Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

October Jobs Report: Is the US Economy “Basically Healthy?”

October Jobs Report: Is the US Economy “Basically Healthy?”

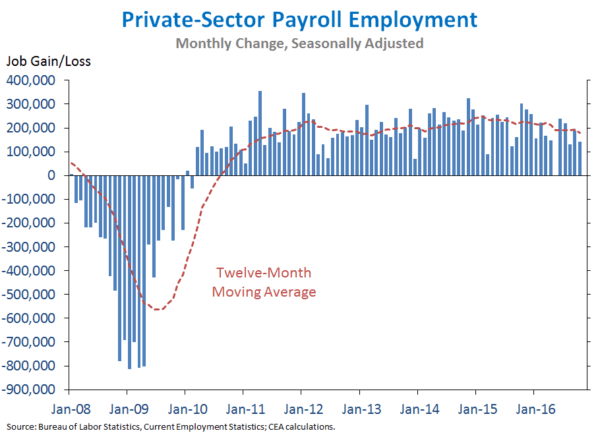

The October jobs report contained lots of good news. Even though the 161,000 increase in nonfarm jobs was a bit shy of expectations, it came with a 44,000 upward revision to August and September data. This is longest streak of total job growth on record, as American businesses have now added 15.5 million jobs since early 2010.

The October jobs report contained lots of good news. Even though the 161,000 increase in nonfarm jobs was a bit shy of expectations, it came with a 44,000 upward revision to August and September data. This is longest streak of total job growth on record, as American businesses have now added 15.5 million jobs since early 2010.

Perhaps the brightest spot was the wage data. The 0.4% increase in average hourly earnings last month nudged the annual growth rate up to a seven-year high of 2.8%, from 2.7%. More from First Trust Advisors: “Total hours worked increased 0.2% in October and are up 1.5% in the past year. Combined with the earnings data, this means, total cash earnings (which exclude fringe benefits and irregular bonuses/commissions) are up 4.4% in the past year, which is plenty of fuel to push consumer spending higher.”

And RSM US economist Joseph Brusuelas notes that, “for the first time since prior to the 2007-2009 Great Recession wages are rising for the two lower quintile of income earners.”

So where is the US economy just days before voters elect the next American president? A New York Times piece about the employment report offers a cheery headline: “These Jobs Numbers Show an Economy That Is Basically Healthy.” And this from reporter Neil Irwin:

The current economic expansion may be the most maligned in history. Among the complaints: It has been too weak, too slow, too uneven; it has been accompanied by people dropping out of the labor force; it hasn’t brought meaningful income gains; it is driven entirely by the sugar high of monetary stimulus from the Federal Reserve.

And these statements aren’t wrong! It really has been painfully slow, particularly given the depth of the 2008-2009 recession from which the United States has been recovering these last seven years.

But it’s worth pausing to look at what has been achieved. Some 95.1 percent of Americans who tell survey-takers that they want a job are working. And they are finally starting to get the bigger paychecks they have long hungered for. It took a long time getting here, but the problems in the economy don’t have much to do with recessions and recoveries anymore. They’re about deeper questions of how best to improve the nation’s long-term economic potential.

The next president will take office with a sound economy. The decision voters face is over which candidate’s long-term vision they find most compelling for building upon that.

I think there is a lot to what Irwin is saying, especially if you think the major problem with the slow-mo recovery and expansion has been the aftermath of the nasty Great Recession, cyclical effects of which are continuing to fade. Now it is time to focus more on structural issues that are lowering the economy’s potential growth rate.

For example: I have trouble confidently declaring the economy “healthy” or “sound” or “fine” when, officially measured productivity growth is just crawling along, despite a strong Q3 report. Nor would I accept the current prime-age labor force participation as the best we can do. Guess I would put it this way: The US economy is back to normal, but that normal could be significantly better with better public policy — regulation, education, housing, infrastructure — that promoted greater dynamism, competition, innovation, and good-paying work. I doubt, though, whether “a better new normal” is a slogan that would inspire many voters.

Published in Economics

A few years ago Lance Roberts observed that we don’t see bread lines and soup kitchens these days because now it comes electronically or in the mail.

Current “unemployment” – the U3 rate – is just below 5%. The U6 rate, which includes those that have not had an interview for a while, is at 9%. To me that leaves lots of room for improvement.

Even worse, if you’ve been unemployed for over a year, you disappear entirely from those unemployment measures and it’s been that way since I think it was 1994. According to shadowstats, if you included those folk the number would be in excess of 20%.

Maybe if I was an economist I could call this economy good, but I’m not.

“…driven entirely by the sugar high of monetary stimulus from the Federal Reserve.”

Which shows the recovery isn’t real. All the Fed has to to is hint of higher interests and the stock market dives and we are put on the threshold of another financial crisis. If the economy is basically healthy, why doesn’t the Fed immediately raise interest rates to say, 2% – still well under the historical norm?

Because everyone knows it would immediately plunge us into a depression. There has been no economic recovery, just a failure to address the true problems by masking them with cheap money and debt. What happens when that (soon) becomes no longer possible?

I think there is a lot to what Irwin is saying, especially if you think the major problem with the slow-mo recovery and expansion has been the aftermath of the nasty Great Recession,

The financial collapse was created by government and would have turned around rapidly had it not been for government. These false narratives keep us from learning from our mistakes.

“October jobs report contained lots of good news.” Let’s have a look…

My go-to jobs number is from the Household Survey….

Employed, Usually Work Full Time. Data set LNS12500000

Here are some selected numbers from that data set…

Oct 2016. 124,193,000 today

This is actually a DECLINE or 103,000 full time jobs from September

Nov 2007. 121,875,000 Bush high

Oct 2007. 121,378,000 9 yrs ago

Oct 2008. 119,349,000 Obama elect

Dec 2009. 110,559,000 Obama low

Measured from the Dec 2009 Obama low point until today, 13,634,000 full time jobs were added.

Democrats think that Government creates jobs. Let’s run with that. What did it take to create 13,634,000 full time jobs? Round numbers. US Gov’t debt increased 9 Trillion Dollars. Fed balance sheet increased 3 Trillion dollars. Total borrowing plus money creation is about 12 Trillion dollars. Or about 898,000 dollars per full time job. Forget about the additional tax revenues that were spent. This is just the borrowing. Obama borrowed $898,000 for every one of those 13,364,000 full time jobs.

Measured from the prior high point during the Bush years – 121,875,000 in Nov 2007 – we have only added 2,318,000 full time jobs. That works out to $5,176,800 per job. Over 5 MILLION dollars borrowed PER JOB to yield an additional 2.3 Million full time jobs!!!

I don’t get how people can say our economy is basically healthy, when so much of the economy is driven by people spending their government checks, which the government has either borrowed or taken from other taxpayers to fund, and when the rest of it is financed by artificially low interest rates, again financed by the government!

No, I don’t get it.

And yes, I was an art history major, so maybe it’s just me.