Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Hey, Not June!

Hey, Not June!

Hey June, you ain’t so bad,

Take a sad job report, and make it better…

The June jobs report, contra Larry Kudlow’s disconsolateness, doesn’t seem to have much dented the optimism of Fed’s chief Janet Yellen.

Overall, Yellen said, “I see good reasons to expect that the positive forces supporting employment growth and higher inflation will continue to outweigh the negative ones.”

While last month’s jobs report, released Friday, was “disappointing,” and bears watching, policymakers will respond “only to the extent that we determine or come to the view that the data is meaningful in terms of changing our view of the medium- and longer-term economic outlook.”

Still, Yellen was careful not to give any hints about the timing of a next rate increase, in contrast to a speech on May 27, when she said such a move would probably be appropriate “in coming months.”

Among the tea leaf readers — Fedwatching being the economists’ version of Kremlinology, examining the order of people flanking the general secretary of the Politburo — this is seen as meaning an interest rate increase is far away, more than however long “coming months” is.

Besides being unscientific, such observations ignore clear signs that the economy is doing well in some areas that would indicate a rate increase is appropriate, and bad in other areas … that would indicate a rate increase is appropriate. Consider:

- Productivity was reported to have declined 0.6% in the first quarter. This means the cost of labor is rising for firms, who then will look to pass those costs on in higher prices. Firms are already reporting a drag on profitability, as Kudlow recognizes. And they expect the rate of price increases to rise.

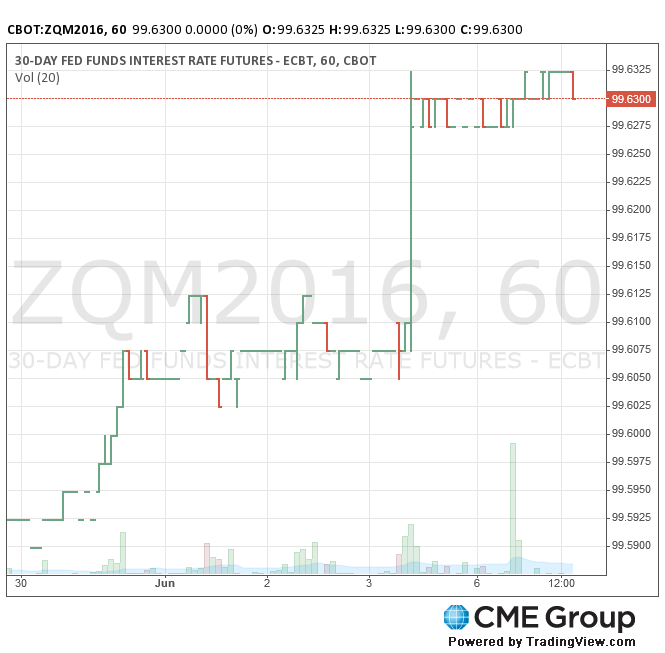

The lack of a rate rise for June was already baked in the cake. The change on Friday from the rate rise was all of 2 basis points. CMEGroup shows that currently there is a 27% probability of a rise in Fed Funds in July — very unusual insofar as there is no press conference scheduled — and 45% for September. We pretty well knew this was going to be the case going in. While Yellen’s speech claimed that the new report was causing the FOMC to “be wrestling” with the labor market data, the wrestling had begun long ago.

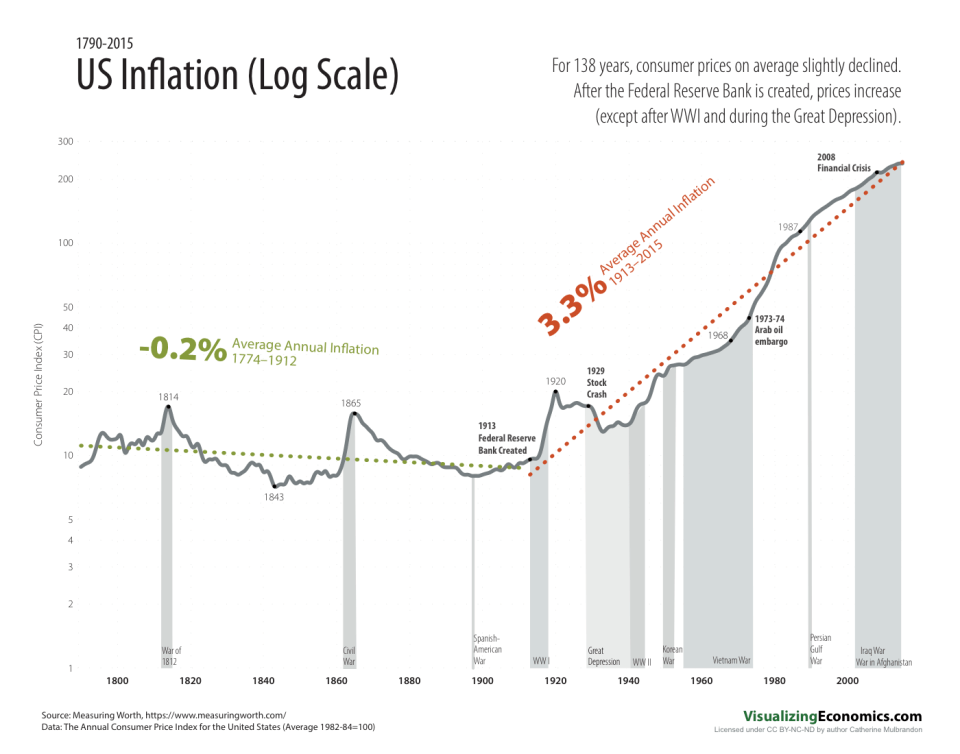

The lack of a rate rise for June was already baked in the cake. The change on Friday from the rate rise was all of 2 basis points. CMEGroup shows that currently there is a 27% probability of a rise in Fed Funds in July — very unusual insofar as there is no press conference scheduled — and 45% for September. We pretty well knew this was going to be the case going in. While Yellen’s speech claimed that the new report was causing the FOMC to “be wrestling” with the labor market data, the wrestling had begun long ago. Perhaps more concerning is the long-run trend, to which we are returning. It may well be that that new trend line from 1995 is our future and we should ignore the previous 80 years. Both gold and silver are up 15% in the last six months (admittedly off multi-year lows, but still.) The dollar is strengthening even though we are somehow making monetary policy easier.

Perhaps more concerning is the long-run trend, to which we are returning. It may well be that that new trend line from 1995 is our future and we should ignore the previous 80 years. Both gold and silver are up 15% in the last six months (admittedly off multi-year lows, but still.) The dollar is strengthening even though we are somehow making monetary policy easier.

I write a local quarterly economic report here in central Minnesota. Our area is more dependent on manufacturing and agriculture than most places in the U.S., and if someplace should have been slipping it would be us. I even had thought so myself a few months ago. Recently though data have improved, as have business sentiments. (We have a new report coming out next week, so I am holding back some information but it will not be inconsistent with this paragraph.) The unemployment rate here is under 3.5%, more and more businesses are reporting wage gains, and at a local economic development authority meeting this afternoon (I am a commissioner) we approved support for three new projects and have a fourth going without any public involvement. There will be more new business development in this community in the first six months of 2016 than there was in all of 2015.

In such an environment, there is no reason for interest rates to remain extraordinarily low. So,

Published in GeneralRemember, to let a good economy into your heart,

Then you can start, to make interest rates more normal.

King, the DX was down 1.7% last Friday and is trading lower tonight so there isn’t much evidence of a strengthening dollar after last week’s labor report.

The Federal Open Mouth Committee Chaired by Ms. Yellen and anchored by Mr Bullard and Ms. Mester have talked themselves into Trillion Dollar Conundrum.

There is little evidence of reason(s) to raise rate yet they are jawboning for higher rates at a fever pitch. I think Yellen and company want to raise rates just so they can lower them again if/when required.

After this weekend’s speeches and Ms. Yellen yesterday I am inclined to think the June meeting is still live.

And anytime you feel the pain,

Hey June, reframe…

But all prosperity depends on government spending, doesn’t it? If only we could get to double digit negative interest and an exponentially increased spending stimulus, oh boy!

I was actually looking at a slightly longer timeframe.

I am looking at that last bounce. Undoubtedly the dollar market got ahead of itself in latter 2015.

You also write “I think Yellen and company want to raise rates just so they can lower them again if/when required.” I think that’s exactly right. How odd that a Fed that spent 7 years creating interest on excess reserves, QE and twisting, now wants to get space to engage in monetary policy old school!

All I am saying

Is give rates a chance.

Eric Hines

Does that phrase, “without any public involvement,” mean that money will be borrowed, but without taxpayer guarantees? I have recently been wondering if there exists such a thing as a bank loan without taxpayer guarantees.

In some sense you’re right that there are not. All business interest paid receives a tax deduction. And a bank loan from an insured bank is covered, though usually with premiums paid to FDIC by the banks. (They certainly believe there is a federal backstop). So I was inarticulate there — what I meant was we were not using city funds nor state funds to assist that last project.