Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Fundamental Transformation … of the Tax Code

Fundamental Transformation … of the Tax Code

I’m writing this at the inspiration of @jamielockett in the interest of demonstrating that we conservatives can and do say “yes.” Some of us may have already broached the subject of whether or not we’re actually conservatives, but whatever, Mr. Lockett. ;)

So, how do we on the Right not merely say “no”? I began discussing the topic here, but I’ve since had the opportunity to think about just what sort of reforms we can advocate which are not merely a return to the past but a way forward into the future; a revolution if you will that might permanently change the game.

That brings us to Milton Friedman and the Negative Income Tax (NIT.)

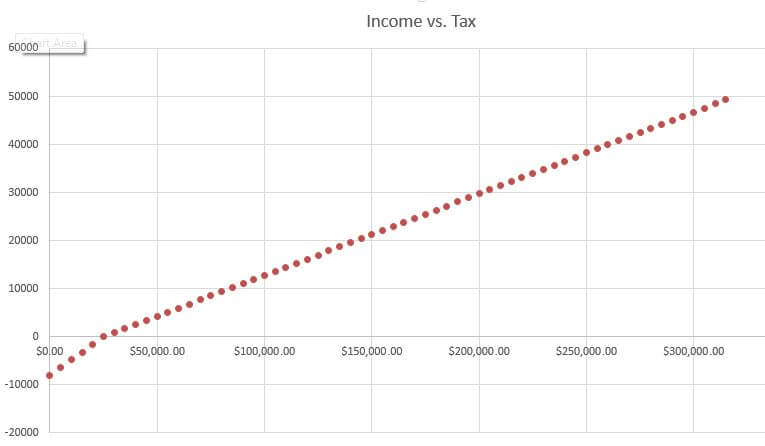

For those unfamiliar with the concept, the idea of a negative income tax is to essentially guarantee a minimum income to each person in the country and then phase the subsidy out as people approach a nominal wage — typically around what is considered the poverty line. A graphical representation can be seen below:

The numbers are open to debate in terms of what the zero-tax point ought to be, what the negative rate should consist of and at what age people begin receiving the subsidy. In this example, I’ve arbitrarily chosen $8,000 for the subsidy, $25,000 as the zero-tax point and 17% as the single bracket income tax rate. This part is somewhat similar to Rick Perry’s flat tax plan from the 2012 campaign.

The system should also have a simple $2,000 refundable child tax credit which would decrease by $500 for each subsequent child. The credit would transfer to the child beginning at age 18 and phase in towards the full minimum income amount at 22.

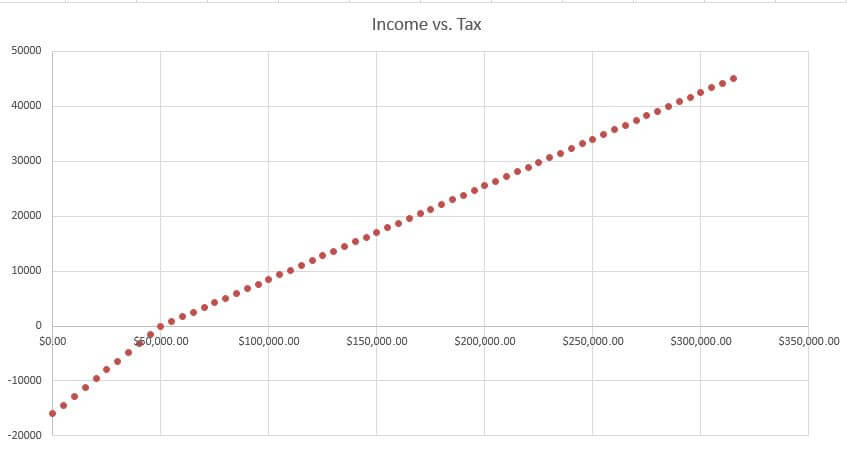

What about the “marriage penalty” which kicks in when you combine two household incomes into one? Simply double the threshold amount for zero tax of households consisting of two earners.

Now, we’ve tackled what the tax side looks like, but surely that’s not the only thing we’re going to do right? Right. We’ve just decided that we’re going to give individuals $8,000 per year to not work. That can’t be correct … surely there’s going to be some offsetting reductions in other benefits. There are.

The existing Food, Housing, Energy and Cash assistance programs could all be replaced by this benefit because it accomplishes the same goal: that of providing an income floor for the poor. Rather than forcing those dollars to be spent on a particular item (as it currently is in the case of energy, food and housing assistance) individuals will essentially figure out for themselves how to spend their subsidy. The average amount spent on these programs per person end up being roughly equivalent on a per capita basis. We’ll leave medical and old age benefits for another time as each of those issues require their own articles to tackle.

There’s more to this and the math becomes daunting the deeper you go because of the confusing web of welfare benefits which are in turn funded by a variety of taxes, the greatest among them being income tax. The attraction of this plan is that it replaces many of the aforementioned benefits for lower-income individuals (and much of the regulatory bureaucracy which shepherds it) with a monthly payment essentially dictated by a person’s annual income as calculated by their payroll processor.

Payroll taxes such as FICA, Medicare and Medicaid could similarly be replaced by jiggering with the inputs so that revenues will be approximately similar afterwards and sufficient to the task of covering those budget items.

This streamlining of the tax system by eliminating vast swaths of absurd write-offs and replacing its existing multiple bracket setup with a single rate will also have the effect of reducing the distortions that currently exist in the economy as a result of the tax code. Taxing capital gains and other forms of income at the same, low rate (despite the double taxation aspect) will defang class warfare rhetoric and probably end up generating more revenue to the treasury in the long run due to the supply-side growth effects of decreased and consistent rates.

If you’d like to examine the spreadsheet and play with the numbers yourself you may PM me and I will provide a link.

Published in Economics

By definition, conservatives oppose fundamental transformation.

;-)

Which is why I questioned whether we are actually conservatives… ;)

Wonderful stuff.

I think the economics are sound, but… negotiating the transition would require good faith on all sides, starting within the conservative “family.” Out in the political world the plan would face even greater challenges. I don’t see anything happening on this until progressivism loses its appeal in America. Yeah, we’re probably talking about our grandchildren, best case — and only if we somehow escape the progressive wave that has been building over several decades and seems to be crashing down upon us today.

we’re radical neo classical liberals in economics, but conservatives it our view of cultural traditions. The two have always been linked in the US, indeed even in Burke.

It is an accident of history that placed Classical Liberals on the side of conservatives.

There are always better ways to address the disastrous mess of our welfare programs, beginning with abolishing them since they do far more harm than good. But assuming we want such things as welfare, then it should not be federal because it is not constitutional and conservatives should not embrace unconstitutional approaches, second it can’t work. The Federal government is remote and cannot be made accountable and will always be turned to some political interest and, with time, become corrupt. At the state level it will be political and corrupt but if funded by state tax payers, it could become accountable. Lets go there with decentralization without funds, each state figuring out how to replace welfare. We must stop trying to be clever. That’s the point of conservatism, the technocratic elite is not clever and never will be. Our best ideas are flawed, we just don’t know how until they are imposed.

I actually like this idea as long as we can keep the NIT low.

I’m not convinced it wouldn’t creep up based on “special” needs, and that it wouldn’t become per person at birth.

I’d be willing to risk it for a 17% flat tax mind you.

You would need a constitutional amendment banning all other forms of welfare and taxation in perpetuity.

So, pipe dream then. Got it.

Hillary would sign off on this in a heartbeat.

I have never understood why welfare became a Federal responsibility. I understand why old age benefits (i.e. Social Security and Medicare) were setup at the Federal level because they are intended to follow a person as he moves from state-to-state throughout his life. If we are going to have (and I would prefer to find a way to eliminate them) SS and Medicare they cannot be managed at the State level.

The other reason why welfare should be a state responsibility is that the poverty level varies significantly from state to state and locale to locale. This makes something like a single national negative income or guaranteed minimum income difficult to set.

8,000 bucks goes a lot farther in Mississippi than it does in California.

No way. It doesn’t provide enough opportunity for control and tinkering with peoples’ lives. It also puts a vast swath of the bureaucracy at the Health and Human Services Department out of work.

You think Hillary is going to want to scrap the system that she has spent the last 30 years selling access to? Doubtful.

You left out an important part of Friedman’s plan, namely that the reduction in benefits will always be less than the increase in wages, so choosing to work always results in a rise in overall income. A big problem with the current welfare system is that it’s possible for a person to actually become poorer for working. When I was working temp jobs a few years back, I heard otherwise good people talking about, “The cost of getting a job.” That needs to be eliminated more than anything else.

It’s a brilliant idea presented at politically potent price points (which don’t seem arbitrary).

Sure the opposition would be ferocious, but if you can’t win against the most villifiable set of rent-seekers like this, then the game is lost. Besides, three-quarters of this approach would be a game changer.

Gets rid of the apparatchiks of the most dismal heart of the welfare state. Maybe puts Virginia back in play!

Gives some nice focus to what welfare is: money for nothing. Replaces the whole whining set of special claims for disability, wrongs of history, class betrayal ad nauseam.

Machiavellian appeal to poorer recipients towards supporters of tax credits which we never win with beneficiaries of the present system. Creates a class of upwardly mobile workers who don’t identify as readily with the check recipients in class below them, creating perhaps a political firewall against large increases.

The flat tax and negative income tax are remarkably well balanced politically and economically once you accept, as 80% of voters do, the federal responsibility for basic income support from cradle to grave.

You need to consider the inflationary effects of this. To take an extreme version of your negative tax plan, to simplify perhaps too much, a guaranteed universal income, money from the government of $8k would only raise the baseline inflation level by those $8k and reduce the universal income’s real buying power to zero.

An income-based negative tax is intermediate to this, but a significant inflation effect will still exist and reduce the real buying power commensurately. And the negative income tax encourages employers to pay their lower income workers that much less–Uncle Sugar will make up the difference.

A mechanical question:

Isn’t the presence of two incomes an argument for lowering the threshold by half?

Your goal (and mine) is to streamline the tax code to a single rate shorn of deductions, credits, loopholes, and froo-froo. This might be a politically expedient way to get there, but I worry about the negative tax-as-entitlement ever being done away with–it’s still a reliance on government as the solution of first resort, rather than of last.

Eric Hines

Agreed, I do not think I am at all.

This is not a good argument since as you say, the poverty level changes from local to local even within a city. So really, I think that poverty level should be more tied with the currency’s buying power rather than local (reference above incentive to move where it is less expensive).

No, the author is correct, two people means twice as much need, means twice the guaranteed income.

Would never get to zero, but a good point

More worrying but not more significant than current policies.

Correct. This aligns incentives in the correct direction: in the direction of working. A married couple working 2 minimum wage jobs will end up seeing only an increase in their pay for getting better, higher paying jobs. This is in many ways the same as the situation we have now except today a similar couple has to jump through various hoops to get the EITC or whatever absurd targeted subsidy they need at that moment.

We and they are already better off for less money under this proposal that we are currently. That alone is enough to recommend it.

Not two people, two incomes–half the need.

Eric Hines

I’ll give you points for being about half right with this.

The problem Conservatives have in reforming the system is that we always want to start with the tax code. “Starving the beast” doesn’t work, as attested by the $16 Trillion or so the debt has gone up since Reagan first suggested it. Cutting taxes only raises revenue on half of the Laffer curve, and I suspect that we’ve been below that point since Reagan’s tax cuts in 1981 and 1986.

Reform spending first, then tax to collect what you need to cover that. Broad bases and low rates, tax policy is fairly simple when you don’t have to raise 20%+ of the GDP to pay for government excess. The negative income tax might be the way to start reforming spending. So maybe that’s the way to start reforming both (taxing and spending) at once.

Whether or not this is the correct solution, and whether the solution involves tax reform or not, reforming benefits programs is something that must be done, and it can be done in a way that can be easily sold to the public, even the people who get the benefits.

Right now there are something 110 like different federal, means-tested, welfare programs. Those programs span nearly every department and agency of the government. Why? Because once they create one, it never ends, and the overall organization is insane. We have a Department of Health, Education and Welfare. But HHS does health, Education does education and everyone does welfare.

Why not have one Department of Welfare that does everything? Instead of figuring out which of the 110 programs you qualify for and then filling out paperwork for 17 programs, go to the Welfare Dept., fill out one form, and get what you need. As one payment instead of targeted vouchers, such as mentioned in the OP.

You call sell that to Welfare-Americans, and you can sell that to conservatives. You can hammer Democrats that oppose it as beholden to the bureaucrats and against the people. And you could shrink government massively.

Actually, Reagan had a deal to cut spending after the taxes were cut–he did the package. Then the O’Neill Democrats running the House at the time welched on the agreement, explicitly to leave Reagan with a rising deficit from the tax cut and no spending cut, for the political benefit of O’Neill and his Democrats.

Reform spending first, or reform spending and taxes together, but don’t trust Democrats to keep their parts of any bargain in this.

Eric Hines

“Here endeth the lesson.”

I actually can’t tell if you like the idea or not… :)

Ever since Bismarck, the Western democracies have been marching towards the notion of providing some form of sustenance to the poor. That’s just the reality of the situation. Politically, a Libertarian, Rugged-individualism of promising no assistance to the poor is going to be essentially unpalatable. This proposal recognizes that reality and tries to work with it in order to minimize the damage rather than against it.

Mathematically, imagine that you have 2 people earning $25,000 (the zero-tax point) who decide to get married. If you look at the first graph (the tax chart for individuals) and put their married incomes together as one: $50,000. Well, now they’ve gone from paying zero tax individually to $4,250 together… the “Marriage Penalty.”

Their combined income under the second chart has them paying zero tax – just as they would separately.

As it should be, but that also ignores–because PC–our Judeo-Christian obligation to help those who can’t help themselves, or to extend a hand up to those who’ve had bad luck. That obligation is individual, though, not collective and not government’s–except….

My argument has always been, and it’s been the argument of many Conservatives (not all) that welfare begins with family and friends and extends to church, charity, local community. As those resources become exhausted–and only then–does government get involved, beginning with the local jurisdictions, and running up through the Federal government only last.

…except: government, at all levels are last resort, not first. Of course, any government involvement at all is anathema to many.

Eric Hines

@Majestyk, I recently made some counterpoints to this type of proposal, in case you hadn’t seen it.

Perhaps a work requirement outside of physical disability? I hear your complaints about the hordes of young unemployed men.