Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Scoring the New Trump Tax Plan

Scoring the New Trump Tax Plan

There’s new modeling of Donald Trump’s new tax plan. This is never an easy exercise, but the Tax Foundation’s efforts were made that much more difficult by the inability of Team Trump to clearly specify the individual income tax rate on pass-through business income. And that makes a big difference, according the group:

There’s new modeling of Donald Trump’s new tax plan. This is never an easy exercise, but the Tax Foundation’s efforts were made that much more difficult by the inability of Team Trump to clearly specify the individual income tax rate on pass-through business income. And that makes a big difference, according the group:

Assuming that the individual income tax rate on pass-through business income is the same as the rates on other individual income, the Trump tax plan would reduce federal tax revenue by $4.4 trillion over the next decade. But if the tax rate on this income is instead intended to be the same as the tax rate on corporate business income, the plan would then reduce federal revenue by $5.9 trillion. In addition to these possibilities, which we see as upper and lower bounds for total revenue generation, the policy may reduce federal revenue somewhere in between.

With dynamic scoring, the TF puts those total revenue losses at between $2.6 trillion and $3.9 trillion. Those are still big, big numbers. Now why am I focusing on the red ink from the plan rather than the economic growth it supposedly generates? Well, maybe because the 74% US debt-GDP ratio is at an historically high level, more twice what it was pre-Great Recession and three times the level when Ronald Reagan took office.

But here are the growth findings:

According to the Tax Foundation’s Taxes and Growth Model, the Trump tax plan would increase the long-run size of the economy by 6.9 percent under the higher-rate assumption, or 8.2 percent under the lower-rate assumption. The larger economy would result in 5.4 percent higher wages and a 20.1 percent larger capital stock under the higher-rate assumption, or 6.3 percent higher wages and a 23.9 percent larger capital stock under the lower-rate assumption. The plan would also result in 1.8 million more full-time equivalent jobs under the higher-rate assumption, or 2.2 million more under the lower-rate assumption.

These projections are measured as of the end of a ten-year period (that is, 2016-2025) and they are compared to the underlying baseline of what would occur under current policy. For example, the U.S. real GDP will grow by 19.2% from 2016-2025, according to the Congressional Budget Office (CBO), even if policy remains unchanged.[9] This paper predicts that the greater incentives for labor and investment provided by this tax reform plan would increase the end-of-period GDP by an additional 6.9% under the higher-rate assumption, or 8.2 percent under the lower-rate assumption, over and beyond the baseline growth already predicted.

The larger economy and higher wages are due chiefly to the significantly lower cost of capital under the proposal, which is due to the lower corporate income tax rate and expensing for those firms that choose to adopt it instead of deducting interest. These projections do not include the economic effects of proposals by Trump that are not specifically tax-related. For example, spending, trade, and immigration proposals are not part of this analysis, even though they are likely to affect the economy substantially and they are therefore worthy of consideration.

Hmm. The bit I put in bold seems like an important cautionary note especially in light of this, from the FT: “Trump’s trade policies would send US into recession, study says: Clinton’s approach would be ‘harmful’, Trump’s ‘horribly destructive’.”

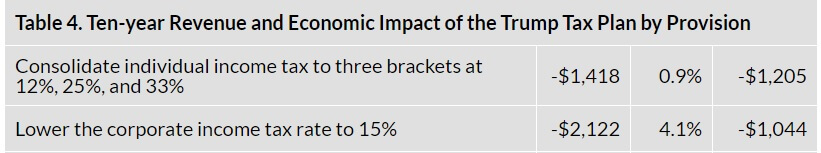

I would also note that the personal income tax cuts — pay attention, supply siders — seem to have a terrible cost-to-growth ratio, especially compared to corporate tax cuts:

There is a magic phrase that often shows up in economic analyses of political proposals. The magic phrase is “over the next decade.” What makes it magic is that it has the power to immediately cause me to lose all interest in anything else said in the analysis. Because obviously, the whole analysis is a fantasy. No one has the faintest idea how a tax proposal, implemented today, will impact revenues a decade from now. A decade – that’s three Presidential administrations. Five Congresses. At least one and probably two recessions. Maybe a war. Almost certainly a lot of behavior changes by the taxpayers, in unexpected ways.

As far as I can tell, anyone who purports to make accurate projections of the economy a decade hence is doing it for one of two reasons: Either to inflate their numbers by multiplying everything by ten; or to backload all of the consequences they predict by projecting most of it to happen in the last few years of their prediction (by which time, the prediction itself will have been lost in the mists of history and irrelevancy).

Pethokoukis wrote in the York Times that the policies of Harding and Coolidge were not responsible for the economic boom of the 1920s. So he is a critic of Republican economic policies going back about a hundred years.

What are Trumps trade proposals?

This sort of scoring seems as rigorous and predictive as ranking proposals by the number of vowels in them.

What specific parts of his economic analysis were flawed? Could you provide a link?

Interesting to me how he characterizes tax revenue reductions as ‘losses’ and ‘red ink’. This may be an indicator of his view of Republican economic policies as well.

The long history of economic forecasting indicates that once you get more than a few quarters into the future, the predictions are no better than chance.

The economy is not predictable. Forecasts can be interesting tools because they force you to call out your assumptions and attempt to quantify them, but the actual numbers in 10 year forecasts are generally nonsense.

As an example, a computer model of an anthill can be very useful in that it allows you to test assumptions about how ants behave, and how their behavior might change under certain stimuli. But as a tool for forecasting the future size and shape of an anthill, they are completely useless. They are useless for prediction because ant behavior has stochastic elements just like the economy, and because complex adaptive systems respond non-linearly and unpredictably to very tiny changes in input.

Well it would result in a net loss of revenue over current tax rates. This constitutes red ink unless Trump puts forth a plan to reduce spending by an equal or greater or amount. Given that Trump has proposed new entitlements, increased military spending, almost no serious discretionary spending cuts and refuses to touch entitlements that would be an accurate picture would it not?

Yes. Washington spending other peoples money, as usual. It’s just that certain language uses can make it sound as if somehow the party losing the revenue has earned it instead of just taking it.

I recognize this as a practical political matter, but I think it only really applies when we are also discussing spending reductions. It is not very conservative to rack up monumental amounts of debt and then default on it.

What would we do without

astrologerseconomists to tell us about the future?We’d all be on our own, which would be awful.

It wasn’t my article. I agree, if one is going to discuss Federal budgets which is really what this is, don’t just do one side and think you’ve done a complete job. The tax reductions are not the cause of the ‘red ink’. But since you mentioned practical political matters, we all know both sides won’t even enter the discussion until taxes are reduced.

Trump’s not conservative: this is news?

I don’t care if there is a government deficit. Spending is the problem and lack of national savings which cause the deficit to spill over into the current account. Treasury debt is at least market conforming, (if it weren’t for the fed but that’s a different and in many ways more important problem) Taxes are not market conforming.