annually—much less more fantastical forecasts. But what about just 3% sustained growth, a bit less than the postwar average? That would be significantly better than current CBO 1.8% estimate of the economy’s sustainable growth over the next decade. And better than the 2.2% average pace of growth during this recessions. (Keep in mind we are talking about potential sustainable growth, not some one-time surge.) From MarketWatch:

Glenn Hubbard, dean of the Columbia University Business School, said Trump’s plans could get GDP growth “up to 2.75% or so.” While the details of Trump’s policies remain unknown, the combination of broad-based tax reform, regulatory reform, infrastructure and military spending could boost the economy, Hubbard said.

However, Jason Furman, Obama’s chief economist, shot back that Republicans were ignoring the “massive” depressing impact on growth from an aging workforce.“This is going to matter a lot. If you forecast something like 2%-2.2% [growth], it is going to take your budget in one direction, if you forecast 2.75% or higher, it is going to take your budget in a different direction, he said. Furman said of growth rates of 2.75% or higher would be further away from the forecast of mainstream economists “than any budget… in the last 24 years.”

Furman makes a good point, one I also frequently mention, about the role of demographics in making very fast growth harder today than in the past. Likewise, the piece notes Furman’s additional point that productivity growth—the other key ingredient in faster overall GDP growth—has been declining globally. So any fixes need to take into account that reality. So “Thanks, Obama” probably is at best an incomplete diagnosis of the problem.

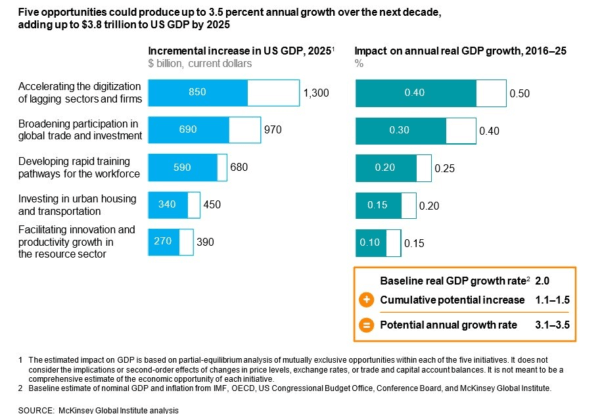

Now I happen to think that with better policy, Hubbard is closer to the truth here, even a bit overly cautious. (And this all assumes current GDP estimates aren’t biased lower because of productivity mismeasurement of the technology sector.) Faster growth is possible. For instance: McKinsey recently highlighted five policy areas that could “collectively raise GDP growth to 3 or even 3.5 percent,” growth rates not seen since the 1990s.

One final point: Former ObamaWhite House economist Alan Krueger offered an interesting explanation for the slow recovery. Again, from MarketWatch:

Krueger told the panel that the administration might have accepted a lower growth rate in order to foster a “no-drama” economy so that the financial sector could heal from the financial crisis. “Part of that was by design, part of that was…an attempt to make the financial system safer to ensure that banks raised more capital as a buffer against shocks. It probably has come at the cost of some growth,” Krueger said.

Tantalizingly, Krueger added that “we may go from a no-drama economy to something very different.” As long as the drama is one about innovation-driven growth and not asset price bubble-driven growth from crazy lending, it’s story I would be eager to see play out.

Published in Economics

Wonderful, an almost Kinsleyan Gaffe, that the policy of the government for the past 8 years has been a form of financial repression*.

To paraphrase a former President, a recession is when your neighbor loses his job. A depression is when you lose your job. A recovery is when the government prioritizes economic growth over making banks great again.

* I know the book definition is Financial repression refers to “policies that result in savers earning returns below the rate of inflation” in order to allow banks to “provide cheap loans to companies and governments, reducing the burden of repayments”. Is there another term that describes their policies better?

I get the one over the world view that without a financial system, all other things don’t matter. But we’ve seen this movie before and none of the miscreants or greater fools go to jail or forfeit all their assets.

I have a standing bet of 5 percent for one quarter in two years. I expect to collect.