Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

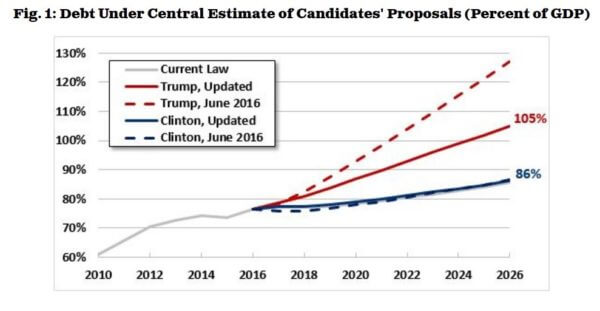

Debt Is Headed Up Under Hillarynomics, Even Higher Under Trumponomics

Debt Is Headed Up Under Hillarynomics, Even Higher Under Trumponomics

The Committee for a Responsible Federal Budget has updated its (non-dynamic) budget scoring of the presidential economic plans. Context: The federal debt-GDP ratio was 35% in 2007, which is more or less the postwar average. I would love see the number on a medium-term glide-path back to that level, though there is certainly no need to expedite things as Libertarian presidential candidate Gary Johnson would do.

Published in Economics

Yikes!!! That doesn’t look very good for Trump.

Something I have been wondering about is how will he make up the lost revenue from the business tax cuts. Kudlow, et al have been saying that it will make our economy much more competitive, but how will the federal budget react? According to that graph, not so well…

Good gracious, you mean the man actually wants to cut Federal spending 20%? Clearly he’s insane! We should throw Johnson in the loony bin, and elect a sensible leader like Trump or Clinton (doesn’t really matter which) who understands that continuing to spend money we don’t have is the key to sustaining the kind of robust economic growth we’ve seen in the past decade!

Debt is subsidiary to growth. There is no magical steady-state economy available for analysis. If growth becomes robust, then government revenue will climb, debt will fall in proportion, and we will become healthier in general. You can’t isolate any factor, especially growth. If GDP climbs at a more normal rate. all bets are off, and your entire analysis is moot.

As an example of how graphs can mislead, just look at the historical level of government revenue, versus the maximum marginal tax rate. It’s intuitively inverse.

True, though I also often read Trump supporters saying things like:

If Trump reduces GDP by stifling trade and immigration, the debt numbers might end up even worse than the graph above.

Under Hillary the debt will increase, the fed will monetize it, the economy will stagnate and it will continue until markets decide the dollar isn’t sustainable, or some country pushes it over the cliff, which could be decades or not. Under Trump it will increase, but if he deregulates and cuts taxes the economy will grow, credit will expand, the fed will have to tighten, interest rates will rise and he’ll have to make decisions what to do. The liberal media will scream but will he cave or cut spending, reform entitlements and engage in other reforms that reduce external borrowing in order to accommodate higher borrowing costs? If he does the latter the higher interest rates will be relatively short lived but since they are the price of money and investment, they will allocate credit to the highest yielding investments squeezing out low yield stuff as well as squeezing out government spending. This is good and what happened under Reagan. It’s what markets do.

I believe your made up numbers about as much as I believe anybody else’s made up numbers.

In short, we’re doomed, aren’t we?

Thanks, you just locked up my vote for Gary Johnson. Pace Ann Coulter, Johnson can smoke dope grown by illegal immigrants in the White House if he will just balance the budget.