Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Should the Fed Let the Economy “Run Hot” to Raise the Labor Force Participation Rate?

Should the Fed Let the Economy “Run Hot” to Raise the Labor Force Participation Rate?

I’ve been writing about Janet Yellen’s speech last week where the Fed boss explored the idea that running a “high-pressure” economy — defined by her as “robust aggregate demand and a tight labor market” — could positively impact the supply-side of the economy, improving both labor force participation and productivity.

In practical terms, this might mean delaying any interest rates hikes until core PCE inflation reaches 2%. Goldman Sachs sees two downside risks: first, a “modest but not neglible” risk of a large inflation overshoot by 3-8 percentage points; second, a “deliberate overheating” could start the economy on the path to recession via “economic and financial imbalances.”

And what about the potential upside of letting the economy run hot? Could it, for instance, improve non-participation by prime-age workers as the jobless rate is pushed ever lower? Goldman is skeptical:

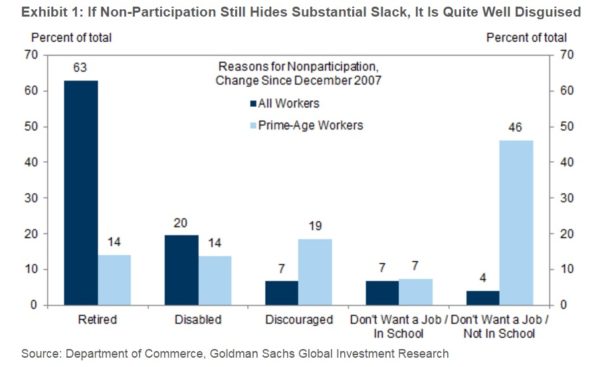

A high-pressure economy could aid the recovery of aggregate supply by increasing either the size of the labor force or productivity. In past research, we have shown that labor force participation does respond to the business cycle and tends to recover quite gradually. In our view, much of that cyclical recovery has already occurred, seen in the reduced number of discouraged workers, and there is likely only a modest amount of further slack in the form of non-participation. Believing that non-participation is hiding substantially more slack requires believing that it is quite well disguised. [See image below.] While this is not impossible, the late 90s did not see a notably lower share of prime-age workers reporting themselves as disabled or not wanting a job.

But some Americans who want to work might be helped:

Overall, we see the most convincing case for a high-pressure economy as helping low-wage workers and ensuring that the still-large pool of long-term unemployed eventually find jobs. But recent wage trend sand the already-declining rate of labor force exit of the long-term unemployed suggest these goals might be partially achievable without a sharply lower unemployment rate. We view the other potential benefits—substantially raising either the participation rate or productivity growth—as more speculative. It is plausible that so-called “hysteresis” can work in reverse, but the evidence is limited.

Goldman also notes there is an important trade-off to consider, citing research showing a low unemployment rate “tends to draw some young people away from finishing high school or pursuing post-secondary education.”

One more thing: that bar to the far left of the above chart is fairly stunning. Lots of prime age workers don’t want a job. Some useful insights here from my AEI colleague Nicholas Eberstadt.

And check out this also this from the White House CEA.

Published in Economics

As a general critique – I thought the Fed knew what to do in all cases, given their purported unique knowledge and experience. So if they really don’t know the answer, and throwing darts to see what sticks is going to be status quo for the Fed – isn’t that what markets do, but instead with many millions of minds tackling the problem? How could you expect a substantially different outcome if the Fed adopts one or two general policies compared to letting the market figure it out?

James explored in the link why people don’t want to invest in research and development, and then offers a mildly incomplete what-if:

“So if the US has a modest demand problem, but a major structural supply-side problem, then that would argue against a purely redistributive ‘middle out’ economic policy agenda in favor of more of a mix. Something weighted toward pro-work, pro-empowering innovation polices, but with some demand-side components. Some policies — infrastructure, startups — would serve double duty here. Conceptually this would not seem hard to put together.”

This is conceptually rational but forgets to factor the easy reason it won’t work: regulation. Particularly for “startups”, the short-term costs are simply too high right now to satisfy bureaucracy. Regulation applies to everyone so no amount of stimulus will change that. This isn’t really a monetary problem and the Fed has no tool to fix it.

Maybe Congress would do better to amend the Fed’s statutory objectives – maximum employment, stable prices, and moderate long-term interest rates – to factor regulation into them and give the Fed some ability to regulate the regulations in pursuit of their other objectives. Although, it’s a much simpler path to just remove the regulations.

Hmmm: what does “a ‘high-pressure’ economy” defined as “robust aggregate demand and a tight labor market,” look like?

The phrase immediately brought to my mind one of the major forces that overtook and ended the Depression: WWII, and an economy mobilized and on a true wartime footing.

Given the tinder box so many areas of the world are daily coming to be, I pray we are not heading in that direction.

I suspect that the non-participation rate amongst the lazy (category 5), the lotus eaters (category 4), the surrenderers (category 3), and at least half the disabled who are scamming (category 2) could be effectively reduced by the creation of a category 6: Not eating/Do Not Wish To Eat.

This illustrates the impossibility of the Fed’s dual mandate. Maximizing employment isn’t really a monetary issue and I’d guess that the risk of unintended consequences is high when attempting to influence employment with monetary policy.

There is is a great employment study done by the Census department in conjunction with the Univ. of Md. It concluded that most job growth comes from NEW businesses. The old rule of thumb is that small businesses drive employment. But it is really NEW businesses (most of which happen to be small) that drive employment growth. And new business creation under Obama just plain stinks.

We don’t need another government program. De-regulation. Ending the “you-didn’t build that” mantra. Ending Obamacare. Lowering capital gains taxes. Anything that removes penalties and obstructions to risk taking … Those things will aid employment growth. Less is more.

I’m with @ekosj and @kwhopper. The Fed’s dual mandate is a problem and, rather than adding to it, as @kwhopper suggests, we should simplify it. The reason for doing that is the one @kwhopper advances in a sarcastic way and which I’ll restate: The Fed doesn’t know what to do, it’s expertise is inadequate to the task, and it’s out of tools.

“I’m not an economist and we all know economists were created to make weather forecasters look good.”

Rupert Murdoch

The Central Banks including Janet’s Yellen’s bailiwick have lopped off the invisible hand, stopped price discovery, prevented creative destruction, and generally have created zombie markets, zombie banks, zombie companies which are lurching about the world bumping into and destroying people’s livelihoods.

Enough already!

Want to pin the blame for the Trump phenomenon, look towards economists.

“When a land-rich family in sparsely populated Cape Breton wanted to attract workers for its understaffed country store, it offered free land to anyone who would come and work for five years.

The family expected a few dozen responses; more than 50,000 poured in — and the calls keep coming.”

How hungry are the people?

http://news.nationalpost.com/news/canada/remote-country-store-in-cape-breton-deluged-with-responses-after-it-offers-free-land-in-search-for-staff

The fed can’t raise interest rates until a Republican becomes president, because it would double or triple the portion of the federal budget (currently 6%) devoted to interest on the debt.

The idea that the Fed can get the economy moving thru monetary policy, without structural issues (such as overregulation and a failed public education system) being addressed is like someone who tries to accelerate a train by advancing the throttle while the air brakes remain locked.

Bravo Viator!

The hoary “Phillips Curve” idea that the economy is anything close to running “red hot” is pure nonsense. Male employment and black employment are at all time statistical lows. Small businesses are dying at a previously unheard of rate of 30-50,000 a year net, and for most of my lifetime two thirds of all new jobs came from small business.

Viator is absolutely correct – easier monetary policy will not change the employment picture much and clearly will not achieve a “red hot employment” picture. Banking regulation alone almost all by itself denies new lending to small businesses and start-ups.

Typically one needs, in clear Nanny State “Catch 22” brilliance, two years of profit before one can get a loan, while of course forgetting that we have created a regulatory system that almost demands heavy investment before one earns a profit. In these days of barely 1% growth, outside investment is almost impossible to come by so it should come as no surprise that we have very few new successful businesses. Of course the Too Big To Fail Banking and Corporate Oligarchy wouldn’t have it any other way. Too much competition is bad for our now sacred Corporate Crony Protected Class you see.

When you add in all the other parts of our draconian regulation regime, you have an economy where beneath all the media and Fed cheerleading the bottom is really dropping out.

So good luck Janet with that “red hot” employment thing.

Exactly. Inflation as stimulus is utter nonsense. The only reason there is some correlation is because inflation causes real wages to fall making things like union contracts and minimum wages less distorting for a short period. It’s popular with the political class however because they get to spend the new money, and even better, they get to spend it first. Moreover, bracket creep lets them spend old money as well. The net of inflation in the medium term is economic weakness. It’s structural everywhere always.