Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Real Reason the US Economy Seems Stuck in Slow-growth Mode

The Real Reason the US Economy Seems Stuck in Slow-growth Mode

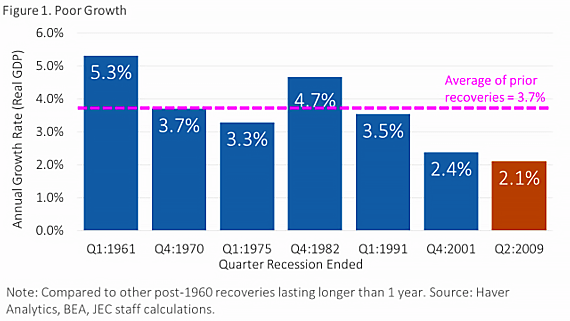

What to make of the above chart? Its creator, Congress’ Joint Economic Committee, offers an opinion on what it calls the “new normal” or persistent economic stagnation:

The United States is in the midst of the most lackluster economic recovery in modern American history. Eight years of economic stagnation has cost the median American family a cumulative $69,000 of income. In addition, effective tax rates on American businesses remain among the most burdensome in the world, and the Obama Administration continues to increase regulations at a record pace. Furthermore, the Administration’s Keynesian approach to economic stimulus has failed to promote strong, sustainable economic growth….

This recovery is so far behind the average of other post-1960 recoveries that to catch up by 2016’s end would require historically unprecedented rates of economic growth. Americans continue to await the strong economic growth and job creation they were promised. Unfortunately, many policies implemented by the Obama Administration and Congressional Democrats have stunted economic growth, discouraged job creation, and made more people reliant on government assistance. The opportunity to restore America’s prosperity is still attainable, but commonsense action is essential. Lower tax rates, a simplified tax code, reduced government spending, free trade, and less burdensome regulation are the path to restoring American growth and opportunity.

Thanks, Obama! (And a non-sarcastic or ironic “thanks” to the JEC for mentioning “free trade.”) But seriously, when examining the “new normal,” one must also note growth was hardly gangbusters during the 2000-2007 period, averaging a bit less than 2.5% a year. And officially measured productivity growth also began to fade before the Great Recession and the implementation of Obamanomics.

What’s more, weak productivity growth is hardly isolated to the American economy. (By some measures, the UK recovery is the weakest in centuries.) And what of the role of monetary policy? Might a more aggressive Fed early on have meant a more robust recovery? For instance: The strong 1980s rebound is arguably a story more complicated than a simple tale of tax cut-driven growth. As I’ve written:

A recent Brookings literature review noted that Martin Feldstein and Doug Elmendorf found in a 1989 analysis “that the 1981 tax cuts had virtually no net impact on economic growth.” They find that the strength of the recovery over the 1980s could be ascribed to monetary policy. In particular, they find no evidence that the tax cuts in 1981 stimulated labor supply.

A thorough, more fully nuanced attempt at explaining the JEC chart might also note the work of economists Carmen Reinhart and Kenneth Rogoff. Their research suggests recessions accompanied by systemic shocks to the banking and housing systems tend to be followed by miserably slow recoveries. From that perspective, as Goldman Sachs economics argues, “the post-2008 U.S. recovery has not been unusually weak or prolonged relative to other financial crisis episodes… .”

And what about the secular stagnation argument of Larry Summers? A new Fed study largely blames demographics for the “new normal.” Do these alternate approaches offer any useful insights that might help explain the “new normal”?

Now none of this is to say better fiscal, as well as monetary, policy would not have been welcome. Government should certainly think harder about what it needs to more and less of to boost innovation-driven productivity. (Also, what about research suggesting these GDP figures undershoot growth?)

I guess my point here is that now is the time for policymakers on both sides to keep an open mind about America’s apparent growth funk and what a portfolio of structural reforms might look like in the 21st century beyond the obvious and comfortable.

Published in Economics

When you do nearly everything possible to stop growth in the way of omnipresent regulations that a drain the life out of small business, the highest effective tax rates both personal and corporate in many a decade, a refusal to lend to startups and small business and a Crony Capitalist Government structure that protects the Big Banks and the Multi-National Corporations to the nth degree while persistently squelching innovations from competitors, one should not be surprised that economic growth is so dismal.

The DemocratRinoRepublicans have done absolutely nothing to encourage growth, and seem hellbent on destroying all business other than that of their paymasters.

The answer is very straight forward if one spends any time on the ground with small business.

Our government has favored large corporations who are rent seekers with donations to politicians. Hence government works for the large corporations who have directed all their growth overseas.

During the financial crisis, they actively adjusted the rules to shrink small and regional banks and give them to the ‘too big to fail’ operations, calling in the loans on many small businesses and removing a large source of financing right when many companies needed some help in weathering the worst recession in decades.

Trade deals are all biased towards large companies needs, again donor driven. Trade enforcement for small and mid size companies is non existent.

Regulations disproportionately hurt small business over large, choking out the large company competition.

Tax policy state and federal has reduced incentives to grow entrepreneurial income. Laws have made hiring a major liability.

Thanks, learned elites. You are killing the worlds best economy in the name of saving the planet, diversity and servicing your donors.

It’s great paying for a “conservative” website that has a guy quoting from a Brookings Institution study arguing that Reagan’s tax cuts had no impact on economic growth. Why not ask Paul Krugman if he wants to post here?

Below is a repost a post from a month or so ago regarding slowing productivity growth, but most of it applies here. Show me the countries with good rule of law, low regulation levels and moderate taxes and slow growth…and I might be more convinced of a secular stagnation in growth. We in the US, however, have high taxes, ever increasing levels of regulation and slowly eroding rule of law. All things being equal, we should expect a reduction in growth….

“A large part of the problem is caused by the massive increase in regulation and labor law complexity over the past 10 years. This change could easily be sucking up any improvements in productivity from technology or process improvement. Warren Meyer at CoyoteBlog writes about this a lot.

See http://www.coyoteblog.com/coyote_blog/2016/08/china-doesnt-kill-american-jobs-politicians-do.html this link as an exmple.

These regulations and labor laws are also shifting a lot of spending towards compliance and away from productivity improvements. For example, to comply with California’s strict laws on employee breaks, many companies have put in software systems to track and manage compliance. This is money and management and IT time that will not be spent on putting in (for example) an new inventory management system that would improve productivity.

Managers and employees are also less productive under these new rules. Spending time making sure that your employees take breaks and sit on the right kind of chair, take away time from the job at hand.

The increase in regulation has also increased the cost and risk of starting a non-internet business. With the overlapping labor, safety, EPA etc regulations, most small business’ are out of compliance with a number of regulations at any one time, no matter how hard they try. That scares off a lot of entrepreneurs and raises the cost of starting and staying in business.

And don’t get me started on Obamacare compliance.

Each of these items may not be that large isolation, but they could easily add up to a 2% – 3% reduction in productivity growth which would take an underlying solid 4% growth and crush it down to the anemic levels we are seeing.

When economists discuss slow job growth and GDP growth (even conservative economists) they seem to have little grasp of the large effect these laws have on reducing the efficiency of business and slowing growth and productivity improvements. The effects of individual regulations are hard to prove empirically, but spend some time running or working with business and you will get some idea of the massive effect they have on business operation.

He’d be more interesting at least.

Then there’s this:

Yes, people actually think this. Or at least, they are willing to say it.

Stop arguing with people who disagree with you. Even when you beat them, they go right back to quacking when you’re gone. You will never convince the author of the blog post I’ve linked. And when you search for this topic, you get that article. Good luck finding this one.

Is it any wonder AEI is a swamp of irrelevance.