Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Does Anyone Still Think the US National Debt Matters?

Does Anyone Still Think the US National Debt Matters?

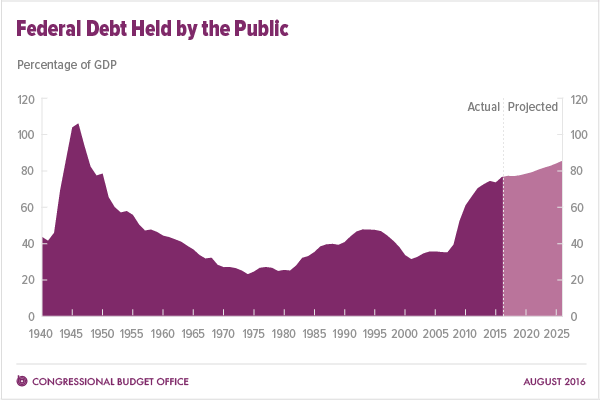

The federal debt-GDP ratio was 74% last year and will be a bit higher this year. Overall it’s twice what it was pre-Great Recession. The CBO baseline forecast puts that debt figure at 86% — and rising — in 2026. Add maybe 20 percentage points or so if Donald Trump is elected, according to analysis by the Committee for a Responsible Federal Budget.

Not that Washington, voters, and many political candidate seem to care. Neither the size of the debt nor entitlement reform have been big parts of this election season. And even among wonks, especially on the left, concern about debt and deficit isn’t what it used to be. After all, the national debt has risen tremendously, yet interest rates are low and the dollar strong.

For a different view, I asked my AEI colleague and budget expert Jim Capretta for some brief thoughts on the matter:

Published in EconomicsThe Congressional Budget Office and other mainstream models continue to show that large, persistent government borrowing depresses growth over the medium and long-term. Here is how CBO put it recently:

On the basis of existing research on the topic, CBO concludes that increased borrowing by the federal government generally crowds out private investment in productive capital in the long term. Crowding out occurs because the portion of saving that people use to buy government securities is not available to finance private investment. The result is a smaller stock of capital and lower output and income in the long term than would otherwise be the case (all else being equal).

Indeed, one could speculate that part of the reason for slower productivity growth today is the crowding out of potential productive investments years ago by federal borrowing and debt.

One should also be very skeptical of claims that additional federal borrowing might be beneficial because the government could then invest even more borrowed funds in productivity-improving programs. When budget constraints are relaxed, the political process tends to move resources toward spending that produces electoral support, which is often benefit payments to individuals that support consumption, not investment.

Finally, there is the growing risk of a federal debt crisis. The U.S. has already borrowed at a rate that is well above the post-war norm since 2008. Just because the aftermath of the financial crash has produced an anomalous period of low interest rates, low inflation, and low growth does not mean these conditions will persist indefinitely. If interest rates do return to more normal levels, then the U.S. will quickly confront an even larger fiscal challenge. It would be reckless to assume there is no risk whatsoever with a debt level in the U.S. approaching what it has been in other countries facing a debt crisis.

There is a limit to what the U.S. can borrow while still retaining its position as the safest place in the world to place resources, including through the purchase of U.S. government securities. It would be best if policymakers were not inclined to test where that limit is.

Thank you for writing this post. This is my single most important issue, for various reasons – some based on personal and corporate experience. I truly believe that the most potent killers of societies that collapse from within are corruption, complexity and debt. And the fact that it is being all but ignored is in my estimation tantamount to whistling past the graveyard.

Me too, @coffeedoghouse.

I’ve come to believe that this issue will never be a winner in the Presidential race. It’s not sexy — people’s eyes would glaze over — and the Left will demagogue anyone bringing it up, claiming you just want to push Grandma over the cliff.

Congress should do something about it, but I’ve given up hope of a GOP Congress expending the political capital needed to meaningfully address the problem. Of course, the Democrats will only use the issue as an excuse to raise taxes, which they’ll immediately spend on some flight of fancy.

I suspect our only hope would be a balanced budget amendment. Since no Congress is going to willingly handicap it’s ability to shovel pork, this would take a Convention of States.

How likely is that? I suspect it’s more likely today than at any point in my life, but that’s not saying much.

The Tea Party movement was the last serious political attempt to force our representatives to get a handle on spending. That movement was successfully thwarted and marginalized, so there is no longer any reason for politicians to pay attention to debt. In the end, they don’t talk about it because we don’t want them to talk about it. We’ll ride the debt train until the inevitable catastrophe.

A balanced budget amendment wouldn’t change anything. It could be gamed with accounting tricks like anything else.

National debt? What does that have to do with the women’s vote?

Saudis, China Dump Treasuries; Foreign Central Banks Liquidate A Record $346 Billion In US Paper

Is there any plausible reason for excluding the more than $5 trillion in intragovernmental debt with no refunding prospects? At the very least, isn’t the national debt nearly $20 trillion by a minimally honest accounting, which excludes over $5 trillion in assorted Freddie and Fannie guarantees and nearly $50 trillion dollars in unfunded Social Security, Medicare and Medicaid mandates.

Honestly, I don’t believe even an honest accounting set at $20 trillion, $25 trillion or even $75 trillion would have mattered this year.

What’s left but to hope that Kevin Williamson is right about the awesomeness of the end.

It’s one of my top three factors, in deciding who to vote for.

No GOP candidate was going to address it either.Why only go after Trump?

Oh, wait, you think Clinton will be better. Because, as we have seen with Obama, Democrats are reserved in their spoending.

Remember when Christie started to make the issue — meaning the $75 trillion issue — his campaign theme? Lasted two or three days and then he retreated to schoolyard bullying; within two months he was groveling for Trump’s VP slot.

For two days I was suckered into thinking we might have a candidate with metaphorical guts.

I think you are missing some important figures.

Gross debt: 19Trillion (Gross Debt to GDP 106.23%)

Debt Held by foreigners (countries an people): 6.276 Trillion

Trade Deficit: 738 Billion

Government spending all levels: 6.685 Trillion ( 36% of GDP)

Government unfunded liabilities: 100+ Trillion

Total debt of all entities and types: 66 Trillion

Total Assets: 123 Trillion

Thus Debt to Assets Ratio of nearly 50%

Total Debt per Citizen/Total Assets per Citizen: 204k/381k

I have also seen reports that banks have 100s of trillion of dollars of exposure to derivative investments (not tied directly to an asset). Which may or may not be as bad as it sounds since it is likely an inflated number due to the nature of derivatives and that some may hedging or somehow balanced exposure.

And most important is that the fed has increased the money supply rapidly in the last decade. Which, I believe can only inflate our money.

Thus, it is a very big issue.

James, ModEcon and Quaker are absolutely right, your claim that the National Debt was only 74% of GDP is a real whopper. Such lies are beneath you and shred your credibility.

Why it matters: To put the problem in perspective Cyprus’s (which was forced into a kind of sovereign bankruptcy with disastrous consequences) Debt to GDP ratio in 2013 was 112% and Greece’s s which had a similar problem was at 175%. Italy, is at 132% roughly. Japan and China also have huge debt problems.

If you include the Fannie and Freddie obligations, America is at roughly 132%, without taking into account it’s Social Security and Medicare obligation or it’s failing government pensions. So that would normally place America in the Bad Debt Country Status range. America does have much more where with all than those other nations, but at some point ( and no one can guess when) our credit could be restricted.

To make matters worse, the Fed has painted itself into a corner where substantially higher interest rates than the close to zero rates now would devastate the Stock, Bond and Real Estate markets and could add upward of a trillion dollars a year to the Federal Deficit.

The National Debt is just one of the many inter-related enormous economic problems our nation faces including gross underemployment of men and blacks, stagnant economic growth and the destruction of small businesses employment. We are in a real fix, actually far worse than 2008.

Yes.

Come now Unsk, introducing entirely predictable short term movements which could devastate the mansions of cards.

“like” seems wrong for this. We need an “agree” button.

You’re right, of course. That’s why I wrote “hope”, not “certainty”. I assume one could be crafted that would minimize the opportunities for gaming it, but regardless, it seems the only way to exert any control over things. And again, I don’t give it much chance of happening to begin with.

On further consideration, I’m starting to think Texit is my only hope. If we pull it off, you guys outside the Lone Star state are welcome to immigrate, provided you leave any leftist relatives behind.

The Democrats and their friends at the Fed have instituted the defacto end of interest rates. This has the side effect of taking government debt issues off the table. Keep in mind, if interest rates are even 1% higher….thats $200B extra in interest costs annually on the $20T debt. If/when the Fed actually raises interest rates…….lets have this conversation again.

To be fair to @jamespethokoukis, the ratio of publicly held debt, which is exactly what the graph in the post is describing, to GDP is an interesting figure. The significance of that difference between gross and public is not clear to me. I think it has to do with the difference between the government inflating by borrowing money against itself, fiat money printing, and the amount that the government borrows from other entities. We all know that our wonderful federal reserve has been creating money like crazy in the past decade. That printed money or “borrowed” money could drive inflation once the USA is no longer the most stable asset in the world.

So all I am saying, is that James was not technically incorrect. It all depends on how you define it. In fact, our “disagreement” on the definition would be an interesting conversation all on its own.

Thus, in the end, I must agree with @unsk and his analysis of the significance of both the gross debt and the situation we are in.

Some more data for y’all.

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Does the national debt still matter? Of course it does, but it has grown beyond the ability of the political process to do anything about it. Without controlling entitlements, it is impossible to control the deficit. And the political opposition to controlling entitlements is so strong that neither party can do it. The Democrats, of course, won’t even try. Republicans will continue to try and fail. And it seems that the GOPe-haters will blame the Republicans for failing to do the impossible, and thereby further strengthen the Democrats. A death spiral.

Since we can’t control the deficit, it will be impossible to keep the debt from growing further. Much less paying it down. So there is one and only one possible result. Sooner or later, we will severely devalue the dollar. The other word for that is hyperinflation. Your money is going to be worth less. Maybe worthless.

I’m not worried about the lack of capital for investment. The world is awash in liquidity. That is what caused the housing crisis. The banks are holding trillions of dollars, with no place to lend it (even at negative interest rates) because no one wants to invest. That’s not the problem. When the Fed’s ability to keep its finger in the dyke by printing money fails, and it will fail, the economy crashes. The Iron Law of Economics: Whatever can’t go on, won’t go on.

Yes. There is a strange logic going on as it is now tacitly agreed that nothing can or will be done about spending until the inevitable catastrophe occurs. We are in a strange twilight zone where terrible events are both inevitable and unmentionable.

Although I think “finger in the dyke” wasn’t quite what you were going for.

Nice imagery though.

I could have used some “band-aid” reference, but I think everyone got my point.

Democrats won’t deal with it because if there is a collapse it will be the middle class that is wiped out. They can use that crisis quite nicely thank you. Republicans can’t deal with it because they’re afraid of bad press. And while it isn’t a good campaign issue, it is one that can be wrapped into fundamental tax reform. Cruz would have understood how to do that and set the stage for it with his tax proposals. No such luck. But in a nut shell, spending is the problem because it means we have to raise taxes or borrow money. Borrowing, unlike distorting and repressive taxes, is at least market conforming and if we had rational economic policies, such as deep extensive regulatory and tax reform we could grow and if we privatized SS, abolished Obamacare and rationalize medicare, we would. SS spending is just a transfer from Peter to Paul and impacts the economy because Paul thinks he doesn’t have to save, and Peter thinks he is. We need savings. The thing should be privatized. And by the way Hillary referred to the SS trust fund as if it were real and Trump failed to call her on it. Beside venal rent seeking dishonesty and cowardice, there is also ignorance.

But you didn’t appear to get his … a dyke is not the same as a dike.

http://grammarist.com/spelling/dike-dyke/

Ah. Well, the Oxford English Dictionary accepts both meanings with the “y” spelling.

Larry, you win! :)

This unnerving. Why would people not care about our country being in debt and it increasing? I have my own personal debt and worried when I saw it increase after my son was born. My wife and I had to rethink some things. Now, you would think that the national debt would stay fresh on people’s minds because it can affect all of us.