Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

January Jobs Report: Any Signs of a Looming Recession?

January Jobs Report: Any Signs of a Looming Recession?

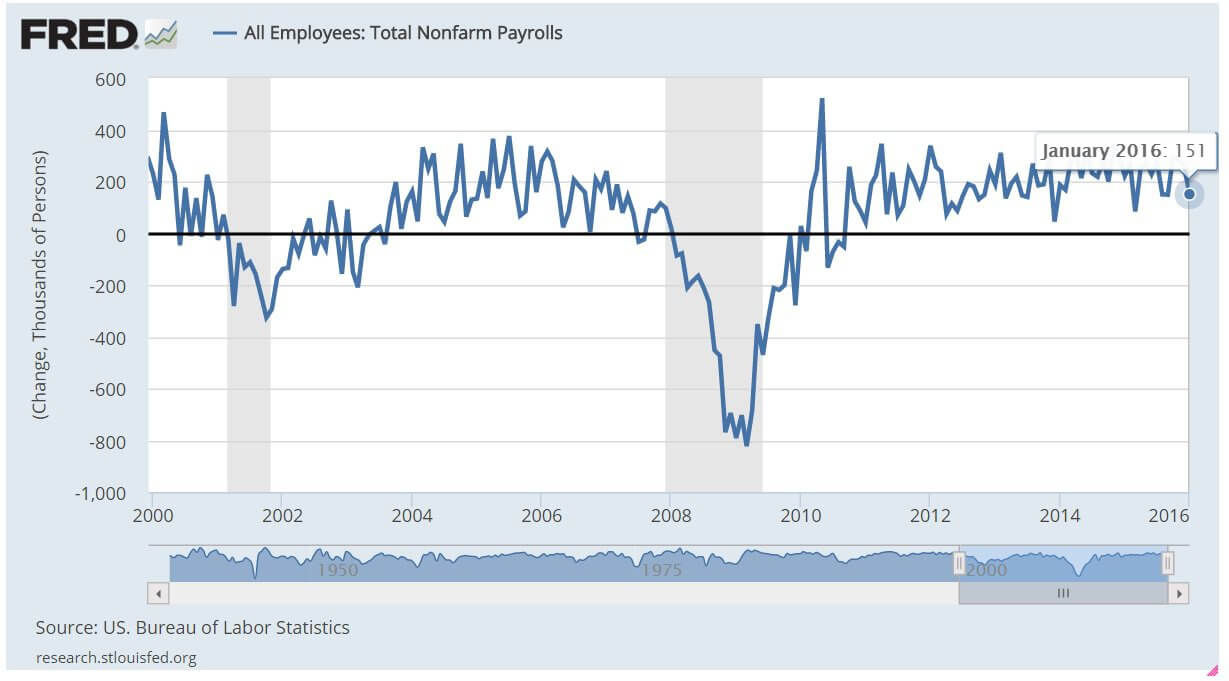

Not bad at all. The January jobs report — 115,000 net new payrolls, 4.9% unemployment rate — contained lots of good news: the lowest jobless rate since February 2008, a higher labor force participation rate, a higher employment rate, and average hourly earnings up 2.5% from a year earlier with the monthly jump the best since July 2009.

Not bad at all. The January jobs report — 115,000 net new payrolls, 4.9% unemployment rate — contained lots of good news: the lowest jobless rate since February 2008, a higher labor force participation rate, a higher employment rate, and average hourly earnings up 2.5% from a year earlier with the monthly jump the best since July 2009.

It’s also worth nothing that using the new jobs data, the Atlanta Fed upgraded its first-quarter GDPNow model forecast to 2.2% from 1.2% — a good sign that the US economy is not about to sink into recession after that zero-handle fourth quarter. And this from John Silvia of Wells Fargo: “… growth in the residential and nonresidential construction sectors remains evident in the 18,000 gain in construction jobs last month. These gains represent solid trends supporting continued economic growth and certainly do not signal recession.”

Not everything was great: job gains far short of 185,000 expectations (though averaging 231,000 the past three months), U-6 unemployment-underemployment rate unchanged at 9.9%, long-term unemployment worsened, labor force participation and employment rate still way below pre-recession levels, wages gains short of what you would expect to see in a full-throttle economy. Particularly vexing for Barclays was job weakness in the service sector.

So where is the US labor market right now, a month into 2016? How far from full employment, if we are not there already? Do we “still have a very long way to go,” as Bernie Sanders said in last night’s Democratic presidential debate?

A recent Goldman Sachs report made some good points on this. The bank’s economic team noted, for instance, how population aging and prolonged unemployment after a recession can affect the “unemployment gap”– the difference between the actual unemployment rate and the estimated structural rate. You can’t just look at what employment and participation rates were in 2007 — almost a decade ago! — and wait for a reversion. GS’s estimate of remaining slack:

Our 4.7% structural rate estimate implies that the headline unemployment rate—currently at 5%—indicates 0.3pp of slack. Based on our method for estimating the additional slack represented by the participation gap and the elevated number of involuntary part-time workers, we estimate that total labor market slack currently amounts to about 1.3% of the labor force. This represents a decline of 1.3pp from our estimate of 2.6% total slack one year ago. (Alternatively, our 4.7% structural rate estimate for U3 implies a structural rate of roughly 8.7% for the more familiar U6 indicator, implying a current U6 gap of 1.2pp.)

Our findings suggest that it is misleading to think of the labor market as having already reached full employment and make the current below-target rate of inflation less puzzling than it might at first appear. If inflation remains below the target for an extended period of time and the unemployment rate continues to decline, we suspect that the FOMC might reduce its estimate of the structural rate somewhat further. Such a change would increase the committee’s implicit estimate of the unemployment gap and would naturally have dovish implications. Even so, the impressive momentum of recent employment growth suggests that we will likely return to roughly full employment even as measured by broader measures of slack by year-end, supporting the case for continued gradual policy normalization this year.

Gettin’ there, America. But no reason for Washington to continue to ignore the need for pro-growth policy on taxes, regulation, public investment, and targeted job market interventions by government. Would like the Fed to pause as well.

Published in Economics

At this hour…

Pethokoukis: Not bad at all.

Meanwhile, back at the ranch…

This also from Drudge

What jobs? BLS says 665,000 job LOSSES

What jobs, how many full time, how many government or dependent on government? How many on welfare in some form?

If you believe these numbers than you are counting on this to be the only function of government not yet corrupted by this administration.

They’re all unicorn crap.

These numbers are complete nonsense. Total unemployed in the US is something like 95 million. They just stop counting after a few weeks because the job seekers have ‘left the labour force’. This is banana republic stuff. The US is already in a textbook industrial recession and corporate profit recession – the latter being an indicator with 100% success in predicting two quarters of GDP contraction. Jobs and the stock market are simply the last dominoes to fall.

Don’t think you are going to find this reassuring…

70% Of Jobs Added In January Were Minimum Wage Waiters And Retail Workers

All Job Gains Since December 2007 Have Gone To Foreign-Born Workers

America’s Transition To A Part-Time Worker Society Accelerates As Part-Time Jobs Hit Record

Record Numbers Of Retired Americans Are Working Part-Time Jobs

Finally…

Record 94 Million Americans Not In The Labor Force; Participation Rate Lowest Since 1977

Not to worry. The economy is going gangbusters. That’s the official Pravda.