Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Hillary and Bernie Both Want to Raise Investment Taxes Dramatically

Hillary and Bernie Both Want to Raise Investment Taxes Dramatically

I thought a goal of smart tax policy was that you raised taxes on what you didn’t want (like pollution) and cut them on what you did want (like more investment and work). Over at Forbes, Ryan Ellis notes that Hillary Clinton and Bernie Sanders are proposing the highest capital gains tax rates in history, 47.4% for Clinton and 60% for Sanders vs. 23.8% today.

I thought a goal of smart tax policy was that you raised taxes on what you didn’t want (like pollution) and cut them on what you did want (like more investment and work). Over at Forbes, Ryan Ellis notes that Hillary Clinton and Bernie Sanders are proposing the highest capital gains tax rates in history, 47.4% for Clinton and 60% for Sanders vs. 23.8% today.

In the case of Clinton, according to Ellis, the math is a top headline rate of 39.6% + the 3.8% Obama “net investment income tax” + a new 4% high-income surtax. (By the way, the top capital gains tax rate was 20% when Bill Clinton left office and 15% under President George W. Bush.)

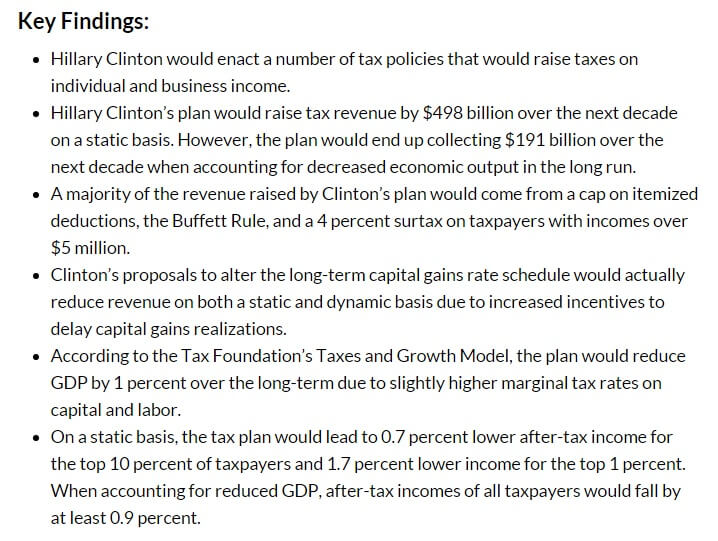

Now as it happens, the Tax Foundation just released its analysis of the Clinton plan, summarized thusly:

Regarding capital gains taxes, the TF analysis finds the Clinton plan — raising rates on medium-term capital gains to between 27.8% and 47.4% — would actually lose $374 billion on a static basis by encouraging people to realize their capital gains later. (The total revenue loss under dynamic scoring is $409 billion from its “small impact” on the cost of capital.)

Now I am not sure Team Hillary would really view this is as a bug since one of the supposed goals of the plan is to combat “short-termism” by encouraging longer-term investment. On the political front, the plan allows Clinton to tout the issue of “tax fairness.”

Anyway, this is certainly an issue where there is a great deal of difference between what Democrats and Republicans are saying. Reporters Nick Timiraos and Richard Rubin note in the Wall Street Journal today that “Republican plans all shift the U.S. away from taxing investments and toward taxing consumption.” As a general proposition, most economic models suggest switching to consumption taxation from income taxation might increase long-run economic growth. Here is a long-read Q&A with AEI’s Alan Viard about consumption taxes and tax reform more broadly.

Published in Culture, Economics

I remember another Clinton actually cut capital gains taxes, and it worked out pretty well. But I guess for Democrat primary voters “sticking it to the rich” is more important than sound economic policy.

They will make tax loophole lawyers rich. We will all have to have one on retainer.

They seem to think only rich people have investments. What do they think funds pension plans, union or private sector?

Probably heresy, but… All income should be taxed at the same rate – period. And, that rate should be as low as possible. And, the pool from which to draw it should be a broad as possible. There’s not a dime’s worth of difference whether I make money with my brawn, brain or capital. Caveat – provide capital investment with the ability to write-off losses to encourage it. We get such no advantage with our brawn or brains. I don’t think taxing income, aka a profit, from capital investment is double-taxation. An inheritance tax is an example of double taxation.

This is one of the advantages of a VAT tax is that it makes no distinction of earning – only spending. But, good luck with that.

Any tax increase is an investment tax, if only through taking money away from someone that he might otherwise have invested at least some of. That’s the market price of fungibility.

No, the goal of smart tax policy is to fund government IAW the constitutionally mandated purposes. Taxing for social engineering is one of the more remarkably stupid goals of tax policy.

Eric Hines

True dat. Eric beat me to it —again.

Sure, but are there no judgments to be made on the manner in which that revenue is raised? I generally share your sentiment, but if you start with the premise that revenue must be raised (no matter how small) then you have already crossed the Rubicon and are moving on to the political judgment of how it should be raised.

Under our current system, capital is most certainly subject to double taxation, at least at C-Corps and most large businesses with diverse shareholders are C-Corps. Profit is taxed at the corporate level first and then shareholders pay additional taxes on any dividends received and on capital gains when the shares are sold.

Don’t forget the corporate interest deduction. Not only do we double-tax equity, we subsidize corporate debt. It’s nasty.

Sure, but I was responding to OP’s premise that the revenue should be used for social engineering and rejecting that premise. The use judgment from which I proceed begins with what the Constitution explicitly permits and its later injunction that if a thing is not explicitly permitted to the Federal government, the Federal government is not allowed to do it. Social engineering is not on the Constitution’s very short list of purposes for raising revenue.

Following that, I proceed from the additional premise that government revenues should be raised in the most market neutral manner possible. Which also excludes social engineering purposes, as these explicitly manipulate the market, as OP noted.

Finally, as you note, when we start with the premise that revenue must be raised, we’ve made a judgment on how the revenue should be raised. That by itself, though, contains no judgment on the purpose for which the revenue is raised, or the purpose, beyond raising revenue, for choosing this method vs that one for the raising.

Eric Hines

I am with you as far as it goes, but by saying “market neutral” here you are already beginning to make a judgement. The definition of “market neutral” is not necessarily some objective standard. You are basically engaging in your own version of social engineering with this premise. Again, very sympathetic to your overall premise but and agree that social engineering through the tax code is best avoided to the extent possible. Unfortunately, it is almost impossible to avoid in one form or another depending on your point of view.

I wouldn’t necessarily agree that we subsidize debt. It only appears subsidized because we tax interest once and tax equity twice. You are certainly correct that the above results in a distortion in the market (more debt vs. equity than otherwise would be) but that is more a result of penalizing equity with the additional layer of tax rather than subsidizing debt.

Not so much. The Constitution has already done that; I’m just saying follow the Constitution.

Eric Hines

Yes, so much. Last I checked, the Constitution doesn’t include the phrase “market neutral” anywhere and certainly not as it relates to taxes. Also, 100% the Constitution does not define “market neutral” in any objective fashion.

No, it just enjoins against social engineering, which pretty much leaves market neutral by default.

Eric Hines

This is now just getting circular. I agree with you that “market neutral” is the goal. However, “market neutral” is not some objective standard…hence politics and sausage making.